A new paper shows how financial ties between companies and non-profits can subvert rulemaking process and lead to regulations that favor the interests of companies rather than the general public.

Public officials face an inherent tension in getting feedback on proposed rules and regulations—the best-informed parties are often those with an interest in seeking particular outcomes. If you’re interested in, say, the costs and benefits of green energy requirements, utility companies could surely provide expert advice on the costs and benefits of such rules.

The very same experts, however, might be tempted to minimize the benefits and overstate the costs, in an effort to minimize the regulatory burden imposed on their businesses. Relative to private companies, non-profits and research institutions may be seen as more impartial or even adversarial to corporate perspectives. If regulators hear the same message from, say, both utility companies and non-profits like Greenpeace or Earthjustice, they might give more weight to their suggestions.

In theory, the above captures the process by which regulators in the US solicit feedback from the public on proposed rules, and adjust final regulations in response to a slate of public comments from wide-ranging sources. This feedback, submitted by any interested party—for-profits, non-profits, lawmakers, and individuals—can be weighed by rule-makers taking into account both the expertise and potential bias of the commenter.

In our paper, forthcoming in the Quarterly Journal of Economics, we show how financial ties between companies and non-profits—possibly unbeknownst to regulators—can subvert this process of information acquisition and lead to regulations that favor the interests of companies rather than the general public. Non-profits receive donations from corporations or their foundations, and in return lend their support to companies’ regulatory agendas.

Before turning to our statistical results, it is helpful to continue with our opening example, which will provide a concrete instance of the type of influence-seeking we have in mind. Take the specific case of Florida regulators’ proposed strengthening of energy efficiency standards in 2014. The revised rules were opposed by Florida Power and Light, which expected to see their costs go up, but also by the state’s National Association for the Advancement of Colored People (NAACP) conference, an organization that received $225,000 from the utility company just as it was pushing to weaken the state’s energy efficiency goals. The Florida conference’s director later observed that it was clear that, “if we wanted the money, we had to [support the utilities’ position]” in their commentary. The company’s efforts paid off, as the NAACP’s comments were later cited by regulators in the ruling in favor of utilities’ demands. (The NAACP’s national office saw these types of concerns as sufficiently pervasive and problematic that in 2019 it published a white paper for its local chapters, warning them of the various ways that energy companies would try to co-opt non-profits in pursuing fossil-fuel-friendly policies.)

“Non-profits receive donations from corporations or their foundations, and in return lend their support to companies’ regulatory agendas.”

Our research shows that the problem of hidden influence suggested by this anecdote applies more generally within the federal rulemaking process. We use charitable-giving data derived from the tax returns of foundations linked to corporations in the S&P 500 and Fortune 500, linked to records of public comments submitted to federal government agencies on proposed regulations between 2003 and 2016, to demonstrate how corporations influence the rulemaking process via charitable donations.

The rules we study are all drawn from federal agencies such as the Environmental Protection Agency (EPA) and the Office of the Comptroller of the Currency (OCC) (this contrasts with the Florida utilities example above, which involved state-level regulations). By law, agencies allow public comment, generally for 30 to 60 days, to elicit feedback on proposed rules from any interested party. The agency then issues a final rule, which may be altered—or withdrawn entirely—based on responses received from the public. In spelling out the final rule, agencies often explain how public feedback has been taken into account.

We provide three main pieces of evidence to build our case that companies may coopt non-profits via donations and deploy them to distort regulatory outcomes. First, we show that donations lead to a greater likelihood that a company and non-profit co-comment on a proposed regulation: A donation in the prior year is associated with a 76 percent increase in the likelihood that a company and non-profit both comment on the same rule, relative to other years in which there were no such financial ties between that specific company and that specific non-profit. By focusing on the commenting decisions of grantees in years when they have just received a donation from a particular company versus years when they haven’t, we account for factors that might lead a company to support a particular non-profit and also comment on the same rules, such as shared ideology or area of specialization.

Second, using natural language processing (tools developed by computer scientists to analyze the content of written or spoken text) to parse the content of public comments, we further demonstrate that the content of feedback from businesses and non-profits is more similar if they are linked by a recent donation. Importantly, the timing again coincides with charitable donations from businesses to non-profits: comments from a firm and a non-profit in the year immediately following a donation are the most similar.

Finally, we demonstrate that this supportive feedback matters for the content of final rules issued by regulators: the content of regulations is more similar to comments from a company if the regulator also received feedback from one of the company’s grantees.

