Stigler treats industry groups as the heavyweights in regulatory contests. But surprisingly often groups of farmers and workers knock them for a loop in political combat.

Editor’s note: In 1971, George Stigler published his article “The Theory of Economic Regulation.” To mark the 50-year anniversary of Stigler’s seminal piece, we are launching a series of articles examining his theory’s past, present, and future legacy. The series is part of the Stigler Center’s George Stigler 50 Years Later symposium.

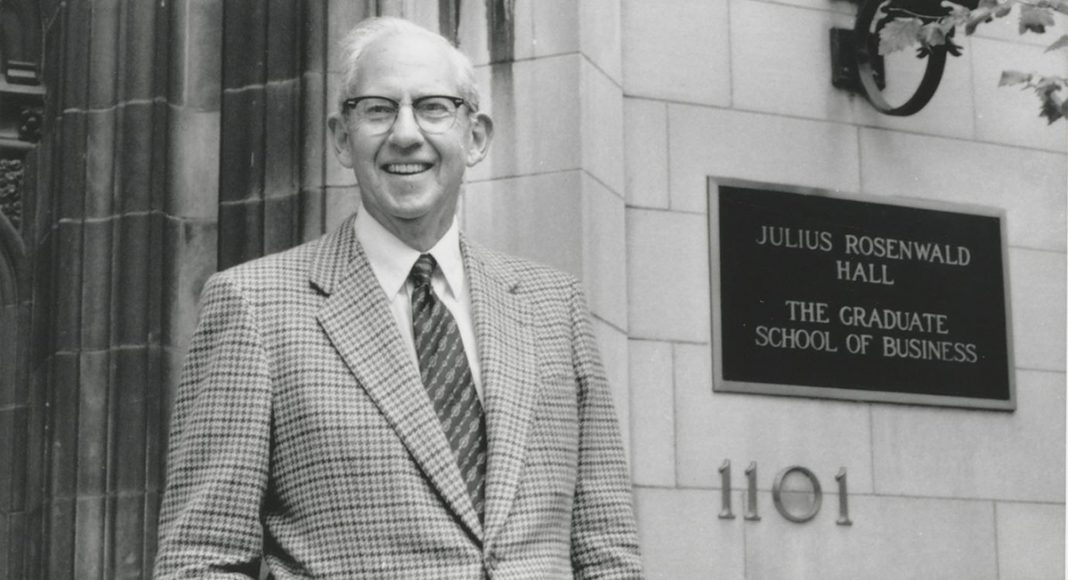

George Stigler’s modest 19-page essay “The Theory of Economic Regulation,” published in the Bell Journal of Economics and Management Sciences in the Spring of 1971, is one of the landmarks of economic thought. Some sense of Stigler’s general mindset is evident from the subtle ambition of his essay’s title—“the”—which implies the one and only. That “the” captured his mindset perfectly. Stigler could never be bothered with subtle qualifications, even though he was keenly aware that those complications existed. For him, academic work was about seizing the main chance, staking out a strong position, and then letting lesser minds (and in Stigler’s case, there were many) nibble around the edges in the effort to undermine, even slightly, his main thesis.

As a rhetorical device, that tactic has continued to pay handsome dividends some 50 years after the paper was first published. Stigler has his passionate defenders, such as Susan Dudley; his thoughtful expositors, such as Anat Admati; his gentle critics, such as Andrei Shleifer; and his persistent skeptics, such as Cass Sunstein.

I am in the odd position of thinking that Stigler’s work is sufficiently rich and textured that all four of these authors have a point, even though their positions are in evident tension with each other.

The key question is how these apparent opposites cohere, to which I think that the best answer turns on one simple point. The field of regulation is rich, varied, and far more extensive today than when Stigler wrote. The key to understanding the puzzle is that the many commentators on Stigler all look at the overall picture from the point of view of their own area of expertise and specialization. Stigler made it pretty clear from the outset that his focus is on industry: “The state—the machinery and power of the state—is a potential resource or threat to every industry in society.” There are of course lots of groups in society that are not classified as industries; these include not only charitable and religious organizations, which were well represented in Stigler’s time, but also a vast array of new interest groups with a very different focus, such as environmental groups, disability groups, and civil rights groups.

To take one example, the American Association of Retired People (AARP) was formed in 1958, and today has about 38 million members. It was clearly instrumental back in the 1960s in dealing with the major legislative initiative that brought about the passage of Medicare and Medicaid, two huge programs that fell outside of Stigler’s main interests in airlines, motor vehicles, petroleum, agriculture, and the like. The same could be said about organizations like the NAACP and the ACLU, which took an active role on matters of race relations and civil rights, which led, for example, to the passage of the Civil Rights Act of 1964, the Voting Rights Act of 1965, and the Fair Housing Act of 1968. A fuller picture of regulation would include these various initiatives to which many businesses were far from indifferent, but it seems to make sense to first deal with the areas in which Stigler concentrated his firepower.

“The state—the machinery and power of the state—is a potential resource or threat to every industry in society.”

George Stigler

As is commonly understood, Stigler thinks of the entire problem as one that takes place within the legislative and administrative arenas, involving statutes like the Interstate Commerce Act of 1887, the Motor Vehicle Act of 1935, Civil Aeronautics Act of 1938, Agricultural Adjustment Acts of 1935, and the Fair Labor Standards Act of 1938. Each of these statutes represents the outcome of interest group politics, but the variety of winners should give us pause about Stigler’s positive theory that has industry coming out on top. The many iterations of the Interstate Commerce Act had industry score big wins, but suffer big losses. The MVA was passed to protect drivers in a non-concentrated industry; the CAA fits Stigler’s model of protecting incumbent firms; the AAA protected farms in a decentralized industry; ditto with labor (and its unions with the FLSA). The Stigler model presupposes in general that the organized access and clout of these regulated industries enable them to call the shots. As he writes:

“A central thesis of this paper is that, as a rule, regulation is acquired by the industry and is designed and operated primarily for its benefit. There are regulations whose net effects upon the regulated industry are undeniably onerous; a simple example is the differentially heavy taxation of the industry’s product (whiskey, playing cards). These onerous regulations, however, are exceptional and can be explained by the same theory that explains beneficial (we may call it “acquired”) regulation.”

It is important to look at this thesis with some degree of care. Stigler states that, in general, regulation is acquired (i.e., obtained by lobbying and other forms of influence) for the benefit of the regulated industry. His rival was the public interest theory, which assumed that righteous legislators protected the public at large from the action of dangerous industries. The clear subtext is that Stigler thinks that in most cases, what industry wants, industry gets. The correct thesis seems to be a split verdict: the public interest theory still comes out in second place, but in partisan struggles industry loses far more often than Stigler supposed, both before 1970 and afterwards. To see why, it is necessary to look at regulation through a broader lens.

From Madison to Stigler and Beyond

It is worth noting that Stigler’s view of the imperfections of the political process resonates well with James Madison’s views of faction in Federalist Number 10, which is the origin of modern interest group theory that anticipates Stigler’s view that legislative cabals, whether majority or minority, can upset market institutions. Without going into the details, it is clear that even with the economic issues that Stigler identifies, the overall analysis is quite a bit more complicated than he perceived. Here are two major omissions from his account, but which fit quite comfortably into Madison’s:

First, Stigler makes no reference to the systems of regulation of the antitrust statutes, most notably the Sherman Act of 1890 and the Clayton Act of 1914—two Acts which both of us would describe as unwelcome industry regulation. But history takes odd turns. The passage of Sections 6 and 20 of the Clayton Act does not square with Stigler’s prediction of likely winners. Business lost because Section 6 exempted labor and agricultural groups from the Sherman Act. Business also lost because Section 7 of the Act allowed the federal government to attack any merger on the ground that it “substantially lessened competition or tend to create a monopoly.” Progressive politics won out both times.

Nonetheless, even this institutional account is incomplete because it ignores, as did Stigler, the role of courts in dealing with these economic rivalries. The omission is huge because various forms of rate and safety regulation were among the most frequently litigated issues in the Supreme Court during the period between the end of the Civil War and the start of the Second World War. Throughout this period, the Supreme Court took two positions. The first was that rate regulation was proper with respect to those industries “affected with the public interest,” which at the beginning of this period basically covered industries like common carriers and public utilities. The second was that the regulations could not be so confiscatory as to deny the carrier or utility a reasonable rate of return on its investment, which was defined, roughly, as a risk-adjusted rate of return on its initial. The subject is highly intricate, but in my view the performance of the court in this period was in general admirable. I do not attribute that result to interest group pressures but rather to a level of economic sophistication that all too often modern judges seem to lack. In the aftermath of the New Deal, the Supreme Court relaxed its scrutiny of these economic transactions, again under the influence of progressive thought. Simple solutions are hard to come by, but a complete theory of economic regulation needs to discuss these constitutional dimensions.

The same observation applies to the regulation of labor markets, already alluded to above. Indeed, the entire history of labor regulation during the first 40 years of the twentieth century revealed the might of organized labor in overcoming a set two hostile judicial decisions: Adair v. United States, which struck down a federal collective bargaining statute in 1908, and Coppage v. Kansas did the same for state labor statutes in 1915. These were overcome in favor of labor with the passage of the Norris-LaGuardia Act in 1932, the National Labor Relations Act in 1935 and the Fair Labor Standards Act in 1938.

Popular Majorities vs Organized Minorities

We need a theory to explain why the results of interest group struggles can veer in both directions. I think that it is possible to supply one that is in the spirit of Stigler’s article. Roughly speaking, there is a division between types of legislative struggles, with many intermediate variations. On the one side lie those cases that have such great notoriety that the well-organized industry group are just overwhelmed by popular pressure—which was the fate of the 1908 unanimous Supreme Court decision in Loewe v. Lawlor that provoked a fierce progressive outcry that directly led to the passage of the Clayton Act. On the other hand, there are many smaller issues that fall below some visibility threshold, when these industry groups can work successfully under the radar to make small tweaks in statutes that have major consequences for some industry group. In practice, a major issue precipitates a big new regime, whose effect may be whittled away by industry groups once the public’s eyes move on to the other issues.

Note that this approach helps explain one class of cases that Stigler wishes to push off to one side—the so-called “sin” taxes that apply, as he noted, to whiskey and playing cards. These cases fall under what has been traditionally called the “morals” head of the police power. The power of the state to regulate private morals was at the heart of a sprawling class of cases included such issues as polygamy, where in 1878, the Supreme Court in Reynolds v. United States hit hard at the Mormons who practiced it by disenfranchising them from all their properties. The relentless efforts of the temperance movement led to the adoption of the Eighteenth Amendment that ushered in the Prohibition era. Restrictions on gaming and lotteries were also common, as were prohibitions of many forms sexual conduct outside of marriage, and of course, abortion, which was commonly criminalized at the time.

“In partisan struggles industry loses far more often than Stigler supposed, both before 1970 and afterwards.”

The success of these movements depended heavily on popular support from religious and social groups, which kept them on the center stage throughout that period. The best explanation for the loosening of these prohibitions is that in the 1960s and 70s, those older interest groups lost their clout. In rapid succession Griswold v. Connecticut (1965), protecting the purchase of contraceptives, and Roe v. Wade (1973) allowing an unfettered right of abortion in the first trimester, transformed the constitutional dimensions of “morals” regulation. Those forms of conduct went from criminally prosecuted to constitutionally protected, albeit by judicial means. Nonetheless, once in place, these two decisions enjoyed such widespread public support that they could not be dislodged by contrary legislation. Abortion has provoked multiple pitched battles, but virtually no one has ever tried to block the sale of contraceptives.

Then and Now

In summary, Stigler gets a partial vindication from the study of the pre-1970 period, during which the emphasis was on various forms of regulation of rates and prices. It should never be forgotten that these forms of regulation still persist where the tension between popular and industry support remains active.

One such area is of course rent control, which has its origins in this earlier period. As a matter of principle, rent control should carry a big, fat target on its back because it is a form of price control that has the capacity to distort markets in the long and short term. Indeed, in their only joint publication “Roofs or Ceilings?”, Milton Friedman and George Stigler denounced it and showed that San Francisco’s real estate markets after the 1906 earthquake roared back to life in the absence of government price and rent controls.

Yet rent controls are all too often the preferred response to social dislocation, including the two-year moratorium on rent increases in the Washington, DC market in the aftermath of the World War I. That restriction was upheld in Block v. Hirsh, which then ushered in ever more restrictive systems of rent control in the decades to follow because of this simple public choice dynamic. All tenants are local, and many landlords are not. As such, the electoral system is powerfully rigged in favor of tenants, so that once the system gets entrenched it will take a constitutional revolution to remove it, which is not likely to happen at either the state or federal level today. Quite the opposite, the most restrictive rent control in New York City was passed in 2019. The real estate interest groups have largely been ineffectual, even though they are calling not for special protections but for a return to competitive markets.

But if the old order still remains, the new order has radically shifted the market in so many areas that it is hard to keep track. Cass Sunstein opens up his skeptical commentary on the Stigler hypothesis with a set of regulations that came out during the Obama administration. A taste of what has been done is offered by his first entry:

“In 2010, the Department of Justice issued new regulations under the Americans with Disabilities Act. The regulations established requirements for facilities such as detention facilities and courtrooms, amusement rides, boating facilities, golf and miniature golf facilities, swimming pools, and play areas.”

Noticeably absent from his simple description is any justification as to why this huge response is superior to market responses to the same problem. Clearly the two will work in different directions, if only because we should expect that in a market tailored institutions will arise that can best cater to these special needs. Yet the public regulations are always universal in impact, and thus cover all sorts of places where they are highly unlikely to be cost-effective, as Mario Loyola and I tried to demonstrate some years ago, but it all falls on deaf ears. The key explanation lies in the transaction costs account given before. Now it is easy for any interest group to organize through a variety of websites, and in my experience high-profile landlords, fearing reputational losses, often cave without a lawsuit to avoid adverse publicity.

The same can be said about civil rights groups, who were able quickly to overturn General Electric Co. v. Gilbert (1976), by the quick passage of the Pregnancy Discrimination Act of 1978, which treated discrimination on grounds of pregnancy as a form of sex discrimination. Similarly, when Wards Cove Packing Co. v. Atonio (1989) threatened to undermine the disparate impact of Griggs v. Duke Power (1971), under the 1964 Civil Rights Act, the Civil Rights Act of 1990 quickly gave Griggs a stronger legal foundation.

One can like or dislike these decisions, but two points stand out: First, as a descriptive matter, industry loses out to well-organized interest groups; Second, these groups are no more in favor of competitive solutions than the industry cartels of old. Indeed, I shall end on this somewhat distressing result. It is generally more difficult to get legislation that restores competition—an example is the Airline Deregulation Act of 1978. Nothing has gotten easier in the age of environmental protection and global warming. Stigler was right to think that there is less romanticism in politics than the public interest theory presupposed. But the constellation of forces has changed much in the past 50 years, which means we like Stigler must be alert to the risks of partisan politics.