How does a monopolist know what prices to charge to extract the most profit? A new paper digs into the classic monopolist’s problem with a look at the tobacco monopoly in the 19th century Kingdom of Italy.

We teach first-year students that a textbook monopoly is a firm whose demand is wholly unaffected by the actions of any other firm, and which therefore needs only worry about the consumer’s response to its own action.

Such firms are today very rare in practice. Nonetheless, in a recent paper, we study the behavior of one firm that, in the less globalised economy of 150 years ago, came remarkably close to this ideal abstraction: it was the “Società Anonima per la Regìa Cointeressata dei Tabacchi.” A private syndicate of European financial organisations, for the 15-year period from 1869 to 1883 it ran the franchise of the operation of the entire tobacco industry in the newly formed Kingdom of Italy, from imports of raw materials and finished products, through manufacture, down to distribution to retailers of the more than hundred different tobacco products for sale in the country. The Regìa negotiated with the Italian government, which awarded it the franchise, a profit-sharing contract that comprised an annual rent, that is, a fixed payment accounting for the award of the franchise and for the payment for the lease of all the government-owned plants and equipment and a share of the annual profit

The Regìa was in charge of the operational and managerial control, with the Italian government retaining complete control of the prices of all tobacco products. It is thus clear that the objective of both parties was to extract as much profit as possible from the market. Agostino Magliani, the Finance Minister (Treasury Secretary) made this quite clear both when he boasted in Parliament that the good deal obtained for the Treasury was due to his negotiating skills, and when he enacted price changes with “emergency legislation.” This ruse allowed him to change the price overnight, and get the necessary legislation through Parliament after the fact, to avoid, as he explained, “giving consumers advanced warning of a price increase, which would detract enormous amounts of tobacco from the new tariff,” as they would buy as much as they could and store it for future use. Consumers were not just effectively prevented from short-buying, but also from benefitting from smuggling and bootlegging: historical sources suggest that the extent of these activities was negligible. And of course the addictive nature of tobacco consumption, the total vertical integration of the supply chain, and the absence of any plausible substitute closed the circle and made the industry the elusive textbook monopoly.

|

This real-life profit-maximising textbook non-discriminating monopolist thus had the will and the legal power to charge profit-maximising prices. Did it, however, have the knowledge of what these prices were? |

Also perfectly in line with textbook monopoly was the Regìa’s complete inability to do any price discrimination. All consumers, rich and poor, from the Alps to Sicily, could buy the same products at the same prices. This was not so much due to legislation requiring price to be uniform across the country—legislation that could conceivably have been changed—but rather to the lack of internal barriers to trade, so that different prices in different parts of Italy would have created easy arbitrage opportunities that would be impossibly costly to police. Similarly, it would have been very hard to prevent consumers from taking advantage of quantity discounts, or any form of early-days frequent-flyer-type device to vary the unit price charged according to the number of units a smoker purchased.

This real-life profit-maximising textbook non-discriminating monopolist thus had the will and the legal power to charge profit-maximising prices. Did it, however, have the knowledge of what these prices were? Knowing the position and slope of the demand curve is usually something that we take for granted when we explain the monopolist’s problem by drawing a smooth nice downward sloping demand function on our classroom whiteboards. However, in a world where market research is well into the future and you are trying to sell more than one hundred products, things are not so simple. In particular, the demand functions for tobacco products are highly interdependent: an increase in the price of luxury cigars will convince some customers to switch to cheaper brands, just as a decrease in the price might relieve other customers from the hassle of rolling one’s own and purchase ready-made cigarettes instead of loose-leaf cut tobacco. Mister Magliani, the man (pictured above) in charge of choosing prices, was indeed well aware of this interdependence: the Parliament minutes have him explaining to his colleagues, “I examined each variety of tobacco, in relation not only to its similar ones, but also those fairly different ones, to understand the effect on sales of changes in tariff of any variety.”

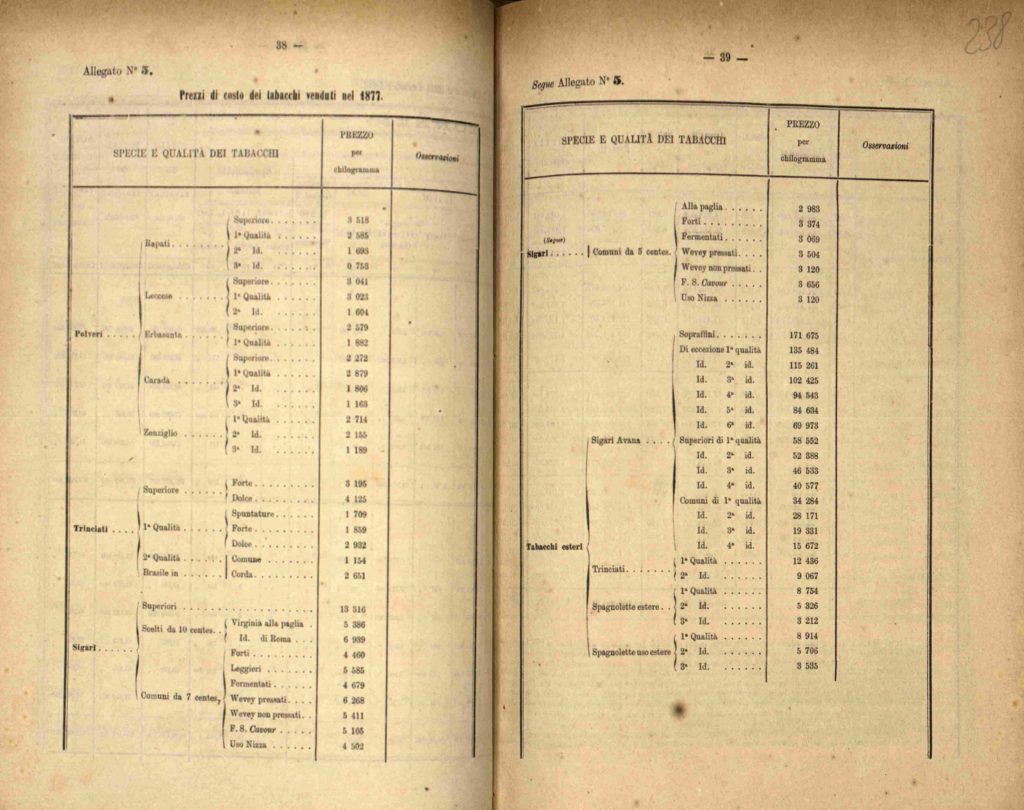

Our paper tests whether he was successful first in understanding these effects and second in working out their consequences on the best set of prices for all the products available to Italian tobacco users. We do so using the very detailed information on sales of every product in every province that the Regìa was obliged to record by the contractual terms with the government. This information was duly digitised from the accounting registers still held today in the archives of the Ministry (see Figure 1).

For the first step, we calculate how the demand for each tobacco product varies when the prices of all the available products vary, and of course other possible influences on demand such as income and, given the addictive nature of tobacco consumption, the amount consumed in the past. To perform this step, we need to introduce two simplifying assumptions. First we assume that consumers in each Italian province have similar preferences for tobacco: in essence, we take the average demand for each province as the demand of the representative consumer of that province. Second, we aggregate the products as well: many products differ in name only, being similar in mode of consumption and in price, and so we treat them as one product. This aggregation process leads us by steps to classify all the products into nine categories: high, middle, and low varieties of cigars, loose leaf cut tobacco, and snuff. Next, we use established techniques to estimate the nine demand functions of these products (or rather “product groups”), that is, how each of the nine prices affects the demand for each of the nine products.

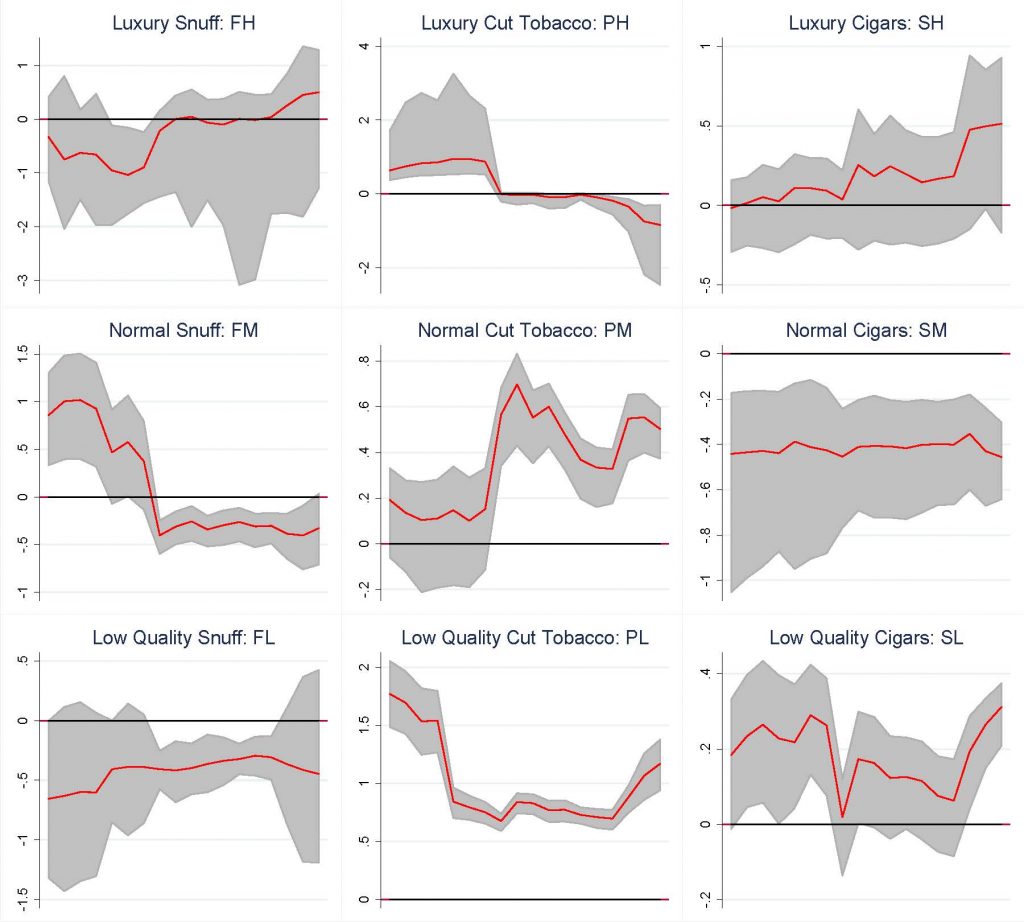

For the second step, we apply fairly complex formulae, developed by microeconomic theorists after the 1970s, which combine the shapes and slopes of these nine-dimensional demand functions with the production costs of each of the products to determine nine numbers which, for profit maximisation, should be equated to the corresponding markup. The markup is the proportion by which the retail price should exceed the production cost for each of the nine products. Our results can be summarised in Figure 2, which shows, for each of the nine products, the difference between the mark-up and this complex expressions. This is given year by year, by the red line in each small diagram. When the difference is zero for a product, the price of that product was bang-on the profit-maximising one. The grey bands around the red line contain the 95 percent confidence intervals of our estimation of the difference: the narrower the band, the smaller the possible error due to imperfect measurement of the data.

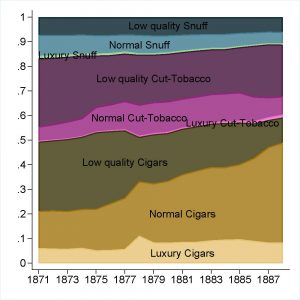

As the Figure shows, overall, the prices charged in those years were not too distant from those that a careful econometric analysis, au fait with the theory of addiction, armed with the techniques necessary to estimate interdependent demand functions, and aware of the multi-dimensional profit-maximisation problem would have recommended. Note also that tobacco prices were not just set simply following some naive rule such as a constant markup over cost: in fact, while production costs were relatively stable in the period we consider, prices instead increased substantially, following steady increases in demand, which moreover was not equally distributed among the products, as Figure 3 illustrates. This may suggest that the managers of the private franchise and Minister Magliani, a man who, having been among the founders of the Adam Smith Society in Florence perhaps understood well the allocative role of prices, were able to choose the prices of tobacco with a good intuitive knowledge of the demand and cost conditions.

Record keeping and hard information becomes patchy with the end of the franchise and the return of the industry into direct government control, and, perhaps especially after Magliani’s eviction from office, and it is impossible to extend our analysis beyond 1888.

Carlo Ciccarelli is an economic historian at the University of Rome Tor Vergata.

Gianni De Fraja is Professor of Economics at the University of Nottingham, and at the University of Rome Tor Vergata.

Silvia Tiezzi is an economist at the University of Siena – Department of Economics and Statistics.

Disclaimer: The ProMarket blog is dedicated to discussing how competition tends to be subverted by special interests. The posts represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty. For more information, please visit ProMarket Blog Policy.