One objective of political finance is to hold power to account. However, gatekeeping, both direct and indirect, is keeping important work from being conducted and poses a threat to the whole field.

Editor’s note: This piece is based on a keynote speech Renée Adams made on June 25, 2021 at the Second Political Finance conference organized by Systemic Risk Centre.

Being able to learn from rejection is a painful but necessary skill for academic career development. Yet rejections often reveal more about the field than about the quality of the work being rejected. I use examples from my own history of rejections to show that gatekeepers block important work being conducted in the field of political finance, both directly (through actual gatekeeping) and indirectly (by creating expectations of further gatekeeping). There will always be threats to the enterprise of holding power to account, but the field of political finance loses credibility if the threats come from within the field itself. To regain credibility, I argue, there needs to be more awareness of gatekeeping and introspection in the field, and we should strengthen our field’s governance.

Somewhat conveniently, it would be easy to dismiss criticism of our field using the methods of our own discipline. To be credible according to our own standards, we would require extensive data that, because of gatekeeping, would be difficult to obtain. We would also require any analysis to pass a methodological bar concerning causality that would be difficult to satisfy. But one could also argue that the appropriate locus of criticism of our field lies outside our field, much as “external reviews” are more credible than “internal reviews.” Using my own history of rejections to make my points can be understood as using a methodological approach outside our field. It is an example of autoethnography, which is the practice of using self-reflection and writing to connect anecdotal and personal experience to wider cultural, political, and social meanings and understandings.

I use two anecdotes to make my arguments, as well as an attempt at generalization. One anecdote relates to a proposal I put together for a bank governance center at the Federal Reserve Bank of New York while I was working there as an economist. The second anecdote relates to my experience trying to publish a paper about the Federal Reserve System. My attempt at generalization will come from the 2021 climate survey of the American Finance Association (AFA).

Anecdote number one occurred during my first job as a newly-minted PhD, which was in the Banking Group at the New York Fed. Because my dissertation was on boards and I ended in the Banking Group, it was natural for me to start studying the governance of banks. I looked at the literature and realized that not much was written on bank governance. One reason was that there was very little data that could be used to study the topic. Since I was at the Fed, the disconnect between the vast amounts of data that is collected on banks, at every level, and the absence of data on bank decision-makers and boards was particularly striking. So, my colleague Hamid Mehran and I put together a proposal to establish a bank governance center at the New York Fed. Here are a couple of lines that come verbatim from the proposal:

“It would update data on the governance of banks collected for Banking Supervision. It would provide the data to researchers interested in studying the governance of banks. It would collect material and corporate governance standards and relevant regulations. It would act as a reference library on governance within the bank. It would enhance the ability of the research and market analysis group to respond to client requests concerning governance if the need arises. An example of a question that the center could look at is: How does the design of top executive compensation and banks with insufficient capital adequacy affect risk taking by management? And finally, it would increase confidence in the bank’s expertise within the business and banking communities.”

This proposal was rejected. An important fact about this proposal is that we made it in 2001. With hindsight, I think it should be clear that this proposed center could have been an extremely valuable resource to the Fed when the 2008 financial crisis hit. People argued bank governance was partly to blame for the financial crisis, but there was little data or research on bank governance.

Denying the proposal was bad for the Fed. Initially, I also thought it was bad for me. But, sometimes constraints are good. Since I had no resources to collect data, I had to hand-collect my own data. This led to my second anecdote.

Conflicts of Interest in the Fed

While collecting data on directors, I noticed a pattern. I observed that bank executives sitting on the boards of their banks would sometimes also hold a board seat at a Federal Reserve bank. I thought this was interesting, because the Fed is responsible for supervising the banks, but as directors the bankers are also responsible for “supervising” the Fed. This situation represented a classic conflict-of-interest, political finance setting that was worthy of study.

