In new research, Matthias Breuer, Anthony Le, and Felix Vetter find that when companies are required by the government to seek a third-party financial audit, they turn to lower quality auditors. As a result, the accounting industry grows, but touted benefits for markets and corporate stakeholders appear elusive.

Regulatory requirements for companies to obtain audits from private, third-party auditors are ubiquitous. Such requirements aim to ensure that companies comply with standards and regulations (e.g., financial accounting or food safety standards). They are a cornerstone of financial and environmental regulations and are commonplace in consumer markets. However, the effectiveness of audit mandates has repeatedly been called into question.

High-profile audit failures, such as the Enron and Wirecard scandals, raise concerns about the independence of auditors hired by auditees. For example, Arthur Andersen, Enron’s auditor at the time of their collapse, came under sharp scrutiny in 2002 for potential conflicts of interest due to the simultaneous provision of consulting and auditing services. In addition to concerns about the integrity of many audits, researchers have struggled to document any clear benefit of audit mandates for auditees or the markets they operate in. Accordingly, it remains uncertain whether the mandates work and whom they benefit.

Audit markets include companies purchasing audits (i.e., customers), audit firms offering audits (i.e., producers), and auditors auditing companies on behalf of audit firms (i.e., employees). In a recent paper, we conduct a comprehensive examination of how these markets are shaped by audit mandates applying to financial statements of companies in the European Union (EU) and identify a potential reason for why the mandates sometimes produce disappointing results: they increase demand for low quality audits. The audit firms and accounting profession at large are the main beneficiaries of the government mandated demand for audits, while benefits accruing to other stakeholders are limited.

Audit Mandates, Companies’ Audit Choice, and Audit Firm Size

In the EU, the Accounting Directives have required audits for the financial accounts of limited-liability companies since the 1980s. This requirement, applying to both private and publicly listed companies, is more expansive than the mandates in the United States. Compared to the U.S., with its sizable public-capital market and shareholder orientation, the emphasis of Europe’s accounting regulation lies more on the protection of a broader set of stakeholders (e.g., customers, suppliers, and employees), including shareholders.

The Accounting Directives allow EU member states to exempt private companies from audit mandates if they fall below two out of three thresholds relating to companies’ total assets, sales, and employees from the audit mandates. The EU member states determine the specifications of these thresholds and have implemented different exemption thresholds over time. We use the differences in the share of (industrial) companies subject to audit mandates to study the impact of audit mandates on the market for audits.

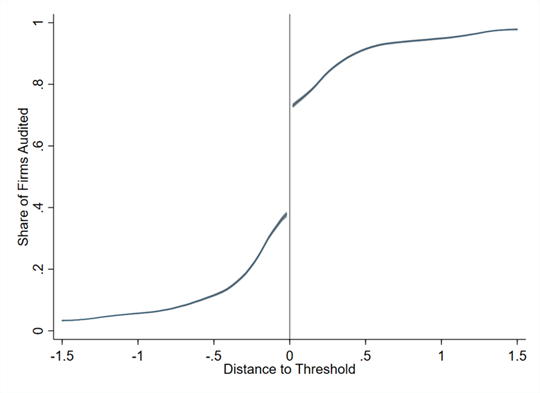

First, we find that the likelihood of obtaining an audit increases with a company’s size independent of any government mandate, reflecting the fact that larger companies face greater financial complexities and more diverse stakeholders and thus have a greater private demand to obtain a financial statement audit. Nevertheless, within a sample of German companies, we find that audit mandates lead to a 63 percentage point increase in the likelihood that a company above the exemption thresholds obtains an audit. Figure 1 illustrates the jump in the demand for audits for companies around the exemption thresholds. The figure shows a stark discontinuity in audit demand for companies just above the threshold relative to those just below.

Figure 1: Distance to Regulatory Threshold and Likelihood of Obtaining an Audit

Second, we find that audit mandates benefit the auditors by creating new demand, particularly from smaller companies just above the exemption threshold. In the sample of EU audit firms, we find that 10 percentage point increase in the share of companies subjected to an audit increases the size of a given audit firm’s portfolio by 2.5%, reduces its average client size by 5.8%, increases its total assets by 3.7%, increases its total number of employees by 3%, and increases its total employee costs by 2.3%.

Third, using detailed German administrative data that allow us to separate workers by industry and occupation, we find that the number of auditors in the market also grows. The impact of the audit mandates on the average wage within the audit occupation, however, is negative. That is, while the total compensation paid to all employees increases due to the growth in the number of auditors, the average wage paid to auditors decreases. At first sight, this result appears puzzling as it seems to suggest that more auditors can be attracted with lower wages. The puzzle can be solved by considering a critical feature of the audit market: product differentiation.

