A memo from George Stigler and Richard Posner to the Reagan administration was recently unearthed. To understand the meaning behind the memo, as well as its influence, it is important to examine the context of antitrust attitudes at the time it was written.

This article is part of ProMarket’s history series. You can read all of the pieces in the series here.

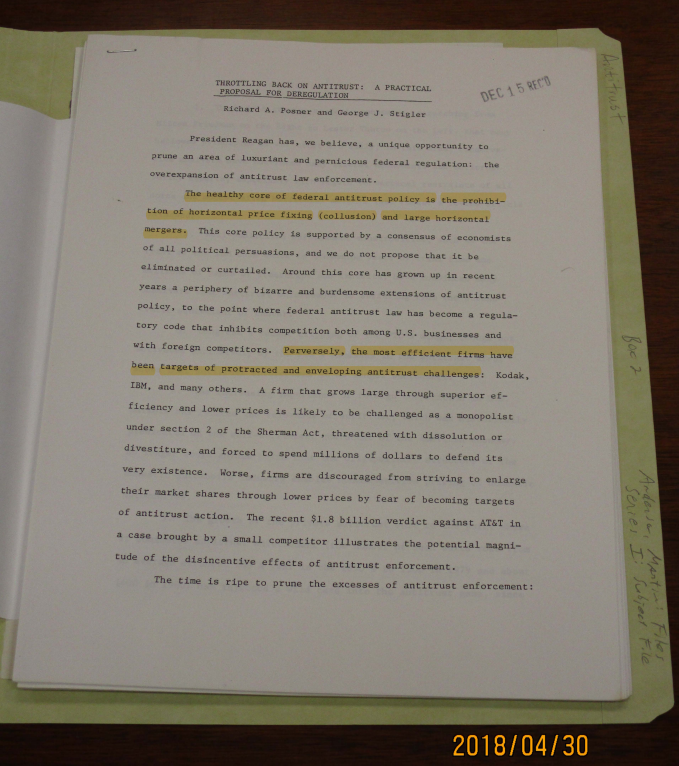

In late 1980 law Professor Richard A. Posner and economist George J. Stigler sent an undated memorandum to Martin Anderson, an economist serving on President-elect Ronald Reagan’s transition team. Posner was a professor at the University of Chicago Law School and had already written an influential book on antitrust law. In 1981, President Reagan would nominate him to the United States Court of Appeals for the Seventh Circuit, where he finished out his career. George J. Stigler was a prominent professor of economics at the University of Chicago. His name was strongly associated with the Mont Pelerin Society and the Chicago School of economics. One of his notable contributions was to politicize the theory of economic regulation by rejecting its neoclassical foundations in favor of a theory focusing on competition among firms for government favors. Martin Anderson himself would go on to be one of President Reagan’s leading economic advisors.

Some conspiracy theorists claim that this memorandum proves a right-wing cabal to unleash American corporate power. Hardly. White House transition teams receive hundreds of policy recommendations. The memorandum is one small piece of evidence that the new administration was being beseeched by neoliberal leaders in economic and political thought. They received a prominent place not only in the Reagan Administration but also that of Margaret Thatcher in the UK and elsewhere. That agenda included the appointment of conservative academics such as Antonin Scalia, Robert Bork, Richard Posner, and Frank Easterbrook to high judicial offices.

A more realistic way to view the memorandum and Reagan era antitrust policy is as a continuation of policies that originated in the Nixon administration. Nixon’s appointment of Chief Justice Burger in 1969 brought the era of the Earl Warren Court and New Deal dominance to an end. It also effectively killed any political effort to pursue industrial concentration legislation. For antitrust, the Nixon election was the real watershed. What happened during the Reagan administration was a continuation of changes that had already been set in place, but that eventually went too far.

The Posner-Stigler memorandum’s title, “Throttling Back on Antitrust: A Practical Proposal for Deregulation,” suggested that “deregulation” involved a reduction in antitrust enforcement. In one sense that is true. At the atmospheric level neoliberal economic policy wished for less government intervention of all kinds. At the micro level, however, deregulation opened the way for more antitrust enforcement in newly deregulated industries such as air travel, trucking, telecommunications, and securities regulation. In fact, deregulators themselves requested that antitrust immunities be removed once deregulation occurred.

Two things about the Posner/Stigler memorandum seem noteworthy. First, it was absolutely correct that regulation and antitrust were in a bad place in the 1970s. Second, however, the neoliberal alternatives proposed by the Posner/Stigler memorandum were extreme and counterproductive.

On the first point, the regulatory excesses of the 1960s and 1970s were legendary. In the late 1970s Alfred Kahn, chair of the (now defunct) Civil Aeronautics Board, famously ridiculed proposed government regulation of the maximum size of sandwiches served to passengers. In antitrust most of the damage was done by the Supreme Court. In merger policy the Court had condemned the Brown Shoe merger because it resulted in “lower prices or in higher quality for the same price,” thus making it more difficult for smaller competitors to compete. The Court routinely condemned mergers in unconcentrated markets with low entry barriers that could not possibly have resulted in higher prices. In distribution law the Court had made it unlawful for manufacturers to control the locations of their dealers, to limit the resale prices of price-gouging dealers, or to forbid firms from offering low priced financing of their own homes unless they made the same terms available to purchasers of competitors’ homes. Enforcement of the Robinson-Patman Act was an anticompetitive mess, condemning suppliers for rewarding better-performing dealers with discounts, and grocery distributors for selling unadvertised house brands at lower prices than nationally advertised name brands. The Federal Trade Commission had a policy forbidding price discounts to wholesale buyers who picked up their purchases rather than having them delivered, wasting thousands of gallons of gasoline.

“How influential was the Posner-Stigler memorandum? As a game-changer, probably not very.”

Posner and Stigler were clearly correct that antitrust law had lost its way, becoming obsessed with imaginary harms or captured by associations of small business entities. This was at the expense of consumers and also labor, which suffers when product output declines as a result of higher costs. This abject failure in 1960s antitrust policy explains why the Chicago School was initially so popular.

The memorandum’s substantive recommendations show Stigler’s hand more than Posner’s—not surprising, since Stigler was nearly thirty years Posner’s senior and on the verge of receiving the Nobel Prize in economics. Stigler had devoted much of his career to defending perfect competition economic models over theories of imperfect competition that called for greater government intervention. Consistent with that assumption, the memo recommended a significant reduction in private enforcement and appointment of conservatives to the Federal Trade Commission. More starkly, it also recommended that antitrust enforcement be limited to price fixing and large horizontal mergers.

As Posner’s career developed his own positions moderated, embracing greater recognition of oligopoly and exclusionary practices as antitrust concerns. Stigler remained intransigent, even though his ideas about perfect competition were already losing theoretical and empirical support in American economics departments. They would continue to find life in law schools, although today that is no longer true. Stigler’s ideas are not as far out of the mainstream on the right as 1960s-era antitrust policy was on the left, but they are out of the mainstream nonetheless.

How influential was the Posner-Stigler memorandum? As a game-changer, probably not very. The memo was consistent with the ideology that was already driving the Reagan Presidential campaign. But under the more moderate Nixon administration and the leadership of Chief Justice Warren Burger, the Supreme Court had already begun trimming antitrust law’s excesses. In 1974 the Government lost one horizontal merger case and one potential competition merger case. That ended a string that once provoked Justice Potter Stewart’s complaint that the only consistency in U.S. merger cases was that the government always wins. By 1980, the Court had already overruled the antitrust rule forbidding manufacturers from setting dealer locations, as well as the rule forbidding firms from offering subsidized financing limited to their own products. It had already limited the range of harms for which plaintiffs could recover antitrust damages, recoveries in self-regulated industries, and had placed severe limitations on antitrust class actions and indirect purchaser lawsuits. It also put the brakes on Robinson-Act enforcement, instructing that courts should interpret the Act more consistently with the competition-enforcing goals of the other antitrust laws. For example, it held that the Robinson-Patman Act should no longer be interpreted to require firms to verify competitors’ prices, in the process facilitating collusion, or to forbid buyers from trying to obtain lower prices from suppliers. In 1977 the Carter Justice Department’s stinging Report on the Robinson-Patman Act effectively announced that the Justice Department would no longer enforce it. All of these things had happened prior to Reagan’s election and the Posner-Stigler memorandum. By contrast, the most aggressive changes that the Posner-Stigler memo recommended would never occur.

The memorandum clearly could have influenced some Reagan administration antitrust policies, however. One was the 1982 revision of the Government’s Merger Guidelines. This was the most neoliberal and laissez-faire version of the Guidelines, and subsequent versions were more moderate, but they have had a lasting influence on merger policy. Another Reagan accomplishment was the Government’s 1982 dismissal of the IBM case, although it was already foundering by the time of the election. By contrast, and inconsistent with the memorandum’s recommendations, the Reagan administration used the antitrust law of monopolization to achieve the largest breakup in antitrust history – that of the telephone system. Aside from that, however, the Reagan administration remained on a path that already been set.

Read more about our disclosure policy here.