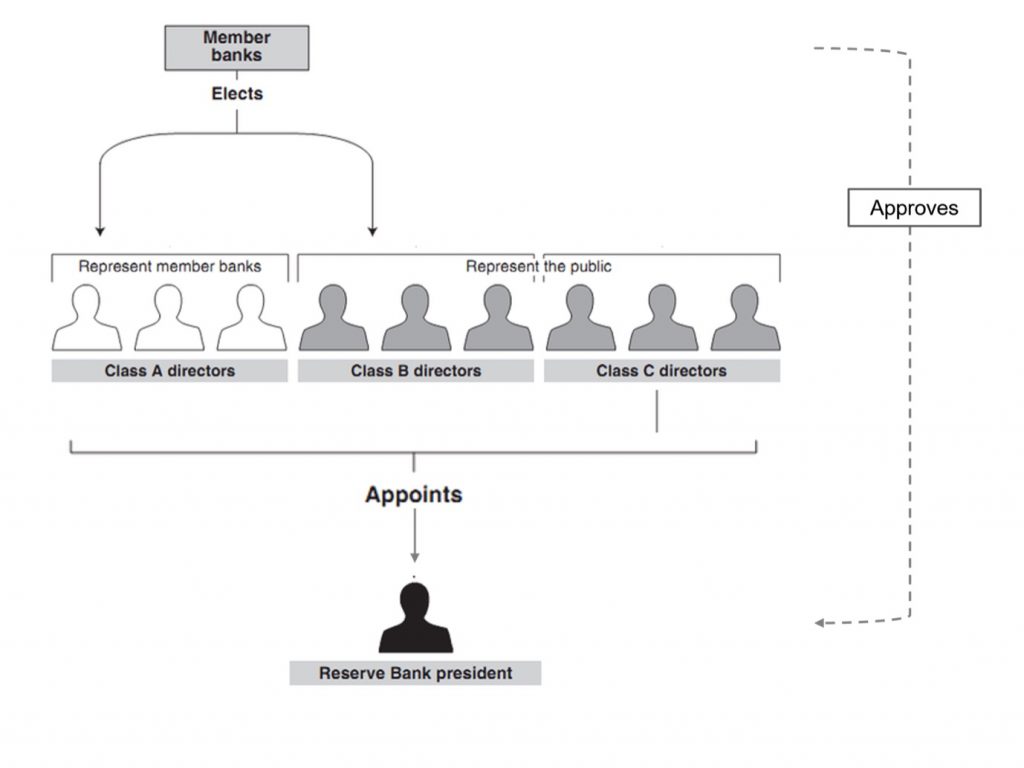

Figure 1 shows how Federal Reserve Bank boards were structured prior to the Dodd-Frank Act. Just like a corporation, each of the Federal Reserve Banks has a board of directors. Each board has nine directors. The directors are divided into three categories. Three “Class A” directors represent the banking community. Three “Class B” directors represent the non-banking community. Three “Class C” directors are appointed by the Board of Governors. What is special about the three directors representing the banking community and the three directors representing the non-banking community is that they’re elected by member banks. So six directors are elected by member banks. In addition, while the three class A directors only need to represent the banking community, in practice, they are all bankers.

Do these boards matter? Just like in a corporation, the board is responsible for appointing the chief executive, the president of the Fed.

The question I was interested in is whether these representatives of the banking community who sit on boards of Feds somehow get preferential treatment. This was not an easy question to analyze because board structure is fixed, so there is no variation in standard measures of corporate governance. So, I used a variety of approaches to try to answer the question. The fact that directors are elected meant that I could examine how contested elections were. I could also exploit the fact that some directors worked for listed companies and conduct an event study around the election of firms’ officers to the boards of Federal Reserve Banks.

The data work involved in this project was substantial. I hand collected data on the boards of Federal Reserve Banks. I obtained documents pertaining to director elections directly from the Federal Reserve Banks. I hand collected data on elections. I obtained data on the population of banks and bank holding companies, as well as non-financial firms.

I found that elections for Class A directors who represent the banking community are more contested than elections for Class B directors. This suggests that being a banker on the board of a Fed is more valuable than being a non-banker. I also found that large banks are more likely to be represented on Reserve Bank boards. Most importantly, on average the market reacted positively to a director’s election to a Federal Reserve Bank board, but only if they were elected to Class A positions. If anything, the market reaction for Class B directors was negative. For example, the market reacted positively to the election of Jamie Dimon, CEO of JP Morgan, to the board of the New York Fed in 2007, but negatively to the election of Indra K. Nooyi, CEO of PepsiCo, to the board of the New York Fed in 2006. Clearly, the market views being elected to a Reserve Bank directorship as good news for the banks.

When I wrote the paper, there were many reasons I thought it was going to be the defining paper of my career. First, there was little literature on the topic, so the paper had the potential to expand the literature. Second, the approach to analyzing the question was not obvious, so the analysis displayed creativity. Third, the paper was about the Fed, so it had the potential to have impact and stimulate institutional change. Finally, the question was interesting because the answer was not obvious.

I wrote a version of the paper in 2001. But contrary to my expectations, the paper received little interest from my more senior colleagues in the research department. I also received dismissive feedback at a conference organized by the Sveriges Riksbank in 2006. One conference participant from the Board of Governors told me that my paper had nothing to say about governance. My (very senior) discussant essentially dismissed my analysis and argued that to examine the effectiveness of Fed governance, I should focus instead on examining how well the Fed fulfilled its-check processing function. In the face of the negative feedback, I shelved the paper.

Then the financial crisis happened. Since there were many stories about Reserve Bank directors in the news, I thought it was time to update my paper. To do this, I had to file a Freedom of Information Act request and collect a lot more data. But updating the paper allowed me to compare the stock price reaction to being elected to the Board of a Fed before the crisis and during the crisis. What I found was that there was a more positive stock price reaction when bank officers are elected to the Board of a Fed during the crisis than before the crisis. At this point, I thought I was really on to something.

Once I started submitting the paper to journals, however, I learned that the profession had little tolerance for a paper that asked questions about the governance of the Fed.

I submitted my paper to all three of the top Finance journals: the Journal of Financial Economics, the Journal of Finance, and the Review of Financial Studies. Despite the fact that I continued to accumulate evidence consistent with the idea that banks benefited from having an officer on a Reserve Bank board, the publication bar was raised higher with each successive submission. Moreover, by their own admission, the otherwise anonymous reviewers were frequently directly associated with the Federal Reserve Banks.

The reviewer at the Journal of Financial Economics recommended my paper should be rejected based on a conversation with a Federal Reserve Governor. The reviewer at the Journal of Finance admitted they worked at a Federal Reserve Bank and recommended my paper be rejected by saying: “My personal experience—which I admit is anecdotal―does not support the author’s interpretations.” I appealed the rejection by pointing out that the referee had a conflict of interest and was not an objective reviewer, yet neither the editor nor the appeal referee engaged with this criticism. Instead, the appeal referee deferred to the reviewer’s “anecdotal” experience by stating that “it would not be surprising if the [Federal Reserve Website] does not spell out the true [director election process] behind the scenes.” Thus, somewhat ironically, poor governance at the Fed—in the form of reviewer subjectivity and a lack of institutional transparency—was the basis of the rejection of my paper about governance at the Fed.

When I submitted the paper to the Review of Financial Studies in 2018, I got the following editorial feedback: “The breadth and scope of your Fed directorships experiment is certainly worthy. But there were genuine concerns about positioning relative to some recent papers and some worries about alternative explanations.” Although my paper had been in the public domain since before 2011, I was now asked to clarify my contribution to subsequent work that looked at similar issues. To address the reviewer’s “genuine concerns,” the editor asked me to collect a substantial amount of additional data. I wrote to the editor and pointed out that collecting and analyzing the additional data the referees were asking me to collect would take me years and make the paper, which already contained more unique data sets than most papers published in any of the top three finance journals, unreadable. The editor’s response was: “I do not want you to shy away from analysis that can help you convince [referee 4] of the robustness and importance of your work.”

“Gatekeeping does not just prevent existing work from being published; it also reduces incentives to start new work. Because this gatekeeping occurred at the beginning of my career, it affected my entire research agenda.”

Gatekeeping Reduces Incentives to Start New Work

These anecdotes help illustrate how gatekeepers within our profession block important questions from being discussed in the field of political finance. My paper touches on many aspects of institutional design that I think are fair to ask. For example, I analyze trading behavior of directors of Federal Reserve banks. My analysis is useful for understanding the recent criticisms of Federal Reserve officials’ trading during the pandemic. But instead of being able to inform this discussion, my work is held hostage to referees with unreasonable demands.

Gatekeeping does not just prevent existing work from being published; it also reduces incentives to start new work. Because this gatekeeping occurred at the beginning of my career, it affected my entire research agenda. Although I have accumulated a treasure trove of data on the Fed, I view the cost of writing another paper on the Fed as too high.

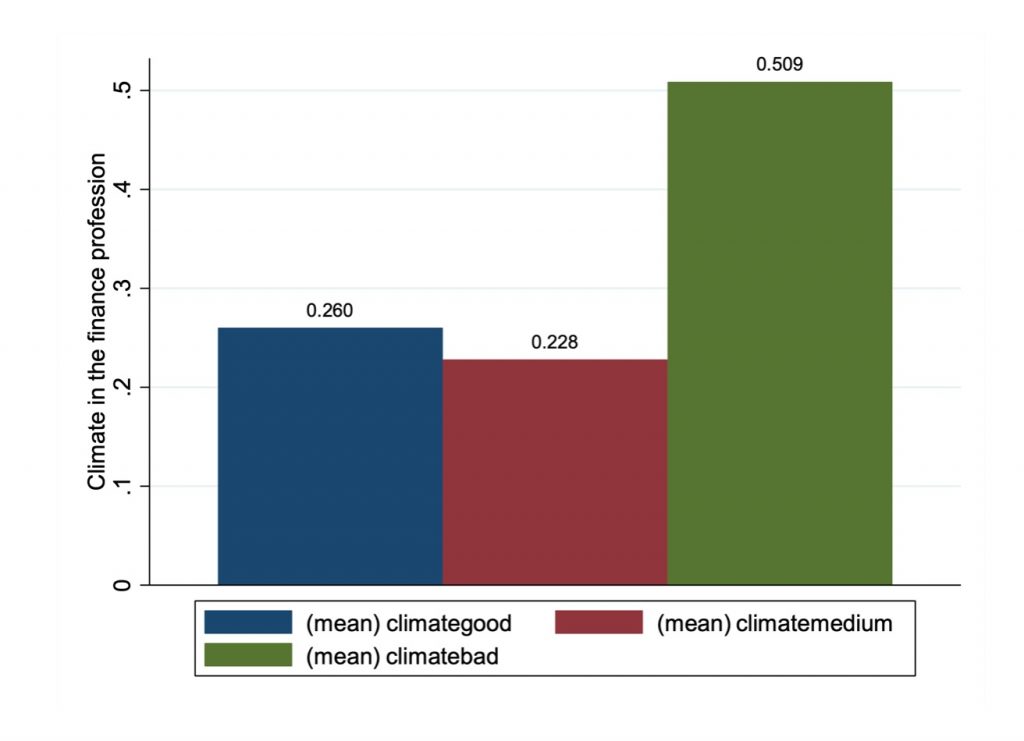

Although I rely on autoethnography to make my points, my experience of gatekeeping is not unique. Some more conventional evidence that people feel there is too little tolerance in the profession for certain topics comes from the 2020/2021 survey of professional culture of members of the American Finance Association that Michelle Lowry and I are currently analyzing. In free-text anonymous comments, 342 members commented on the professional climate in the field of finance. I read all the responses and coded overall perceptions of the professional climate (good, medium, or bad) and the themes people identified as problematic. Of these respondents, 50.9 percent rated the professional climate as “bad” and only 26 percent rated the climate as “good.”

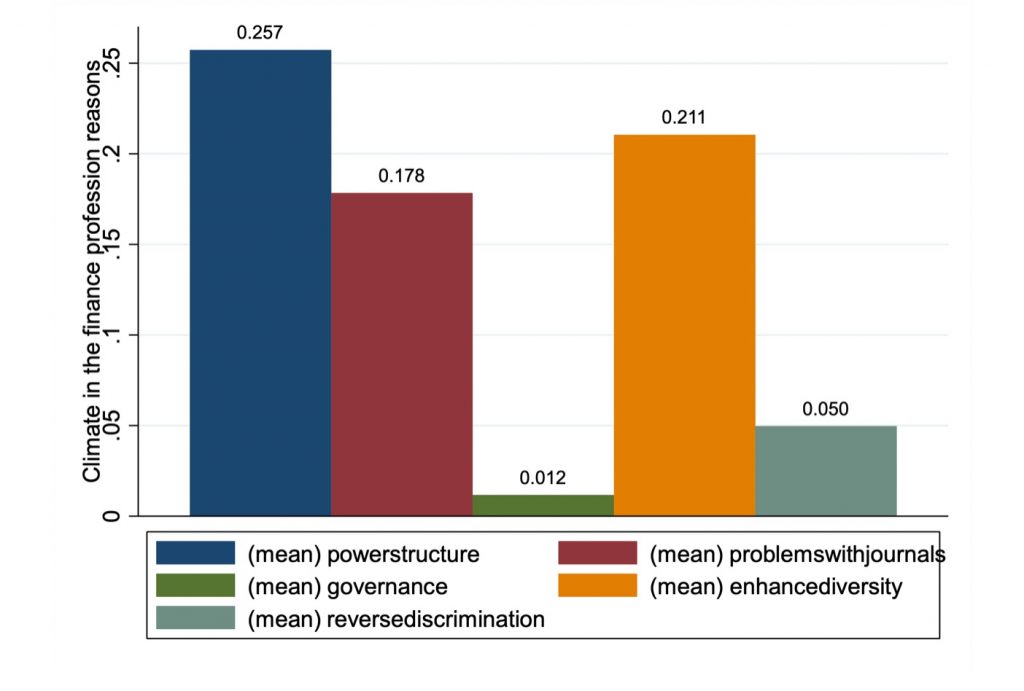

The most common complaints about the profession were related to power structures and the journals: 25.7 percent of respondents complained about elitism and nepotism in the profession and 17.8 percent specifically complained about gatekeeping at the journals with respect to new ideas. Although the set of respondents voicing these complaints is relatively small, a larger set of respondents to the American Economic Association’s 2019 professional climate survey voiced similar concerns.

One objective of political finance is to hold power to account. By providing systematic evidence on political corruption and lobbying in finance and revolving doors between financial institutions and regulators, academics in political finance expose important institutional weaknesses. Their evidence informs policy makers’s attempts to build trust in institutions, a potentially important driver of economic growth. If, as I highlight here, this exercise is hampered by real and imagined gatekeeping within the finance profession, this endeavor of political finance loses its credibility, with real consequences for broader society.

What can we do to regain credibility? First, we need to build awareness. Evidence from anonymous surveys, like the AFA survey, is easily dismissed. We need more public acknowledgement of gatekeeping. We also need to engage in introspection. How can we hold political and regulatory power to account if we do not hold editorial and professional power to account? One thing that struck me from the AFA survey is that many people complained about power structures, but very few people complained about governance. As a governance scholar, it is natural to me to think that strengthening the governance of the field can help reestablish credibility. We regularly criticize political institutions, regulators and financial institutions for their lack of transparency and poor governance. We should also practice what we preach.

Learn more about our disclosure policy here.