A new working paper by James Bessen from Boston University finds that much of the rise in corporate profits since 2000 was caused by political rent seeking.

Looking at both intangible investments and political activities to explain the 20 percent rise in Tobin’s q in the U.S. since 1970, a new working paper by James Bessen from Boston University concludes that activity associated with increased federal regulation is the most important explanatory factor, especially after 2000. In fact, spending on R&D and other intangibles has fallen, relative to conventional assets, since 2000.

Noting that operating margins for these firms have also risen since 1990 by over 2 percent in aggregate, Bessen’s study also found that variables associated with regulation and corporate campaign contributions account for about half of this increase.

When expressing the political rent seeking effect in dollar terms, the paper states that it corresponds to an increase in the value of non-financial public corporations of about $2 trillion, and that this amounts to an annual transfer from consumers to firms of about $200 billion. Several tests performed by Bessen also suggest that the link between industry regulation and corporate profits is indeed causal, flowing from regulation to profits.

Central to the study is Bessen’s use of RegData.((http://regdata.org/)) Based on a November 2014 paper by Omar Al-Ubaydli and Patrick McLaughlin, “RegData: A numerical database on industry-specific regulations for all United States industries and federal regulations, 1997-2012”, RegData is currently the most advanced way of improving the measurement of regulations and the regulatory process. In contrast with previous methods that counted words or pages in regulatory documents, RegData quantifies regulations based on the actual content of regulatory text and is focused on “restrictive” words that indicate an obligation to comply, such as “shall” or “must.”

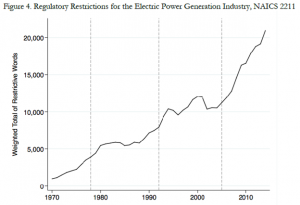

The RegData technique provides deep insight into the complexity of regulation. For example, last January, the Mercatus Center at George Mason University, which hosts the RegData project, published “The McLaughlin-Sherouse List: The 10 Most-Regulated Industries of 2014,”((Patrick McLaughlin and Oliver Sherouse, “The McLaughlin-Sherouse List: The 10 Most-Regulated Industries of 2014,” (2016).))which was led by petroleum and coal products manufacturing (25,482 restrictive words), electrical power generation, transmission and distribution (20,959 restrictive words), and motor vehicle manufacturing (16,757 restrictive words). Bessen used RegData to gain a deeper understanding of the relationship between regulation, rent seeking and the balance of power between corporations and consumers.

Bessen’s paper corresponds with a 2015 presentation by Jason Furman and Peter Orszag, in which they explored the potential role of rents in the rise in inequality, and in allowing firms to achieve super-normal returns. After comparing the distribution of returns on equity across S&P 500 firms between 1996 and 2014, they found a distinct possibility of “an increased prevalence of super-normal returns over time” (which the distribution skewed to the high-end over time, since the firm at the high-end of the distribution earn more super-normal returns). After reviewing Census Bureau data on market consolidation showing that in three quarters of the industry covered by the census, the 50 largest firms have experienced a rise in revenue share, the two concluded that “consolidation may be contributing to the changing distribution of capital returns and the increased share of firms with apparently super-normal returns.”

Bessen’s path to his current academic post, a lecturer at the Boston University School of Law, was unusual.

Bessen studied economics at Harvard. Later he became a software engineer and developed the first commercially successful “what-you-see-is-what-you-get” (WYSIWYG) PC publishing program. In 1993 he sold the company he founded, Bestinfo. He returned to academia, working with Nobel Laureate Eric Maskin on a paper about software patents. In 2002 he became a visiting scholar at MIT’s Sloan School of Management, and in 2004 he joined Boston University.

Last May he published a Working Paper, “Accounting for Rising Corporate Profits: Intangibles or Regulatory Rents?”,((James E. Bessen, “Accounting for Rising Corporate Profits: Intangibles or Regulatory Rents?” Boston University School of Law, Law and Economics Research Paper No. 16-18 (2016).)) which has received good feedback.

Guy Rolnik: In the January/February 2015 issue of Foreign Affairs you wrote((James Bessen, “The Anti-Innovators,” Foreign Affairs (2015).)) on how special interests undermine entrepreneurship, and in May 2016 you wrote an HBR piece titled “Lobbyists Are Behind the Rise in Corporate Profits.”((James Bessen, “Lobbyists Are Behind the Rise in Corporate Profits,” Harvard Business Review (2016).))Why are you so interested in regulatory capture and special interests?

James Bessen: My main research focus is technology. I have a technology background. I ran a software company and it’s what I have been studying for about 15 to 20 years. This is my second piece on political economy. The first was that Foreign Affairs piece.

