Pricing algorithms have shown the potential to both help and harm competition. Our new series, Computational Antitrust, explores how algorithms can abet tacit collusion, allowing competitors to set prices at anticompetitive levels without active human assistance. This series will introduce the legal and economic theory behind algorithmic collusion, explore its theoretical and empirical risks for competition, and discuss what regulators can and should do to protect competition and consumers from this rapidly advancing technology.

While the development of artificial intelligence has led to efficient business strategies, such as dynamic pricing, this new technology is vulnerable to collusion and consumer harm when companies share the same software through a central platform. Gabriele Bortolotti highlights the importance of antitrust enforcement in this domain for the second article in our series, using as a case study the RealPage class action lawsuit in the Seattle housing market. Return next Tuesday for the next addition to our Computational Antitrust series.

With new developments in artificial intelligence (AI), public pressure to regulate the technology has increased. The accuracy of modern natural language processing tools raises questions regarding the concentration of power, as well as scrutiny over who owns these models and the huge datasets to train them. But another important question is how these tools are used. A more connected digital economy can create new products and services. It can also bring new antitrust concerns related to the coordination effects among competitors using the same tools.

AI has shown that a large number of tasks will soon be automated efficiently, with better results than humanly possible. It is tempting to delegate decisions to a machine with low marginal costs and a reproducible and scalable protocol. This is referred to as techno-solutionism, and it carries the risk of reinforcing biases, spreading misinformation, and enabling large scale market manipulation. As a result, we could face pervasive price discrimination, inefficient allocation of resources, and excessive negative externalities due to challenges in making algorithms internalize social aspects that are hard to quantify.

AI enables conscious parallelism

Engaging in direct communication to raise prices or limit supply is considered per se illegal under Section 1 of the Sherman Act. However, the conduct is not considered unlawful if there is no evidence of a direct link between the parties—known as tacit collusion or conscious parallelism (see Theatre Enterprises v. Paramount Distributing). To examine this scenario, courts have developed plus factors, or market characteristics without which collusion is unlikely to take place. Proving these plus factors enables plaintiffs to survive a potential motion to dismiss and collect more evidence in the discovery phase. Plus factors such as concentrated markets, high barriers to entry, transparent prices, and inelastic demand reduce the costs of collusion for cartels and facilitate the enforceability of the agreement. For example, In re Text Messaging Antitrust Litigation—a class action against an alleged text messages cartel—plaintiffs proved the plausibility of their allegation by showing that the four firms controlled 90% of the market, participated in trade associations, and changed prices simultaneously.

As we delegate price strategies to algorithms, conscious parallelism might become the new standard with collusion more undetectable as a result. Digital platforms reduce the costs for price adjustment, enabling faster price fluctuations. The ease of changing prices creates barriers to entry, as it introduces uncertainty for potential entrants over how long the high margins will last. Ultimately, it makes detection harder. As noted by Francisco Beneke and Mark-Oliver Mackenrodt, the detection of anticompetitive behavior might require regulators to adopt models that are at least as advanced as those employed by companies, yet with smaller budgets available. Critics say that detection tools for tacit collusion are likely to produce several false positives, mistakenly pursuing conduct that is not anticompetitive. Others suggest that we should revisit what constitutes coordination in collusive agreements, drawing the line between naked and tacit collusion.

Algorithms and conspiracies

The procompetitive effects of AI are undeniable. Task automation, content generation, and fraud detection can cut production costs, ultimately resulting in lower prices for consumers. But algorithms can also accurately predict customers’ willingness to pay, transferring part of the consumer surplus to producers. Imagine if an e-commerce platform accounted for your location, age, ethnicity, average monthly spending, and other personal predictors to decide how much to charge you for a specific product. This might not be illegal—especially if we consider the algorithm as a black box—but it would create a power imbalance in favor of the producers.

A more problematic scenario would be an oligopolistic market where all firms use the same software to decide output and price, based on an AI estimation of consumer demand. Companies are already using machine learning to optimize their pricing strategy, but these models do not factor competitors’ proprietary information into their equation. A software tasked with maximizing profits might consider the fact that raising prices in more competitive markets leads to a larger revenue loss than in more concentrated ones. Adding a variable to the model that accounts for the share of competitors using the same software is just a step away. According to allegations, this is what RealPage was doing in Seattle’s rental market.

RealPage as a case study in algorithmic collusion

Following an investigation by ProPublica, a series of class action lawsuits were filed against RealPage, a real estate software company providing revenue management services in the United States (Navarro v. RealPage, Inc. et al.; Cherry et al. v. RealPage, Inc. et al.). Plaintiffs are accusing property owners of conspiracy to raise rent prices in downtown Seattle since 2016, enabled by RealPage’s software, YieldStar. With this software, owners used live dynamic pricing that updates regularly, based on a model trained on a large dataset of over 16 million units. The software is also improving as new property managers are added to their list of clients, and is currently responsible for the pricing of 8% of all rentals units nationwide. While the weights of the algorithms are unknown, it is likely that it uses predictors such as property type, vacancy rate in the market, housing price indexes, and some indicator for rental prices.

The leasing market for multifamily residential real estate in downtown Seattle presents a series of plus factors that could facilitate collusive behavior. The market for multifamily properties in Seattle is highly concentrated. Plaintiffs in Cherry v. RealPage, Inc. et al. claim that in the neighborhoods of Downtown Seattle, Capitol Hill/Central District, and South Lake Union/Queen Anne (which the lawsuit labels collectively “downtown Seattle”), more than 60% of properties were priced through YieldStar. In the greater Seattle area, this share is at least 57%. Real estate in downtown Seattle is also limited and expensive, creating high barriers to entry. The demand is relatively inelastic, as many residents would be willing to pay more instead of moving to peripheral areas. In addition, the majority of the property managers are delegating their price strategy to the same software, accepting YieldStar’s rates 90% of the time. They also have opportunities to communicate directly, as they are members of the same trade associations, like the National Multifamily Housing Council (NMHC). Finally, property managers’ profits have increased despite a decrease in occupancy rate.

RealPage marketed YieldStar as a pricing solution that would maximize property value over capacity. Property managers used to operate at above a 97% occupancy rate, but with the introduction of the new software, this decreased to 95%, while increasing revenues by 3-4%. Considering the hypothetical monopolist test, if a small but significant, non-transitory increase in price does not cause a sufficient number of consumers to switch away, the product market is defined. In this case, the market was defined as the leasing of multifamily residential real estate in downtown Seattle.

