George Stigler might have been wrong in his essay on economic regulation, but his influence is undeniable. The unity of purpose in his writings on regulation forced those who defend regulations to tighten their theories, to produce new evidence, and to defend particular regulations and regulators using better evidence and metrics. Considering Stigler’s errors and their virtues, it might be time to retire the term “capture” altogether.

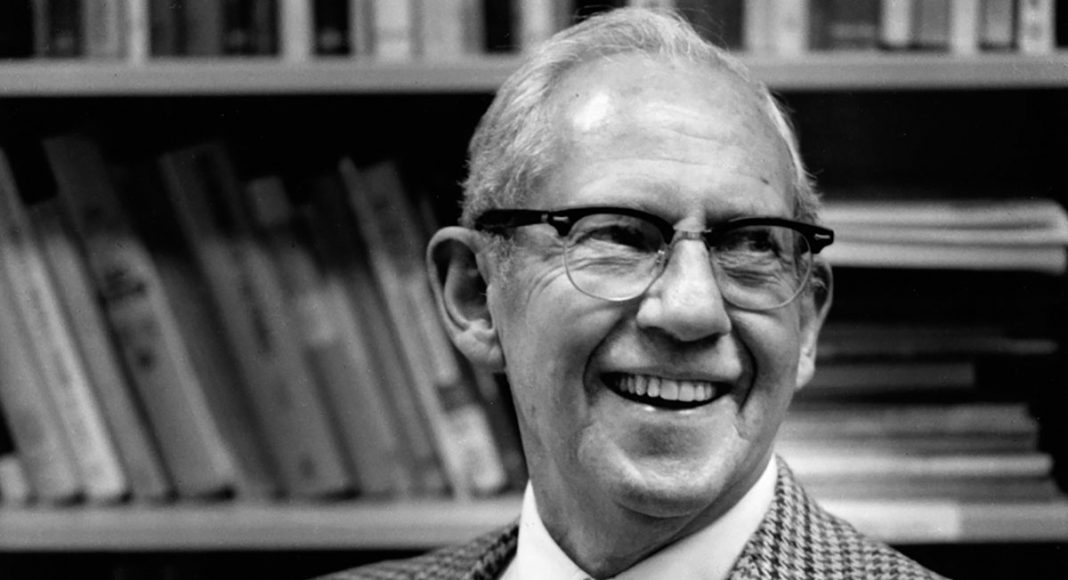

Editor’s note: In 1971, George Stigler published his article “The Theory of Economic Regulation.” To mark the 50-year anniversary of Stigler’s seminal piece, we are launching a series of articles examining his theory’s past, present, and future legacy. The series is part of the Stigler Center’s George Stigler 50 Years Later symposium.

Where does regulation come from? Whose interests does it serve? How does it become stable in an often turbulent political and economic world? In his landmark essay “The Theory of Economic Regulation,” George Stigler put forward a joint and systematically political answer to these questions. His characteristically elegant prose— a reminder of a time when any number of social scientists were, however mathematical, statistical or technological their craft, better writers than many of their successors—combined with an equilibrium logic rendered these ideas powerful, portable, and enduring. Stigler was joining a movement already launched by the historian Gabriel Kolko and the political scientists Sam Huntington and Marver Bernstein (the latter a teacher of mine in college).

Stigler’s answers were simple. Economic regulation serves the interests of incumbent firms, or incumbent providers or producers (“the industry”). It is either designed from the get-go or “acquired” ex post by those incumbents, as a way of giving to incumbents another, non-market tool of competition against smaller or potentially new competitors. What we see as a public interest serving regulation to keep heavy trucks off the roads or to ensure that practitioners of a craft have advanced training is—once read through the lens of political economy—actually a way of producing and protecting market rents. This explains, in Stigler’s writing, why regulations could systematically fail to achieve their announced aims and yet systematically endure.

For many reasons, I think Stigler was wrong. But before I get to why, let me say that I think his errors were illuminating and a good example of the kinds of productive discourse that happens in political economy and the social sciences in general. Good science and good academic inquiry do not advance unless we can falsify hypotheses and arguments, and for that we need plausible, persuasive targets. Stigler’s unity of purpose in his writings on regulation forced those who defend regulations to tighten their theories, to produce new evidence, and to defend particular regulations and regulators using better evidence and metrics. Stigler was not alone in causing these improvements, but his influence is undeniable.

“Good science and good academic inquiry do not advance unless we can falsify hypotheses and arguments, and for that we need plausible, persuasive targets.”

Nonetheless, I think Stigler was largely in the wrong in his essay. The first reason is that for many regulations, Stigler’s theory of incumbent protection simply does not apply. I agree with Cass Sunstein on this point, though for different reasons. The kind of rules that Sunstein lists in his well-argued note of skepticism were not, in the main, the kind of regulations that Stigler had in mind. I think Stigler was more apt to think of regulatory regimes, not just the trucking weight limits in his classic multistate regression but the entire congeries of restrictions imposed upon entrants to the trucking industry at the time—the 1920s, in his data, and by railroad interests, in the main—including admissible freight regulations, regulations governing drivers and their hours. Stigler might also respond to Sunstein and other critics in this thread that, just because there are counterexamples to the “acquisition” regulation by industry does not mean that there are not strong examples. Stigler’s is a model, after all, and Stigler and Stiglerian thinkers might argue that licensing regimes for occupations like barbers, physical trainers, health providers, and thousands of other jobs make for readier examples.

But a range of regulations that emerged at the time that Stigler was writing—including environmental regulation and approval regulation in medicines—fit poorly with the Stiglerian model. Pharmaceutical regulation in the early- to mid-twentieth century certainly raised the costs of entry into the industry, but as Steven Vogel has argued more generally, Stigler’s “industry” usually fights the regulations that will purportedly benefit it. In the medicines realm, for instance, the incumbents who stood most to benefit from the 1938 Food, Drug and Cosmetic Act and the 1962 Kefauver-Harris Amendments fought these laws tooth and nail. So too with environmental regulations, which undoubtedly gave some implicit advantages to larger firms that could more easily shoulder their burdens, but were also vociferously (and expensively) opposed by those same interests.

Second, Stigler’s politics of capture was focused upon anti-competitive capture, but as David Moss and I have argued, there is another form, deregulatory or corrosive capture (see also Steven Vogel’s essay in this conversation). (This, in my reading, is the kind of capture to which Anat Admati gestures in her thoughtful essay.) Deregulatory capture (or one form of it) occurs when a legislature or agency intended to advance a public-interest-serving rule, but the application or interpretation of the rule gets watered down by a captured agency.

Corrosive capture is a real possibility, but proving it is not easy. The scholarly trick in these cases is both theoretical and methodological. Theoretically, one would have to have some sort of real public interest that regulation were to serve, a public interest that was somehow established theoretically or empirically. The abundant theory and consensus in economics behind free trade would offer one such rationale (thus casting doubts upon protectionist regulations that limited commerce). Meanwhile, the abundant evidence on the health harms associated with tobacco use might offer a more empirically-based rationale for a “public interest” in which the uses of these products were regulated.

Third, and perhaps most important, I think Stigler set up a kind of thin-evidence functionalism that regarded observable regulatory benefit as a kind of proof for the hypothesis that policies that delivered that benefit were designed or influenced by the “industry.” The positive side of Stigler’s legacy was a rigorous critique of accounts of regulation that assumed it served a public interest. The negative side is this functionalist residue in economics, political science and related fields. This kind of thinking was in the original Bell Journal essay, but Stigler doubled down on it when he published the essay in a 1975 book:

“The theory [of economic regulation] tells us to look, as precisely and carefully as we can, at who gains and who loses, and how much, when we seek to explain a regulatory policy. … It is of course true that the theory would be contradicted if, for a given regulatory policy, we found the group with larger benefits and lower costs of political action being dominated by another group with lesser benefits and higher cost of political action. …

The first purpose of the empirical studies is to identify the purpose of the legislation! The announced goals of a policy are sometimes unrelated or perversely related to its actual effects, and the truly intended effects should be deduced from the actual effects.”

As I demonstrated in an applied mathematical essay in 2004, this principle is logically incorrect. A regulation can end up giving distinct and enduring advantages to larger, older firms in an industry while having ben originally design in a way that was entirely neutral. In a world where a regulator understood as rational in the pure Bayesian sense regulated a population of firms and their new products, the regulator would have less uncertainty about the incumbents. There is simply more data on them. In this way, larger, older firms might be “trusted” by the regulator in an uncertain world, and the repeated interaction of a Bayesian regulator would produce systematic decision advantages (what looks like forbearance but is in fact a rational balancing of risk) for what Stigler called “the industry.” As my colleagues and I showed in a follow-on paper, this model of pharmaceutical regulation fits the FDA’s behavior far better than does the Stiglerian perspective.

“the word ‘Capture’ has become too sexy for its own (or our) good. It can be too easily and too lazily applied to all manner of phenomena, often when …the capture-lamenting critic is disappointed with the policy outcome in question.”

At the end of the day, I confess that I have doubts about the use of the term capture. In some ways the word has become too sexy for its own (or our) good. It can be too easily and too lazily applied to all manner of phenomena, often when, as the rulemaking scholar Susan Yackee has observed, the capture-lamenting critic is disappointed with the policy outcome in question. I believe that, to the extent that we keep it, “diagnoses” of capture should follow rigid empirical criteria. This assessment has courted lots of criticism, admittedly, and mainly from what one might call the regulatory left.

At the same time, the kind of things that capture describes are important. If some form of what Cass Sunstein calls “epistemic capture” is partly responsible for mitigating our collective response to climate change or to systemic financial risk, then trillions of dollars and billions of human lives are at stake. The trick, it seems to me, is to thoughtfully advance models and studies of regulatory corrosion without, in so doing, tethering the phenomenon to a word (“capture”) that invokes so many possible models, mechanisms, and stories as to have surrendered a good deal of its meaning.