In the years leading up to the pandemic, rising inequality created a saving glut of the rich which pushed down interest rates and fueled a large rise in government and household debt. But with interest rates now hitting their effective lower bound, it is impossible to encourage even more borrowing and consumption by the non-rich.

The Covid-19 health crisis has struck a world economy already suffering from sustained weakness. Extremely low interest rates, lackluster growth, and historically high levels of debt have characterized almost all of the advanced economies of the world even before the health crisis.

Very low interest rates have complicated the economic policy response to the Covid-19 health crisis, as central banks have had little room to maneuver before hitting the effective lower bound.

Our recent research argues that rising income inequality has played a central role in explaining such weakness. Many have argued that rising inequality is problematic for both fairness and political economy reasons, and we agree. However, our recent research argues that rising income inequality is also bad for the overall economy. (The two research studies are “The Saving Glut of the Rich and the Rise in Household Debt” and “Indebted Demand”.)

This argument may sound puzzling.

A typical argument in macroeconomics is that inequality is good for growth. According to this argument, the rich save more of their income, and such saving boosts capital investment. More capital investment means that we can produce more goods and services, and therefore have a stronger economy.

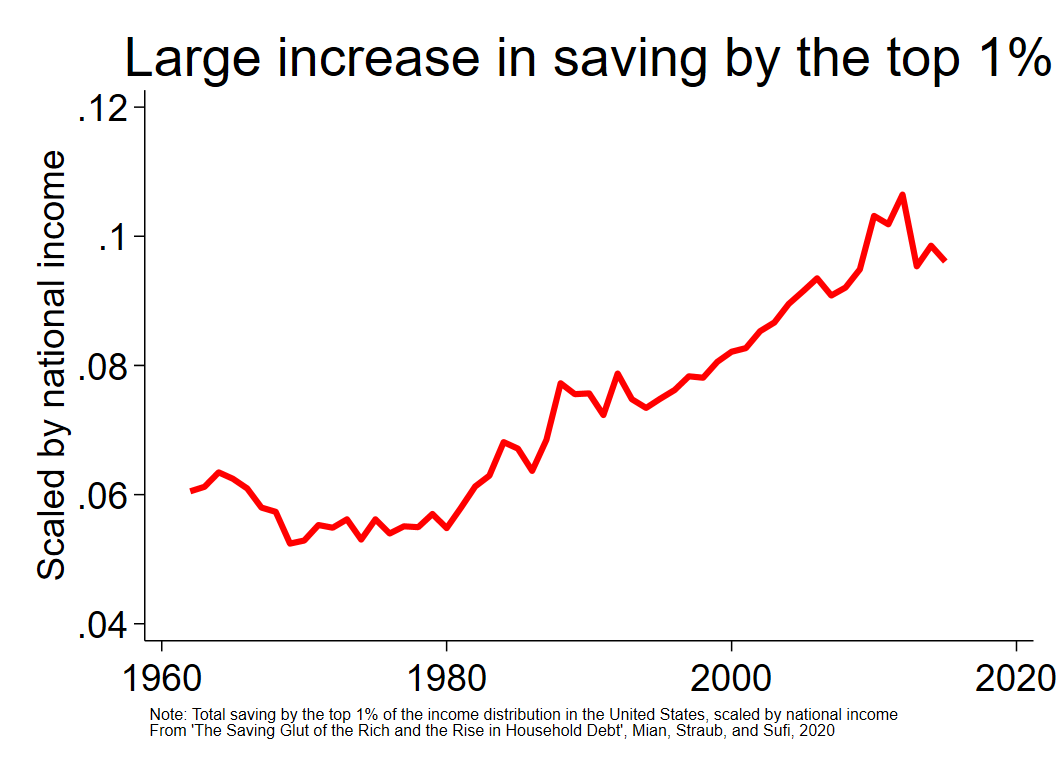

Is this argument empirically accurate? Let’s focus on the United States. From the 1980s to recent years, the top 1% share of national income rose significantly. And indeed, the rich saved more of this income, generating a substantial rise in saving.

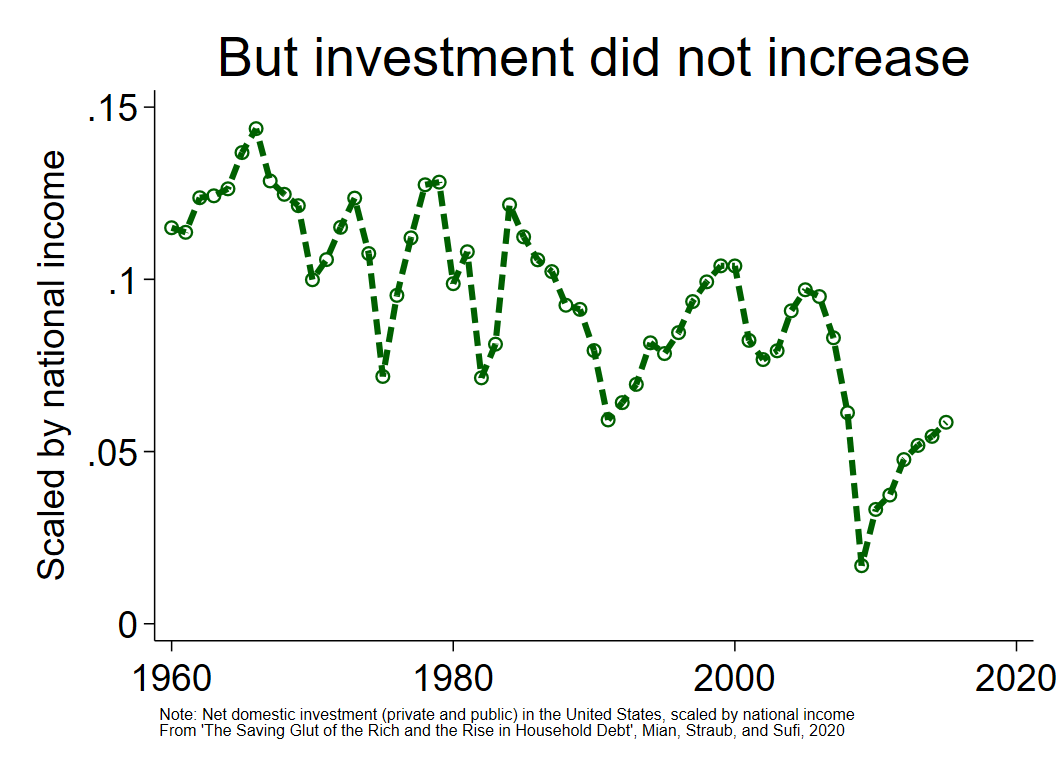

So far, so good. But did investment in capital goods rise?

This is where the traditional view breaks down. The investment to national income ratio (which includes both private and government investment) has actually fallen considerably since the 1980s. The savings of the rich have not translated into more capital investment.

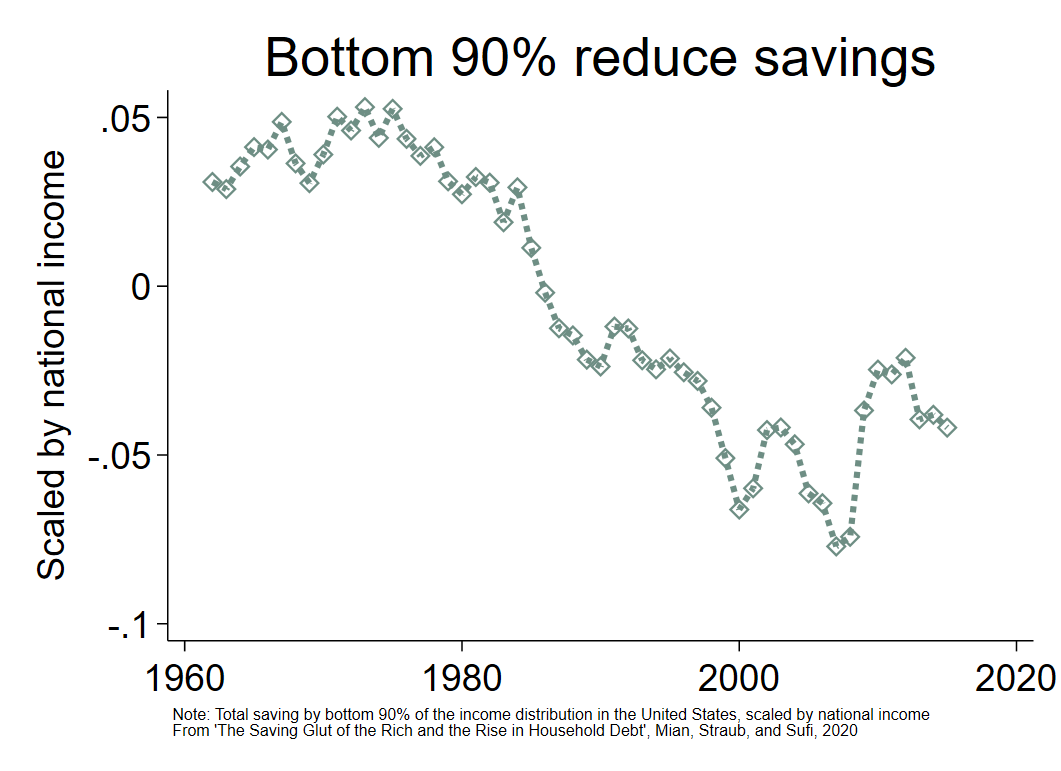

So where did the savings of the rich go? The answer: more borrowing by the non-rich (think, bottom 90% of the income distribution) and the government.

The large rise in household debt up to the Great Recession was directly tied to the large increase in income inequality through the saving glut of the rich.

After the Great Recession, the savings of the rich financed dissaving by the government. Inequality has driven the rise in both household and government debt through this “saving glut of the rich.”

This game of lending is not sustainable. As the non-rich and the government continue to borrow from the rich, such borrowing creates a stream of debt service payments that go to the rich. This amplifies income inequality.

Furthermore, the rich have a saving rate that is higher than the non-rich, and as a result these debt service payments that go from the non-rich to the rich weaken aggregate demand.

The only way for the economy to maintain equilibrium in light of this depressed demand is to lower interest rates, which is exactly what has happened across the world as income inequality has risen.

For a while, this lower interest rate strategy may work, as financial markets encourage more and more borrowing by the non-rich to sustain demand.

Unfortunately, this debt dynamic has a dead end (or perhaps we should say a “debt end”).

When interest rates hit their effective lower bound, it is impossible to lower interest rates further to encourage even more borrowing and consumption by the non-rich.

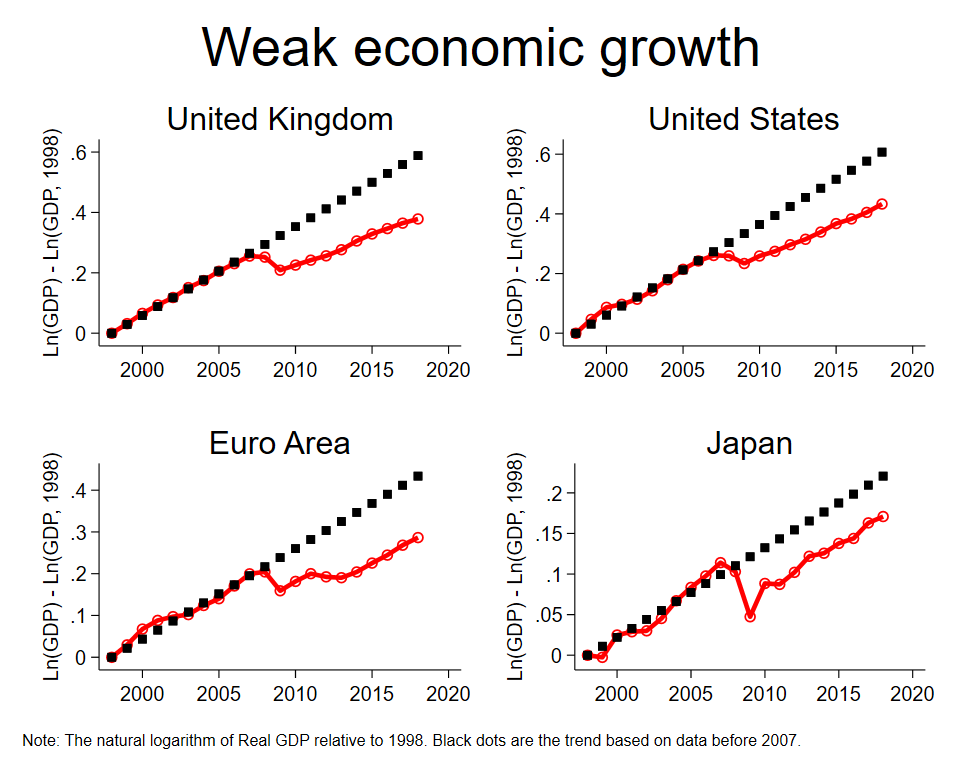

The economy cannot maintain equilibrium unless output falls. The world then sees depressed economic growth. This is exactly what we see in the data. When economies around the world approached the effective lower bound on interest rates, economic growth weakened considerably.

This simple logic explains how the persistent and large rise in income inequality leads to (a) rising debt levels, (b) falling interest rates, and (c) depressed economic growth.

This simple logic also implies that attacking the rise in inequality directly is the most effective way at achieving a healthy economy in the long-term.

Reduced inequality is good for fairness and political economy concerns, but policy-makers should also consider policies that help dampen income inequality for the sake of the overall economy.

The framework we have developed implies that a sustained and successful effort to boost income levels of the non-rich would strengthen aggregate demand, boost output, and help economies leave the effective lower bound on interest rates.

Atif Mian is John H. Laporte, Jr. Class of 1967 Professor of Economics, Public Policy and Finance at Princeton University, and Director of the Julis-Rabinowitz Center for Public Policy and Finance at the Woodrow Wilson School. Ludwig Straub is an assistant professor of economics at Harvard University. Amir Sufi is the Bruce Lindsay Professor of Economics and Public Policy at the University of Chicago Booth School of Business.