Relatively few American companies have bankers on their boards. New research reveals that bankers were commonly represented on corporate boards in the 19th century, and that affiliations with banks helped sustain non-financial corporations in the wake of financial crises.

A unique characteristic of the boards of American public companies is that they include relatively few bankers. Only about 7 percent include an officer of a bank that has actually lent to the firm, and 17 percent include an officer of a bank that has not lent to the firm (Güner et al. 2008). Given the potential for banker-directors to act as monitors and help facilitate access to credit, the fact that we see so few suggests that there must be costs to having a banker on the board.

Financial economists have argued that there may indeed be costs, and that it may not be in a firm’s interest to have bankers participating in its management. The interests of creditors, who benefit from stability, do not always coincide with those of shareholders, who reap the gains of risky investments (Kroszner and Strahan, 2001). And if lenders on a company’s board acquire privileged information about the firm, they may be able to use it to their own advantage in their interactions with the firm (Rajan 1992). Any benefits in the form of better access to credit may be outweighed by the costs associated with granting creditors a role in corporate decision-making. The fact that we do not see many bankers on corporate boards suggests that those costs typically outweigh the benefits.

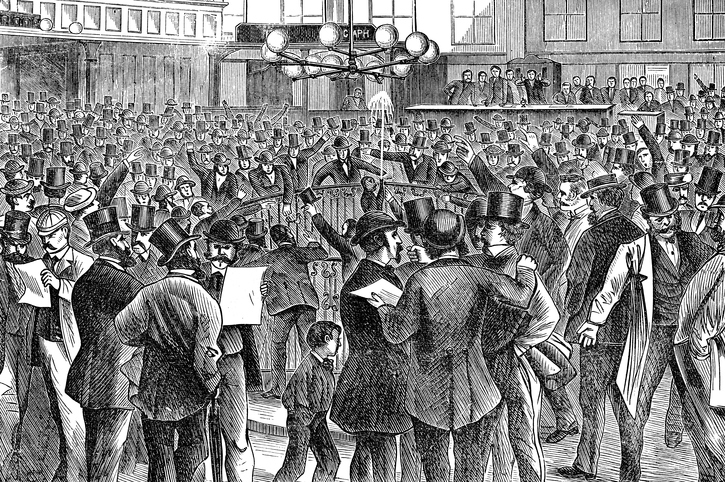

Yet bankers once played a significant role in American corporate governance. In a new paper, “Banks, Insider Connections, and Industrialization in New England: Evidence from the Panic of 1873,” I study the role of bankers on corporate boards in the nineteenth century. The analysis is focused on companies located in Massachusetts, a state where a number of leading manufacturing companies and important railroads were then located.

Among the non-financial corporations in the state in the early 1870s, nearly 60 percent had a banker on their board. And among the corporations whose shares were traded on the Boston Stock Exchange—typically the largest firms—the rate was greater than 80 percent. The benefits of having an affiliation with a bank were clearly perceived to outweigh the cost.

Those benefits can be seen with the experience of the Panic of 1873. That crisis originated among investment banks in New York and did not impact New England’s commercial banks directly, although it did cause an economic slump that continued until 1879. If having a banker on the board helped facilitate access to credit, then those benefits should have been particularly important in the years following the crisis, when waves of insolvencies likely made banks wary of borrowers.

The data reveal that firms with bankers on their boards survived the recession of the 1870s at higher rates, and among the surviving firms, those with bank affiliations grew faster. The annual growth rates of companies with and without banker-directors are presented in Figure 1 below.

The magnitude of this growth advantage was substantial: counterfactual estimates suggest that if there had been no banker-directors, the total assets of all non-financial corporations in Massachusetts that existed in 1872 would have been 35 percent lower in 1881. And consistent with the notion that banker-directors helped to resolve problems related to asymmetric information, the estimated effects were strongest among young firms.

One concern regarding these results could be that they reflect selection effects: particular types of firms may have been more likely to have a banker-director. The estimation framework controls for firm fixed effects, which eliminate the influence of any unchanging characteristics such as the quality of the firm. A more subtle concern might be that firms that were more resilient to a shock were more likely to have banker directors. Yet credit ratings from J.M. Bradstreet & Son are available for many of the firms, and these ratings should serve as a measure of resiliency. Controlling for the firms’ credit ratings diminishes the size of the estimated effects of banker-directors, but it remains substantial.

Why did 19th century corporations have bankers on their boards, whereas modern corporations do not? Part of the explanation may be found in the ownership stakes held by the bankers who held corporate directorships. Most of the banker-directors of the 1870s were major shareholders in the corporations where they held board seats, and their ownership stakes likely aligned their interests with those of the other stockholders. In fact their holdings in non-financial corporations typically dwarfed their ownership of bank stock, and they are best thought of as capitalists, rather than bankers. The individuals who would today serve as banker-directors are more likely to be specialized bankers, whose interests would be more closely aligned with creditors.

Equity ownership is also an important part of bank relationships in countries today where bank-directors are more common. German banks, for example, are permitted to hold stock in their client firms, and often do so. This likely helps address the divergence between the interests of creditors and those of the stockholders (Calomiris, 1995; Kroszner and Strahan, 2001). In contrast, American banks have typically not been permitted to hold equity stakes.

| Counterfactual estimates suggest that if there had been no banker-directors, the total assets of all non-financial corporations in Massachusetts that existed in 1872 would have been 35 percent lower in 1881. |

But politics has also played a role in the decline of American banker-directors. In the later years of the 19th century, commercial and investment bankers attained even greater influence among non-financial corporations, and by 1912 a small number of elite financiers held directorships with most of America’s large public companies. It was feared by many that the vast influence these men held over economic life would be used to entrench incumbent firms and stifle competition. In response, the Clayton Antitrust Act of 1914 contained several provisions intended to limit the power of financiers in corporate governance (Frydman and Hilt, 2017). That Act served as the foundation for the more radical financial reforms of the New Deal, which may also have contributed to the decline of bankers in American corporate governance. That legislation reflects a judgment that the costs to society as a whole of bankers holding large numbers of corporate directorships may outweigh any benefits enjoyed by particular firms.

Eric Hilt is Professor of Economics at Wellesley College, and a Research Associate of the NBER.

References

Charles Calomiris. 1995. “The Costs of Rejecting Universal Banking: American Finance in the German Mirror, 1870-1914” in Naomi R. Lamoreaux and Daniel M.G. Raff, eds, Coordination and Information: Historical Perspectives on the Organization of Enterprise. Chicago: University of Chicago Press.

Carola Frydman and Eric Hilt. 2017. “Investment Banks as Corporate Monitors in the Early Twentieth Century United States,” American Economic Review 107: 1938-1970.

Burak Güner, Ulrike Malmendier, and Geoffrey Tate. 2008. “Financial expertise of directors” Journal of Financial Economics 88: 323-354.

Eric Hilt. 2018. “Banks, Insider Connections and Industrialization in New England: Evidence from the Panic of 1873” NBER Working Paper Series, number 24792.

Raghuram G. Rajan. 1992. “Insiders and Outsiders: The Choice between Informed and Arm’s-Length Debt” Journal of Finance 47: 1367–1400.

Randall S. Kroszner and Philip E. Strahan. 2001. “Bankers on boards: monitoring, conflicts of interest, and lender liability” Journal of Financial Economics 62: 415-452.

Disclaimer: The ProMarket blog is dedicated to discussing how competition tends to be subverted by special interests. The posts represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty. For more information, please visit ProMarket Blog Policy.