Do negative economic shocks trigger social unrest? The declining support for mainstream parties and the rise of populist movements across Europe in the aftermath of the Eurozone crisis have brought this question to the fore of debate among academics, policymakers, and the general public. The intensification of social unrest in a number of countries in recent years has led to renewed interest in its drivers by international organizations including the OECD (Renn, Jovanovic, and Schröter, 2011), the World Bank (Word Bank, 2016), and the International Labour Organization (ILO, 2013).

Despite its relevance, however, we don’t yet have a clear answer to this question, and the data are often hard to interpret. First, we often observe social unrest in countries with poor economic performance, but in general we do not know what causes what. Intuitively, poor economic performance may exacerbate social tensions; but social unrest itself may also worsen investment prospects, leading to lower employment and output. Second, the presence of fiscal and monetary authorities, whose policies may pursue social objectives, can confound the evidence, as it is difficult to disentangle the effects of a shock and the effects of policies designed to address it. Third, present-day social unrest is associated with movements outside the political mainstream whose ideological base is often vaguely delineated. It is thus hard to trace a fringe movement’s support to a specific social class exposed to economic hardship.

To address these difficulties, in our paper “Credit and Social Unrest: Evidence from 1930s China,” we turn to study a credit shock in 1930s China. That helps us in three ways. First, we isolate the direction of causality, from economic performance to social unrest, via a natural experiment triggered by the US 1933 Silver Purchase program. Undertaken for purely US domestic reasons, and independent of Chinese economic conditions, the Silver Purchase raised the price of silver worldwide and drained the Chinese silver stock. Because China was on the silver standard, the credit capacity of its banks was tied to their silver holdings. Banks with lower silver holdings were more exposed to the Silver Purchase “shock” and had to cut credit, potentially with a social impact. Second, in our setting the link between policy and the economy is much looser than today: the fledgling Republic of China lacked a central bank regulating money supply and credit, and private ones issued money and loans. Third, the main fringe movement in 1930s China, the Communist Party, had a well-defined social target in the urban areas: the working class, and in particular factory workers.

We assemble a novel, hand-collected database from archival information on credit, labor relations, and Communist activities in 1930s China. Our data reconstruct a Chinese “credit registry” for the period 1931–35, and document firm-level labor unrest episodes in three major Chinese cities (Nanjing, Shanghai, and Tianjin), as well as Communist Party penetration among workers at firms located in Shanghai.

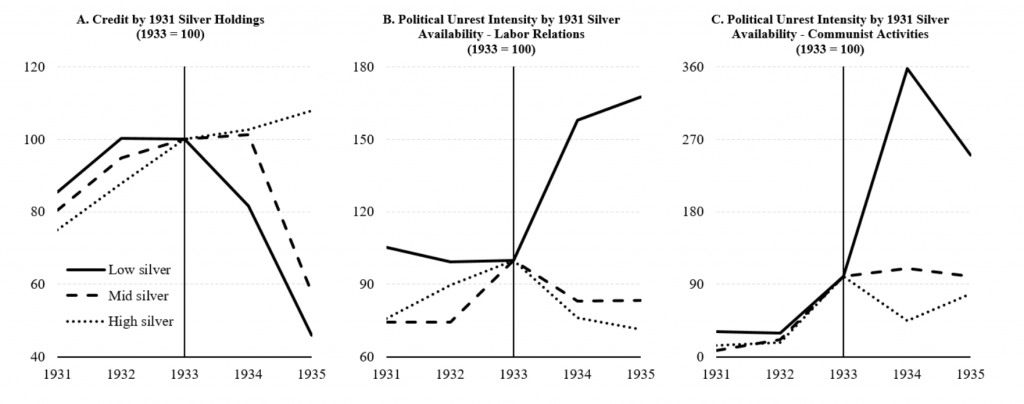

We provide two pieces of evidence, linked by the credit shock. First, we show that banks with a larger exposure to the Silver Purchase (lower pre-1933 silver reserves) curb credit after 1933, in comparison to banks that are less exposed. Second, we show that labor unrest episodes and Communist penetration in Chinese firms relate to their banks’ exposure to the Silver Purchase. Intuitively, firms borrowing from exposed banks face tighter financial constraints, which limit investment and lead to pay cuts and layoffs, increasing the likelihood of labor unrest and Communist support.

Our main results are immediately visible in the data. Chinese credit sharply contracts over 1933–35: credit-to-GDP drops by about 15 percent, and credit-to-deposits by 10 percent. This is similar in magnitude to more recent credit crises, such as the ones experienced by Scandinavian countries in the early 1990s, Turkey in 2000, or Spain in 2010. As we show in Figure 1, this is driven by banks with lower pre-1933 silver reserves (panel A). Firms borrowing from these banks, in turn, experience increased labor unrest intensity and Communist party penetration. By 1935, labor unrest episodes (panel B) and Communist penetration (panel C) are about twice more likely than at firms borrowing from banks with larger reserves.

An important challenge in our analysis is establishing whether these intuitive patterns can be interpreted as driven by credit supply (i.e., banks lend less) rather than credit demand (i.e., firms and households borrow less). This is in general hard to determine, because all that we can observe is credit quantity, at the intersection of the credit demand and supply curves.

To address this challenge, we collect individual loan contracts from the period 1931–1933, from a variety of archives spread in all major Chinese cities. Figure 2 depicts one such contract. Its last page (on the right) indicates the borrowing firm and the lending bank (as well as a notary and a guarantor on the loan). We exploit this information to isolate the credit supply effect. Because we can observe who borrows from whom, we are able to show that the same firm, borrowing from multiple banks, experiences restricted lending only from those banks that are more exposed to the Silver Purchase. Because this test holds credit demand constant within a given firm, our finding indicates a contraction of the credit supply.

The credit rationing generated by the Silver Purchase shock appears to have had material consequences on Chinese firms. For a sample of textile mills, we find that firms with access to banks that are more exposed to the shock are more likely to reduce employment, electricity consumption, and output after 1933.

The output contraction generated by the credit shock leads to social unrest, as we document in the second part of our paper. As a first gauge, we document that firms that are more exposed to the Silver Purchase shock experience a disproportionate increase in labor unrest episodes after 1933. We measure a firm’s exposure by its access to the pool of silver reserves held by banks located in its vicinity. Smaller reserves pools are related to a larger increase in labor unrest intensity. Our estimates imply that borrowers with access to the smallest reserves pools experience a 30 percent larger increase in the number of labor unrest episodes, and a 15 percent longer average episode duration, in comparison to firms borrowing from banks with the largest reserve pools.

As a second measure of social unrest, we study fringe political activity, proxied by Communist Party penetration. It turns out this information is not generally available in China, as in the 1930s the Communists were largely underground and didn’t exactly advertise their membership. We retrieve information on Communist activities from the Shanghai Municipal Police (SMP) files. The SMP was a British-run police force active in Shanghai during the 1930s, which used to infiltrate Communist cells with undercover agents. From the reports filed by those agents (one is depicted in Figure 3), we are able to identify whether a given firm has been penetrated by the Communists, and with what intensity. Using this information, we show that firms more exposed to the Silver Purchase shock experience a 3 to 6.5 percent larger increase in Communist penetration, relative to firms with access to the largest reserve pools. Limited access to credit resulting from the Silver Purchase, thus, has important socio-political consequences, exacerbating labor relations and, to a more modest extent, affecting the reach of the Communist Party.

Additional tests rule out alternative interpretations of our findings. We show that the effects we uncover are unlikely to be driven by omitted factors affecting East Asian economies in the 1930s. Comparing industries exposed to versus isolated from international trade, to assess the impact of a mechanical currency appreciation driven by the Silver Purchase, we find statistically indistinguishable effects across the two groups. This indicates that an exchange rate channel is unlikely to be behind our results, and alleviates concerns about a worldwide trend toward greater instability associated with the 1930s Great Depression. In addition, there is no evidence of similar effects in Hong Kong, the closest economy to 1930s China. Finally, we do not find any evidence that contemporaneous events such as the Japanese attack on Shanghai of 1932 affect our results.

Taken together, our findings indicate that the social and political consequences of credit and, more generally, economic shocks are material, and suggest that “social” considerations can be relevant for regulators and policy makers.

Fabio Braggion is associate professor of finance at Tilburg University and CentER.

Alberto Manconi is assistant professor of finance at Bocconi University and research affiliate in the financial economics program at CEPR.

Haikun Zhu is a PhD student in finance at Tilburg University and CentER.

References

International Labor Organization (ILO), 2013, World of Work Report: Repairing the Social Fabric.

Renn, O., Jovanovic, A. and Schröter, R., 2011, Social Unrest, OECD Working Paper IFP/WKP/FGS(2011)5.

World Bank Group, 2016, Polarization and Populism. Office of the Chief Economist.

Disclaimer: The ProMarket blog is dedicated to discussing how competition tends to be subverted by special interests. The posts represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty. For more information, please visit ProMarket Blog Policy.