The first academic study of American consumers’ reaction to the pandemic finds that total spending rose by half between February 26 and March 11, 2020, when President Trump declared a national emergency. Data shows levels of elevated grocery spending that continued through the month of March and sharp drops in restaurants, retail, air travel, and public transport as people began to stay at home.

The rapid spread of the novel coronavirus, Covid-19, coupled with great uncertainty about both its health effects and impact on the economy, has led to drastic changes in the way we live our lives. In many cities and states, businesses were closed by government mandates and Americans were required exposure to others following shelter-in-place orders. These changes have had profound effects on the way households spend, save and borrow, among others.

In joint work, we use de-identified data from a non-profit Fintech to study how US household spending responded to the current pandemic. Pandemics and epidemics have ravaged humanity throughout its existence, and have often changed human interactions and the economy. In our study, we present the first academic study of how household consumption responds to the spread of an infectious disease.

We find that households dramatically changed their spending as Covid-19 spread.

Initially, spending increased sharply as households stockpiled needed home goods in anticipation of a higher level of home-production, an inability to visit retailers or shortages of items.

We found that total spending rose by approximately half between February 26 and March 11, 2020, when President Trump declared a national emergency and as cases slowly grew throughout the country.

We also see increases in card spending, which may indicate borrowing to stockpile goods.

News Paper Coverage of COVID-19

This graph displays the fraction of newspaper articles in US newspapers that mention a term related to Covid-19. Data shown for selected states. Nationwide, over 3,000 newspapers are utilized.

Following the imposition of a national emergency and before many states and cities began issuing shelter-in-place orders on March 17, we see continued levels of elevated grocery spending that continued through the month of March.

We also saw very sharp drops in restaurants, retail, air travel, and public transport in mid-to-late March as people began to stay at home.

The drop in spending was not consistent across all categories though—grocery spending increased, as did food deliveries. Still, overall spending dropped sharply by approximately 50 percent.

This is consistent with survey evidence in France that suggests a 35 percent drop in overall consumption.

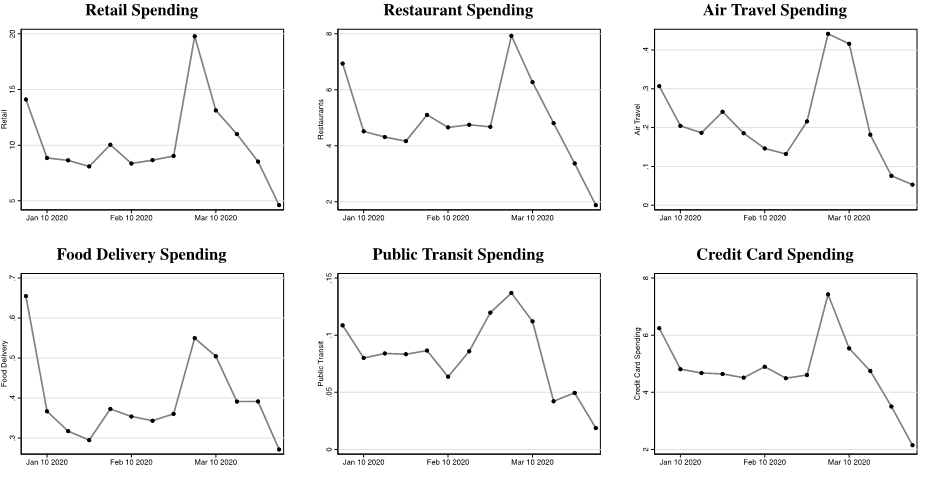

Household Spending Responses Across Categories

This graph displays the response of household spending across a number of categories of spending. Spending is measured in daily dollars. Estimates are taken as the change in household spending from the first week of February to the first week of March. Source: Non-Profit Fintech.

We use the rich dataset to characterize heterogeneity across demographics, income groups, and partisan affiliation.

We find that men stockpile slightly less, and families with children stockpile more than other households. We also find that younger households stockpile later than other households, which is consistent with media reports of many younger individuals initially taking the crisis lackadaisically.

We find little heterogeneity across income levels—although our sample is skewed toward lower-income individuals, both high and low income stockpiled. This is consistent with theories of the “wealthy hand-to-mouth” and wealthier households behaving as if they are constrained and having similar liquid resources to other households.

In regard to partisan views on the severity of the pandemic, media reports and polls suggested that Republicans and Democrats had very different outlook on the threat posed by the new virus. For instance, a Quinnipac poll between March 5 and 8, 2020 found that 68 percent of Democrats were concerned, compared to 35 percent of Republicans.

We did find real differences in social distancing between political groups—individuals in states with more Trump voters were much more likely to move around in mid and late March, according to aggregated data from mobile phone records.

However, we find that Republicans stockpiled more than Democrats, spending more on groceries in the run-up to the virus spreading. We do find some evidence that Republicans were spending more in retail shops and at restaurants in late March, which could reflect differences in beliefs about the severity of the crisis, or differential risk exposure.

Our study offers a firm and timely glimpse into how Covid-19 impacted American household spending in the short term. It is important to caution that these are very short-term responses to the pandemic. It is possible that effects may change over time.

This paper also demonstrates the utility of de-identified household transaction level data, which provides a nearly real-time window into household finances and aggregates trend. The Covid-19 pandemic has upended economics around the world and we are surely just at the beginning of understanding the full impact at both household and national levels.

We anticipate a great deal of ongoing future work examining the full impact of the epidemic on households, exploring how households rearranged spending and shifted from traditional to online retailers and food delivery services, and how they used available resources and credit to smooth consumption.

Additionally, the ability to observe household-level income will assist researchers in studying how individuals deal with sudden (un)employment shocks. For example, unemployed restaurant waiters may move to food delivery services, and retail workers who lose their jobs may work in Amazon warehouses.

Scott R. Baker is an Associate Professor of Finance at the Kellogg School of Management. R.A. Farrokhnia is an Executive Director at the Dean’s Office of “Advanced Projects and Applied Research in Fintech,” Columbia Business School. Steffen Meyer is an Assistant Professor of Finance at the University of Southern Denmark. Michaela Pagel is the Roderick H. Cushman Associate Professor of Business at Columbia Business School. Constantine Yannelis is an Assistant Professor of Finance at the University of Chicago Booth School of Business

ProMarket is dedicated to discussing how competition tends to be subverted by special interests. The posts represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty. For more information, please visit ProMarket Blog Policy.