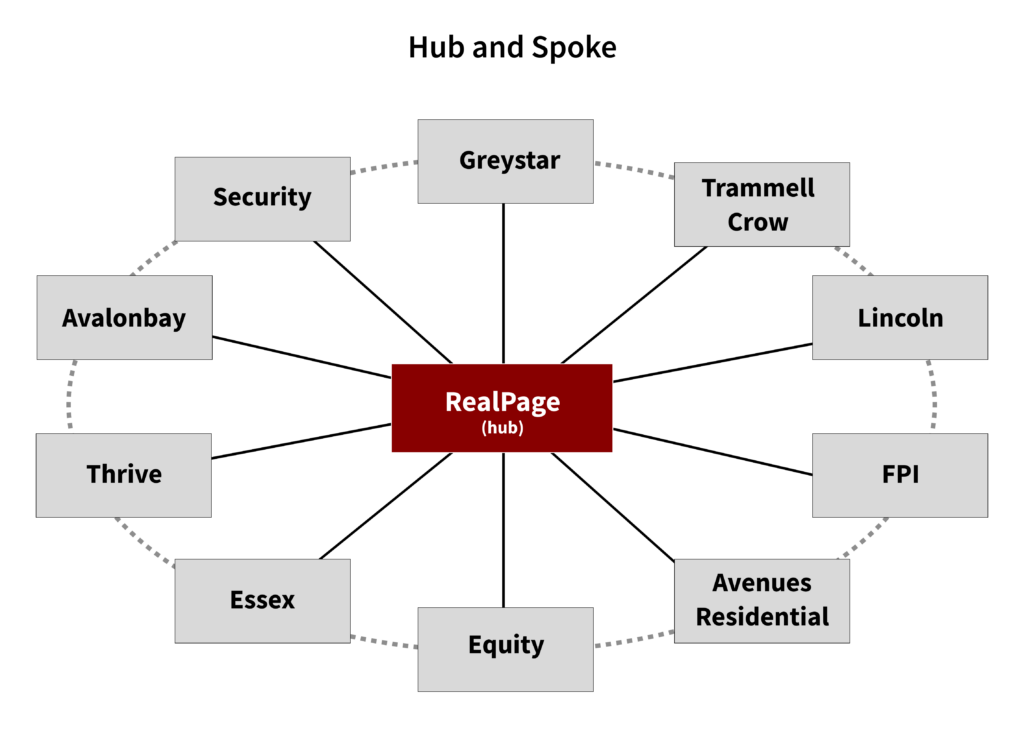

The fact that a group of competitors outsources pricing decisions to the same software is problematic. To understand the theory of harm in this case, it is useful to think about “hub and spoke” conspiracies. A central platform (the hub) is in direct communication with a group of firms that compete against each other (the spokes). The spokes are not in direct contact with each other but decide to increase prices or reduce output based on their communication with the hub (see Interstate Circuit, Inc. v. United States). It is important that all the spokes are aware that each one of them is in communication with the hub, otherwise they face the risk that higher prices would be undercut by competitors. In the case of YieldStar, we can imagine the 10 property managers as the spokes and RealPage as the hub. Rejecting the price recommended by the algorithm is rare, as it requires a justification that includes out-of-model factors and needs to be approved by RealPage representatives. By controlling the pricing of large shares of the market, the algorithm could then easily factor all its clients’ pricing strategies into the equation, knowing that the more elastic tenants would not be able to easily substitute for a cheaper property given the fewer apartments in downtown Seattle. YieldStar could also limit discounts, recommend coordinated leasing lengths, or simultaneously raise prices in narrow sub-markets, like apartments with certain luxurious amenities.

The efficiency argument for algorithmic pricing would emphasize that an improvement in dynamic pricing can help the market adapt to periods of high and low demand, avoiding unexpected losses and cutting costs. Sophie Calder-Wang and Gi Heung Kim confirm that a market with algorithmic pricing appears to help property managers price more efficiently, adapting faster to shocks. However, they also find that these efficiencies are not large enough to prevent an increase in rents and lower occupancy rates. A quick analysis of the downtown Seattle market based on properties advertised on a listing site confirms that. Apartments listed by Greystar, Holland, Avenue5 and Thrive—four of the largest property owners in the alleged cartel—displayed rents that were $120 to $790 higher than other property managers in late 2022, controlling for apartment characteristics, zip-code median income, and zip-code median rent.

The class actions are still ongoing, and it will take time before we can access more information on their pricing algorithm. A group of senators, including Elizabeth Warren and Bernie Sanders, have questioned RealPage over the allegation. The company stated that, when price adjustments are needed, “the software uses aggregated, anonymized data from multiple sources abut [sic] publicly available asking rents or actual, historically achieved rents at similar properties…” The senators invited an investigation from the Department of Justice, raising concerns over Yieldstar’s contribution to rising housing market prices.

Regulation must address collusive algorithms

We are likely to see an increase in firms adopting dynamic pricing, and more sophisticated AI pricing tools will make detection even harder. Due to reliance on large datasets and reinforcement learning mechanisms, pricing algorithms will face large network effects, leading to concentration. Government enforcers should pay close attention to competition in the market for algorithmic software programs and consider the coordinated effects that mergers could generate in industries with dynamic pricing. Ultimately, as the OECD highlighted, regulators should intervene to increase the transparency of machine learning algorithms and make it costly for firms to conspire.

Articles represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty.