Report: For every dollar spent on lobbying, the 50 largest corporations received more than $4,000 in government support.

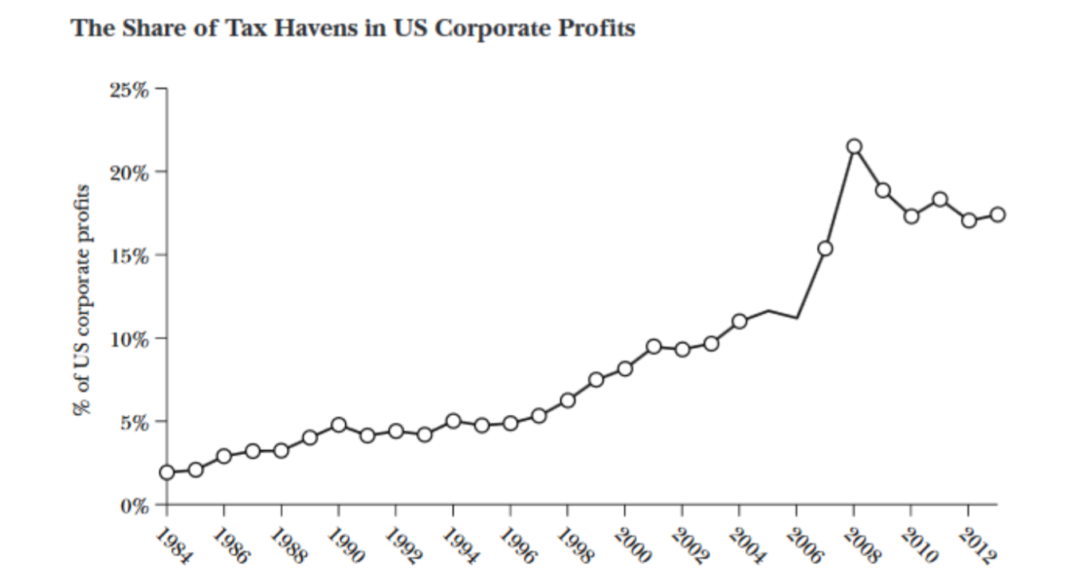

The US government is losing as much as $111 billion each year due to corporations “shifting” profits to offshore tax havens, according to a recent paper by Kimberly A. Clausing of Reed College.

Clausing found that by 2012, the annual revenue cost to the US government due to corporate tax dodging had amounted to $77-111 billion. For the world as a whole, she estimated revenue losses to be above $280 billion. (Last year, IMF economists Ernesto Crivelli, Ruud De Mooij, and Michael Keen estimated that developing countries lose $105 billion each year due to tax base erosion).

Clausing writes that “erosion and profit shifting is a larger problem today than even before,” and concludes that it “must result in lower government spending, higher tax revenues from other sources, or increased budget deficits.”

This week, Clausing’s figures were the basis of a new report released by anti-poverty charity Oxfam, which estimated that the 50 largest corporations in the United States have hidden more than $1.4 trillion in offshore tax havens, all the while collecting trillions of dollars in taxpayer subsidies.

The report, a financial analysis of America’s 50 largest public companies—multinational corporations like Alphabet, Apple, Goldman Sachs, and Disney—details an “opaque and secretive network” of 1,608 disclosed subsidiaries based in tax havens like the Cayman Islands, in addition to thousands of additional subsidiaries that these companies “may have failed to disclose to the Securities and Exchange Commission due to weak reporting requirements.”

The report estimates that the US loses $111 billion a year and that developing countries lose $100 billion annually due to corporate tax dodging. From 2008-2014, according to the report, the top 50 American corporations reported $4 trillion in profits and paid $1 trillion in taxes globally, with only $412 billion of that going to the federal US government. At the same time, they received $11.2 trillion from the government “in the form of loans, loan guarantees, and bailout assistance,” in addition to $337 billion in tax breaks.

The use of tax havens allowed the surveyed firms to reduce their overall effective tax rate to 26.5 percent on average, 8.5 percent lower than the statutory rate of 35 percent. For each dollar they paid in federal taxes, according to the report, the top 50 US firms received $27 in federal support.

This money allowed firms to “retain a multibillion-dollar army of lobbyists to influence federal policy,” according to Oxfam. Their investment in lobbying turned out to have an “incredible return”: The top 50 US firms spent $2.6 billion on lobbying the federal government. For every dollar they spent on lobbying, they received (collectively) $130 in tax breaks and more than $4,000 in federal assistance, such as loans, loan guarantees, and bailouts.