Senator Mitt Romney wrote Donald Trump a letter to stop his plan to reduce capital gain taxes. This is an important signal that a part of the Republican Party is becoming socially conservative but economically heterodox.

One of the more shocking political trends of the last year has been a sharp turn in political economy thinking by Republicans. It’s not just Donald Trump and trade policy, it’s an increasing belief among thinkers within the GOP that the party strategy of pursuing unfettered rights for capital no longer delivers for the American economy, and increasingly opens up our communities to attacks from both an authoritarian China and domestic Big Tech progressives (what they sometimes call “woke capital”).

This debate remained largely hidden, with the important exception of Tucker Carlson’s populist turn on Fox News, but it is becoming explicit as Republican elected leaders start making the case. Senator Marco Rubio, for instance, has written reports on financialization and China, Senator Josh Hawley is taking on Big Tech and increasingly Wall Street, and Congressman Doug Collins and Texas Attorney General Ken Paxton are investigating Google for antitrust violations. We can now add another Republican to the anti-libertarian and pro-business trend, and this one’s as important as they come.

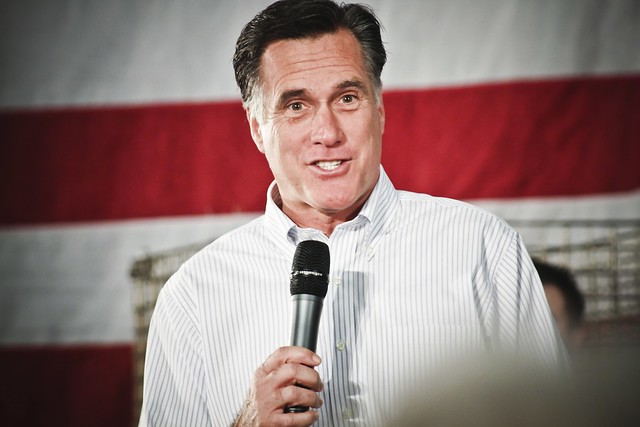

Last week, Utah Senator and former Presidential nominee Mitt Romney wrote a letter to Donald Trump, a letter in which Romney argued against Trump pursuing a capital gains tax cut.

There is a debate within the administration, with Wall Street-friendly advisors like Larry Kudlow and Steve Mnuchin encouraging Trump to try and loosen tax obligations for investors who want to sell assets with a capital gain. They sought to have Trump go around Congress and issue a controversial executive order to index capital gains taxes to inflation, which would effectively reduce capital gains taxes. Trump has so far refused.

It was surprising enough to have a prominent Republican arguing against a capital gains tax cut. But the argument itself was far more important than the politics. Romney made several points in his letter, but this was the driving rationale:

Investors are not starved for capital, but rather productive investments are increasingly difficult to find. This retroactive tax cut creates a windfall for those who have already invested in capital assets based on past decisions, rather than encouraging future capital formation.

Essentially, Romney is saying that such a cut would be bad for business because the current finance-friendly model of capital deployment isn’t helping capital formation anymore. Romney is correct on this point.

I’ve discussed what excessive financialization does to companies like Boeing, destroying engineering integrity and ultimately the corporation itself. Romney’s making a broader argument, that such a tax cut no longer helps put capital together in productive ways. His point on capital formation is shocking not only because he’s a Republican, but because he’s a former private equity baron, one of the early pioneers of the industry.

To understand why this is such a big deal, you have to understand the context of the entire move towards finance-friendly politics in America. Private equity’s rationale for existence was the idea that there was a “capital shortage” hindering American business. In my piece from late July on the origin of private equity in the late 1970s, I noted that private equity was a financial model largely created by a conservative Republican Nixon official and financier named William Simon in response to inflation and a lack of incentives for financiers to put capital to work. In 1978, a Democratic Congress and a Democratic President accepted Simon’s arguments and cut capital gains taxes.

These tax cuts were in the context of a society in which politicians perceived there wasn’t a lot of capital to invest because of the high-inflation environment. But that was forty years ago. Romney’s arguing that not only is there no more capital shortage, but that there is a capital glut. We don’t lack capital, we lack productive areas in which to place that capital. To paraphrase, Romney is saying that this ain’t the 1970s anymore.

Romney is also making the case that such a tax cut would be bad for workers:

I also welcome President Trump’s focus on the welfare of American workers, and share his notice that the proposed change would accrue primarily to high-income Americans. In 2018, 91.4% of Americans reported no long-term positive gains, while the top 1% of income earners paid 72.0% of all capital gains tax. The average tax paid on gains for taxpayers in the middle quintile is $280 – far less than the top 1% that pays $157,890 on average. Furthermore, all contributions and earnings taxpayers withdraw from traditional retirement accounts, such as a 401(k) or an IRA, are taxable as ordinary income and do not stand to directly benefit from indexing capital gains.

My jaw is honestly on the floor at a Republican Senator who helped create the private equity industry making the (accurate) case that increasing financial power in our political economy is good for wealthy rentiers and bad for entrepreneurs and workers. Private equity was driven by an idea, and Romney is saying that this idea, while it used to make sense, has gone too far. The implication is that our real economic need at this point is to focus on production and innovation rather than just financing.

There’s pushback, of course. Kudlow, Mnunchin, 20 Republican Senators led by Ted Cruz, and the US Chamber of Commerce supported the proposed capital gains cut. And Romney’s argument has been criticized by libertarian anti-tax activist Grover Norquist, who wrote a letter in response that accused Romney of using “regrettable left-wing rhetoric.” But Norquist made no real policy arguments. Other conservative movement operators made the argument that Romney might technically be correct on substance, but it’s politically inconvenient for Republicans to be as honest as Romney is in his letter to Trump.

I’ve always thought of Norquist as a savvy political strategist with a long-term goal of reshaping society. But what is fascinating is to see how petty Norquist looks, shorn of any intellectual rationale for what he’s doing. He seems silly and out of touch advocating for capital gains tax cuts in today’s world, like the liberals in the 1970s seemed arguing from the premise America was endlessly affluent as stagflation was hitting. There’s a real lack of ideas within the libertarian right, and it shows.

Romney’s argument, by contrast, reflects a refreshed idea about what is driving our economy. He is contributing to a new and different intellectual framework for the GOP, and one that is fascinating to watch emerge. Republicans are beginning a shift towards a party that is socially conservative but economically heterodox. It’s still a tentative series of steps, but the party seems to be evolving its political economy thinking in the wake of the financial crisis. And it is driven by ideas. Rubio’s work on financialization is oriented around analyzing deep-seated economic trends. And Senator Hawley, for instance, who is another important leader in the GOP, wrote a very impressive book on 19th-century intellectual history and the political creation of corporate America.

At this point, there’s something of a race between the Democrats and the GOP over who has something to say about the multiple combinations of crises we as a society are facing. My best proxy is the quiet collapse at Boeing, which combines a corrupt defense and political establishment, monopolization, financialization, Chinese power, all leading to crashed civilian airplanes. So far, neither party has grabbed this problem directly, because neither has a totally coherent way to understand the breakdown of productive integrity. But Romney’s observation about the role of excess financial power is getting close to the core of the problem.

It may seem trite, it may seem naive, but what I’ve seen from over 15 years in politics is that ideas really do matter.

Editor’s note: This article is an excerpt from the latest edition of BIG, Matt Stoller’s newsletter on the politics of monopoly. You can subscribe here. Matt Stoller is the author of the upcoming book Goliath: The Hundred Year War Between Monopoly Power and Democracy and a fellow at the Open Markets Institute.

The ProMarket blog is dedicated to discussing how competition tends to be subverted by special interests. The posts represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty. For more information, please visit ProMarket Blog Policy.