Over the past four decades, the United States has seen rising market power, slowing productivity growth, and deepening wealth inequality. In new research, Giammario Impullitti and Pontus Rendahl explore how declining competition may be the common culprit.

This article appeared originally on VoxEU.

From the inception of economics as a discipline, questions of competition, growth, and the distribution of their benefits have been central concerns. Pioneers like Adam Smith and Karl Marx grappled with these issues, shaping our understanding of markets, wealth creation, and its distribution. These concerns remain at the forefront of modern advanced economies. In recent years, the rise of ”superstar firms” and the growing concentration of market power have become hot-button issues in economic policy debates.

From Washington to Brussels, policymakers are grappling with questions about why a handful of companies dominate entire industries; why productivity growth has slowed down; and why wealth inequality has reached levels not seen since the Gilded Age. These concerns are not just academic – they are central to the economic challenges of our time.

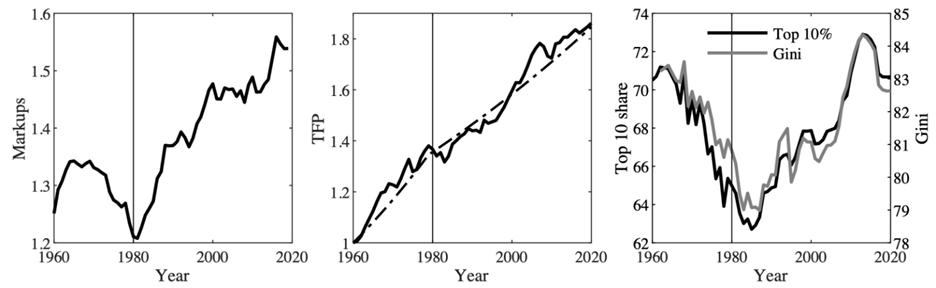

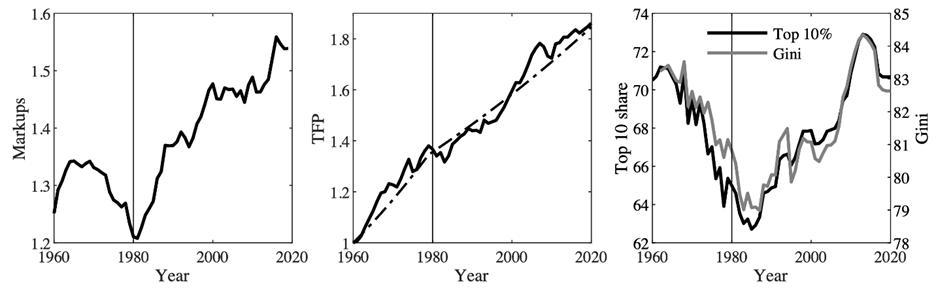

Concerns are particularly acute in the United States, where market power has surged significantly since the early 1980s. Indeed, average markups increased from 20% to 55% by 2020. Meanwhile, productivity growth has stagnated, with total factor productivity slowing from 1.56% in the 1960–1980 period to just 0.77% in subsequent decades. This rise in market power and decline in productivity growth has coincided with a sharp increase in wealth inequality, as reflected in the growing share of wealth held by the top percentiles. These trends are illustrated in Figure 1.

Figure 1 Market power, growth, and wealth inequality in the U.S.

But what exactly is the link between market power, growth, and inequality? And why should policymakers care? In our recent research, we provide a framework that ties these trends together, offering new insights into how market power shapes the economy.

Market power and the return gap (r-g)

Piketty popularized the idea that wealth inequality is driven by the difference between the rate of return on assets and the growth rate of the economy, or the return gap, r-g. A higher return gap increases inequality as wealthier households, who own more assets, benefit from higher returns and save more, further increasing their wealth. Poorer households, who rely more on wages, see their incomes stagnate due to slower growth and higher markups. This dynamic deepens the divide between the rich and the poor, leading to a more unequal society.

How does market power affect the return on assets and the growth rate? To answer this question, we build a macroeconomic model where large firms invest in innovation to gain market shares and where aggregate innovation pushes overall productivity growth. Uninsurable income risk generates wealth heterogeneity across households.

We engineer a rise in markups as a response to an exogenous increase in the cost of entry for firms.When barriers to entry rise, fewer firms compete in the market. This reduction in competition allows incumbent firms to charge higher markups, boosting their profits. Higher profits, in turn, increase the value of these firms, driving up returns and asset prices.

But reduced competition also affects innovation. Aggregate innovation (i.e. the sum of innovation from all firms) contributes to the economy’s overall stock of knowledge, which functions as a public good. Firms continuously learn from one another, fostering a cycle of innovation and progress. However, when competition declines, this knowledge-sharing process weakens. With fewer competitors, opportunities for exchanging ideas diminish, reducing the efficiency of innovation and ultimately slowing economic growth, g. This dynamic – where weaker competition stifles knowledge spillovers – creates a direct link between rising market power and declining innovation efficiency.

Finally, lower competition also conveys some bad news for labour income, both in the present and in the future. Higher markups create a wedge between the price of goods and the associated marginal costs: wages. As markups rise, real wages fall. Additionally, slower economic growth further exacerbates this outcome, dampening the prospects for future wage increases, which are closely tied to productivity growth.

The return gap and wealth inequality

Why does a rise in the return gap exacerbate wealth inequality? After all, if all agents have some wealth and are affected proportionally by a rise in the r-g differential, wealth inequality would be unaltered.Our theory demonstrates that a widening return gap exacerbates inequality by affecting the saving behaviour of households in distinct ways across the wealth spectrum.

In our economy, uninsurable income risk implies that there are two reasons for saving: intertemporal substitution, and a precautionary motive. Poorer households, driven by the need to buffer against income risk, predominantly save for precautionary reasons, whereas richer households – having attained a high level of self-insurance – primarily save for intertemporal reasons. An increase in asset returns enhances the incentives for intertemporal substitution but has little impact on the precautionary motive. As a result, wealthier households respond more strongly to rising returns, increasing their savings at a higher rate than asset-poor households and further accumulating wealth.

Welfare effect

Our research also sheds light on the welfare implications of rising market power. We find that the increase in markups and the slowdown in growth since 1980 have led to substantial welfare losses for most households. For the bottom 80% of the wealth distribution, these losses amount to roughly 34% of long-run consumption. In contrast, the top 1% of households have seen significant gains, with the top 0.1% experiencing a 30% increase in consumption.

Thus, while the rise in market power has benefited a small fraction of the population, it has come at a significant cost to the broader economy.

Conclusion

In the last four decades, advanced economies have witnessed a secular rise in both market power and inequality, as well as a slowdown in productivity growth. While these trends have happened concurrently, they may not have happened independently. Indeed, our research indicates that the rise in market power alone could have been a strong contributing factor to the rise in wealth inequality and the slowdown in productivity growth.

One takeaway from this intertwined nature of the above secular trends is that economic policies may have unintended consequences in domains where they do not directly operate, necessitating a multi-targeted approach for, for instance, competition policy. Given the role of market power in exacerbating wealth concentration, policymakers should rethink competition policy’s broader economic and social implications.Stronger enforcement and pro-competitive reforms can help restore not only innovation and productivity but also a more equitable distribution of economic gains.

As policymakers grapple with these challenges, they must consider not only the immediate effects of their decisions, but also the long-term consequences for growth and inequality. By addressing the root causes of market power and its distributional effects, it may be possible to create a more prosperous and dynamic economy that also encompasses a more even distribution of both gains and losses.

This article appeared originally on VoxEU.

Articles represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty.