Similar to noncompete clauses in employment contracts, training repayment agreements, which require employees to pay back their employers for firm-sponsored training if they quit early, can impede worker mobility and reduce competition in labor markets. The authors document the pervasiveness of these provisions and suggest directions for future research.

Regulatory scrutiny of the fine print of employment contracts has reached a fever pitch. A forthright illustration of these efforts is the many state and federal proposals to ban noncompete clauses, which are contractual provisions that temporarily prohibit departing employees from joining or starting competing enterprises, often for one or two years. Employers point to noncompete clauses as a way to protect trade secrets and encourage business investment in specialized employee training. Advocates for proposals to ban noncompetes often respond that noncompetes are unnecessary to encourage and protect employer investments because alternative, more tailored solutions exist. Unfortunately, some of these alternatives may be even more restrictive than noncompetes. Chief among these potentially problematic alternatives are training repayment agreements—which are themselves now subject to calls for regulation.

A training repayment agreement (which sometimes goes by the descriptive acronym TRAP for training repayment agreement provision) stipulates that a firm will pay for a worker’s training expenses in return for a worker agreeing to a repayment schedule if the worker leaves the firm before a designated time. For example, a trucking firm might agree to provide or pay for outside training for a commercial driver’s license at a cost of $9,000. In return, drivers might agree to repay the full $9,000 if they quit within a year of receiving the training, $6,000 if they quit before two years, and $3,000 if they quit before three years. Other common arrangements include firms paying for a specialized degree, such as an MBA, or simply on-the-job training that that comes with onboarding at a new firm.

Some commentators suggest that a training repayment agreement is a more tailored and fairer substitute for a noncompete clause. This is because a noncompete clause still applies after the firm recoups its investment in worker training, while a training repayment agreement only applies if the worker leaves before the investment has been paid back. Despite this common-sense intuition, recent research highlights the potential downsides of training repayment agreements. Firms have strong incentives to artificially inflate their training costs, and can easily do so when the firm itself does the training. Moreover, workers may be unaware of the terms of their repayment agreements. As a result, these contracts may effectively require unwitting workers to pay a substantial “exit fee” to leave their job, even if they do not join or start a competing business. In this important sense, training repayment agreements can be substantially broader than industry-specific restrictions like noncompetes or nonsolicitation agreements (in which a departing employee agrees not to solicit the company’s clients in their new role). Thus, by increasing exit costs, training repayment agreements—like noncompetes—may ultimately curtail labor market competition for workers, reducing their ability to take a new job that improves their livelihood and future prospects, regardless of whether the new job leverages any training they received.

New regulatory approaches attempt to address some of these challenges. For example, the Uniform Restrictive Employment Agreement Act, promulgated in 2021 by the Uniform Law Commission, a non-profit association that drafts model acts for state adoption to promote statute consistency, would prohibit training repayment agreements for general rather than specialized training and if the repayment period lasts more than two years. Other calls include allowing the Federal Trade Commission to ban training repayment agreements as “unfair methods of competition,” pushing the Department of Labor to categorize training repayment agreements as unlawful kickbacks under the Fair Labor Standards Act, and encouraging individual states to restrict or ban training repayment agreements as they have for noncompetes.

Aside from a handful of studies, it is anyone’s guess how common training repayment agreements are in the U.S. labor force. Indeed, just as in 2014 when we lacked any sense of the general prevalence of noncompete clauses, today we are similarly ignorant about the prevalence of training repayment agreements in the U.S. economy.

Our goal here is to provide some foundational evidence on the frequency of training repayment agreements in the U.S. labor force. We look at their prevalence by industry and occupation as well as by the age, education, and income of workers. Our data come from two surveys of workers. One is the Noncompete Survey Project (NSP), a nationally representative internet survey from 2014 covering approximately 11,500 workers. The other is the Cornell National Social Survey (CNSS), a random digit dial survey in 2020 covering 254 workers.

The 2020 CNSS asks workers, “Did you agree to repay any training expenses your employer spent on your behalf if you quit work before a specified length of time, sometimes called a training repayment agreement?” The survey allows workers to answer based on whether they definitely or probably agreed or did not agree, or whether they didn’t know (or did not want to respond). The CNSS data also include information on education and age but are otherwise fairly limited. By comparison, the 2014 NSP asks, “Did you sign any of the following agreements in your current position with your current employer?,” and one of the options is “Training repayment plan (i.e., must pay back training if you leave early).” The NSP data contain many other measures of worker conditions and outcomes, which have been studied here and here. To estimate the incidence of worker repayment agreements, we use sample weights to extrapolate to a national estimate in our analysis of both datasets.

Overall, in the CNSS data, we find that 6.7% of respondents report having definitely agreed to a training repayment agreement, while 0.9% report probably agreeing to one, for a total of 7.6% workers who report having probably or definitely agreed to a training repayment agreement. This number jumps to 8.7% if we exclude those who refused to answer and those who report not knowing if they have a training repayment agreement. In the 2014 NSP data, only 4.1% of workers report having agreed to a training repayment agreement. The rise between 2014 and 2020 may reflect a growing use of these agreements, though we caution that such a pattern may simply be due to noise, given the small sample in 2020, or to differences in how the survey questions are worded.

Importantly, the point estimates we provide are overall averages, potentially obscuring significant variation in the use of training repayment agreements. For example, firms might use training repayments more often for young or less-educated workers, who presumably receive the lion’s share of training investments. In what follows, we explore heterogeneity along these dimensions using both the CNSS and NSP data.

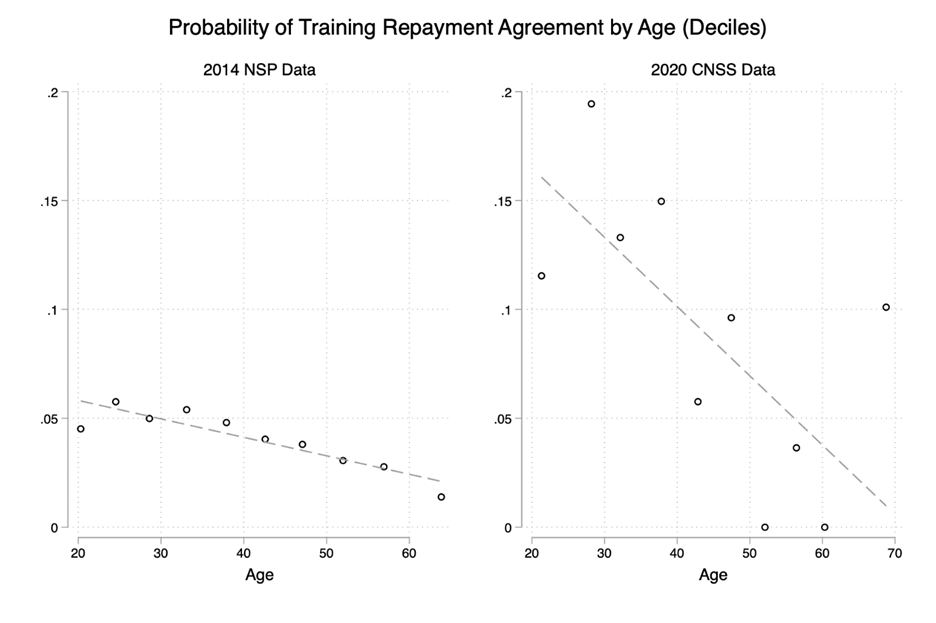

Figure 1 shows that training repayment agreements are more common for younger relative to older workers, though the two datasets give fairly different baseline estimates for the young. In the 2014 NSP data, 25-40 year-olds sign training repayment agreements at a rate of 5-6%. In the 2020 CNSS, training repayment agreements are seemingly more common among workers in this age range, covering 15-20% of workers between the ages of 25 and 40. For workers between 41 and 65 years, the rates are 3.6% and 4.3% in the 2014 and 2020 datasets, respectively.

Figure 1. Training Repayment Agreements by Age Deciles

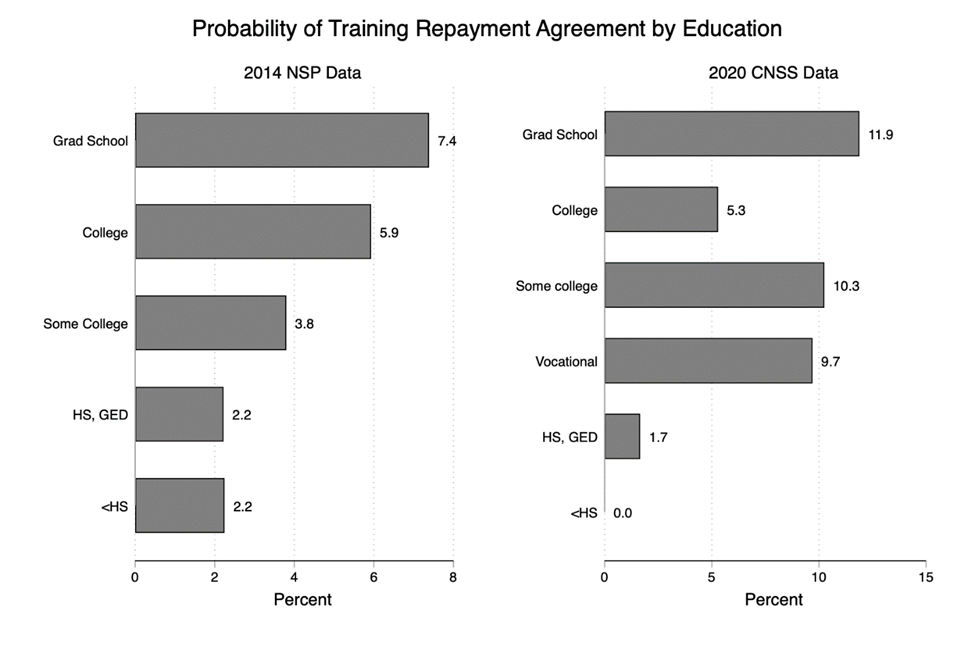

Figure 2 presents a similar analysis by worker educational achievement. A similar pattern emerges across datasets for workers with different levels of education: more educated workers appear more likely to enter training repayment agreements. For example, in both datasets, those with a graduate degree are the most likely to have a training repayment agreement (7.4% in 2014 and 11.9% in 2020). In contrast, those with at most a high school degree are the least likely to have one (0-2% in both 2014 and 2020). Notably, in the CNSS data, workers with just some college or a vocational degree are also somewhat likely to have training repayment agreements (approximately 10%). However, we caution against reading too much into this last result because it is based on a small sample of observations.

Figure 2. Training Repayment Agreements by Education

Unfortunately, these two datasets do not overlap in the other worker or firm characteristics they capture. Nevertheless, because the NSP data include worker information likely to be relevant to the use of training repayment agreements, we can ask a few other questions, including how common training repayment agreements are for workers with different income levels and in which types of jobs do they appear most frequently.

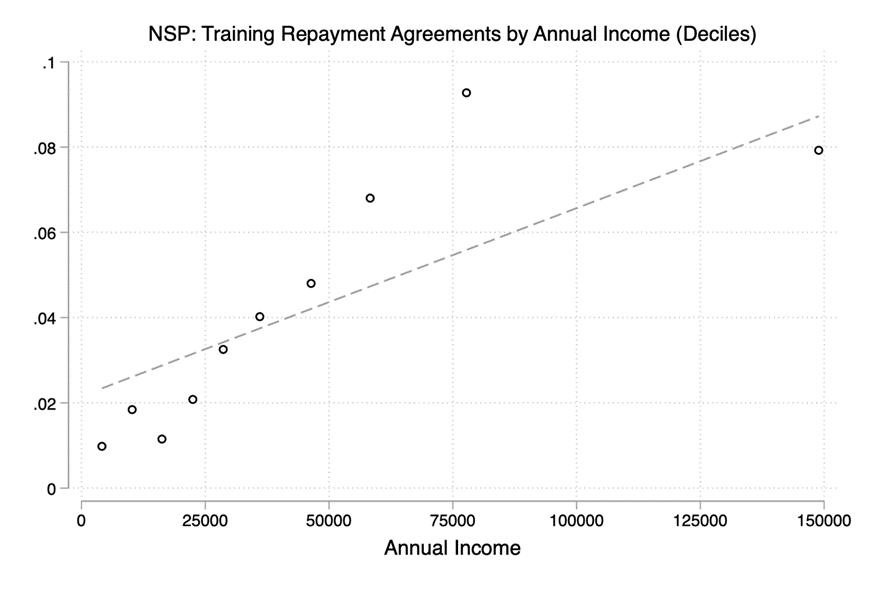

Consistent with the analysis of educational achievement levels, Figure 3 finds that training repayment agreements are more common for workers with higher annual incomes, reaching approximately 8-10% for those in the top two earnings deciles in 2014.

Figure 3. Training Repayment Agreements by Annual Income

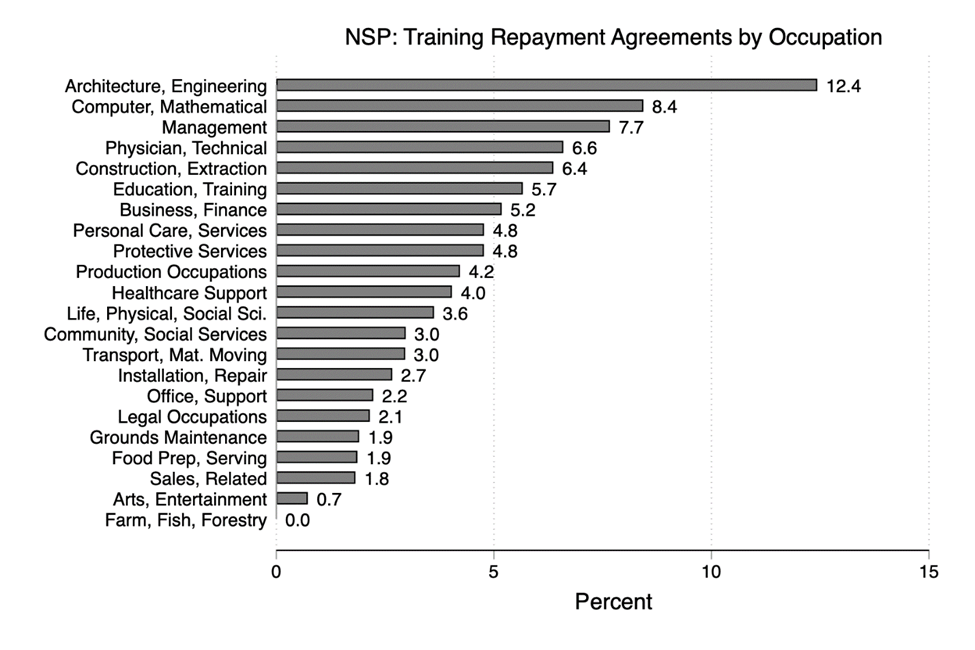

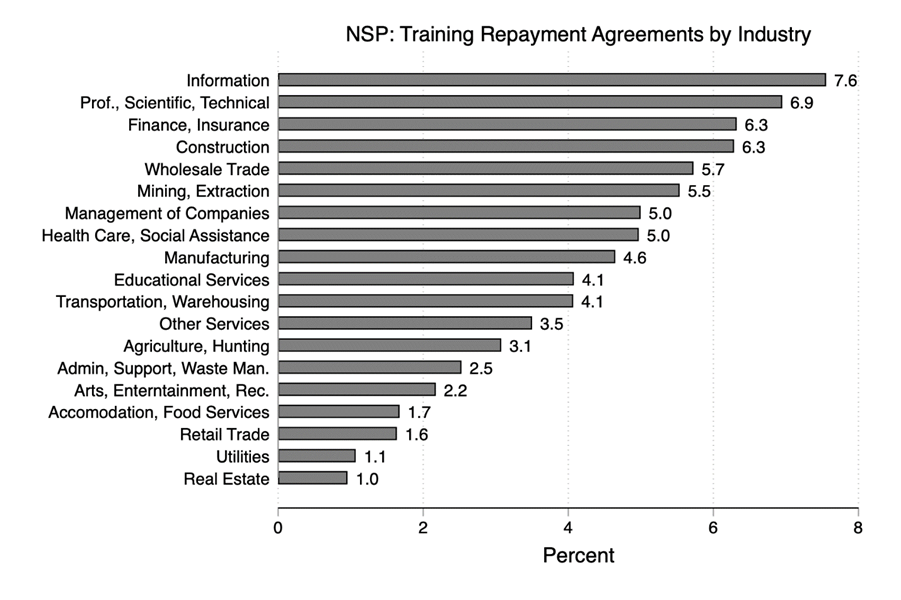

Figures 4 and 5 show the distribution of training repayments in 2014 based on occupation and industry. Training repayment agreements are most frequently found in engineering and architecture occupations (12%), managerial positions (7.7%), and computer and mathematical jobs (8.4%). They are least common in farm, fishing, and forestry jobs (0%), arts and entertainment (0.7%), and sales positions (1.8%). For industries, training repayment agreements are more common in technical industries like information (7.6%) and professional and technical services (6.9%) and least common in real estate (1%) and utilities (1.1%).

Figure 4. Training Repayment Agreements by Occupation

Figure 5. Training Repayment Agreements by Industry

These statistics form a baseline assessment of how common training repayments are in the U.S. labor force. They appear to be somewhat less common than noncompete agreements, nonsolicitation agreements, and nondisclosure agreements but not at all rare, especially for some groups. While they are more common for younger workers, they seem to cover more-educated workers relative to less-educated workers. However, if the increases between the estimates from the 2014 NSP data and the 2020 CNSS data indicate a real trend, then as policymakers continue to crack down on noncompetes, we may see a further rise in the use of training repayment agreements. The findings documented here help us understand where to look to see where these agreements—as well the policies that regulate them or their substitutes—might have the biggest impact.

The estimates from these data sets begin to show which kinds of workers are bound by training repayment agreements, but these numbers are just a start. Many interesting research questions call for further investigation. What are the typical contents and repayment schedules of training repayment agreements? How do they vary by type of training (e.g., paying for an MBA versus tacit on-the-job training)? What causes firms to deploy training repayment agreements? How does a training repayment agreement affect the firm and its workers? What happens in markets where training repayment agreements are the norm? What are the effects of various regulatory approaches to training repayment agreements? As policymakers continue to regulate the fine print of employment contracts, answers to these questions will become ever more important. We hope the patterns emerging from these data—the best data we have at the moment—are a useful first step.

Articles represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty.