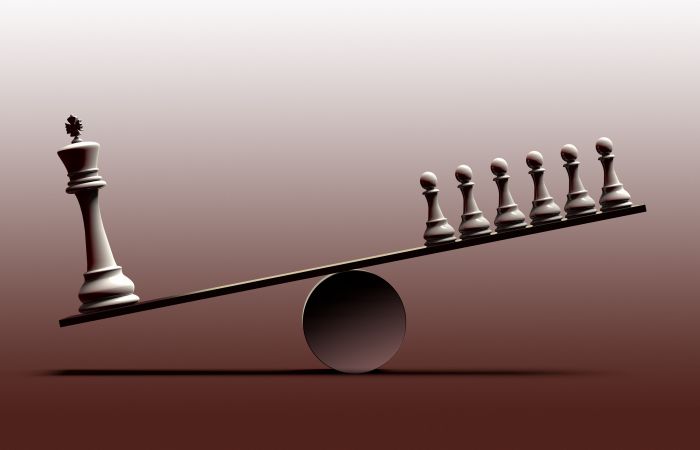

Rich people are much richer than they used to be in large part because they pay much less tax than they used to. This—not technological change, trade, “superstar effects,” “skills gaps,” or “decaying family structure”—explains rising inequality, and it is central to what it means to be rich in the 21st century.

This presidential election season has had one happy byproduct: extensive public discussion of the extent to which wealthy Americans avoid paying taxes.

Obviously, the revelation that Donald Trump himself has likely avoided paying income taxes entirely since booking a nearly $1 billion capital loss in 1995 is the clearest example. But there’s also Hillary Clinton’s somewhat surprising statement at the first presidential debate that the upper-income tax cuts during the administration of George W. Bush, in 2001 and 2003, were part of a “perfect storm” that created the 2008 financial crisis. In a larger sense, Clinton’s promise not to increase taxes at all on households earning less than $250,000—criticized by many, especially on the left, for arbitrarily constraining the policy space and ruling out some good ideas like expanding Social Security—has had the welcome effect of focusing attention on just how much income north of that figure there is to tax.

Clinton’s claim is at odds with conventional wisdom in economics and in economic policy-making in two ways. First, that so-called wisdom holds that the share of income and wealth in the hands of the wealthy is unrelated to economic outcomes for the rest of us. Second, conventional economic wisdom holds that the “optimal” policy is not to tax wealth at all and to tax income only if doing so does not result in significant reduction in labor supply by the rich.

These ideas, which many take as universal truth, depend on highly stylized assumptions about what causes capital formation, wage-setting, and economic growth more generally—assumptions that, on the whole, have been shown to be either wrong or at least highly simplistic by recent empirical research. And yet, tax policy has increasingly reflected these so-called “optimal” policies. In fact, part of the justification for increasing the number of carve-outs benefiting the rich is that reducing their tax burden more overtly might be seen, unfortunately, as politically problematic, so it’s fine to riddle the tax code with loopholes behind the scenes so as to bring about optimal policy. That, more or less, has been the mindset of policy-makers, heavily influenced by advocates for wealthy interests.

Part of the backdrop for this electoral debate about taxes is a feud among economists about the role of tax policy in soaring income inequality. Last year, William Gale, Melissa Kearney, and Peter Orszag, all affiliated with the Brookings Institution, published a short paper arguing that increasing tax rates on the rich would not meaningfully impact income inequality. They “showed” this with a fairly simple calculation reducing rich people’s earnings in the event the top statutory marginal income tax rate (the taxes paid on the highest incomes) were increased from its present 39.6 percent to 50 percent. This calculation ignores any potential effect such a policy change might have on labor supply or any other “real” economic variable—such as wages and earnings for everyone else. More on that below.

At the time, I wrote a blog post criticizing both the metrics they employed and the strong conclusions about the relationship between tax policy and inequality they derived from that exercise, and Henry Aaron, also at the Brookings Institution, followed up with a short paper titled “Can taxing the rich reduce inequality? You bet it can!” Commenting further on the controversy, Patrick Driessen argued that the exercise ignores the accumulated, undistributed wealth on corporate balance sheets—wealth that is effectively owned by the rich but that is largely untaxed in our loophole-ridden corporate tax system.

Why dredge up a minor 2015 disagreement among tax wonks now? Because one person whose income would be entirely unaffected by raising the statutory top marginal tax rate to 50 percent is Donald Trump—he’s not paying income taxes at all! And that directs attention to further policy questions—why has the effective tax rate paid by the rich been on a long downward march, even as the statutory rate for high incomes has bounced up and down since the early 1990s? Our tax system is riddled with vehicles by which the rich can avoid taxes, especially on savings, so long as they can designate the accumulated wealth as serving some social policy end—saving for retirement, for housing, for their children’s college education, for healthcare, even for fuel-efficient vehicles. All of these social policy tax shelters have their root in, first of all, some measure of social glow associated with each of these activities, and second, a reluctance to have government actually spend money on anything in its budget. Better to “incentivize” individuals to save themselves—even if the government does lose significant revenue on the back end, and even if that incentive is worth far more to people who pay more taxes and who likely would have been doing the saving anyway—i.e., the rich.

Then consider tax policies that truly do only benefit the extremely rich: the step-up in basis of securities values at death, meaning that heirs get to wipe the slate clean when it comes to paying taxes on fortunes accumulated by their benefactors. Or the ability to take an enormous pass-through business “net operating loss” as an ongoing shelter for ordinary income, as Trump seems to have done. Megan McArdle wrote a column praising the economic soundness of the policy, since it allows business-owners to smooth their income so that their annual tax bill isn’t completely unrelated to their ability to pay—and presumably there’s a policy interest in doing that in order to promote entrepreneurial risk-taking. The only problem is that this is not a tax strategy we extend to those with less to lose. Lily Batchelder conducted an analysis of what would happen if we extended the logic of income-smoothing down the income distribution: it would result i

n a fairer tax system. But to a large degree, it is the rich who have discretion over when and how their income is earned, not the poor, and even under similar tax rules for both groups, the rich would still enjoy the enormously lucrative benefit of choosing how much tax they want to pay.

And then we come to our sorry corporate tax system. Gabriel Zucman has shown the enormous cost of allowing corporations to choose where their profits are earned—in low-tax jurisdictions, where they then let the money pile up in order to avoid the U.S. corporate tax, which is only levied when that income is “repatriated,” or returned to the U.S.

A number of authors working in and outside the U.S. Treasury further estimate the effect of so-called “pass-through entities,” corporate structures that do not exist for tax purposes, but instead pass their income to their owners, who then (supposedly) pay taxes at the individual level. Unless they’re Donald Trump—or someone like him, but wise enough not to run for president. Often these pass-throughs are themselves owned by pass-throughs or otherwise non-taxed entities, to the point that the team of eight experts at analyzing tax data mentioned earlier was entirely unable to track 20 percent of pass-through income to its beneficial owner. The income they could trace is taxed at a much lower effective rate than in the traditional corporate sector. And even for the more traditional U.S. corporations that issue publicly-traded stock, recent research by the Tax Policy Center shows that an astounding 76 percent of the outstanding value is held in non-taxable accounts. Even ambitious tax reforms like equalizing treatment of capital gains and ordinary income won’t touch that pile, since it’s not subject to capital gains tax at all.

What does this all mean? To a large extent, that rich people are much richer than they used to be in large part because they pay much less tax than they used to. This—not technological change, trade, “superstar effects,” “skills gaps,” or “decaying family structure”—explains rising inequality, and it is central to what it means to be rich in the 21st century. Moreover, it doesn’t just explain why “post-tax” inequality has risen—it also goes a long way to explaining why pre-tax inequality has as well. Why? Because when rich people face a high effective marginal tax rate—and in fact, it used to be 90 percent—that is a de facto maximum income, and all of the strategies that re-direct income toward the top (financial chicanery, outsourcing labor, merging already-profitable businesses and/or engaging in anti-competitive behavior more broadly) become pointless and self-defeating. But when effective marginal tax rates are low, as they increasingly have been in recent decades, those strategies look much more attractive.

That mechanism—what Thomas Piketty, Emmanuel Saez, and Stephanie Stantcheva call the “third elasticity” in their 2014 paper relating taxation of the rich to rising inequality across countries—is why economics papers on “optimal taxation,” which inform so much of our tax policy, often miss the policy’s most critical implications. “Optimal taxation” papers usually assume that every worker, rich and poor, is paid their marginal product of labor, and that those who own capital are in turn paid its marginal product as a dividend. Whereas in the real world it’s clear that wage-setting in the labor market and payouts to the owners of accumulated capital are both quite a bit more complex.

The third elasticity is why Clinton’s somewhat inscrutable debate comment about tax policy in George W. Bush’s administration isn’t as disconnected from reality as some commentators have claimed. The Piketty, Saez, and Stantcheva paper suggests a mechanism by which tax policy might be behind the labor market’s weakness since, and even before, the Great Recession. Tax policy is also likely to be a major contributor to the larger phenomenon of financialization—or the outsized role of the financial sector in our economy—certainly in privileging payouts to shareholders and rising pay for executives over other corporate uses of funds. Did tax policy then play a role in, for instance, the mortgage securitization and the risky financial structures of banks and quasi-banks that caused the 2008 financial crisis itself? That is an ambitious thesis and a heavy burden for tax policy alone to bear, but that isn’t what Clinton was saying. She was saying that a menu of wealth-friendly policies set the stage for a financial and economic meltdown. And when we look at all the effects tax policy has in the real world, as opposed to those theorized by economic models, there is certainly evidence for that theory of recent economic history.

(Note: Marshall Steinbaum is Senior Economist and Fellow at the Roosevelt Institute researching the labor market, inequality, higher education, and student debt. This post originally appeared on October 17 in the Roosevelt Forward Blog)