Politicians and governments in the United States and elsewhere have recently proposed or implemented wealth taxes to supplement revenue and reduce wealth inequality. In a new study, Samira Marti, Isabel Z. Martínez, and Florian Scheuer show how decreases in wealth taxes led to increases in wealth inequality in Switzerland, though they find that these decreases alone are not enough to explain the magnitude of widening disparities.

Rather than earning regular income, many super-rich, notably founders of successful businesses, such as Elon Musk, Warren Buffet, or Jeff Bezos, earn their income from capital gains, that is, the profit from selling an asset for more than one paid for it. Unrealized capital gains (those assets that have gained value on paper but have not yet been sold) are not taxable in most countries, and even when realized, capital gains are typically taxed at much lower rates than ordinary income. As capital gains are concentrated among the wealthiest, overall tax progressivity has corroded to the degree that the average tax rate millionaires and billionaires pay can be lower than that of individuals in lower income brackets. While the average American pays 13% in federal income taxes, according to a White House analysis, the wealthiest 400 families in the United States only paid on average 8.2% in federal income tax between 2010 and 2018.

In response, several candidates during the 2020 U.S. presidential election proposed a federal wealth tax. Most prominently, Massachusetts Democratic Senator Elizabeth Warren called for a 2% yearly “ultra-millionaire tax” on Americans with a net worth over $50 million, and 6% on those with wealth exceeding one billion. Vermont independent Senator Bernie Sanders’ plan was even more progressive, with a tiered approach starting at 1% for fortunes above $32 million and rising up to 8% on net wealth over $10 billion. While neither candidate won the election, wealth tax proposals have continued to gain traction in the U.S. and other countries. Some 64% of Americans support a wealth tax on the super-rich, including 77% of Democrats and 53% of Republicans, according to a 2020 Reuters/Ipsos poll. In line with the idea of making billionaires pay “their fair share,” President Joe Biden has proposed tax increases on the rich, in particular on capital gains, in his budget for fiscal year 2024. Other countries have recently introduced wealth taxes, such as Colombia in 2019, or raised existing wealth taxes on the rich, like Argentina in 2021.

Proponents of a wealth tax argue that a more progressive tax system would not only be fairer but also help mitigate rising wealth inequality. In 2019, the top 1% wealthiest individuals in the U.S. owned 35% of total wealth, up from 22% in 1978, according to the World Inequality Database. The richest 5% were the only group to have gained wealth since the 2007-8 Great Recession. Although the data reveals vast wealth inequality and regressive tax schemes, there has been little systematic evidence showing how (progressive) wealth taxes actually affect wealth concentration.

In a new study, we address this question by exploiting the decentralized structure of the Swiss wealth tax, where each of Switzerland’s 26 cantons (states) sets its own rates, as a laboratory setting. While 12 European countries levied an annual tax on net wealth in the 1990s, only three—Norway, Spain, and Switzerland—still levy such a tax. With wealth tax revenue amounting to 3.8% of total government revenue, only Switzerland raises a level of revenue comparable to recent proposals put forward by Senators Sanders and Warren in the U.S. The Swiss example is therefore of particular interest to the ongoing policy debate in the U.S. and elsewhere.

The wealth tax has a long tradition in Switzerland and even predates the modern income tax. The Swiss states, called cantons, have been taxing wealth since the early 18th century—in fact, this was their main source of revenue until World War I. In addition, wealth was taxed at the federal level between 1915 and 1959. Since then, there has been no federal wealth tax but all cantons must levy a comprehensive wealth tax, which they have significant freedom to design. The base of the Swiss wealth tax is broad: in principle, all assets, including those held abroad, are taxable. Only common household assets, foreign real estate, and private pension wealth are exempt from wealth taxation.

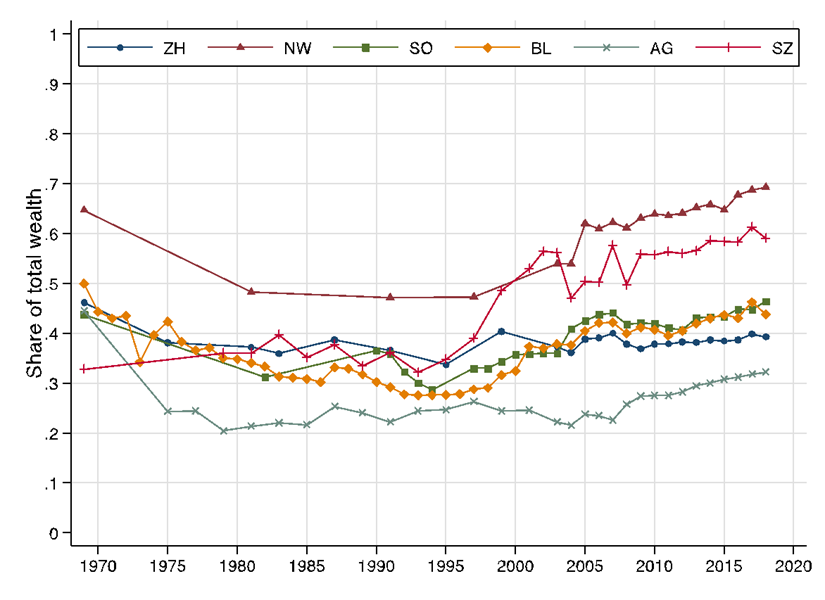

Based on wealth tax statistics from cantonal archives, we construct novel time series for top wealth concentration in each of the 26 Swiss cantons since 1969. We find that the overall increase in wealth concentration at the national level—where the top 1% wealth share reached 43% in 2019—masks striking differences across cantons, in terms of both levels of inequality and comparative trends between cantons (Figure 1). Whereas some cantons (such as Zurich) have seen a reduction in their top 1% wealth share over the last 50 years, others (such as Schwyz) have seen their shares almost double.

Figure 1: Top 1% wealth shares of the cantons Zurich, Nidwalden, Solothurn, Basel- Landschaft, Aargau and Schwyz, 1969-2018

Since the cantons have freedom in designing their wealth tax schedules, this raises the question to what degree these diverging trends are driven by differences in wealth taxation. We therefore complement our information on cantonal wealth distributions with the corresponding data on top marginal wealth taxes, going back to 1964. Cantons have changed their top tax rates 634 times from 1969-2018 with an overall downward trend, but there exists significant variation. For instance, the highest rate in our data is 1.34% in Glarus in 1970, and the lowest is 0.13% in Nidwalden in 2014. Most of the tax reforms reduced the top marginal tax wealth rate by less than 0.1 percentage points, and the 10% largest reforms are associated with a change in the tax rate of at least 0.05 percentage points.

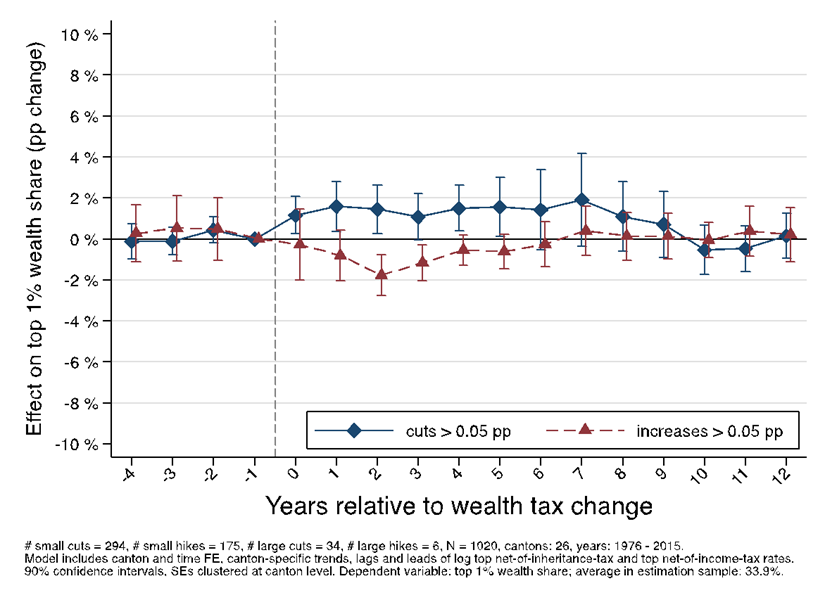

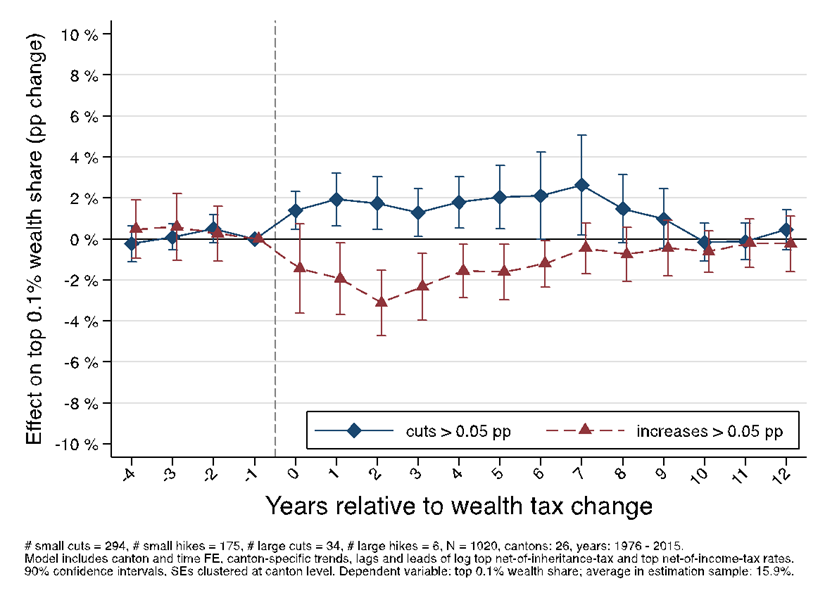

We use an event study design to estimate the dynamic effect of cantonal wealth tax reforms on the subsequent evolution of top wealth shares. Focusing on large tax reforms and controlling for income and bequest taxes, we find that cuts to the top marginal wealth tax rate in a given canton increase wealth concentration in that canton over the course of the following decade, and that tax increases reduce it. The effect is strongest at the very top of the distribution. For the top 1% and 0.1%, for instance (shown in Figure 2), a reduction in the top marginal wealth tax rate by 0.1 percentage points increases their wealth share by 0.9 and 1.2 percentage points, respectively, five years after the reform (compared to an average wealth share of 34% for the top 1%, and 16% for the top 0.1%). This implies that the overall reduction in the progressivity of the wealth tax in the Swiss cantons over the last decades explains roughly a fifth of the increase in concentration among the top 1% and a quarter of the increase in concentration among the top 0.1% from 1969-2018. Note that, in 2018, the top 0.1% group only included roughly 5,000 tax units. Thus, it is an impressively small number of the wealthiest households who benefited most from reduced wealth tax rates at the top.

Figure 2a): Effect of large wealth tax cuts and increases on the top 1% wealth share within Swiss cantons

Figure 2b): Effect of large wealth tax cuts and increases on the top 0.1% wealth share within Swiss cantons

While the wealth tax cuts explain a sizable portion of the increase in wealth concentration, they are not the only characteristic of the Swiss tax system to contribute to wealth inequality. In part, this is because the wealth tax is not very progressive in any canton, with moderate top rates, especially compared to recent proposals in the U.S. Furthermore, the wealth taxes have relatively low exemption amounts (starting at around CHF 100K, equivalent to approximately $115K), implying that a large swath of the population is subject to it. Indeed, the Swiss wealth tax was never intended to achieve a major redistribution of wealth, but rather to generate stable revenues for the cantons and municipalities.

It is likely that other changes to the Swiss tax system over the last 50 years have played a sizable role in the growth of wealth inequality. In particular, most cantons have abolished bequest taxes for direct descendants and there is no bequest tax at the federal level. At the same time, bequests account for a considerable part of the wealth of the super-rich in Switzerland. For instance, Enea Baselgia and Isabel Z. Martínez show that, most recently, 75% of the 300 richest individuals in Switzerland inherited much of their wealth. This is extremely high compared to the Forbes 400, the corresponding list for the U.S. In 2018, 69% of the wealthiest Americans were self-made, having founded their businesses. Quantifying the degree to which the erosion of the cantonal bequest taxes has contributed to long-run wealth inequality in Switzerland would be an interesting topic for further investigation.

Articles represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty.