“Despite all the rhetorical support for free markets, it turns out that employers would rather corner their market, not free it, especially their market for labor,” writes Jake Rosenfeld in his book You’re Paid What You’re Worth: And Other Myths Of The Modern Economy.

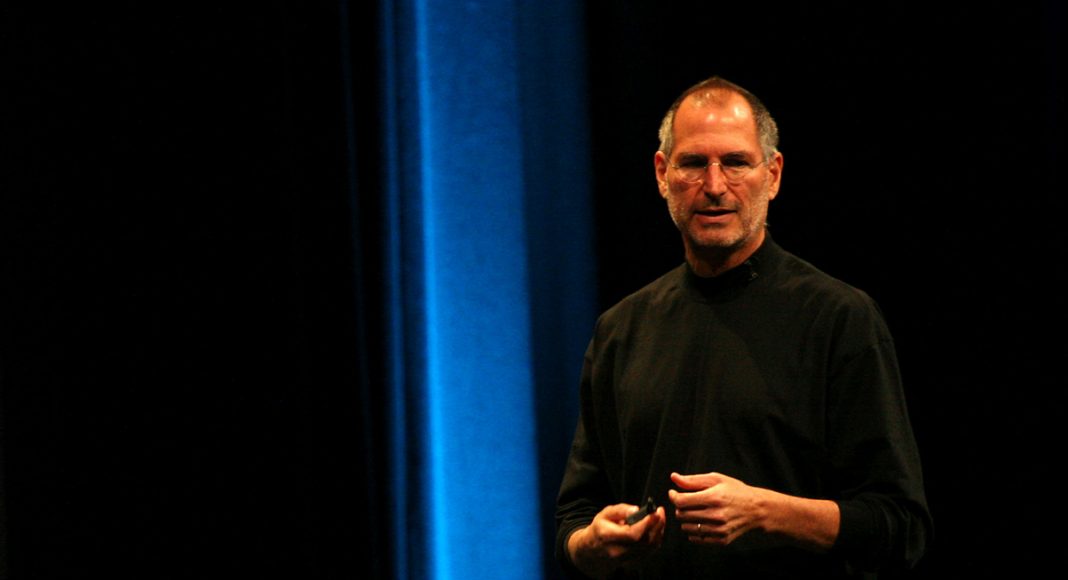

In 2005, Apple CEO Steve Jobs learned that fast-growing Google was trying to lure away a team of Apple software developers working on a highly strategic project. He wasn’t pleased. As recalled by Google cofounder Sergey Brin, Jobs called Brin and vowed, “If you hire a single one of these people, that means war.” Brin backed down. Soon, the two technology titans came to an agreement not to poach talent from one another, and both then pursued similar agreements with other Silicon Valley firms. The executives policed the arrangement vigorously: in 2007, a Google recruiter, perhaps unaware of this new form of collusion in the industry, approached an Apple engineer. Jobs found out about the transgression and quickly complained. Google fired the recruiter within days.

When word leaked of the agreement, a group of engineers filed a class action suit. It alleged that Apple, Google, Intel, and Adobe had established multiyear no-poaching agreements that barred the participating firms from recruiting each other’s talent. Why did the engineers care? Because, like noncompetes, no-poaching agreements hinder the claims-making power of in-demand workers: the suppression of outside job offers means less opportunity to bid up pay. A rising Apple engineer making, say, $135,000 annually has a pretty powerful claim at his disposal if Google offers him $165,000 to jump ship. Apple might counter the outside offer by increasing his pay, or the worker might accept Google’s higher annual salary. Placing employers in competition like this is a tried-and-true way for workers to shift power dynamics in their favor. But it can’t work if the firms have already agreed it is not in their interests to compete for labor.

“Like noncompetes, no-poaching agreements hinder the claims-making power of in-demand workers: the suppression of outside job offers means less opportunity to bid up pay.”

The class action lawsuit dragged on for years. The tens of thousands of engineers represented in the suit demanded $3 billion, but a decade after the collusion began, they settled for $415 million, and each engineer received just under $6,500. Certainly, $415 million is a lot of money, and the settlement represented a victory for the aggrieved workers. But these were highly paid professionals who could have negotiated raises worth many multiples of the court case’s spoils if they had received the right calls from executive recruiters. That is, if they hadn’t been working for firms who were mimicking other firms’ no-poaching policies.

Perhaps it’s hard to conjure much sympathy for the already well- remunerated set of software engineers who have driven up housing costs in the technology corridors of San Francisco, Seattle, and other cities (and who won at least some of their lost compensation back). In that case, consider that such anticompetitive arrangements, sometimes tacit and sometimes explicit, have also been found in many other industries, including fast food. That’s right: fast food. Alan Krueger, a past chairman of the President’s Council of Economic Advisors, found that no-poaching rules are “ubiquitous” in fast food franchising agreements. More likely than not, if you are the operator of a local Pizza Hut, one of the documents you signed as the franchisee prevents you from hiring from other Pizza Huts. The same is true of Burger King. In 2017, of the major fast food chains, nearly 80 percent contained this sort of “no hire” rule. Some agreed to drop them after Krueger and fellow labor economist Orley Ashenfelter publicized the practice.

Fast food isn’t the only low-paying industry in which no-poaching agreements are common. Franchisees of many of the major fitness chains, including Curves, routinely sign contracts with such clauses. The same is true of some businesses where you have your car serviced, such as Jiffy Lube. Business owners have argued that the costs of training new hires justify such protection from poaching. Yet it takes very little time to train an entry-level employee at, say, Burger King. And of course, a non-collusive way to hold on to productive workers would be to pay them a higher wage. It is often when employers are reluctant to do so that they instead search for such workarounds as noncompetes and no-hire rules. Indeed, Krueger and Ashenfelter conclude that the presence of these rules among many low-wage employers helps “explain a recent puzzle in the labor market: unemployment has reached a sixteen-year low and job openings are high, yet wage growth has remained surprisingly sluggish.”

Mimicry becomes outright collusion when it is organized, secretive, and intended to deprive workers of a vital tool to negotiate higher pay. It’s often illegal, as the Silicon Valley settlement demonstrated. It’s also commonplace in today’s labor markets.

Writing in the late 1940s about the nation’s efforts to rein in monopolies, lawyer Wallace Murchison noted, “Certainly efforts to eliminate competition have been at least as characteristic of the American economy as competition itself.” True then, and true today.

Anti-competitive practices among employers are pervasive, have expanded in scope, and have constrained worker pay since the 1970s, when average wages for workers began to stagnate. In 2015, Thomas Donohue, president of the US Chamber of Commerce, decried the growing hostility to free enterprise, the vibrant entrepreneurship that “made the United States the land of opportunity and created the American Dream.” His ire was directed at “big government,” but another big target was closer at hand: the major corporations the Chamber lobbies on behalf of, who, by lowering competition through illegal, semi-legal, and perfectly legal means, have produced today’s “rigged labor market.” Despite all the rhetorical support for free markets, it turns out that employers would rather corner their market, not free it, especially their market for labor.

Excerpted from You’re Paid What You’re Worth: And Other Myths Of The Modern Economy by Jake Rosenfeld, published by The Belknap Press of Harvard University Press. Copyright © 2021 by Jake Rosenfeld. Used by permission. All rights reserved.