Differentiation in the audit market can occur because government mandates leave it to the companies to choose their auditor, so that companies are able to choose audits of different “qualities.” For example, prior research and conventional wisdom suggest that the “Big 4” (i.e., Deloitte, Ernst & Young, PWC, and KPMG) offer higher-quality audit services at a steeper price than smaller audit firms. Companies that would not get an audit absent a government mandate are, thus, able to obtain cheap and lower-quality audits to comply with the mandate. Thus, audit mandates can create extra demand for low-quality audits.

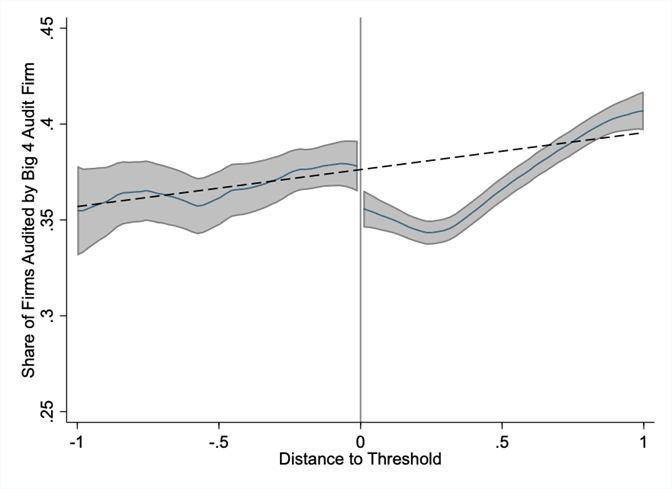

We explore this interpretation through multiple avenues. First, we examine the type of audit firm chosen by companies around the exemption thresholds. In Figure 2, we find that, among the companies that obtain audits, those just above the exemption thresholds are much less likely to purchase an audit from a Big 4 firm (i.e., an indicator of a high-quality audit) relative to those just below.

Figure 2: Distance to Regulatory Threshold and the Proportion of Companies Audited by Big 4

Second, we examine how the typical audit firm in the audit market changes in response to audit mandates. We observe that audit mandates, if anything, decrease the average size of audit firms within a given country. Notably, these results contrast to the earlier finding that mandates significantly increase a given audit firm’s size. As with the auditors’ wages, this discrepancy hints at a compositional shift. While a given audit firm may grow due to the mandates, the average size of audit firms in the country decreases due to the entry of many smaller audit firms serving the low-quality demand.

Along these lines, we find that audit mandates lead to substantial entry of new audit firms and reduced audit-market concentration. In the sample of EU audit firms, we find that a 10 percentage point increase in the share of companies subjected to an audit within a country increases the number of audit firms by 7% and reduces the audit firm Herfindahl-Hirschman Index (HHI), a measure of market concentration, by 9%. Notably, smaller audit firms appear to employ auditors with lower earnings potential. These findings are consistent with smaller, newly entering audit firms producing lower quality audits compared to large, established audit firms which have significant technological infrastructure and employ highly qualified employees.

Our results cast doubt on the effectiveness of audit mandates for ensuring compliance with regulations and standards (e.g., financial accounting or environmental standards). They highlight that, in differentiated audit markets, where firms can choose their preferred compliance mechanism, we should not necessarily expect mandatory audits to lead to substantive compliance with the audit mandate. The lack of substantive compliance means that, ultimately, meaningful market-wide improvements are unlikely to materialize. In this vein, we do not find significant benefits of audit mandates accruing to companies and their stakeholders (e.g., productivity, tax collection, or well-being), in line with the disappointing results documented in much of the prior literature. Our study’s evidence that audit mandates primarily expand the lower quality segment of the audit market provides a potential explanation for the disappointing results. This lesson is particularly important and timely given recent efforts to mandate the verification of ESG information (e.g., in the European Union) in an attempt to combat greenwashing.

Our results show one player that appears to benefit from audit mandates: the audit industry. By forcing firms to buy audits irrespective of their value, audit mandates appear to increase the size of the audit market and profession. This expansion of the audit market, however, is primarily driven by more low-quality audits provided by low-quality audit firms and auditors. The increased size of the profession may come with greater economic importance and political influence in the short run. In the long run, however, the shift toward low-quality audits may erode the public’s trust in and standing of the profession.

Articles represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty.