Is the rise of wealth inequality in the United States related to a decline in competition? A new paper answers in the affirmative.

Is the rise of wealth inequality in the United States related to a decline in competition? And if so, could reinvigorating antitrust help address it? Lately, these two pertinent questions have been the subject of much discussion. Earlier this week, the debate over the nature of the relationship between competition and inequality has also been featured in the pages of the New York Times. (The New York Times also devoted an editorial to this issue last year).

We at ProMarket have recently explored the connection between antitrust enforcement and inequality in a series of posts, the last of which was an interview with University of Michigan law professor Daniel Crane, who in a recent paper argued that the connection between antitrust and wealth inequality has been grossly oversimplified by antitrust advocates((Daniel A. Crane, “Antitrust and Wealth Inequality,” Cornell Law Review 101 (2015).)).

The relationship between income distribution and market power, Crane argues, is “subtle, circumstantially contingent, and, at least for a developed economy, extremely difficult to generalize,” which makes the connection between the level of antitrust enforcement and the level of inequality “far more complex” than what many antitrust proponents make it out to be.

In his paper, Crane disputes some of the major arguments raised by antitrust advocates and notable scholars like Joseph Stiglitz and Paul Krugman: namely, that monopoly profits are disproportionately captured by wealthy corporate managers and shareholders; that firms profits are higher in highly-concentrated markets; that wages are lower in concentrated markets (in fact, he argues, wages are higher in concentrated markets due to monopoly wage premiums); and that monopoly prices are disproportionately paid by the less affluent.

While conceding that there may be some relationship between wealth inequality and market competitiveness, and that some antitrust interventions could have an effect of reducing inequality, Crane argues against the claims that more rigorous antitrust would necessarily lead to a progressive redistribution of wealth. Some antitrust enforcement, he claims, could even have an unintended effect of increasing inequality.

Crane’s arguments have been criticized by some, most notably by Harvard Law School professor Einer Elhauge, who in a recent paper about horizontal shareholding called Crane’s arguments “mistaken,” writing that “because anticompetitive profits accrue to only some firms, anticompetitive profits increase income inequality by making some shareholders richer than others.”((Einer Elhauge, “Horizontal Shareholding,” Harvard Law Review 129 (2016): 1267-1317.))

A continuously growing body of literature has suggested in recent years that the U.S. economy is indeed more concentrated, and that this concentration has had regressive effects. A 2015 study by Gustavo Grullon, Yelena Larkin, and Roni Michaely has shown((Gustavo Grullon, Yelena Larkin, and Roni Michaely, “The Disappearance of Public Firms and the Changing Nature of U.S. Industries,” working paper (2015).)) that in the last two decades, more than 90 percent of U.S industries experienced an increase in concentration levels. According to Census Bureau data cited by Jason Furman and Peter Orszag, in three-fourths of the broad sectors for which the Census Bureau has data available, the 50 largest firms experienced an increase in market share between 1997 and 2007.((Jason Furman and Peter Orszag, “A Firm-Level Perspective on the Role of Rents in the Rise in Inequality.” Presentation at “A Just Society,” Centennial Event in Honor of Joseph Stiglitz at Columbia University (2015).))

Recent studies have shown how increasing consolidation in industries such as healthcare, airlines, banking, and agriculture has led to significant price increase. A 2012 paper by Northeastern University’s John Kwoka((John Kwoka, “Does Merger Control Work? A Retrospective on U.S. Enforcement Actions and Merger Outcomes,” Antitrust Law Journal , Vol. 78 (2013).)), cited by the New York Times, studied the effects 48 approved mergers and found that 36 mergers (or 76.6 percent) were followed by price increases, with an average increase of 8.64 percent.

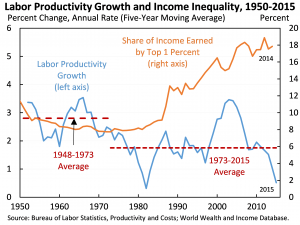

Some scholars, most notably Thomas Piketty, point to abuses of market power as a contributing factor to the rise of wealth inequality in the US. In a recent article, Furman—Chairman of the White House Council of Economic Advisers—suggested that a rise in monopoly rents has contributed to both the slowdown in productivity growth and the rapid rise in inequality.

Is antitrust the right tool to address wealth inequality?

The notion that market power contributes to a decline in competition, reduced dynamism in the labor market, and significant price increases, all of which can contribute to a rise in inequality, seems well-established by now. But to the extent that inequality may be influenced by lack of competition, is antitrust really the best tool to address it? In a recent interview with ProMarket, Elhauge replied in the affirmative, arguing that “the level of antitrust enforcement could have a large effect on economic inequality and likely has a significant or noticeable effect on it, but not for sure.” Carnegie Mellon professor Martin Gaynor told the New York Times that he doesn’t see antitrust as a “major tool for addressing inequality.” Crane also believes antitrust should not regard reducing inequality as a goal. “Antitrust law works best when it’s concerned with economic efficiency and the protection of consumer welfare,” he told ProMarket.

A forthcoming paper by Lina Khan from Yale Law School, and Sandeep Vaheesan, regulations counsel at the Consumer Financial Protection Bureau and former special counsel at the American Antitrust Institute, however, makes the case for a more rigorous antitrust regime as one possible remedy (among others) for the rise in inequality((Lina Khan and Sandeep Vaheesan, “Market Power and Inequality: The Antitrust Counterrevolution and its Discontents,” Harvard Law & Policy Review, forthcoming.)). “Our argument is not that addressing inequality should be an explicit goal of antitrust, but that the enfeebling of antitrust has contributed to inequality, and that one effect of reinvigorating antitrust may be to mitigate that inequality,” says Khan.

Khan and Vaheesan counter many of Crane’s arguments, arguing that monopoly profits do tend to be disproportionately captured by wealthy CEOs and shareholders, that market power does in fact leads to a reduction in wages, and that a lack of competition resulting from lax antitrust enforcement leads to regressive distributional effects.

Market power, Khan and Vaheesan write, is an important and “significantly underappreciated” contributor to economic inequality in the United States. “Businesses have used a variety of methods—including collusion, mergers, and exclusion—that are, at best, policed imperfectly, to extract greater wealth from the public than would be possible were the markets that they dominate more competitive,” they write.

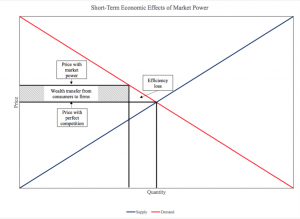

Among other things, they argue, concentration enables wealth transfers from consumers, workers, and entrepreneurs to corporate executives and shareholders. Market power, they write “can be a powerful mechanism for transferring wealth from the many among the working and middle classes to the few belonging to the 1 and 0.1 percent at the top of the income and wealth distribution.” Market power translates into political power, enabling monopolistic and oligopolistic companies to use their economic power to “push for laws and regulation that further entrench their position, enhance their clout, and transfer wealth upwards.”

“We’re not arguing that this connection is simplistic or very linear, or that market power is the sole reason for inequality,” says Khan, a fellow with the Open Markets Program at New America. “Declining market competition and weak antitrust is likely one contributing factor to inequality, and wealth transfers from consumers to investors is one face of that dynamic. But the effect extreme market concentration and lack of competition have on wages and entrepreneurship are equally important, and far less studied.”

In order to illustrate and explain why market power does have a regressive redistributive effect, Kahn and Vaheesan include case studies of seven sectors in which there is evidence of anticompetitive behavior.

In telecommunications, a wave of consolidation that followed the 1996 Telecommunications Act has created an environment in which 98 percent of the mobile subscription market is controlled by four firms—AT&T, Verizon, T-Mobile and Sprint—and the top two firms control 68 percent. The result of this consolidation, Khan and Vaheesan note, has not been improved service, but quite the opposite: the top firms introduced data caps and hiked prices, thereby forcing consumers to pay more for less. 50-70 percent of Americans today, according to some estimations, overpay on their mobile phone prices, and Americans now pay more than double for high-speed broadband than European consumers.

