Academics have argued that changes in product markup trends show that the European markets, abetted by the adoption of the Single Market and stronger antitrust enforcement, have become more competitive over the last half-century, whereas American markets have become more concentrated. In their research, Tommaso Crescioli and Angelo Martelli argue that a study of labor market power in Europe muddles this picture of higher competition in Europe.

One of the defining features of the current American economy is the rise in market power of large corporations. In a seminal contribution, Jan De Loecker, Jan Eeckhout, and Gabriel Unger estimate that markups—the difference in a product’s retail price and the (marginal) cost of production, and a common measure of (product) market power—have tripled since the 1980s. What is more, some scholars find this increase in markups (and hence market power) to be driven by large firms.

Recent contributions to the literature claim a mix of globalization and technological progress may be the source of this increase in market power. American firms are continuously exposed to a fiercely competitive world economy, and consequently, only a handful of highly productive firms can survive the global competition game. In this view, therefore, the market power belonging to what the literature labels as “superstar firms” is something earned through fair market competition.

In his famous book, The Great Reversal, Thomas Philippon provides a different explanation for worsening competition in the U.S. American firms are not more productive than they were in the past.What changed instead is the increasing capture of U.S. competition authorities by business interests and the concomitant reduction in merger review and antitrust enforcement.

According to Philippon, the opposite is true across the Atlantic. The European Commission has gained fame for resisting business influence and putting competition at the forefront in parallel with efforts by the European Union to open up markets, most notably by the creation of the Single Market. The findings of The Great Reversal were unexpected for many, since the U.S. was for a long time considered the archetype of a competitive economy to which Europe should aspire. However, despite its success and robust arguments, The Great Reversal left important questions unanswered.

The first concerns the relationship between market power and openness to trade and international competition. Some of the previously cited studies argue that economic openness has favored the emergence of superstar firms in the U.S. In this respect, there have been a series of events, particularly the launch of the Single Market in 1993 and the Euro in 1999, that have fostered trade and economic integration in Europe. However, did the introduction of the common currency really lead to a reduction in market power? Second, Philippon’s Great Reversal focuses on product market competition, but what about competition in the labor market? How does the labor market factor into this discussion of market power?

This second question is highly relevant because, following the seminal contributions of Joan Robinson, firms can also derive power from the labor market. Robinson theorizes monopsony as the flip side of monopoly, where only one buyer exists. Labor market power, in this case, originates from the limited competition between employers that allows firms to pay workers (buy their labor) for less than their productivity. Thus, market power can be decomposed into product and labor market power. In particular, firms can still have market power in a highly open (competitive) economic environment, where they face limited price-setting capacity, in the presence of labor market imperfections. More than in the U.S., Europe has a vast array of labor market institutions and actors (e.g., employment protection legislation, minimum wages, unions) that significantly impact the relationship between wages and productivity, thereby affecting firms’ monopsony power. How have these institutions impacted the labor market and thus the total market power of firms?

In our paper, we try to answer this question by investigating how 1) economic openness created by the Single Market and adoption of the Euro impacted European competition and firms’ market power, and 2) how Europe’s unique labor market institutions influence the distribution of market power. We find that EU markets have seen their own rise of superstar firms as markets opened, but that this rise in market power paradoxically did not accompany a rise in product markups; rather it saw a decrease. Consideration of labor market power alongside product market power explains this paradox and reveals a different story about EU competition than previous scholarship suggests.

First, to determine how openness has impacted market power, we exploited the increasing economic integration created by the launch of the Euro in 1999 and investigated the evolution of market power in Europe by comparing Eurozone firms with non-Eurozone firms.

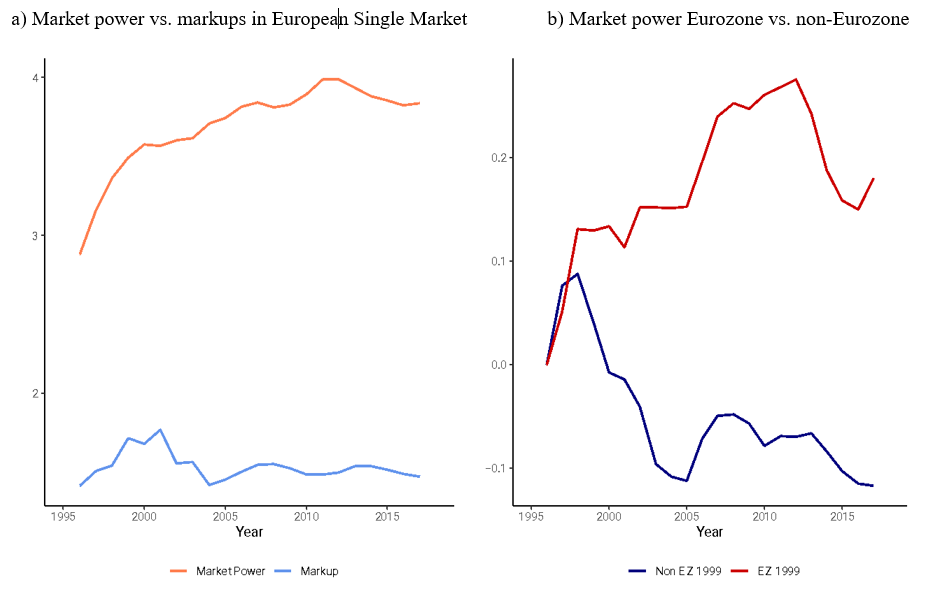

Figure 1 highlights the importance of the Euro on market power. When considering the entire European Single Market, product markups, following an initial increase, decreased after 2000 and remained stable thereafter at about 1.50 per year (Figure 1a). However, when we consider the market power indicator, which also accounts for labor market competition, we can see an overall increase in market power throughout the period. This trend suggests that while product market competition has increased after 2000, leading to lower markups, different mechanisms may be at work in the labor market.

Economy-wide aggregation, however, may mask some institutional effects. When focusing on European countries that adopted the Euro in 1999 (EZ 1999), we see that market power has increased sharply relative to countries that were EU members in 1999 but never adopted the Euro (non EZ 1999 in Figure 1b). This indicates that adoption of the Euro has been a significant factor in growing market power.

Figure 1

Figure 1. Market power and markups trends, three-year moving averages. The left panel shows the change in levels of the index, while the right one shows the absolute changes from 1996.

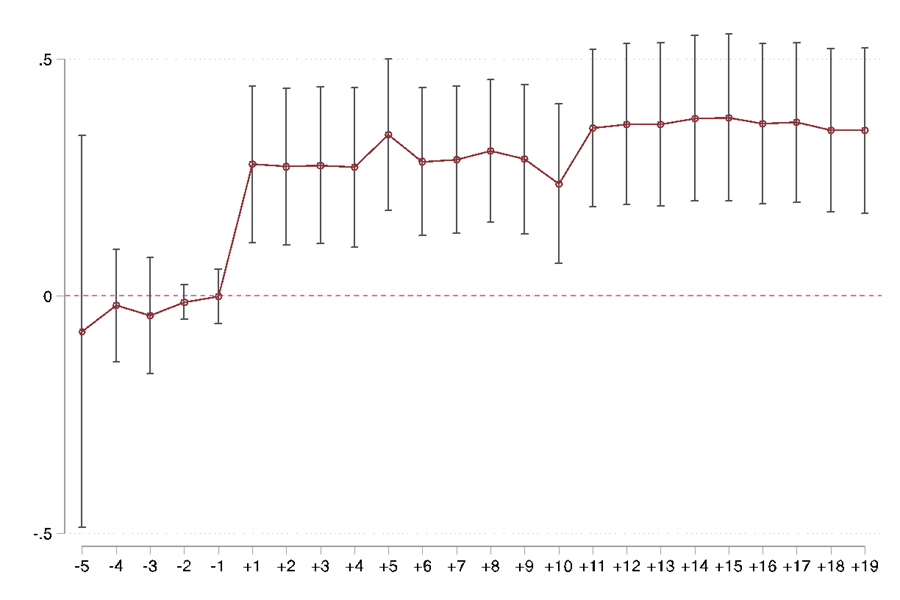

The following graph zooms in on the effect of the Euro on market power in the years following its adoption. On average, we estimate that the adoption of the Euro has facilitated an increase in firm-level market power by 23-30%.

Figure 2

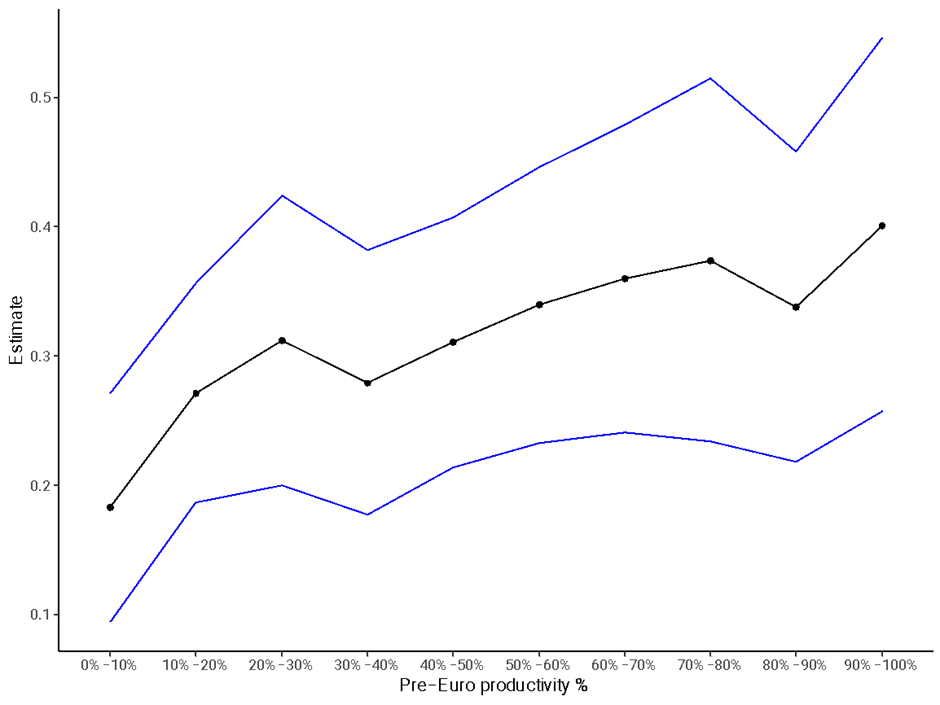

Our intuition is that increasing integration created by the Euro contributed to a highly competitive environment in which we observe a reallocation of economic activity towards the most productive firms. To corroborate this intuition, we see how the effect of the Euro varies in tradable sectors—those more exposed to international economic forces—and for productive firms (following the standard definition of total factor productivity). In this respect, the Euro effect on market power is between 8-9% larger for tradable industries and 10-17% larger for firms in the top 1% bracket of most productive firms in the Eurozone before the adoption of the Euro.

Figure 3

Counterintuitively, while firm market power has increased since the adoption of the Euro in 1999, product market power has decreased between 15-27%, in line with other studies finding increasing product market competition in Europe. Higher firm market power should correspond with an increase in market power. Here is where it becomes important to focus on labor markets to explain these different trends. We find that higher labor market power explains how many large firms have acquired a dominant position without raising product market power.

Our measure of labor market power consists of the estimated ratio between wage and the marginal productivity of labor. In a perfectly competitive labor market, this ratio is equal to one, and the lower this ratio is, the larger the employer’s power. In other words, when this index is low, employers face lower labor costs relatively to the productivity of their workers, increasing the competitiveness and the price these firms can potentially charge.

To understand the evolution of monopsony power, one must understand how cooperative institutions work in several European countries, most notably Germany. These institutions, such as coordinated wage bargaining, can favor the emergence of pacts between labor and business interests. Unions may accept wage restraints in exchange for future work-related benefits, such as better pension schemes, healthcare, and training. Wage restraint, in turn, favors the competitiveness of firms by keeping wages low with respect to worker’s productivity, allowing them to gain larger shares in the EU Single Market (the same dynamic also explains the amplification of levels of competitiveness and market power in the Eurozone). Therefore, for firms in countries with more robust cooperative institutions, unions, by accepting wages which are lower than labor productivity, decrease the ratio between wages and marginal labor productivity and thus increase firms’ monopsony power.

Put together, our results depict a European version of the superstar firm story, where firms’ consolidation of market power also depends on the capacity to design new strategies that integrate the evolving supranational and domestic institutional environment. Our evidence, therefore, gives an institutional flavor to the global rise in market power by focusing on the role of unions and labor market institutions. Two important policy implications arise. First, when investigating competition law infringements and looking at sources of market power, competition authorities should broaden the scope of their analyses to account not only for product market competition but also for labor market imperfections. Lastly, the system of industrial relations can play a key role in determining the success of further economic integration.

Articles represent the opinions of their writers, not necessarily those of ProMarket, the University of Chicago, the Booth School of Business, or its faculty.