In an interview with ProMarket, Jan Eeckhout discusses his new book The Profit Paradox and explains how market power brings down wages, even if dominant companies treat their own workers well.

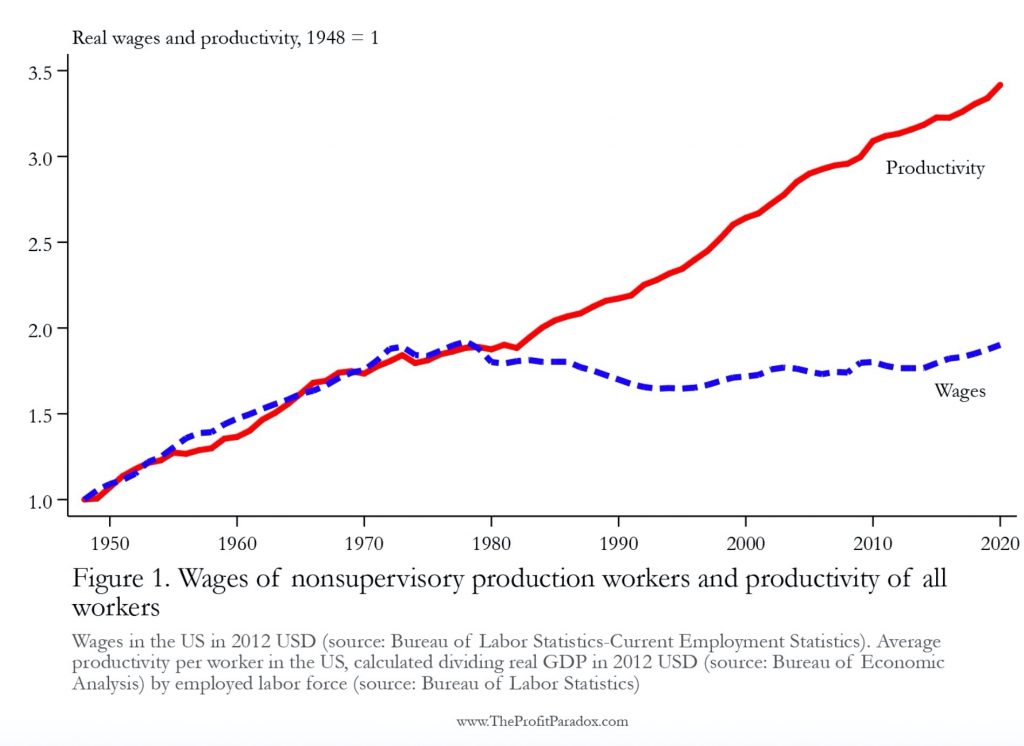

The last few decades have not been good for American workers. Wages have stagnated since the 1980s, except at the very top, and the labor share—the part of national income that’s allocated to wages—has significantly declined. What has made this stagnation particularly perplexing for economists is that during that same period, workers have become much more productive, with productivity growing at an average rate of 1.7 percent per year. Corporate profits, too, have been soaring—even the Covid-19 pandemic hasn’t managed to stop their rise.

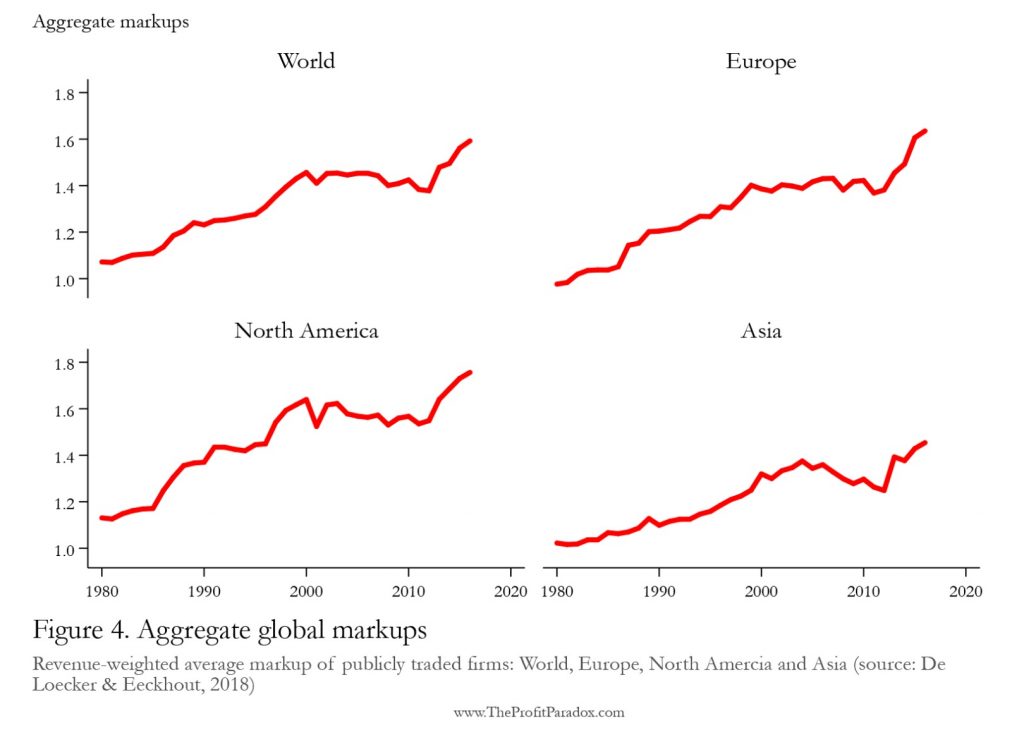

In theory, this success should translate to higher wages. And yet, it didn’t. Why? In recent years, a number of academic papers, most notably by Jan Eeckhout and Jan De Loecker and Simcha Barkai, have proposed an answer: market power. In separate papers, De Loecker and Eeckhout and Barkai have shown that while the share of output that’s allocated to labor and capital (which includes what companies spend on equipment) has declined, the profit share increased more than sixfold, the result of higher markups, especially in industries that experienced an increase in concentration.

In other words, as Eeckhout notes, what’s good for companies is not necessarily good for workers. In his new book Eeckhout, a professor at Pompeu Fabra University in Barcelona, calls it the Profit Paradox: technological innovation, he argues, has made it easier for economic power to be concentrated in fewer hands. As a result, our economy is dominated by giant, thriving firms able to use their market power to set higher prices and reap record profits, while a majority of workers are suffering the consequences of rampant market power: higher prices, reduced demand for labor, and, ultimately, lower wages.

In order to learn more about the profit paradox, we recently caught up with Eeckhout for an interview. In his ProMarket interview, Eeckhout explained how market power can bring down wages, even if dominant companies treat their own workers well.

[The following conversation has been edited and condensed for clarity and length.]

Q: What is the main takeaway you hope people would get from this book?

I think the main takeaway is to highlight one thing that has not been present in the debate: the effect of market power is going through wages, even the wages of firms that have nothing to do with it.

A substantial amount of dominant firms exerting market power may be treating their own workers very well. They may not be exerting monopsony power, in the sense that they’re not extracting rents from their workers. But, because there are enough firms that have market power, that reduces how much they produce because they set higher prices, so people buy less. Given that reduction in sales, there’s also a reduction in demand for labor. If there’s a reduction in demand for labor, there is a reduction in wages.

This is not coming from [a company like] Apple directly screwing its workers—it’s coming from the fact that there are many Apples. There are many firms that are dominant, large firms, and this leads to the macro effect of decline in labor demand, and therefore wages. That’s what I call the profit paradox. Basically, what’s good for firms is not necessarily good for workers.

I think we’ve seen similar developments with the second industrial revolution, at the end of the 19th century through the First World War, where there was extremely rapid economic growth, extremely fast technological progress—then it was electricity, rail transportation, oil. There were many new developments that then led, in a similar fashion, to the emergence of dominant firms.

This technological progress has been good for customers in many ways. But these firms that become dominant are doing it in the same way that Rockefeller and JP Morgan did. They use technology in two ways: one is to increase efficiency and lower costs, which is desirable; and to create a moat around them to protect their firms. And that’s where the negative effect comes in, and all those positive gains are being lost in order for these firms to maintain their power.

Q: So these firms don’t have to actually exert market power? Just the fact that they exist and have this market power leads to a negative effect on workers and wages?

There’s a distinction between exerting market power in the labor market and exerting market power in the goods market. They don’t have to exert monopsony power in the labor market, but they do exert some form of market power in the goods market. And their workers are affected by that.

Since the 1980s, there has been a decoupling between productivity and wages. Not for everyone, of course—the top wages have gone up like crazy. But production worker wages have stagnated. For high school dropouts, wages in real terms have declined. If your wage declines, that means that your marginal product has declined, [but does this] mean that you are less productive today than you were 40 years ago? That’s unlikely. The reason these wages have declined is not because their productivity goes down—it’s because they don’t get the same share as they used to get.

Q: For workers at the top of the ladder, the highly sought after workers, wages have increased. Whose wages have stagnated?

I would say all wages, except those of people who supervise other people. People who are somehow either co-owners—for instance, CEOs who get shares in the company as compensation—or superstars. That’s about 20 percent, of which I’d say the main group, in terms of importance and numbers, is people who supervise other people. Because if you supervise people, you can scale your labor. If you don’t do that, you’re just very easily substituted. Anyone else can do your job. Of course, this is true for flipping a burger or being a security guard or cleaning washrooms, but it’s even more true for coders down the ladder.

Q: Recently on Twitter, you used sports—specifically, European soccer—as an example of how market power affects workers. Can you elaborate on that?

I think that sports really reflect, to a large extent, what’s going on in the US and around the world, which is that the insiders are trying to manipulate the institutions in such a way that it gives them market power to build a moat around their “castle.”

What reinforces externalities in sports is their zero sum nature: if I win, you lose. The best way to win that zero sum game many times is to get all the best players in one team. So the owners of the franchises in, say, the NBA, they get together and set rules to make the competition more balanced: salary caps, rookie drafts, things like that. Then they go one step further and say: well, now that we have a salary cap, why don’t we lower it?

With the European Super League, the idea was to do exactly the same thing: close the competition from other promotions, and then on top of it, the first thing they discussed was salary caps. They say salary caps is a tool to make the competition more balanced, but it’s also another tool to lower the salaries for everyone. It’s a form of collusion.

Q: In the book, you make the point that it’s not about one individual company. That it’s not just the Apples and Googles of the world—this is happening across industries, across countries.

Yes. It has to do with technological innovation. As I mentioned earlier, we saw that at the turn of the last century, with the second industrial revolution. This fast technological change is good and has improved people’s lives, but this technology is also used to build a moat. So on the one hand, you have these huge gains from technology. On the other, you get the negative effects from not sharing those gains.

I have this quote from George Orwell: “The trouble with competitions is that somebody wins them.” He wrote this when discussing The Road to Serfdom by Hayek. Of course, we want competition between innovators, like Google was at one time, but what happens is that once they win this fierce competition, they exploit the same technology to keep other firms out. That can be through taking over competitors, or buying up startups before they even become competitors. And it can also be through changing legislation.

“Competitive markets are not desirable for someone who wants to maximize shareholder value.”

Q: We used to hear a lot about a rising tide that lifts all boats. In the book, you talk about a falling tide, driven by market power. Can you elaborate on this concept of a falling tide?

It’s extremely hard to explain what economists call equilibrium effect, so I tried to use this image of the falling tide to explain that these businesses are doing very well, and yet, even without them having any intention of lowering their wages, they do lower wages.

It’s a complicated concept that has legal implications. It’s a little bit like pollution: me driving a car is causing pollution, but it’s tiny compared to the fact that three billion people are driving cars at the same time. So it’s the same with Apple: it’s not that Apple is responsible for the lowering wages; it’s that there are many Apples out there that is lowering the wages.

Q: You write that markups in the US increased from 1980 to 2000, stalled for a few years, and then boomed again after the 2008 crisis. In Europe, you find that the trend is identical to the US. A lot of the debate on market power so far has been very focused on America. How do you explain that the same pattern holds across continents and countries?

I think the reason that this is so widespread, or so homogeneous across different countries, is because it’s a global phenomenon. Part of it is because these dominant winners are mainly global businesses. We cannot easily assign an identity or nationality to them. The iPhone is everywhere. Do we measure where it’s produced? No. What matters is where it’s sold, because that’s where the market is. And that’s a global market. I think that’s why we see these very common patterns across many different countries. Differences in policy objectives and implementation are kind of watered down once you are in front of these very mobile companies.

Q: You make the distinction between being pro-market and being pro-business. How do you see the distinction between the two? You also write that right now, “pro-market capitalism is losing out to pro-business.” Can you elaborate on why that is?

Being pro-market means lowering the profits of many businesses. If I’m a business owner, I am pro-business: I want monopoly, because that’s how I can make most money. Competitive markets are not desirable for someone who wants to maximize shareholder value. As shareholder value is higher, the higher the profits. Society’s viewpoint is, well, we really want zero profits: the fiercer the competition, the better it is for society at large.

Why am I saying pro-market is losing out to pro-business? Because if you tell people that the stock market will go up by 10 percent over the next three months, they will think it’s great. But this is a disaster for society, because what are stocks? They’re reflecting the discounted stream of all future profits. It means that people expect even more profits. In competitive markets, profits will go down, and the stock market should be lower. That’s precisely the profit paradox: people seem to equate success in stocks and profits with a healthy economy. And it’s exactly the opposite.

At the same time, we want successful firms, because we want firms that innovate. We do need some Schumpeterian dynamic, so we need some temporary monopoly power, at least through a patent or through a temporary kind of leadership in a market, because that’s going to compensate companies for their investment. But what’s going on now is very un-Schumpeterian, because they maintain their monopoly for the long run. In that sense, the pro-business is winning over the pro-market.

There is an additional aspect to it, which is this vicious circle between market power and the political system: if I get some market power, this gives me cash. With that cash, I can very easily influence the institutional aspects of the market— buy politicians to regulate you less, or regulate in a way that favors your business.

“if you tell people that the stock market will go up by 10 percent over the next three months, they will think it’s great. But this is a disaster for society.”

Q: You propose a number of remedies in the book, such as making mergers a lot more difficult. You also propose a change in the way we think about antitrust enforcement, from the so-called consumer welfare standard to considering all stakeholders and the economy-wide implications. Why do we need to move on from consumer welfare?

First of all, I think the legislation, going back to the Sherman Act, is perfectly fine. But we currently have no legal way to deal with the much larger societal effect that all these firms having market power has on wages. I’m not saying that the solution is easy, the same way that dealing with pollution through legislation is hard. But I am saying this should be on the agenda, and currently, it’s not even discussed. The only thing that is being discussed is whether the price of my iPhone is too high and whether that affects the consumer of the iPhone.

Q: You stop short though of calling for breakups and in some cases, you prefer regulation. Why not just break up these giant, moat-surrounded multinationals, given the negative effects on wages and higher prices?

In some cases, breaking up would work. I think we should break up Facebook, Instagram, and WhatsApp—but they were already kind of put together in an artificial way. I don’t think we should break up an Amazon, or a Walmart even. The reason why has to do with the two aspects of technological progress: on the one hand, technological progress increases efficiency, and a lot of this efficiency is coming from scale. Amazon is successful because of scale.

It was the same way with the railways 100 years ago—there’s no point building two parallel railway lines. There’s no point in competing like that, it’s much better to compete on the railway lines. My AT&T plan in the US cost about three times as much as my plan here in Spain. The quality of the service is actually better here because in the US, coverage wasn’t so good. Why is that? Well, there’s regulation in the EU. And that regulation says: if you own a mobile phone tower, then you as the owner are forced to accept competitors. If I’m Movistar in Spain and Vodafone from the UK comes and says, “I want to distribute in Spain,” I have to let Vodafone on it at a price set by the regulator. There’s about 400 million people in the EU and there are between 100-150 providers. The US population is 330 million and there are three providers; price is much higher and services are worse.

Now, this is a very simple regulation. The only thing regulators have to do is to set the right price. You set it too low, it’s not good for the firm that has made the investment; you set it too high, it’s as if you didn’t regulate. So you have to get it right. But with enough data, this is fairly straightforward to do. This concept we call interoperability leads to a huge increase in efficiency, enormous competition—150 competitors versus three for a similar market—through a very simple legislative change.

Q: But then we run into the problem of capture, no? As you mentioned, because these companies are powerful and have moats around them, they can either resist regulation or work it so it benefits them and protects their market power.

Look, no one solution is going to be perfect. In terms of policy prescriptions and changes, we have to go on case-by-case basis.

I advocate for an independent competition authority that operates just like an independent central bank and says: “I’m going to decide where there’s going to be competition, and I’m not going to have any interference from lobbyists.”

Now, an independent authority that is large and can work with experts that can work on case-by -base basis is not going to be cheap. Nowadays, there are about 30,000 people working in the central bank system in the United States and about 3,000 people working on antitrust. The cost of inflation is estimated to be around 0.5-1 percent of GDP. We estimate the cost of market power at 9 percent of GDP, annually. And we have those 3,000 people doing all the work, all the heavy lifting.

Q: The book seems to take a dim view of stakeholder capitalism. Why do you see strong regulation as preferable?

I am not against stakeholder capitalism at all. We all want stakeholders to benefit. What I’m trying to arrive at is that if you truly have such a broad economic effect, then stakeholder capitalism is well-intended, but it’s never going to have an effect. Ask the CEO or board of an oil company to do something about pollution and they’ll say sure, but it’s impossible for them to solve pollution. For that, you need something like a tax on gas. [Stakeholder capitalism] is a great way of making people aware of certain issues. But in terms of solving the problem, if it’s an economy-wide problem, one individual firm cannot do it. Wages are affected by many different firms at the same time. Apple’s CEO alone cannot deal with that.