As I was looking at what was happening in technology policy across many different areas, I saw the same thing happening, whether you are talking about trade secret law, patents, non-compete agreements for employees, or government procurement policy. It just seems that policy is working against startups in way not seen in the past. It seemed to be in favor of the incumbent firms. That observation led me to the Foreign Affairs piece.

GR

: Did it come from your academic work, or was it something that you picked up when you were still in industry?

JB: It came more from the academic work. A lot of my work was in the area of patents. When I was in industry, I was in the software business. Just after I sold my company, they started issuing software patents in large numbers. Immediately, people in the software industry were upset by this.

They felt that, “Here’s a very innovative industry. Why do you want to introduce patents and lawyers into something that’s working very well without them?” To this day, most software developers are opposed to patents on software, or at least most patents on software.

I started a line of research that looked at that controversy. What happened was, it turned out that it was the well-established hardware companies, and then later on, the large software companies, were in favor of these patents, but most software developers were not.

Even as recently as four or five years ago, start-up firms generally didn’t get patents in software.

These patents benefit large hardware and software companies, sometimes at the expense of startups. But because this change created large numbers of software patents with poorly defined property boundaries, patent litigation started to increase sharply. Many of these lawsuits were filed by patent trolls who used lawsuits to extract settlement payments from startups.

As we did more empirical research on what was going on with patents and patent trolls, and it became a legislative issue, it was very striking.

We did a lot of work on patent trolls that was entered into the debate as firms were pushing for legislative reform on patents. The lobbying that went on was so striking. It was huge. It was an education for me.

Where I’d been thinking in very academic terms, there is this brutal policy landscape and conflict that goes on. That has a whole lot to do with how this policy has evolved in the beginning and how it is evolving today.

GR: When you say it was an educating experience for you, do you mean that you realized that regulation and patents work for the big incumbents?

JB: Right. Not only do they work for them, but that the political process was centered around them.

I’ll give you a little backstory. There was a lot of discontent that started bubbling up in the late 2000s, a huge increase in lawsuits.

Lots of small companies were sued both in tech fields and even outside of tech. A lot of retailers, a lot of travel or hotel industry people, who all of a sudden are upset about patents because they’re getting sued over this whole range of patents that should never have been issued, but it becomes a legal strategy to extract money out of them.

In 2011 a new patent law passed, the Leahy-Smith America Invents Act. This patent law was essentially negotiated between a small number of large pharma companies and a small number of large tech companies.

This law has some good things about it, but there was a huge amount of lobbying, a huge amount of money that poured into this, and they came up with something that was very tame.

Because it didn’t address the problems, all of a sudden you have a whole lot of small businesses in every state in the country who are now upset about getting sued for patent infringement over these very ridiculous claims.

What you saw from 2013 is this much broader grassroots activity pushing for patent reform by a lot of start-ups, by a lot of small companies, throughout the country.

It’s been pretty much blocked by pharmaceutical companies, patent trial lawyers and some well-established interests. This was my original education on how things are playing out. It’s happening in other policy areas.

GR: What brought you to this recent paper?

JB: I’ve been reading some of the papers of Jason Furman and Peter Orszag.

GR: Do you mean the paper about the “super firms”?

JB: Yeah, “A Firm-Level Perspective on the Role of Rents in the Rise in Inequality.” As a technology guy, my first guess was that a lot of this rise in profits may not be about political rent seeking. It may be just returns on technology investments as firms are making more and more technology investments.

These investments don’t show up in normal accounting, in the normal balance sheet, as assets, and this has been a well-known problem for some time. When I started out I had the expectation that I was going to find that there were some political rent seeking aspects to the rise in profits and the rise in corporate valuations, but that it was probably more an issue of unmeasured technology investments.

What I found was that I was wrong in my prior opinion, especially for the last decade, it’s been more a story about political rent, especially concentrated in regulated industries.

GR: How long was the period you’ve been looking at?

JB: The total period I looked at was from 1970 to 2014, but when I say, “The last decade,” I really mean from 2000 on. 2000—that was when the tech bubble burst, the Internet bubble, and firms had been spending a lot on technology. They cut back some of that spending. Since then, you’ve seen a relative decrease in technology spending, but regulation and campaign spending have gone up.

GR: Why do you think that lobbying expenditure is a good measure of rent seeking?

JB: I don’t think lobbying expenditure itself is a very good measure. One of the things that comes out of this paper is the suggestion that lobbying expenditure and campaign spending are tip-of-the-iceberg measures.

What it finds is that the regulation index is the strongest factor.

GR: The RegData index.

JB: The RegData, yeah. That is picking up. My interpretation is that when you see an industry with a very high RegData index, a very high level of complexity or restrictive words in the regulation, that reflects a lot of industry rent seeking activity. But the nature of that activity is very varied and involves a lot of different things.

It includes lobbying and campaign expenditure, but those two things are probably a small part of it.

GR: Is this a more of a Stiglerian phenomenon, or more of a tollbooth phenomenon?

JB: It’s very much a Stiglerian type phenomenon. The tollbooth idea implies that regulators want to extract rents from companies, and so you would expect highly regulated industries to have decreased rents.

The Stiglerian idea is that regulation comes about because of cooperation between regulators and industry, and so you would see greater rents. That’s what we see. It may not be a simple story of industry activity capturing individual regulators.

There may be a much more complex story. It may be, for instance, that regulatory complexity helps established firms extract rents and complexity serves as a barrier to entry to new startups; these barriers can increase rents and corporate valuations.

GR: So the important empirical evidence is derived from RegData correlating with the rents that are manifested by the Tobin outcomes?

JB: Right. I’m seeing a large correlation, and that seems to be accounting for a very substantial part of the increase in rents.

It could be that we’re seeing a spurious correlation and that perhaps it’s high-profit industries that are attracting regulation.

At the turn of the 20th century, trusts were these high rent, high monopoly industries that were getting attacked by regulators because they were making high profits.

I did this causal analysis and found that the causality really does flow the other way: when you see an increase in regulation, profits follow.

GR: Another surprising finding of yours is that you feel that most of the rents are derived from complex regulations, and not from market power driven by concentration.

JB: I don’t think these things are necessarily in opposition. The problem is that my data doesn’t speak to it. I do use the share of the top four firms in an industry and find that it does not have much explanatory power. But that’s only one measurement of market power.

There may be many other sorts and it may be that the relevant sorts of market power aren’t picked up by a simple index like that. It may be that, for instance, when you think about the electric utility industry, the relative market power is not the national market but the local market, so you’re not going to pick it up there.

When you think about the pharmaceutical industry, you may be talking about a highly differentiated product market, so it’s not the number of pharmaceutical firms in general. It may be the ones that are particularly involved in producing Statins, or cancer drugs or other treatments.

There are these niche markets that they compete in and they may very well work as monopolies.

GR: Some of the industries that you do mention that have rising regulatory complexity are also quite concentrated or have high HHI values, like telecom, mobile, cable, big pharma, and of course airlines, railways, and so on.

JB: That’s right. The study raises more questions than it answers. These are some of the interesting questions. What it speaks to is that we really don’t have our arms around what’s going on in all these industries. We can speculate.

It’s this notion that we can look at these concentration ratios, and they’re indicative for some industries, but in other industries it’s not picking it up. It’s just not the best measure.

GR: How is it that the financial sector does not appear among the five industries that you mentioned?

JB: Good question. It’s because the way that balance sheets are constructed and…

GR: Because of the Tobin’s measure, you can’t use Tobin for financial companies. Since RegData is the base of your empirics, can you say something about the way it works?

JB: It’s a very clever approach they’ve got. They’re continuing to refine it. Previous measures have just looked at the gross number of words in regulations. The developers of RegData do two things. One is they look at restrictive words, words like “shall,” or “must,” to rank the restrictiveness of each section of the Federal Code. They also look at key words that relate to a particular industry, using a sophisticated textual analysis, and that’s where we get the real action in this case. They’re able to go and do an annual measure, for most industries, that tells us the regulatory complexity. It’s fascinating to look at some of these.

You see something like major legislation gets passed—and then the regulatory complexity goes up. You see some cases where there’s deregulation occasionally and the complexity goes down for a period of time, but the overall trends are up.

GR: Would it be correct to say that, in a way, what you’re saying is that this paper adds to the literature that proves that George Stigler was right, and it’s happening in a big way in the last 15 years?

JB: Yes. The surprise here is the magnitude of things. That’s what caught me and surprised me. I’m seeing a very strong effect and an economically large effect. That makes me stop, think and say “This is important stuff.” It’s Stigler being right in a big way.

GR: In your HBR paper you say that basically lobbyists and lobbyism are only the tip of the iceberg. Can you describe what you think goes beneath the surface level in this?

JB: First of all, it’s not only U.S. activity. It’s global. Second, lobbying is largely directed at getting legislation and regulatory decisions, but there’s a lot of what we would call rent seeking activity.

If you look at the electrical industry or cable television, there are rates that get set. There are these complex rules, and firms have to meet with regulators on an on-going basis. That’s not lobbying, per se.

They may challenge those rates and those rules in court. They need to be monitoring them. They may change their offerings, their products, to take advantage of changes in regulation. That was part of the story with the Cable Act of 1992 where they made these changes.

This is the point that Richard Posner made back in 1975. Using the example of airline regulations, he saw that rent seeking involves actually changing the nature of their products and services. You’ve also go

t activities like clinical drug trials which are huge investments that pharmaceutical firms make with the aim of getting regulatory approval.

All of these sorts of things are termed as rent seeking activitis—activities where the firm invests in getting a political outcome that increases their rent.