Using a household survey with information treatments conducted in the aftermath of the SVB’s collapse, we examine the potential for a large bank’s failure to trigger bank runs and the effectiveness of public communication in containing such a risk. We find that news about SVB’s collapse increases households’ propensity to withdraw bank deposits as people become more worried that their bank may fail and expect larger losses on deposits in case of bank failure. Communication by the Federal Reserve in support of the banking sector and information about FDIC deposit insurance can contain the risk of bank runs, while communication from politicians influences only their electoral base.

This article was originally published in VoxEU.

On March 9, 2023, Silicon Valley Bank (SVB) suffered a major bank run with deposits outflows of over $40 billion, causing the bank to become insolvent. This event cast doubts on the stability of the U.S. banking sector and raised concerns that panic could spread among depositors, triggering other bank runs. To alleviate these concerns, on the morning of Monday, March 13, President Biden addressed the nation to reassure depositors about the solidity of U.S. banks. A few days later, Federal Reserve Chair Jerome Powell opened the Federal Open Market Committee (FOMC) press conference by also expressing confidence in the U.S. banking sector.

To what extent does the collapse of a large bank, such as SVB, increase the risk of panic-driven runs? And can public communication by politicians or central banks lean against such a risk? To address these questions as well as to gain a more general understanding of how U.S. households perceive bank and deposit risks, in a recent paper we examine the results of a survey conducted in the aftermath of the SVB collapse.

Survey Structure

The survey was conducted by YouGov on a sample of about 6,000 U.S. households and was launched at the end of April 2023, gathering a wide range of information on people’s perceptions about bank and deposit risk. To identify the causal effects of news about SVB and policy communication on people’s propensity to withdraw their bank deposits, the survey used randomized controlled trial (RCT) techniques based on information treatments. Similar approaches have been successfully used in a recent but rapidly growing literature, to examine, for example, the factors influencing households’ or firms’ inflation expectations (e.g. Gorodnichenko, Ropele, and Coibion, 2020; Schoenle, Gorodnichenko, Knotek, and Coibion, 2023; Grigoli and Sandri, 2023) or households’ consumption decisions (Gorodnichenko, Weber, and Coibion, 2022). Our study is the first to use these survey techniques to shed light on people’s perceptions and reactions to deposit risk.

Specifically, survey participants were divided into four treatment groups and one control group. The four treatment groups were provided with information about the SVB collapse, statements by either President Biden or Chair Powell expressing confidence in the U.S. banking sector, and information about the Federal Deposit Insurance Corporation (FDIC) to also assess its role in reassuring depositors. The survey collected information about respondents’ “propensity to run”—that is, to withdraw deposits because of concerns that their bank may fail—before and after the treatments. The analysis examines whether the information treatments generate revisions in the propensity to run compared to the control group that is provided with no information.

News About SVB Increases the Risk of Bank Runs but Public Communication Can Help

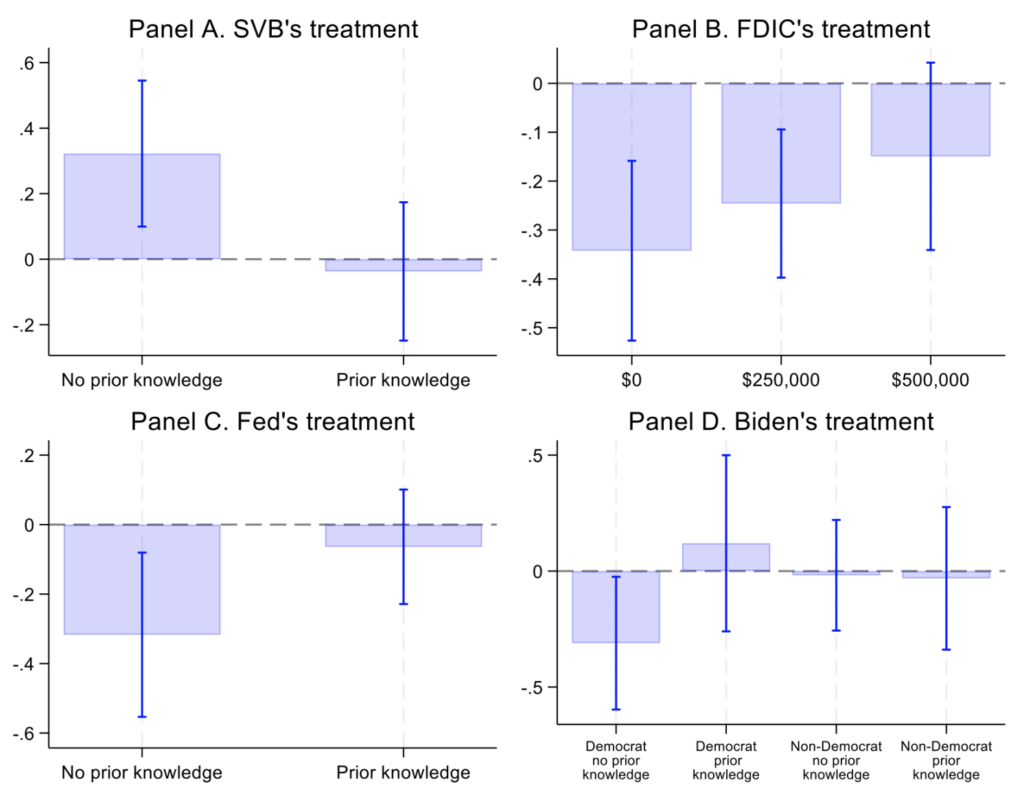

Figure 1 illustrates the key results of the analysis. Panel A shows that the information treatment about SVB’s collapse increases the propensity to run of survey participants that did not already know about SVB. As expected, the SVB information treatment has no effect on people that had prior knowledge about the bank. To provide a quantitative interpretation of these findings, the survey also included questions to assess how households would reallocate their portfolio in the face of bank risk. By leveraging these answers, we find that the SVB information treatment triggers a reduction in bank deposits by about 2.5 percent. Considering that according to our survey data only about one-third of U.S. households heard about SVB, our results predict deposit outflows from the U.S. banking sector of about 0.8 percent following the SVB collapse. This estimate is remarkably close to actual deposit drawdowns in the days following SVB’s demise, which amounted to 0.7 percent between March 8 and 15, 2023.

Figure 1: Information treatment effects on households’ propensity to run

Notes: The figure shows the impact of each information treatment on households’ propensity to withdraw their deposits because of concerns that their bank may fail. The bars show the point estimates while the whiskers show the 90 percent confidence intervals. The labels “prior knowledge” in panels A, C and D denote people that have prior knowledge about the information presented in each treatment. In Panel B, the dollar amounts on the x-axis denote people’s priors about the FDIC insurance limit on individually held accounts.

Panel C shows that communication by the Fed information treatment reduces households’ propensity to run among people that had no prior knowledge about the Fed’s pronouncement. Interestingly, the quantitative impact of the Fed treatment offsets the impact of news about SVB. Panel B shows that information about FDIC insurance can also reduce households’ propensity to run, especially among people who think that deposit insurance thresholds are very low or nil. Hence, communication by the Fed and information about deposit insurance emerge as potentially powerful tools to reassure depositors and prevent panic-driven bank runs.

In contrast, the information treatment based on President Biden’s statement is found to have a more limited reach. This treatment reduces the propensity to run only among Democrats, the electoral base of the President. This underscores the limits of political communication—even by the top government officials—in the current environment of strong political polarization.

Challenges for Policy Communication

The analysis provides encouraging insights about the effectiveness of policy communication in preventing bank runs. Yet key challenges remain. First, for policy communication to be effective, it must reach people—not an easy task in the current era when people are bombarded by information of all types across multiple media platforms. Indeed, our survey reveals that only about one in five people had heard about the Fed’s assurances regarding the banking sector or knew about the correct FDIC insurance threshold on deposits. Second, by differentiating people along socio-economic characteristics, we find evidence that policy communication tends to reassure people that are not necessarily those more responsive to news about SVB. Hence, a large bank failure can still spark bank runs among segments of the population who appear insensitive to public communication. Further research is needed to better examine this type of heterogeneity. Third, our results show the limits of political communication, which seems to resonate only within party lines. This underscores the need for the political system to provide more consistent bipartisan messages if it wants to influence the public at times of crisis.

Authors’ note: The views expressed herein are those of the authors and should not be attributed to the BIS.

Articles represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty.