Most researchers assume that the share of total output lost by labor went to the owners of capital. However, a new working paper shows that the capital share has also declined, while the profit share has gone up. Could this be related to an increase in firms’ market power?

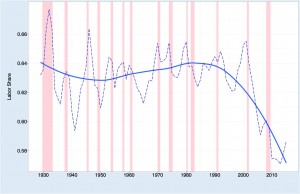

One of the issues most hotly debated in economics these days is the decline in the share of total output that goes to workers (see Figure 1). This labor share is computed simply by summing total compensation received by employees and dividing it by GDP. The recent sharp decline in this share is particularly puzzling, since in the United States it had remained roughly constant for the previous 75 years. Is this the macroeconomic consequence of stagnating median wages? What caused this decline? Possible explanations abound: from the demise of the unions to the introduction of technology that favors capital over labor, from managers’ greed to Piketty’s ‘fundamental laws of capitalism’ (for an intelligent discussion see).

In conducting this analysis, most researchers assumed that whatever was not going to labor had to flow to the owners of capital. After all, in capitalist economies profits tend to go to equity investors. Yet, economic theory distinguishes between labor share, capital share, and profits, i.e. the residuals left after both capital and labor have been paid.

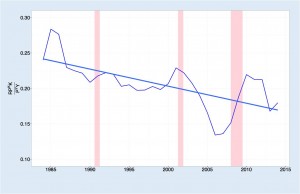

In a new working paper, Simcha Barkai, a PhD student at the University of Chicago Booth School of Business and a fellow at the Stigler Center, studies what happens if we abandon the old practices and follow what theory suggests. When he separates the capital share (i.e., cost of capital times amount of capital divided by output) from the profits share (the residuals), he obtains:

Piketty’s fundamental laws notwithstanding, the capital share declines as fast as the labor share. The big winner is the profit share, which goes from 2 percent of GDP in 1984 to 16 percent in 2014.

This is not just a relabeling. In a world where capital gets all of the residuals after labor is paid, a reduction in labor share automatically means an increase in return to capital, which should make investing very attractive. Thus, why are firms today so profitable but invest so little?

By contrast, if we distinguish between return to capital and profits–as Barkai does–we can appreciate that sometimes profits may come from (non-replicable) barriers to entry and competition, not from capital accumulation. In these cases, additional investments may not be as profitable as past ones. In other words, if what makes Coca-Cola so profitable is its magic formula, new capital investments will have a significantly lower return, because they will be unable to add to the formula. Hence, Coke can be very profitable and not invest a lot.

Distinguishing between capital share and profits allows Barkai to gain some theoretical insights on the cause of the decline in these shares. If markups (the difference between the cost of a good and its selling price) are fixed, any change in relative prices or in technology that causes a decline in labor share must cause an equal increase in the capital share. Thus, if both labor and capital share dropped, we cannot blame a decline in the price of labor, it must be a change in markups, i.e. in the ability of firms to charge more than their cost (pricing power).

Does this mean that the decline in capital and labor shares is due to an increase in firms’ market power? Barkai provides a clue this might be true: a strong cross-sectional correlation between the increase in concentration of an industrial sector between 1997 and 2012 and the corresponding decline in the labor share in that sector. This conclusion is strengthened by a recent Fed working paper, which finds that on average M&As significantly increase markups, but have no statistically significant effect on productivity.

What Barkai does not address is the ultimate source of this increase in market power. Given the phenomenon occurred in the last twenty five years, it would only be natural to attribute it to the network externalities created by the ICT revolution. But the increase in markups is not limited to the high-tech sector. It could also be the effect of the demise of antitrust enforcement. But the phenomenon seems to take place even in industries that are not very highly concentrated.

My hypothesis is that markups have increased because firms became better at creating product differentiation and erecting barriers to entry. In 1980 Michael Porter wrote Competitive Strategy, the ninth most influential book of the 20th century according to the Academy of Management. In this book, Porter explained how firms can create barriers to entry and obstacles to competition to increase their pricing power. The book became the primary textbook of all of the strategy courses taught in business schools and the gospel of the leading consulting firms. It captured also Warren Buffet’s investment rule. As he famously stated: “In business, I look for economic castles protected by unbreachable ‘moats’.” Should we then be surprised if firms finally learned how to apply it?

If this were the case, Barkai’s model clea

rly shows that the outcome is inefficient: economic output and welfare could be greater if there were more competition. But how to promote it? The traditional antitrust method, which looks predominantly at mergers and market shares, could be insufficient. If Barkai’s conclusions prove to be robust, we may need to start thinking about new policies to promote competition.