Both the Chicago and Freiburg schools faced systemic fragility as the crucial property of societal orders. It was this fragility that served as the starting point of their search for a “better” order at the end of the 1920s.

Editor’s note: The current debate in economics seems to lack a historical perspective. To try to address this deficiency, we decided to launch a Sunday column on ProMarket focusing on the historical dimension of economic ideas. You can read all of the pieces in the series here.

If the historiography of ordoliberalism was an album, “The Times They Are a-Changin” might be the perfect title for it. Back in 2010, when we started our project on the politico-economic proximities in the incipient schools at Chicago and Freiburg during the 1930s and 1940s, studying the history of economics in general, and of ordoliberalism in particular, was a pretty lonely enterprise. The history of economics has remained a small niche within economics. But in stark contrast, the historical studies of ordoliberalism and the Freiburg School as its core have literally exploded since the Eurozone crisis. This recent literature is published at some of the best academic presses and stems from disciplines as diverse as macroeconomics, finance, political theory, law, intellectual history, history of economics, sociology of science, or international relations.

In our new paper, part of a Stigler Center’s working paper series, we point out reasons for this comeback. Like peeling an onion, we uncover different layers in the economic thought of the Chicago and Freiburg schools that share a surprisingly high overlap. Both faced systemic fragility as the crucial property of societal orders, and it was this fragility that served as the starting point of their search for a “better” order at the end of the 1920s. The various neoliberalisms of the 1930s and 1940s, of which ordoliberalism was the German variety, shared a key realization: for liberty to have a future after the darkest times of the 20th century, it urgently required new forms. And these forms needed to be more robust and resilient than the ones that kept collapsing since 1914. An entire generation set out to search for such new forms—not only the neoliberals, but also the market socialists and the vibrant group around John Maynard Keynes.

With respect to the neoliberals, it has become commonplace to locate their activities in Vienna, London, Geneva, Freiburg, and Chicago, and to identify the Walter Lippmann Colloquium in Paris in 1938 as the birthplace of the neoliberal discourse. Even though it is true that one group at the Colloquium took “neoliberal” as a self-description to make clear how it aimed at fundamentally renovating liberalism to make it viable in the 20th century (in contrast to “paleoliberals” like Ludwig von Mises who were less reformist-minded), the term “neoliberal” is much older: it can be traced back to the early 19th century and was used at various occasions when a new generation saw the need to reform the legacy of liberalism.

Our paper focuses on a subset within the neoliberal generation that did not attend the Lippmann Colloquium: the groups at Chicago and Freiburg. Henry Simons (1899-1946) and Walter Eucken (1891-1950) form the centerpiece of our quest to explore and explain the proximities in the two emerging schools. We call Simons’ school “Old Chicago,” and thus endorse James Buchanan’s emphasis on the differences to the later, much better known “New Chicago” economists like Milton Friedman and George Stigler. Importantly, we do not base our case on unidirectional “influences” of Simons on Eucken or vice versa. Instead, we focus on their similar formative experiences as young scholars, their emancipation processes and their shared angst about the world of disintegrating orders as the decisive drivers which led to the similarities in the way the economic order was theorized on both sides of the Atlantic.

But before we come to those drivers, what were the politico-economic similarities between the two schools? Both the positive analysis of the economic order and the normative vision of a well-ordered economy are stunningly similar. The positive analysis is centered around two notions. First, Simons and Eucken postulate a separability between the framework as “the rules of the game” on the one hand, and “the moves of the game” on the other. Second, the economy is conceptualized as an interdependent order within the larger order of society, and as such, this sub-order is connected to all other societal orders: the law, the state, science, or religion. Due to this mutual dependence, the economic order can send out positive or negative signals to the other orders, as it happened in the early 1930s in Germany when the Great Depression sent out disastrous signals that eventually destroyed the Weimar Republic. In the US, the Great Depression led to the New Deal and the wide-ranging transformations especially on the federal level, which were seen extremely critically by the Chicagoans.

The normative vision can also be summarized by two notions. First, for Simons and Eucken, a well-ordered economy requires a “division of labor” between the state and the private individuals, where the state is in charge of the rules of the game (including their design, implementation and continuous reform), while the private individuals perform their moves of the game autonomously within the rules. The state should not intervene in the price mechanism: the coordination of the private individuals’ plans crucially depends on the unhampered capability of the price mechanism to signal relative scarcities. Second, the concept for this well-ordered economy on both sides of the Atlantic is the “competitive order.” Here, competition is theorized as a disempowering procedure—that is, as a mechanism which destroys the power for one side of the market by creating additional choices on the other side. The competitive order should simultaneously meet two criteria: it has to be efficient and humane. “Efficient” requires forms which overcome scarcity as well as possible, while “humane” aims at forms which enable living in liberty and justice.

Power is the archenemy for both Simons and Eucken, and all their efforts aim at identifying an order which is viable with a minimum of power. Without reducing economic power, efficiency is at risk because monopolies and cartels—especially in the disintegrated markets during the lifetime of Simons and Eucken—can exploit consumers and employees. Without reducing the power of the state, the humane character of the order is at risk, as was painfully palpable at the time.

In addition, both Simons and Eucken are worried about the entanglement of private and state power. When special interest groups reach out to capture the state, the resulting knot of private and state power can become a lethal threat both to a viable democracy and a thriving economy. To prevent, or at least constantly roll back, this entanglement, “Old Chicago” and Freiburg come up with a key device: the generality of rules or, in other words, the self-restraint to distribute privileges. If a state constantly grants privileges to special interest groups, those are even more incentivized to lobby in the effort to extract ever more privileges from the state in the future. Making legislation as general and thus as privilege-free as possible can at least slow down this spiral. Simons does not remain tacit about the critical issue of legitimation. He embraces the idea of a common constitutional interest by consensus. Eucken’s normative approach points in a similar direction, but without explicitly mentioning the principle of liberal democracy—not surprisingly, given the existential consequences which such pronouncements could have in Germany from 1933 to 1945.

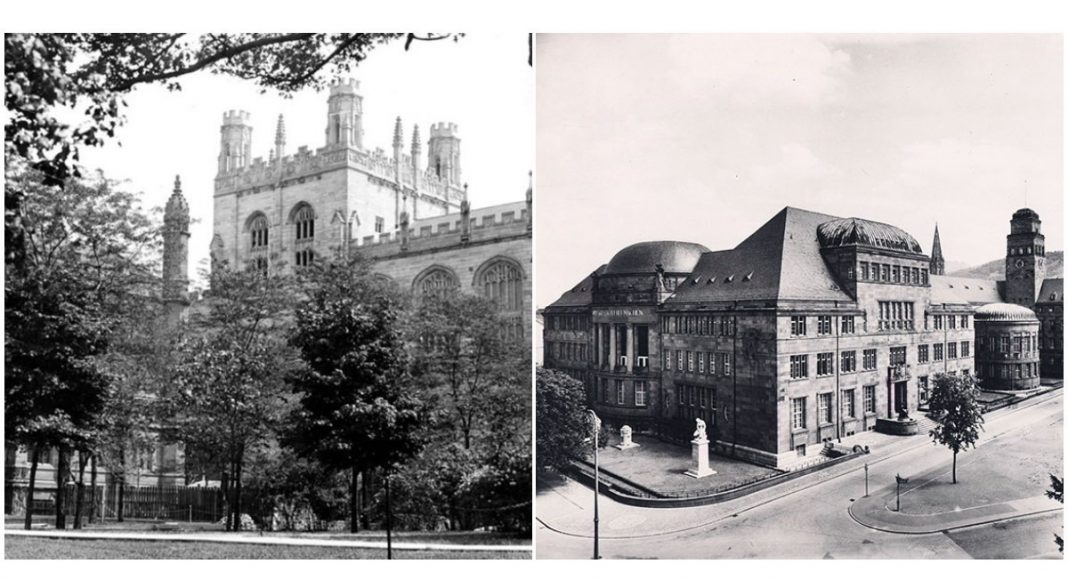

As for the drivers of the Transatlantic proximities, our paper outlines an implicit conversation which started in Berlin during the 1920s and culminated in the immediate years after World War II. Berlin of the early 1920s was crucial for Eucken’s scholarly socialization, and we can trace Simons’ famous “A Positive Program for Laissez Faire” back to his stay at Berlin in 1928, where he acquainted himself with the German literature on political economy and taxation. In 1926, Keynes had delivered his “The End of Laissez-faire” as a lecture at the Friedrich-Wilhelms-Universität Berlin, while Berlin-based economist Heinrich Herkner was proposing a new, “social liberalism” in line with the recent British discourse around J. A. Hobson, Winston Churchill, and Lloyd George. Through the diametrically opposed reactions to this “social liberalism” in the late 1920s by Simons, Eucken, and Wilhelm Röpke on the one hand, and Mises on the other, we show that the emancipation process of the neoliberals vis-à-vis Mises was already in full motion a decade earlier than the Lippmann Colloquium. Many of the later trademarks of neoliberalism, notably activist antitrust policy and the necessity for inequality-abating social policy and taxation, were at least hinted at in this new, “social liberalism.”

“LIKE PEELING AN ONION, WE UNCOVER DIFFERENT LAYERS IN THE ECONOMIC THOUGHT OF THE CHICAGO AND FREIBURG SCHOOLS THAT SHARE A SURPRISINGLY HIGH OVERLAP.”

Even though the conversation never took place in person or in direct correspondence, we emphasize one personal lifeline and one institutional platform which enabled the shared formative experiences (at Berlin), emancipation (from Mises) and the angst about disintegrating orders to (almost) become a real conversation across the Atlantic after World War II. The personal lifeline was Friedrich A. Lutz (1901-1975), Eucken’s most successful student who became a monetary economist and joined Princeton’s faculty in 1938, but remained in close contact with his teacher and constantly informed him about the transformations of Anglo-Saxon economics, including the Chicagoans. It was through Lutz that Eucken came to endorse the “Chicago Plan” of 100 percent reserves. 100 percent reserves prohibit commercial banks to lend funds on bank deposits. Instead, they are forced to hold reserves to back deposits and loans at par. The idea originated in the early 1930s in the US to prevent any more bank runs that had contributed to the Depression. The institutional platform already taking shape before Simons’ death in 1946 was the Mont Pèlerin Society. At its founding meeting in April 1947, the papers presented by Aaron Director (for the deceased Simons), Eucken and Hayek in the session “‘Free Enterprise’ or Competitive Order,” as well as the minutes of the discussions, reveal that the “Old Chicago”/Freiburg type of politico-economic reasoning of “laissez-faire within rules” was met by a wide-ranging consensus among participants from various countries, with the notable but—given our emancipation narrative—not surprising exception of Mises.

If anything, ordoliberalism was not a “German oddity,” but—jointly with the “Old Chicagoan” positive program—arguably the most systematic formulation of this “laissez-faire within rules” consensus of the 1930s and 1940s which was also shared by most neoliberals in Vienna, London, and Geneva. In the postwar conversations, the “within rules” part became less and less prominent, also because the rules of the postwar game appeared rather stable. Facing today’s order fragility, however, liberals may be reminded that a rules-based thinking and the framework of the competitive order provide a toolbox for making our national and international orders more robust and resilient. As it has become visible yet again most recently, freedom presupposes such orders.