When IBM patented a punch card processing machine, it had the power to influence both the market of machines and punch cards, but this is not always the case when a company operates in two different but connected markets.

Editor’s note: Aaron Director, one of the founders of the so-called Chicago School of Law and Economics, died 15 years ago. To mark the anniversary of his death, ProMarket is publishing a series of articles on his work and controversial intellectual legacy. In the following piece, Sam Peltzman analyzes Director’s influence on one of the key concepts in Antitrust theory: tie-in sales. This post is an excerpt from an article published in the Journal of Law and Economics, vol. XLVIII (October 2005) © by The University of Chicago.

The sale of one product (X) conditional on the purchase of another (Y) comes in several varieties. For example, X might be a machine that uses various amounts of Y in a production process. In a “requirements” tie-in, the purchaser or lessor of an X must use only that seller’s brand of Y in the machine. Or X and Y could be two different machines that are both useful to a group of buyers. Bundling or full-line forcing occurs when a producer of X requires customers to buy a package of X and Y at a bundled price.

Tie-ins have been legally problematic when the seller of X (or Y) is a monopoly. For example, when X is protected by a patent or copyright. In such cases, the courts have sought to prevent monopolistic leverage—the use of the X monopoly to secure another monopoly in Y. If one monopoly is good for the monopolist and bad for the consumer, two monopolies must be better for the monopolist and worse for the consumer.

Aaron Director rejected this commonsense reasoning, just as he had rejected the easy logic of widespread predation and the reflexive condemnation of resale price maintenance. He did this by paying attention to some important facts about the way tie-ins worked in practice, facts that were not adequately captured by received theory.

The general idea that a monopolist might prefer to set two prices rather than only one was not novel to economists of Director’s era. Specifically, it was understood that a monopolist of X (say, coffee) would also like to have a monopoly of related goods—substitutes (tea) or complements (sugar). If Y was a substitute like tea, consumers would tend to be worse off with an X-Y monopoly than with an X-only monopoly, because the former would set a higher monopoly price of X than the latter and would extract monopoly rents from consumers of Y as well. If Y was a complement like sugar, the welfare effects were murkier. If the complementarity is strong enough, then both prices could be lower under dual monopoly than under separate monopoly.

Indeed, the possibility that an X-Y monopolist would sell, say, coffee below cost to promote sales of monopoly-priced sugar could not be ruled out. For drinkers of black coffee, such a state of affairs would be preferable even to a competitive coffee market.

The Monopoly Scope

Director had no quarrel with the logic underlying such theoretical propositions, nor did he reject as a broadly valid generality that, with exceptions such as the case of complements just discussed, two monopolies were worse for consumers than one. The problem with both the theory and the courts’ fear of monopolistic leverage was their excessive scope in light of facts about the markets in which tying is found.

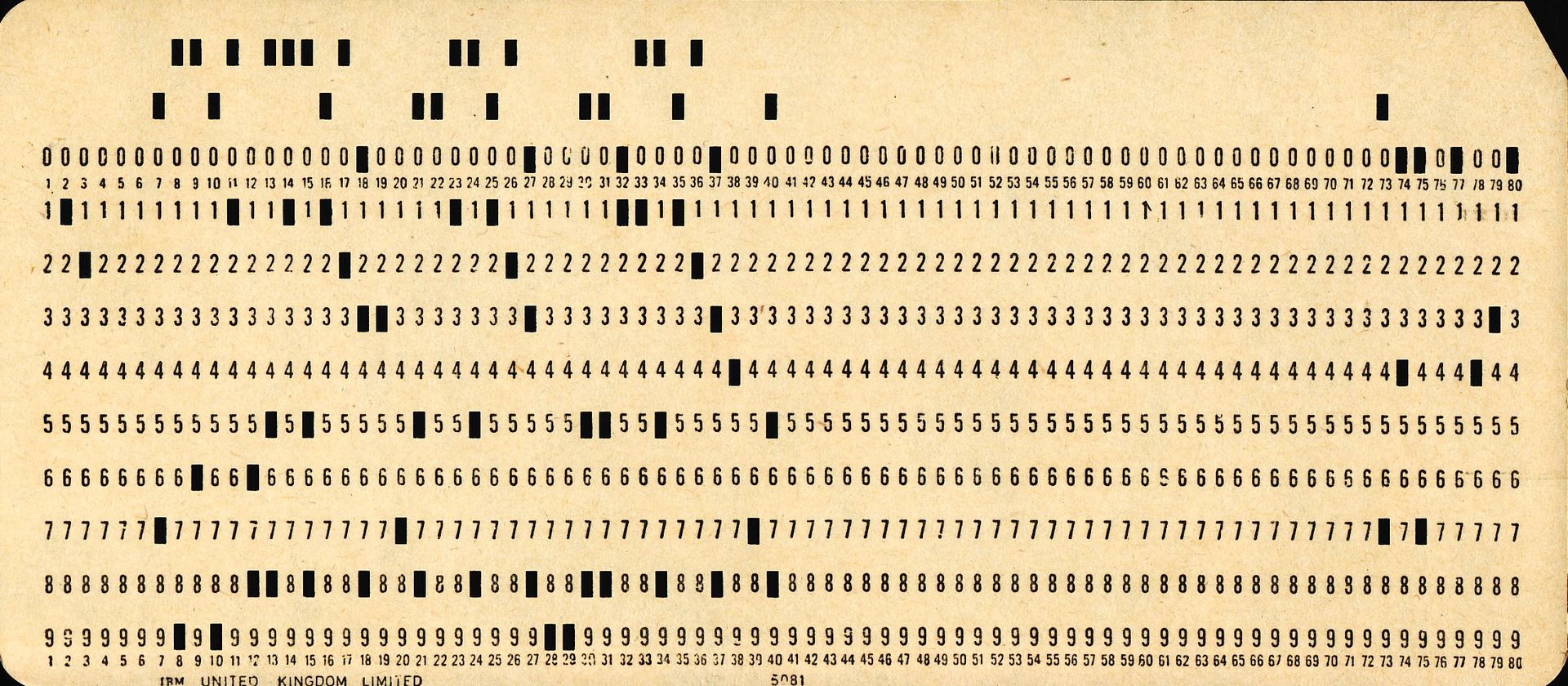

For the sake of brevity, I will focus on requirements tie-ins here. Here, one factual problem concerned the plausibility of the notion that the X monopoly could actually secure the Y monopoly by imposing the tie-in. Sometimes this was plausible, particularly if one took a sufficiently narrow view of the market for Y. Thus, when IBM patented a punch-card processing machine and tied the sale of cards to leases on the machine, all significant competition in the cards that these machines processed was precluded. But what are we to make of International Salt, which patented a salt-dispensing machine used by food processors and tied the sale of salt to dispensing machine leases? Or what of United Shoe Machinery, which tied the sale of thread to the lease of a patented sewing machine? In both cases, the tied sales (of salt and thread) were a small fraction of the total consumption of these items.

The notion that International or United could leverage their patents into monopolies of salt or thread was fanciful. Another problem, this time emanating from the theory, was the overwhelming prevalence of complementarity between the tying good (X) and the tied good (Y).

The theory suggests that the tied good could as easily be a substitute for X, but IBM apparently never contemplated tying accounting ledgers, nor did International Salt tie the sale of other spices. Indeed, by 1960 the theory had been broadened to include utterly unrelated goods as candidates for Y. Thus, M. Burstein wondered why IBM did not tie the sale of salt to its machine leases. Director may have wondered about such matters too, but he knew that, while we awaited a resolution of Burstein’s conundrum, a good theory had to recognize the fact that Y almost always was a complement to X.

Indeed, Y was most often not just any complement, such as sugar for coffee. It was most often part of a joint-service arrangement in which either X or Y or both were valueless without the other. The lessees of IBM machines wanted to process cards. The machines without cards or cards without a machine were valueless. Salt may be valuable without a patented salt dispenser, but the latter is worthless without the former. Any good theory of tie-ins had to come to grips with the prevalence of joint-service arrangements among actual requirements tie-ins, even if it could not tell us why weaker complements like coffee and sugar are not tied.

Underprice the Fixed Component

Director then uncovered a major obstacle to developing such a theory, which I will illustrate with the canonical IBM example. We can express a user’s demand for that joint service in terms of the processing of cards per machine per unit time. That demand is satisfied by machines and cards, which can be supplied separately or via a tie-in. Assume that a potential customer has a demand for processing given by q p = 1 – p, where q is the number of cards processed per machine hour and p is either the price per card processed or the marginal value of processing. For simplicity, assume that both cards and machine are costless and that any customer will use one machine to process cards. The purpose of setting the problem up this way is to focus attention on the question: how should IBM optimally exploit the processing demand if it has a monopoly on the machine?

The answer here is to rent the machine for $.50 per hour and give the cards away—or, more simply, allow them to be supplied by a competitive card industry at a value of p equal to marginal cost, which equals zero.

Here, an effective tie-in which set a positive price on cards and precluded competitive purchases would actually be counterproductive, because the sum of IBM’s card sales and machine rental income would be less than $.50 per hour. This answer, of course, turns a monopoly pricing problem into a paradox. The real IBM did enforce a tie-in.

More broadly, the common pattern in joint-service arrangements is not to collect all monopoly profit in the charge for the fixed component (the machine). Rather, it is to underprice the fixed component—in the extreme, give it away—and thereby leave the surplus to be extracted in sales of the variable component (the cards) at supramarginal cost prices. This is what International did with its salt and United with its thread. This is what another canonical example, Gillette, did with its razors and patented blades, not by contract but by the design and pricing of the components.

Director resolved the paradox by considering the effect of differences among customers in their demand for the joint service. So, suppose only half the consumers had the demand in the previous example, q = 1 – p, while the remaining half had the demand, q = 2(1- p). Think of this second group as high-intensity users (H), who would process twice as many cards per hour at any price per processed card as the low-intensity users (L). This complexity does not by itself change the essential nature of the first-best solution to IBM’s pricing problem. It is still profit-maximizing to extract all profits in machine rentals and none from card tie-ins. The only wrinkle here is that the machine rentals have to discriminate between the L, who continue to be charged $.50 per hour, and the H, who are charged $1.00 per hour.

Director then focused on the second-best problem: Suppose explicit price discrimination is infeasible. Maybe IBM is unable to overcome the usual arbitrage problem whereby the H would try to sublease from the L or masquerade as L. More important, perhaps IBM may not know which customers are H and which L in advance of contracting with them. Accordingly, Director reformulated IBM’s problem as a second-best choice between two nondiscriminatory arrangements.

Suppose IBM had to choose between just setting a nondiscriminatory machine rental or offering a nondiscriminatory tie-in arrangement. Between these two, the tie-in wins out. Specifically, the profit-maximizing tie-in would have IBM rent machines to all for $.28125 per hour, provided the renter agreed to buy all cards the machine would process from IBM at $.25 per unit. This arrangement would produce total revenues of $1.125 per pair of H and L customers. This is less than the $1.50 under first-best discrimination, but it beats the $1.00 maximum from nondiscriminatory machine rental without a tie-in. The tie-in works here because it mimics the pattern that underlies the superiority of first-best discrimination: an H pays more monopoly rent ($.65625 per hour) than an L ($.46875). But the tie-in avoids all of the problems specific to the first-best solution—the need to distinguish customers and to prevent arbitrage. (Of course, the tie-in entails enforcement problems of its own, because any customer would prefer to evade the tie-in restriction.)

More generally, the tie-in is acting as an implicit metering device. It is measuring the intensity with which the customer is employing the machine in circumstances in which the more intensive user (H) also places the highest valuation on the joint service. It is this positive correlation between the intensity of use and valuation that drives the superiority of tie-ins to untied rentals.

Director then went on to develop a complementary rationale for the other major form of tying—full-line forcing or bundling. Again, he rejected the simple leverage argument in favor of an analysis in which bundling is a second-best arrangement that exploits valuation differences when explicit discrimination is infeasible. Specifically, he showed how bundling tended to better exploit negative correlations across customers in their valuation of components (those with high valuations of one component had low valuations of the other, and vice versa) than nondiscriminatory pricing of the separate components.

Sam Peltzman is the Ralph and Dorothy Keller Distinguished Service Professor Emeritus of Economics at the Booth School of Business, University of Chicago. He is also the Director Emeritus of the Stigler Center.

The ProMarket blog is dedicated to discussing how competition tends to be subverted by special interests. The posts represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty. For more information, please visit ProMarket Blog Policy.