In new research, Hoa Briscoe-Tran finds that some investors pulled funds from Florida-based firms in response to the state’s Stop Woke Act, suggesting that they value diversity, equity, and inclusion (DEI) initiatives.

In recent years, corporate diversity, equity, and inclusion (DEI) initiatives have become a hot topic in boardrooms and beyond. While many companies have embraced these efforts, investors have started to question whether DEI initiatives are truly valuable or merely a costly distraction from core business activities, as Elon Musk argued in several viral social media posts in 2024. This raises a critical question: Do investors collectively value corporate DEI efforts? If not, firms may have promoted DEI against their investors’ wishes. In a new study, I leverage a unique policy change in Florida to shed light on this issue.

In 2022, Florida enacted the Stop WOKE Act, a first-of-its-kind law that restricts DEI initiatives in the workplace. This unexpected policy shift created a natural experiment, allowing researchers to examine how the stock market reacted to news about a restriction on corporate DEI efforts.

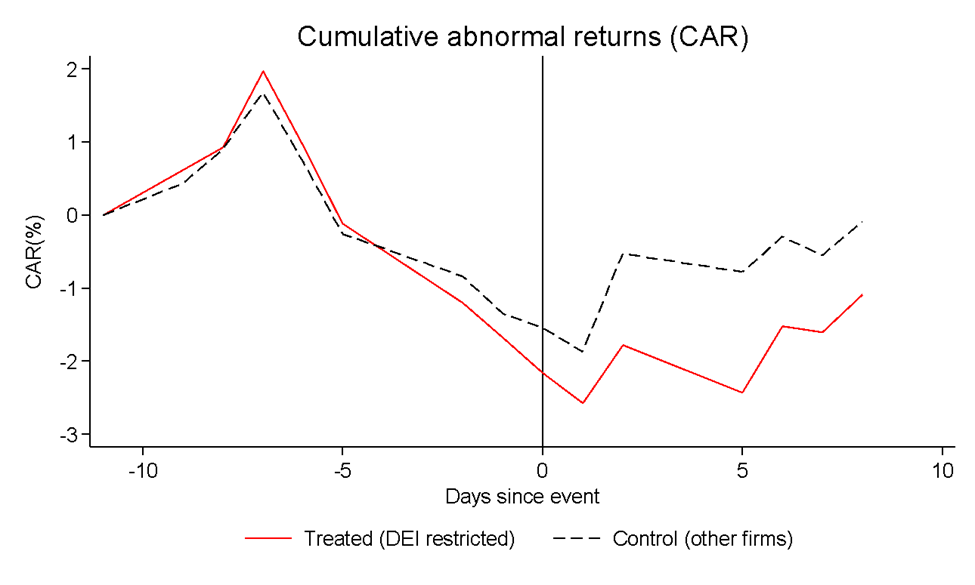

The results were striking (see Figure 1 below). When the act was announced, Florida-based companies saw their stock prices fall by 1.8 percentage points more than similar companies elsewhere in the United States. This comparison helps isolate the law’s impact from broader market trends. While the actual drop for Florida firms was even larger due to other market trends, comparing them to out-of-state peers gives us a clearer picture of the law’s specific effect. The effect was economically significant, equivalent to about $96 million for an average public company in Florida, and larger than the average market reaction to the sudden death of a firm’s CEO. Moreover, this reaction persisted for months after the initial announcement, suggesting it wasn’t a short-term blip.

Figure 1. Abnormal returns around the Stop WOKE Act.

To ensure the robustness of these findings, I conducted a battery of additional tests. They looked at different time windows around the announcement, considered alternative ways of defining which companies were affected by the act, and controlled for various firm characteristics and industry trends. The results held strongly across these different variations, bolstering confidence in the main conclusion: Investors, on average, place a positive value on corporate DEI initiatives.

But why exactly do investors care about DEI? The study explores three potential explanations. First, DEI might have intrinsic value for companies, enhancing team performance through a wider range of perspectives and ideas. Second, strong DEI practices could garner support from key stakeholders like customers, employees, and local governments. Finally, investors themselves might have pro-social preferences, favoring companies with robust DEI efforts regardless of the direct financial impact.

Interestingly, the data suggest that the third explanation – investor preferences – plays the strongest role. Companies whose investors displayed stronger pro-social tendencies, measured by examining the average ESG scores (particularly the S score) of stocks in their portfolios, experienced a more pronounced negative reaction to the Stop WOKE Act (2.4 percentage points). There was also some evidence supporting the intrinsic value of DEI, particularly in industries where diversity issues are considered financially material according to the Sustainability Accounting Standards Board (SASB). By contrast, the study found little support for the idea that DEI’s value stems primarily from pleasing other stakeholders, as the negative market reaction was not more pronounced for firms with employees, customers, and business locations in states with a stronger preference for social issues (such as Democratic states).

I was careful to rule out alternative explanations for these findings. I considered other events occurring around the same time, potential concerns about compliance costs, and the possibility that investors were reacting to the act’s impact on education rather than business practices. None of these alternative explanations held up to scrutiny.

A particularly compelling piece of evidence came in August 2022, when a federal judge temporarily halted enforcement of the Stop WOKE Act. This event provided an opportunity to test whether the market’s initial reaction reversed, and sure enough, the affected Florida companies saw a boost in their stock prices—further supporting the idea that investors value DEI initiatives.

It’s worth noting that, while the study shows a positive average effect, the impact of DEI initiatives may not be uniform across all companies. For example, bigger firms may not be affected by the Act because they are more likely to be geographically diverse, providing a natural hedge to the impact of the Act. If anything, bigger firms may take the Act as a chance to become more competitive, as smaller competitors will be more negatively impacted by the Act and may lose their competitive edge. Indeed, I found that smaller firms experienced a more pronounced negative reaction to the Act, suggesting that larger companies might be better positioned to weather such policy changes.

The study contributes valuable insights to ongoing debates about corporate social responsibility and ESG investing. It provides concrete evidence that, at least in the case of DEI, these initiatives are not merely window dressing but something that the average investor truly cares about. This has important implications for corporate leaders as they weigh the costs and benefits of DEI programs.

However, the research also reveals the complexity of investor motivations. It appears that investors value DEI both because they believe it enhances a company’s financial prospects and because they have a genuine preference for socially responsible firms.

As society continues to grapple with issues of diversity and inclusion, the study offers a rare setting to examine how the market views corporate DEI efforts. It suggests that, far from being a drag on shareholder value, well-implemented DEI initiatives might actually be a source of competitive advantage in the eyes of the average investor. For business leaders and policymakers alike, these findings provide food for thought as they navigate the complex landscape of corporate social responsibility in the 21st century.

Author note: This article is based on his recent paper, “Do investors value DEI? Evidence from the Stop WOKE Act,” available here. A similar version of this article was featured on Columbia Law School’s Blue Sky Blog.

Author Disclosure: The author reports no conflicts of interest. Read ProMarket’s disclosure policy here.

Articles represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty.