Does investing in information technology (IT) enable firms to “scale without mass” and increase their market share? In a new paper, Erik Brynjolfsson, Wang Jin, and Xiupeng Wang examine how IT affects firm size, market concentration, and the labor share of revenue.

Over the last few decades, we have witnessed significant changes in the U.S. business landscape. Companies are getting bigger on average while dominant players in various industries continue to increase their market shares. Using the retail sector as an example, the average industry market share of the top four firms has increased from 30% in the 1990s to above 40% in the 2010s. These companies have higher profits while workers are getting a smaller share. Meanwhile, technological progress has resulted in the widespread adoption of information technology (IT) among U.S. firms. Could IT be the driving force behind these trends? In our recent working paper, we seek to answer this question.

Advances in IT have led to significant cost reductions in storing, transferring, and analyzing digital information. As highlighted by F.A. Hayek, both firms and markets can be viewed as information processing systems. Therefore, the sharp decline in IT’s costs and its rapid diffusion could be an important driving force of the change in economic organizations. For instance, IT played a crucial role in catalyzing innovation in business, specifically in supply chain management, and helped Walmart to become a top retail company.

The effects of IT on firm size are complex. On the one hand, IT can lead to smaller firm size by reducing the costs associated with exchanging goods and services externally (e.g., time and effort involved in negotiating and communication), encouraging firms to rely on market transactions. Business adoption of IT can also result in labor substitution and automation, reducing employment in firms.

On the other hand, IT can also increase optimal firm size by making internal coordination more cost-effective and streamlined, promoting hierarchical structures and broader ownership. For example, CVS used IT to deploy and replicate a digital solution in its 4,000 nationwide pharmacies. In addition, IT can reduce the costs of information transfer and monitoring. By lowering the cost of co-locating decision rights with information, IT can thus enhance decision-making and improve overall efficiency.

Therefore, the theoretical prediction on average firm size remains ambiguous and primarily depends on which effects prevail.

In our paper, we investigate the relationship between firms’ investment in IT and changes in firm size using detailed micro-level data from 2004 to 2013, derived from a representative sample of U.S. firms based on administrative data from the U.S. Census Bureau. We focus on the impact of IT on firms’ employment, revenue, and market share, as well as its role in increasing industrial concentration in recent decades.

Increased IT intensity results in higher employment and sales

Our study provides novel firm-level evidence that IT intensity (i.e., IT investment per employee) is associated with larger firm sizes on average, concerning both the levels and shares of employment and revenue in recent decades. The baseline results reveal that, on average, every additional $60 expenditure in IT per worker is associated with an increase of two employees per firm and an increase of $1 million in revenue. Similarly, when a firm increases its IT intensity, its market share tends to expand, whether measured by employment or by revenue. Our results are robust to a variety of econometric models and alternative IT measures. Furthermore, long-difference models spanning up to five years and analyses using instrumental variables—the share of sedentary workers at the industry level—both suggest that the identified effect of IT on firm size is causal, with the results especially strong for firm revenue.

Increased IT intensity also leads to lower labor share of revenue

While IT leads to larger firm sizes on all the metrics we examined, its impact is most pronounced on firms’ revenue. This suggests that enhanced labor productivity enables firms to increase sales without proportionately hiring more labor, aligning with the “scale without mass” hypothesis. That is, firms can scale up their production and expand their operation via technology through low-cost replication of business processes without the degree of inertia associated with larger firms. We delve into the relationship between IT and a firm’s labor share of revenue to reveal that a 1% increase in IT intensity is associated with a 0.1% decline in labor share of revenue.

IT helps businesses expand with more establishments, local markets, and industries

IT enables firms to codify their operations, streamline the duplication of their business processes across more production units and markets, and ultimately grow in size. We investigate this mechanism using our establishment-level data that covers firms’ operations across various industries and regions in the U.S. It appears that firms with higher IT intensity tend to have a significantly larger number of establishments and are able to expand their operations across counties and industries. For example, a 1% increase in IT intensity is associated with a 0.03% increase in the number of establishments. Similarly, IT is associated with an increase in the number of distinct zip codes and industries in which firms operate. These findings provide supporting evidence that the channels in which IT contributes to increasing firm size are through reducing the costs associated with duplicating business processes and enhancing internal coordination.

Larger firms benefit more from investing in IT

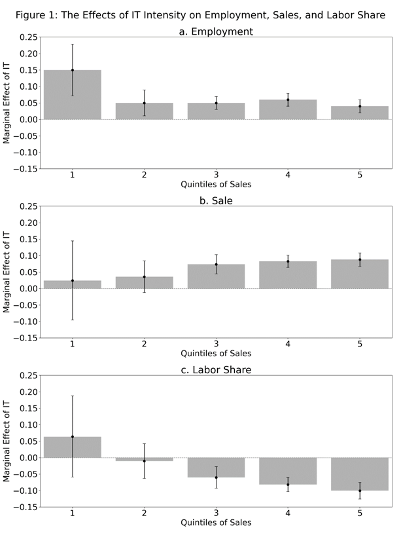

The nature of IT, typically characterized by a high fixed cost and low marginal cost, allows larger firms to use them more efficiently, benefiting from economies of scale. Moreover, larger firms also accumulate a greater level of tangible and intangible assets that complement their IT investments. As a result, the contribution of IT to a firm’s growth may vary depending on the firm’s size. We estimate the effects of IT intensity on employment, sales, and labor share across size categories and plot them correspondingly in Figure 1. For each industry, we categorize firms into quintiles based on their position in the sales distribution.

Panel A indicates that higher IT intensity is associated with increased employment for all size quintiles, with a more significant effect on smaller firms. What’s more, because the average firm size rises quickly from the first to the fifth quintiles, the increased number of employees associated with IT increases monotonically.

In contrast, the effects of IT on firm revenue increase monotonically with firm size and are only significantly different from zero for larger firms, as presented by Panel B. This suggests that although the average effect of IT on firms’ sales might be positive, the disproportionately larger gain for larger firms indicates an increasing return to scale of IT investment.

As shown in the first two panels, the disproportional gains from IT on sales (compared to employment) are more pronounced among firms in the larger size quintiles, which would naturally lead to a decline in labor share on average. We quantified this effect in Panel C. The impact of IT on labor share for firms in the bottom size quintile is positive but noisy. Such an effect declines across the size categories, becoming negative and highly significant for firms in the top three. Given the extensive business adoption of IT across various industries, our results thus provide supporting evidence that IT is one of the driving forces for the decline in labor share and the increased concentration over time.

The second machine age and IT adoption

As we enter “the second machine age,” firms and markets involve extensive information processing—and businesses are relying more heavily on IT to operate effectively. This increased use of IT has led to a significant decrease in internal coordination costs, allowing companies to expand into more local product and physical markets. Our research, which analyzed administrative data from the U.S. Census Bureau, found that larger firms are particularly well-positioned to take advantage of these economies of scale and accumulate more organizational complements.

The enabling and diverse effects of IT across firm sizes also suggest IT substantially impacts market structure, contributing to the rise of industrial concentration and the growth of “superstar firms” that can achieve a dominant market position due to their exceptional performance in their respective industries. In conjunction with a significantly larger effect of IT on revenue than its effect on employment, we further associate IT with the “scale without mass” phenomenon and the significant decline of labor share.

Articles represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty.