Recent negative news on the production of electric vehicles in the United States call into question the government’s industrial policy boosting Detroit’s efforts to go green. Susan Helper writes that not only have there been significant benefits from President Joe Biden’s industrial policies, but promoting the production and adoption of electric vehicles remains essential to achieving national decarbonization targets and increasing resilience, innovation, and national security.

Chinese automaker BYD is selling a plug-in hybrid truck in Australia for $37,000 and a full-electric vehicle in China for $11,000. Meanwhile, the rate of acceleration of electric vehicle adoption in the United States has slowed. Major automakers have announced delays to their EV production targets despite recent efforts from the Biden administration to promote a green transition. Have these efforts failed? Is it time to give up on the U.S. auto industry and the EV transition?

In this article, I will argue that a transition to electric vehicles is vital—as is a strong U.S. auto industry. Policies to promote the transition have begun to bear fruit, and should be strengthened – not abandoned. Below I describe some reasons why the industry is important, and discuss policies needed to aid it in contributing to national goals.

Why the U.S. must support EV production and adoption

Transportation accounted for the largest portion (28%) of total U.S. greenhouse gas (GHG) emissions in 2022. Electric vehicles (EV) produce only one-third as much GHG emissions as gasoline-powered vehicles, with 65% of EV emissions (in 2022) coming from the production of the electricity they use. As more of the electric grid becomes powered by renewable energy, this advantage will continue to grow. Thus, the EV transition is key for meeting climate goals.

In principle, the U.S. could import electric vehicles from China, which leads in many aspects of EV production, including producing over 90% of the world’s supply of several key battery components. However, importing EVs from China isn’t necessarily helpful in reducing climate change because it would reduce public support for future climate measures. The Chinese advantage is only partially based on innovation, and more significantly on massive subsidies, repression of labor, and lax environmental regulation. Depending on China for autos also has implications for U.S. national security, innovation, and resilience. Without a vibrant domestic auto industry, all three of these goals are threatened.

National security. National Security Adviser Jake Sullivan warns that “clean-energy supply chains are at risk of being weaponized in the same way as oil in the 1970s, or natural gas in Europe in 2022.” Key parts of battery supply chains are largely located in China, which refines 60% of the world’s lithium and 80% of the world’s cobalt—two core inputs to high-capacity batteries, without close substitutes. Access to these inputs, which are critical for national defense, is more assured if at least some of the goods are produced domestically. Government policies have already spurred $120 billion in private investment in U.S. production of battery materials and components, investment that will significantly reduce the Chinese stranglehold on the industry.

Innovation. The auto industry is both a driver and recipient of several waves of recent innovation, including sensors and communication technologies, the electric grid, connectivity, data and artificial intelligence, raw materials, manufacturing methods, and new interactions with roads. Certainly, not all auto innovations have positive spillovers: there is significant evidence that fully autonomous vehicles could dramatically increase urban sprawl and vehicle miles travelled, thus harming the climate. However, a vibrant domestic auto industry will encourage innovation in upstream and downstream markets, for example re-designing batteries to require fewer hard-to-access critical minerals such as cobalt.

Resilience. The auto industry is sometimes referred to as an “industry of industries,” since a vehicle’s 30,000 parts draw on sectors ranging from textiles to steel, software, and electronics. As we saw in the Covid-19 pandemic, hiccups in the auto supply chain may have economy-wide repercussions; the shortage of automotive chips reduced GDP growth by a full percentage point in 2021. Conversely, the vast capabilities of domestic automakers played an important role in making up the shortfall in domestic supplies of medical masks, and General Motors engineers figured out how to source the hundreds of parts of a ventilator and set up a mass assembly line in just a few days. Thus, a strong domestic automotive supply chain may improve the health and resilience of other industries as well.

Having significant domestic production of critical goods also means that, in the event of a natural disaster or international conflict, U.S. firms are not existentially dependent on the policy choices of other countries.

Current policies for promoting domestic EV production.

The size of these spillover effects provides a rationale for government action, since firms won’t invest sufficiently when they don’t reap all the benefits. Economists typically recommend a carbon tax to address the climate spillover; however, this policy has not garnered political support in the U.S. In addition, a uniform tax doesn’t address key bottlenecks that arise in a real economy, one which is plagued by imperfect information and coordination problems. In addition, EVs are superior technically, offering faster acceleration, quieter operation, and reduced maintenance; policy can promote these technological spillovers.

Thus, the Biden administration has implemented a variety of policies to promote the transition. These include:

Goal-setting for EVs to be 40-50% of U.S. light vehicle sales by 2030. This goal was hammered out in consultation with automakers and the United Auto Workers, the main union representing U.S. workers in the industry. While the goal is not binding, it has been a key factor in coordinating public and private investment across the multiple tiers of the supply chain and in EV charging.

Supply-side subsidies for batteries and components, plant conversion, and EV chargers.

Demand-side subsidies, namely consumer subsidies for purchase and leasing.

Technical assistance and conveningwith suppliers.

Regulations regarding vehicle fuel economy, and domestic content.

Restrictions on international trade, such as 100% tariffs on Chinese vehicles, and a proposed ban on Chinese software in connected vehicles.

The consumer tax credits represent most of the fiscal cost of the subsidies: estimates range from $7-39 billion annually for a decade. If these sound like a lot, even the high end of this range is much less than the ongoing subsidies for fossil fuels, which have averaged $62 billion per year in recent years.

Outcomes so far

The certainty provided by these actions has unlocked billions in private sector investments in the auto supply chain. The Clean Investment Monitor, run by the MIT Center for Energy and Environmental Policy Research (CEEPR) and the Rhodium Group, estimates that for fiscal year 2023, each dollar of public investment in clean energy from federal financial assistance spurred at least $6 of private investment. This private expenditure is likely evidence of government assistance “crowding in” private investment to achieve an important national goal that would falter otherwise. For example, benefits of the positive feedback loop between EV demand and EV charger investment are not all captured by private firms, meaning they lack sufficient incentive to build a national charging network at anywhere close to a pace that meets climate goals.

Figure 1

This stimulus has also buoyed the auto industry. Auto manufacturing employment is now the highest since 2006, even without counting the tens of thousands of workers already employed in battery factories, or the increasing numbers of non-manufacturing workers crucial for auto production, such as software developers.

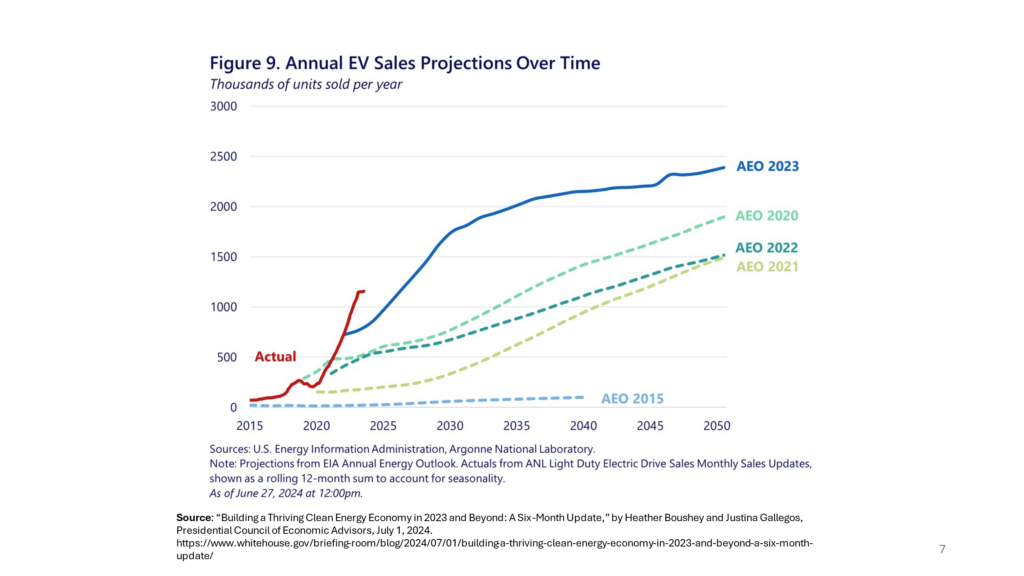

Although the rate of acceleration of EV adoption has slowed in recent quarters, adoption is still ahead of forecasts by the U.S. Energy Information Administration in their Annual Energy Outlook report, even those made last year, and the U.S. is on track to meet the goal of 50% EV sales by 2050. Battery prices are likely to fall significantly in 2026, and the increased availability of charging stations should reduce consumer range anxiety. One out of three U.S. cars sold might be electric by 2027.

Economists (including one from the University of Chicago) estimate that the Inflation Reduction Act’s consumer tax credits produce $1.87 in static benefits (e.g., in reduced GHG and air pollution) for every dollar spent, not including the dynamic spillovers (to innovation, etc.) described above. The benefits would be higher but for the IRA’s leasing provision, which does not require North American content. This provision reduces benefits because it rewards consumers with U.S. tax dollars for buying vehicles produced abroad, but generates little additional EV takeup.

While China currently leads in EV production, their advantage is not insurmountable. For example, current policies encourage U.S. companies, universities, and government labs to develop new battery chemistries that could leapfrog Chinese battery dominance. Next-generation batteries might eliminate liquid electrolytes and replace graphite anodes with lithium metal anodes. This would give them higher energy density, faster charging speed, and longer durability. They would also be much safer.

However, the U.S. could upend all this with policy uncertainty. There are reports that the incoming Trump administration plans to recommend axing the consumer EV incentives. Such action would threaten the U.S. ability to catch up with China on battery technology and EV development. A policy toward EVs that is out of step with the world’s would also lead to the U.S. auto industry attempting to maintain different product lines in the U.S. and in the rest of the world—with serious consequences for production costs. That is, U.S. firms would find its engineering resources stretched thin, and would experience less of the cumulative output needed to benefit from learning curve gains.

Rather than wreak havoc on investments and models planned for years in advance, the U.S. should continue these policies and add more.

New policies: developing supply chain and workforce for an era of architectural innovation

EV production requires significant changes in the automotive supply chain. Even with current industrial policy and private efforts, barriers to production and adoption remain.

For example, the shift to EVs disrupts the car’s propulsion system, replacing the engine with a motor and battery. This shift is sparking changes to other parts of the car, including software, semiconductors, castings, and the electrical system. Meanwhile, advances in sensor technology, automation, and AI could revolutionize production processes and make it profitable to on-shore parts traditionally made in a labor-intensive way, such as wiring harnesses. The competition from China comes not just in the form of finished cars, but also in products and processes such as these. Thus, building an EV propulsion system unlocks other changes in the vehicle that are important for the future of the industry.

Automotive manufacturing accounts for about three million U.S. jobs, most of which are in parts-making. Many of these parts-makers are currently struggling with the transition because they lack information about transition opportunities, lack access to finance, and in many cases currently lack the ability to generate the productivity that would allow them to attract workers by offering good jobs.

Without additional efforts to shore up supply chains, automotive-related supply chains will weaken and provide fewer of the benefits—innovation, resilience, and national security—described above. These policies could be adopted nationally and/or by auto-producing states such as Michigan and Ohio.

Some policies that would help build a collaborative and resilient supply chain:

Promote small-firm investment with joint grants to automakers and their suppliers.

A program that offered grants to an automaker and its suppliers applying together for funding (to be matched by the larger firm) would provide several benefits. The large firm’s support would demonstrate that it is committed to these suppliers and believes these suppliers are viable and strategic. It would also ease a key problem that small firms face: providing them with crucial demand-side certainty greatly reduces the danger they face in making investments in new products or processes since they don’t have the profits to place bets that might go bad. This arrangement would also reduce the government’s vetting costs of small suppliers, since the large firm would have already done some vetting and would be sharing the risk.

Ontario, Canada has a program that is a bit like this (though it is more aimed at startups than established small- and medium-sized enterprises). A U.S. program, AM Forward, also makes use of supply-chain relationships to encourage investment in new technologies.

Redesign jobs to implement automation in a worker-augmenting way.

Many U.S. manufacturers, including auto suppliers, complain that they can’t find workers at the wages they are currently offering, and their productivity does not support a higher wage. Adopting “smart manufacturing” tools such as automation, AI, and real-time equipment monitoring offers (but does not guarantee) both increased productivity and better jobs. These tools often work better if combined with a “high-road” operations strategy, where shop-floor workers have the skills and opportunity to engage with the data these tools provide to quickly solve problems and suggest improvements.

Often, it’s beneficial to design new technologies and new jobs simultaneously rather than simply train workers for jobs defined by employers, who may not have the bandwidth to think through all the options. For example, the Department of Energy’s Battery Workforce Initiative brought together employers, unions, researchers, and training providers to design standardized occupations for battery production to increase productivity and safety. This example provides a good model for other programs.

To implement new technology, firms often need to create or expand their technical staff in areas where they have little experience. To reduce the risk of making a bad hire, another Ontario program pays small firms to work with and train students and recent grads on innovation-related projects.

Taken together, policies such as these promote supply-chain resilience in the broad sense of responsiveness to both to natural disasters and to fast-moving product and process innovation (e.g., new battery chemistries). More collaborative supply chains and more skilled workers could allow resilience to be achieved more through “agility” (faster anticipation and reaction), rather than “redundancy” (more suppliers, more inventory). Agility is usually more effective and often less costly; redundancy does not promote innovation, and may hurt if suppliers compete for business by undercutting each other on productive investment.

Firms’ investments in both their managers and workers’ ability to understand the whole production process and solve problems enables them to pivot quickly to alternative products or processes or to better address surging demand. This flexibility can be enhanced by maintaining more general-purpose equipment (such as 3D printers) and having more generally trained workers.

Domestic production also contributes significantly to resilience by reducing lead time and dependence on other nations’ policy choices. The U.S. does not need to make all (or even most) of every part on every vehicle sold in the U.S., but the auto industry’s vast breadth of technologies, its central role in key areas of innovation, and its complex supply chains make it a key in constructing resilient U.S. supply chains. These capabilities are important even for supply chains outside of the auto industry, as shown both by the economy-wide repercussions of the industry’s vulnerability to disrupted semiconductor supply and by its key contributions to ramping up of PPE and ventilators for pandemic response.

Conclusions

The proposals above would strengthen automakers, the whole auto supply chain, and its workforce and slow climate change. They would also have significant spillover effects on innovation and employment. However, these proposals do not address all the important issues the auto industry faces. Rather than undoing policies that are already providing significant benefits, we should be working on important issues such as preparing for the review of the U.S.-Canada-Mexico trade agreement (USMCA) in 2026 to promote high-road production, and remedying U.S. weaknesses in equipment production and finance, both of which stymy production and innovation in productive manufacturing.

The U.S. needs a vibrant automotive industry—and that industry needs to transition to electric vehicles quickly. Lagging in the race to electrify threatens the entire U.S. auto industry. Due to interconnections with the rest of U.S. manufacturing and to U.S. greenhouse gas emissions, significant shrinkage of the U.S. auto industry would threaten U.S. national security, climate security, and supply-chain resilience. Because of the importance of the industry in the American imagination, job and climate goals are not in conflict: unless we try to achieve both, we may achieve neither.

Author Disclosure: the author reports no conflicts of interest. You can read our disclosure policy here.

Articles represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty.