In new research, Şenay Ağca and Deniz Igan use the shock of the September 11 attacks and declaration of war on Afghanistan to show how defense contracts often go to firms that are best connected to the Pentagon and federal government rather than those best equipped to fulfill the needs of the contracts.

There is a high degree of interdependence between the government and the private sector, particularly in federal procurement. The federal government is the largest single purchaser of goods and services in the United States, with discretionary outlays amounting to about 7.5% of GDP since 2000. Firms participating in procurement bids often engage in politically targeted activities and hire former public officials and government employees with knowledge of the procedures.

Do political connections matter for how much a corporation receives in federal procurement contracts? We ask this question in our recent paper by focusing on the September 2001 terrorist attack and the war in Afghanistan immediately following the attack as an unexpected shock that increased defense spending. We examine the relation between political connections and the amount of defense contracts corporations received following this event. Looking at defense contracts particularly helps to elucidate this relation since defense spending constitutes about half of annual federal discretionary outlays.

Defense Contracts and Political Connections

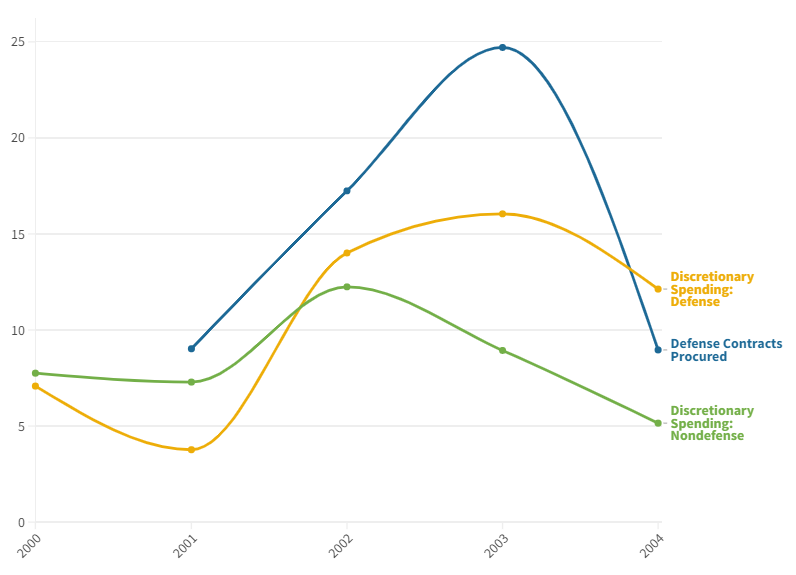

Total dollar amount of defense contracts increased from $170 billion in fiscal year 2002 (October 1, 2001-September 30, 2002) to $212 billion in fiscal year 2003. This corresponded to a change of 25% in total defense procurement funding within a year and is also reflected in a 16% increase in defense discretionary spending authorization—the sharpest jump observed since the Reagan-era military buildup.

The portion of total procurement funding allocated to defense contracts also increased from 65% in fiscal years 2001 and 2002 to 67% in fiscal year 2003. A noteworthy observation is that the defense share was stable between 2000 and 2002, implying that defense and non-defense spending grew at similar rates. Indeed, looking at the growth in defense and non-defense discretionary spending before the event, we can confirm that they evolved similarly until fiscal year 2003. After the September 11 attacks and declaration of war on Afghanistan, non-defense spending continued to grow, but at a smaller rate than defense spending. So, there was no obvious reallocation of resources from non-defense to defense.

Figure 1. Change in Discretionary Spending and Total Defense Contracts (percent)

The defense sector has also been one of the most politically active, with lobbying expenditures having risen from an annual average of about $60 million before 2001 to more than $120 million in 2022. The sector’s campaign contributions have similarly grown from $8 million in 1990 to more than $30 million in 2022. Moreover, the revolving door has been quite pervasive: there were at least 97 former members of Congress who lobbied for the largest defense companies from 2003 through 2014, and 65% of defense lobbyists had employment histories spanning public service.

After the shock

Firms that lobbied received larger dollar amounts in defense contracts following the unexpected shock in 2001. Additionally, firms that contributed to political election campaigns and that had board connections to the Pentagon received larger contracts after the shock. Lobbying brought in 47% more in defense contracts after the event compared to the 11% increase observed for defense firms that did not lobby. For the typical defense firm that received the median value of $1.9 million in contracts before the event, this translated into almost $880,000 more in revenue for firms that lobbied versus $215,000 for firms that did not. The difference of around $660,000 is a sizable return: even at the maximum level of lobbying expenditure observed in our sample ($13.5 million), it implies a return of 5%. As defense contracts constitute around 45% of federal discretionary spending, corresponding to around 3.5% of GDP, these results are useful in putting a dollar amount on the value of lobbying for a sizable segment of the economy.

Contributions to election campaigns constitute an alternative channel for establishing political connections. PAC contributions to winning candidates, in particular, can help companies obtain favorable treatment following elections. Contributing to campaigns brought in 40% more in defense contracts after the event compared to the 12% increase observed for other defense firms. This difference corresponded to roughly half a million dollars between a firm that contributes to campaigns and a firm that does not.

We also explored the board connections of defense contractors to the Pentagon or to the Armed Forces by way of previous employment or by way of having served on other boards with directors that worked in these institutions in the past. Firms with board connections to the Pentagon benefited from increased defense funding after the shock. Board members in our sample include several undersecretaries of Defense for Acquisition, Technology and Logistics and assistant secretaries of Defense for Research and Engineering, as well as positions on the Defense Science Board, where they worked together with the undersecretaries and other high-ranking officials in the Pentagon. These connections were potentially helpful in providing the connected firms with access to major decision-makers in defense procurement contracts. Connected firms received 55% more in contracts after the event while firms without saw a 14% increase. For the pre-event median contract amount, this meant that the typical connected firm received $767,000 more than the typical firm without such connections.

Merit or Political Connections?

Certain firm characteristics that shape the decision to build political connections may also relate to the ability to meet Pentagon’s war-related needs. For instance, larger firms, firms that are able to execute larger contracts, or firms with more flexible operating capacity may find it easier to expand production quickly in response to an increase in defense efforts. The same firms may be better connected as they have the resources to hire better or more lobbyists or attract influential former Pentagon employees as board members. In other words, during a rapid expansion of defense spending, firms obtaining larger defense contracts may be those that can scale up their operations. If these firms are also the ones that are politically connected, it is possible that they receive larger contracts not necessarily due to political connections but due to their ability to expand faster. In this regard, we have a direct look at how those connected firms experiencing an increase in defense contracts differ from others.

We find that firms that lobby are unlikely to be a reflection of their superior ability to support the war effort. On the contrary, firms with less capacity as captured by their smaller size or inferior operating performance obtain larger federal contracts following the surge in defense spending if they lobby. In a similar vein, firms that are under less scrutiny in contract awards as well as those in closer geographical proximity to the Pentagon headquarters get more contracts in relation to their lobbying activities, all else equal.

The evidence does not lend much support to the idea that the Pentagon employs a merit-based awarding mechanism in the sense that those firms that are less suited for the war effort benefit more from lobbying in obtaining federal contracts. The findings on the role of campaign contributions and board connections also provide similar evidence supporting the claim that the awarding mechanism observed by the Pentagon is consistent with a political connection-based system rather than solely a merit-based mechanism.

Conclusion

We contribute to the ongoing debate on the value of political connections by focusing on federal procurement contracts and examining the role of political connections in the allocation of federal contracts following the unexpected increase in defense spending after the September 11 attacks and the subsequent war in Afghanistan.

Overall, political connections played a role in obtaining larger defense contracts after the surge in defense spending in 2002-2003. In other words, defense contract awards are not driven purely by merit considerations. This could reflect various mechanisms in a framework where the interaction between government and corporations is rather direct (procurement of federal contracts). For example, there could be a quid pro quo arrangement between lobbyists or board members and legislators or government agencies that gives connected firms preferential treatment relative to their competitors that do not have connections. Alternatively, lobbyists or board members may use their knowledge of the procurement process to help their clients in preparing bids with a higher chance of being accepted or they may convey private, soft information to the procurement officer that could be relevant to her decision to accept or reject a bid. The balance of evidence in our analysis mostly but does not entirely support the quid pro quo rent-seeking mechanism.

Articles represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty.