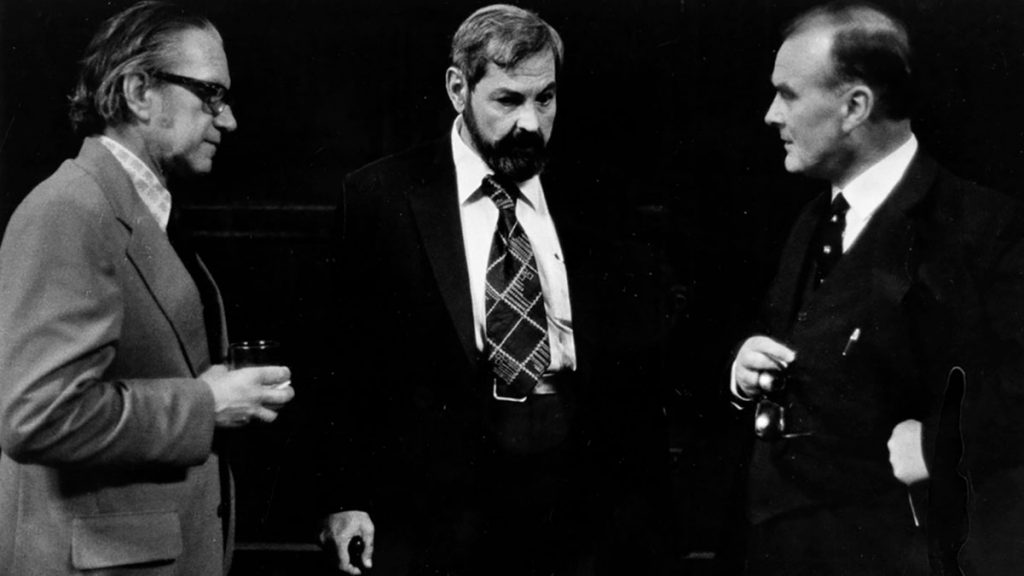

In conversation with Sebastian Edwards, Arnold C. Harberger reflects on his time at the Department of Economics at the University of Chicago.

Editor’s note: The current debate in economics seems to lack a historical perspective. To try to address this deficiency, we decided to launch a Sunday column on ProMarket focusing on the historical dimension of economic ideas. You can read all of the pieces in the series here.

Thousands of pages have been written about the Department of Economics at Chicago. Some works have been celebratory and others have been critical; some have been deep, and others have been superficial. This piece, based on a longer paper, is about the Department of Economics at the University of Chicago, as seen by one of its long-term faculty members —Arnold C. Harberger—and one of its former students, Sebastian Edwards. The period covered is from 1947 through 1982. That is, 35 years that span form the time Harberger arrived as a student to the time Edwards graduated with a PhD. The approach that we have decided to follow is somewhat unusual: the paper has the form of a conversation between two people from different generations, two colleagues and friends, two professional economists who have traveled together around the world providing advice to governments on almost every continent.

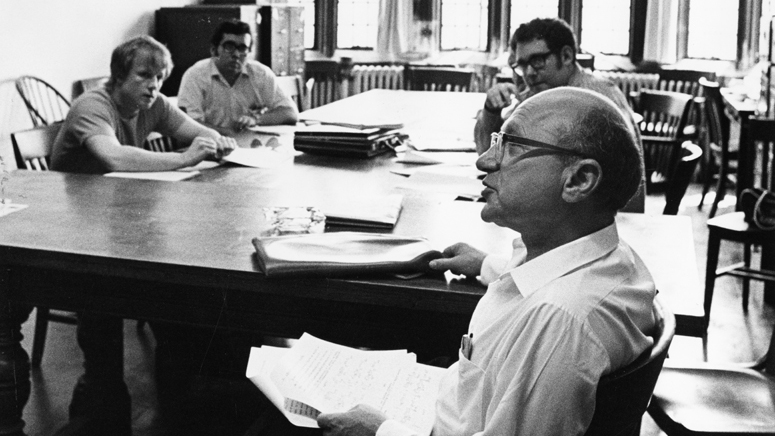

Of course, we played very different roles in the Department. Harberger was a faculty member for over 30 years, and chairman for 12 years. He was a colleague of some of the most famous economists of the second half of the twentieth century and early decades of the twentieth-first, and hired many of them. After four years as a student, Edwards went to UCLA, where he has spent most of his career. He looked at Chicago from afar, but always with great interest.

Sebastian Edwards: You enrolled in the Department of Economics in the fall of 1947, after having spent a year studying international relations at the University of Chicago. At the time, the Department had a large number of very prominent members, including some credited as having founded the “First Chicago School.” People like Frank Knight, Lloyd Mints, Henry Simons, and others. Also, Milton Friedman had just arrived as a faculty member, in 1946. How was the Department when you joined? From today’s perspective, what do you think were the most salient characteristics of the place? And, at the time, how was it different from other leading departments such as Harvard and Yale?

Arnold C. Harberger: In 1947, there were lots of students, but it really did not feel crowded. It was very exciting and to us it was clear that it was a special place. The fact that the Cowles Commission was there added to the sense that this was a unique place. I was hired as a research assistant at Cowles in March 1949 and I shared an office with Stanley Reiter, who ended up having a very distinguished career at Northwestern.

“My belief was that the Chicago School meant believing that market forces were extremely important in determining how things worked out in the real world.”

SE: Some people have said that the Chicago School started with Frank Knight and from him different branches spurred out: Henry Simons, Milton Friedman, George Stigler. Some people say that what made it operational was Milton’s monetary analyses, plus Viner’s and Friedman’s price theory, and George Stigler’s and Ronald Coase’s views on externalities, regulatory capture, and transaction costs.

ACH: If one talks about the existence of a “Chicago School,” one also needs to talk about T.W. Schultz. He was incredibly influential, very talented, and a great economist. He and D. Gale Johnson ran an extremely prestigious agricultural economics program at Chicago. When I think of the Chicago School, I think of three principles: theory is of utmost importance, and should guide economic thinking; theoretical constructs should be confronted with the real world, they should be tested, there should be a lot of data analysis; and when in doubt, always come back to fundamental price theory, to the functioning of markets.

SE: Tell me how you ended up joining the faculty at Chicago? How did it happen? You were an Assistant Professor at Hopkins and you got an offer to go to Chicago.

ACH: T.W. Schultz read my projections on the demand for materials for the year 1975, and decided that I was the man for public finance at Chicago. In that work, I created an image of the 1975 economy, with so many automobiles, and so many washing machines, and so many refrigerators, and so much this, and so much that. And from that I derived the demand for materials. This was very distinct from running a regression and forecasting forward. You can see how terrible job a regression would do. I don’t think it’s the right way, anyway. The reason had to do with history: going back you had the 1920s and the Great Depression and the war, and then inflation. There was no point in using regressions.

SE: Had you taken a formal public finance course at Chicago as a student?

ACH: Yes. That was the only B I got in economics. The professor was Roy Blough, who had been a Treasury official, and the Teaching Assistant was Jim Buchanan. In a way, it was funny that I would come back to Chicago and be in charge of the field where I got my only B.

SE: The public finance workshop, which you ran, was very famous in the 1950s and 1960s. It attracted lots of students, including people like Bob Lucas and many Latin American students. When did the workshops start? What was so special about them?

ACH: Well, the workshops started with Milton. And agricultural economics, with T.W. Schultz and D. Gale Johnson; that was effectively a workshop, whether you call it that or not. And that was alive and well, and strong and powerful. And when I came to Chicago in 53, Schultz practically forced me to have a workshop in public finance. And this was because he and Milton were looking for funding from the Rockefeller Foundation for workshops in general. The idea was that workshops were good, that this was a start. Here was a new faculty member, and why not get him started on the right track. So, I was hardly given an option.

SE: When I arrived as a graduate student, in 1977, my classmates and I had no doubt that we were in a special place, in a unique institution. We also knew that we were in a place that was populated by people with very strong points of view regarding the functioning of markets, the role of monetary policy, the causes of inflation, and the limitations of fine tuning. We also had the feeling that intellectually we were besieged, that the “Chicago view” was a minority view. We did not dislike this. In fact, I think that many of my classmates liked it; we considered ourselves as being in what I would call “Fortress Chicago.” In many ways, we thought that it was a fortress built around Milton Friedman and his views. What are your thoughts about this? How did you feel as a member of the faculty, and earlier, as a graduate student, about the notion that Chicago was almost on its own defending certain principles?

ACH: I resist very much the idea that Chicago was basically a sounding board for Friedman. In point of fact, we had as many people voting Democratic as voting Republican. The thing is that the other leading department had mostly Democrats. It’s not that we were predominantly Republican; we had some, and they didn’t have any (or had very few), so to speak. The question is: What determines the Chicago School? My belief was that the Chicago School meant believing that market forces were extremely important in determining how things worked out in the real world, and there was no one at Chicago who disagreed with that principle.

SE: Let me push you on this: Our sense in the late 1970s—this is just when the “rational expectations” revolution was taking hold—was that there was only a handful of schools with majority views similar to those dominant at Chicago: UCLA, Rochester, maybe Carnegie. At the policy level, there was the St Louis FED monetary model, but not a lot more. Given this situation, how would you characterize relations between faculty members in the top schools?

ACH: In Cambridge and particularly at MIT, and within MIT, Paul Samuelson and Bob Solow, made snide remarks about Chicago, and especially about Milton Friedman’s attitude and interests, and I would say there was a kind of belief that we were all kind of clones of Friedman. This, of course, was not true, and certainly not true of Ted Schultz, Harry Johnson, D. Gale Johnson, Bob Mundell. There makes no sense of talking about clones, knowing the personalities of the people involved. But the outside view was that most of us were, at least partially, Miltonian clones. I would say that Milton didn’t want to have only people like him in the Department. In the appointment process he liked diversity.

“There was a kind of belief that we were all kind of clones of Friedman. This, of course, was not true.”

SE: Was Milton Friedman liked by his colleagues? Did the other faculty members like him?

ACH: I have the feeling that the answer is “Yes, but…” Certainly, Harry Johnson had a hard time with Milton. I don’t know if he wanted to have as much luster around him as came around Milton; it might be that. Harry’s economics were close to Milton, but not by any means as doctrinaire, so to speak, as Milton’s.

SE: The impression one gets looking back is that during those years [1960s and 1970s] the Department was very small, and very well run. Tell me a little bit about the governance, the way in which the faculty interacted with each other, the role played by junior faculty, and relations with other parts of the University.

ACH: I think that the fact that there were very few chairmen is important. From 1945 to the mid-1980s there were only four chairmen. Albert Rees ran the Department for three years. The rest of the time the chairmen where Ted Schultz, D. Gale Johnson, and myself.

SE: Overall, you were chairman for 12 years, probably one of the longest, if not the longest, maybe only comparable to James Laughlin. How were relations among the faculty? Was it hierarchical? Or was it pretty much horizontal?

ACH: Governance was much more democratic than at Harvard or Yale, mostly because of the small numbers of faculty. Never more than 25, while Harvard and Yale probably had 45 or so. Junior members spoke up frequently and freely.

SE: When I arrived as a student in 1977, the entering class was about 60. And the graduating class, those who got a PhD, was 12 or 15. The 60 entering class was a very unusual number for a top program. The entering class at MIT, Harvard or Yale was about 15, almost the same number as those who graduated at Chicago. How large was the entering class when you arrived in Chicago as a student?

ACH: We had about 200 graduate students in economics when I was there because we had all the people from the war. People from 41, 42, 43, 44 and 45, and we were all being financed by the GI Bill of Rights. So, we got our $75 a month, and if you got a fellowship—it didn’t matter which one—you only got another $25. So $75 from the government plus $25 from the University, $100. And that was enough at the time, before too much inflation.

SE: And when you came back as faculty in 1953, how large was the entering class?

ACH: About 60, I am guessing.

SE: So the tradition of having a very large entering class – as the one I had – went way back?

ACH: Right.

SE: You once told me that at Chicago there was the view that a Master’s degree was an earned degree, a useful degree for professional economists that would do good work in government. It was a genuine degree, it was not a consolation prize for those who didn’t pass the core exam. That was different from other top programs.

ACH: Well, we made a bit of fun of Harvard and Yale because they practically guaranteed that every entrant would get a PhD. And we thought that that was for the birds! On the other hand, I think that two-thirds of the people who entered Chicago had the capacity to get the PhD, and two-thirds of them actually got the PhD.

SE: Maybe we should end with a peroration of sorts, with a summary of what you see as the great advantage of the Chicago Department during the years we have been talking about. How would you summarize this advantage?

ACH: A clear advantage was that, among the leading departments, it was smaller; it was only half, or less, than Harvard and Yale. Hence, just about every professor at Chicago was not a supernumerary, everyone was important in his or her own field. The range that we had, from Milton, Harry Johnson, Bob Mundell, T.W. Schultz, John U. Nef, Jim Heckman. Everybody was a real leading person. Because of the size, the number of people responsible for a field was small, and that allowed us, for instance, to have Harry Johnson and Mundell in international, at the same time. So, it was a great Department. Now, our small size had to do with the fact that the University of Chicago didn’t have the great mass of undergraduates that other schools had. At the end, I think that we go back to my three points discussed above. The Chicago School was about the connection between theory and applied analysis. Always test the implications of the theory, confront data with predictions, and do it again and again. Take both theory and data seriously.