What are the consequences of such pay-to-comment relationships? A more benign view is that companies are merely providing like-minded non-profits with the financial resources they need to provide feedback to federal agencies (which can involve complex or costly-to-produce analyses). When rules come up that are of mutual interest, companies donate to non-profits to ensure they express their genuine opinions, which happen to overlap with those of the donor. Even under this interpretation, hidden influence is problematic, as it may lead agencies to believe that a company’s view has broader support than it does in reality.

Leaked documents and other revelations make it clear, however, that, at least in instances in which we get a glimpse of how corporate charity is allocated, there is more often a deliberate attempt at changing non-profits’ public positions. In our paper, we provide a number of case studies that reinforce this “comments-for-sale” view of company-non-profit relationships. We present instances ranging from our opening example of Florida utilities and the NAACP, to the contents of a leaked charitable giving report of the Mobile Foundation that described how each donation served the companies’ interests, to comments from a homeless shelter in support of the AT&T/T-Mobile merger immediately after the shelter received a grant from AT&T’s foundation. (Sometimes, donations may aim to silence opposing views rather than prompt supportive ones. For example, Save the Children dropped their campaign in support of a soda tax around the time the non-profit received a $5 million grant from PespiCo in 2009.)

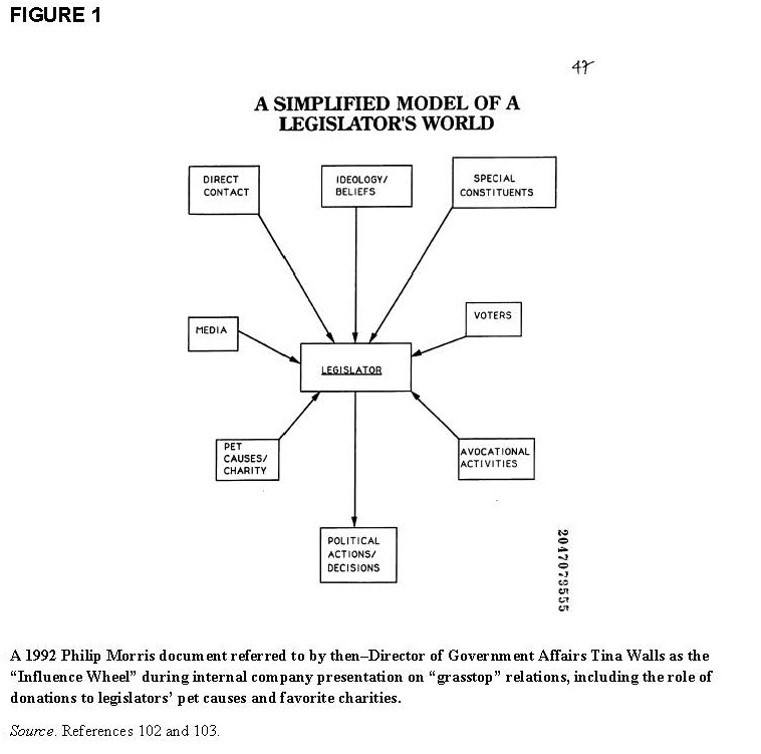

As we mention in our paper, the strategic use by tobacco companies of charitable giving as an influence tool over third party grantees is now so heavily documented (and deemed ultimately detrimental to public welfare) that the World Health Organization’s (WHO) Articles 5.3 and 13 of the Framework Convention on Tobacco Control (FCTC)55 specifically aim to limit the political effects of tobacco industry philanthropy. In court released documents we can see more direct proof. Figure 1 reports the “influence wheel” laid out by Philip Morris employees in 1992, which clearly includes philanthropic giving as an element.

What (if anything) is to be done about charity as a form of hidden influence? It would be both impractical and possibly undesirable to ban this specific type of charitable giving—intent to influence would be hard to prove and there might be value in the signal offered by businesses if they are able to build broad coalitions in in advocating their positions on proposed regulations. But if the problem is that agencies are oblivious to hard-to-trace financial ties linking businesses to non-profits, and therefore cannot adjust their assessments of public comments accordingly, then this may be an instance in which sunlight really is the best disinfectant. Well-meaning regulators should at least be informed of any underlying financial tie that links commenters on any given rule, to allow them to better assess the extent to which comments are motivated by concern for the public versus concern for strategically pleasing corporate benefactors.

Editor’s note: An earlier version of this piece was previously published by the Harvard Law School Forum on Corporate Governance.