According to Khan and Vaheesan, research suggests that this is “an exercise of pure market power”: consumer demand for data has risen sharply and the cost of providing service has declined thanks to technological advancement, yet the quality of service has still been degraded.

This type of behavior can be seen in other sectors as well. Consolidation and common ownership among airlines, as José Azar, Martin C. Schmalz, and Isabel Tecu recently showed, led to a decline in the number of major carriers from nine to four, to a situation in which institutional investors held 77 percent of the stock of all airlines operating in the average flight route from 2001 to 2013, and to an increase of 3-11 percent in ticket prices despite a dramatic drop in fuel prices.((José Azar, Martin C. Schmalz, and Isabel Tecu, “Anti-Competitive Effects of Common Ownership” (Ross School of Business Paper No. 1235, University of Michigan, 2016).))

In agriculture, horizontal consolidation and vertical integration have concentrated control among a few food processors: the top four poultry processors control over 50 percent of the market, while the top four meatpackers control 80 percent of that market. The local impact of the consolidation is even more extreme, often rendering farmers “captive to the one entity” and enabling firms to require farmers to “bear the risks of business—including steep investments in farming equipment—and also dock the rates paid to these farmers.”

In health care, Khan and Vaheesan argue that the increasingly consolidated insurance industry passes higher costs to consumers in the form of higher premiums and deductibles. Hospitals have also experienced an enormous wave of consolidation in recent years, especially in the wake of the Affordable Care Act, with numerous studies showing that the effect has been higher prices for consumers. In health care, Khan argues, the consolidation of providers has fed the consolidation of insurers, and vice versa, as both groups vie for greater bargaining power.

“An interesting trend that applies across sectors is the way that consolidation in one tier spurs consolidation in another tier, which is something you see in health care,” says Khan. “Health insurers say we need to consolidate to counter the bargaining power of the hospitals, and the hospitals say we need to consolidate to counter the bargaining power of the insurers. You see these cascades of mergers, in part because different tiers in the supply chain are trying to counter each other’s bargaining powers. This means you need a forceful merger policy at the get-go: because there is a compelling argument that once one tier has become highly consolidated, for another tier to viably do business with them they need more bargaining power, which they seek to amass through merging.”

Going back to the foundations of antitrust

While the current antitrust regime disregards the political ramifications of market power, Khan and Vaheesan devote a great deal of their paper to the way economic power affects policy and politics, and in turn contributes to inequality. “The fact that companies in concentrated sectors can wield outsized political influence has distributive implications because business interests frequently lobby against regulations from which workers and consumers stand to gain.”

The problems of the current antitrust regime, they write, stem from a “counterrevolution in antitrust”: a set of political choices made during the 1970s and 1980s that “undermined antitrust law, removing a major Congressional safeguard for competitive markets and against monopoly and oligopoly”—namely, the decision to shift the focus of antitrust law from a multitude of factors—including political power—towards an exclusive focus on efficiency.

Whereas the original intent of the Sherman Act, Khan and Vaheesan argue, was to prevent a concentration of political economic power, to prevent unjust wealth transfers from consumers and small suppliers to large entities, and to preserve open markets, the new regime instituted by the likes of William Baxter (Ronald Reagan’s antitrust chief) focused almost exclusively on efficiency, disregarding non-price based harms that result from a lack of competition. Merger guidelines raised the concentration thresholds for horizontal mergers, declared vertical mergers largely benign, and relaxed monopolization standards to the point that anti-monopolization rules (section 2 of the Sherman Act) remain virtually unenforced.

Courts, too, moved from the simple per se rules and presumptions that used to guide antitrust enforcement to a defendant-friendly rule of reason regime, which Judge (and University of Chicago Law Professor) Richard Posner himself once described as “no more than a euphemism for nonliability.” The result, Khan and Vaheesan write, is that dominant firms were “freed to dominate our markets and our politics.”

Unlike Crane and Gaynor, Khan and Vaheesan do believe that antitrust “can and should play an important role in reversing the dramatic rise in economic inequality,” and offer a number of policy prescriptions to that end.

One measure Khan and Vaheesan suggest is a shift back from rule of reason to simple per se rules. “I don’t think rule of reason should be abandoned completely. There are certain contexts where it makes sense. However in highly concentrated markets, per se rules and presumptions may be more appropriate. These standards reflect a market structure-based view of power, which assumes that after achieving a certain level of market power, certain forms of conduct are likely to be anti-competitive, and the burden should be on companies to prove otherwise. This is an approach that simplifies enforcement,” says Khan.

She adds: “Congress had a pluralistic vision of antitrust, and it’s not clear that courts are well-equipped to promote these multiple goals through the rule of reason. To ask courts to essentially balance the economic power of a company against the potential cost-savings of a merger under a rule of reason standard is a recipe for the kind of inconsistent enforcement that a lot of critics say we suffer from. Per se rules and presumptions—the idea that once you reach a certain level of market power, certain activities of yours are assumed to be anticompetitive, with opportunity for rebuttal—would actually create more uniformity.”

The way rule of reason is applied today, she says, is highly open-ended. “A lot of the assumptions and presumptions are very defendant-friendly. There is a huge burden on plaintiffs to show certain forms of harm, which are oftentimes so prospective that it’s implausible to think that plaintiffs will be able to meet them. To bring a successful predatory pricing case, for example, you have to be able to show successful recoupment.

“Basically, you have to able to prove not only that a company was pricing impermissibly below-cost, but that the company would be able to successfully recoup those losses. In a lot in contemporary markets that kind of expectation is totally implausible: Think about Amazon. It has been amassing losses for decades. Amazon is not operating on such a short timeline that you’d be able to show that it could recoup within a few years; its strategy is long-term, which investors have blessed. Thinking about what a predatory pricing case against Amazon would look like with this recoupment requirement shows how these higher standards put an undue burden on plaintiffs. The practical effect is that there are entire areas of doctrine where you can’t bring a case anymore,” Khan adds.

Another option would be to break up firms in situations where vertical integration creates anticompetitive conflicts of interest. In order to remedy monopolization, the two write, “structural solutions should be favored.” Structural solutions “allow for a one-time fix and create or restore a market in which multiple firms exist and competition can develop.”

Khan and Vaheesan devote a part of their paper to call for a refocus of antitrust enforcement around one of the original intents behind the Sherman Act: preventing economic concentration from being translated into political influence.

“If you look at the legislative history of the Sherman Act, it was passed primarily as a political law, not as a technical economic regulation. It was understood at that time that concentration of economic power threatens democracy in the same way that concentration of political power does. There is a paper by Robert Lande, where he notes that, interestingly, when the Sherman Act was passed, consumers’ prices at the time had actually been dropping. He builds this argument to show that the antitrust law and movement were not strictly responding to higher consumers’ prices—given that we were actually seeing the opposite effect. What they were responding to was a feeling that there was an unjustness to what was happening, that there was a certain form of power that was being exploited,” says Khan.

Antitrust agencies, she adds, can take some actions immediately, without waiting for Congress to act. “Updating the horizontal merger guidelines and significantly revamping the vertical merger guidelines are two very basic actions that the executive agencies can undertake without any input from Congress,” she says.

This proposed shift toward market structure, Khan says, does not amount to disregarding the interests of consumers: “One of the most damning things about the current antitrust regime is that even by its own narrow consumer welfare standards, the current approach has failed, given that we’ve seen price rises following almost every major merger that the agencies have cleared. I think the current narrow focus on consumer prices should be abandoned. But I don’t think a market structure-based approach and consumer interests are at odds. I think in many ways a market-structure based approach is a much deeper way of promoting our interests as consumers—as well as, critically, our interests as workers and as producers and as citizens, which is what Congress intended.”