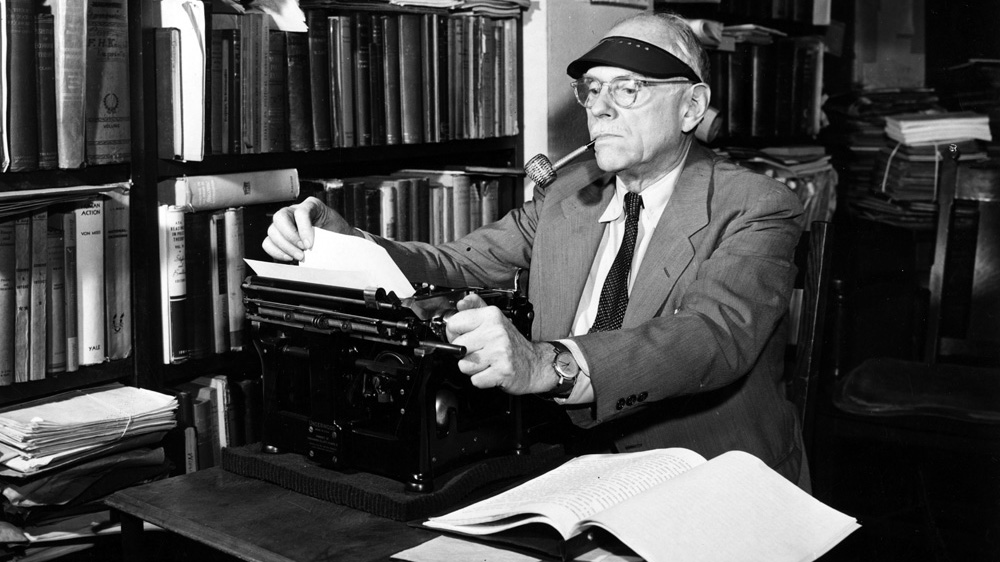

To mark 75 years since the passing of Henry Simons, professor of Economics and Law at the University of Chicago, ProMarket is republishing George Stigler’s 1974 essay, in which he wrote: “Henry Simons was closely tuned to the time and place in which he lived: America in the Great Depression.”

Editor’s note: This article was originally published in 1974 in the Journal of Law and Economics and is reprinted here with persmission. George J. Stigler. 1984. Henry Calvert Simons. The Journal of Law and Economics 17 (1) pp. 1-5.

Henry Calvert Simons was the Crown Prince of that hypothetical kingdom, the Chicago school of economics, and even at this late date it is desirable to present the main facts about the man and his career. Simons was born into an upper middle class family in Virden, Illinois, on October 9, 1899. His father was an attorney, his grandfather an English immigrant who had become a church organist and then a successful grain merchant; his mother was a southern belle whose imperious ambitions caused Simons to escape from home as soon as be completed high school in 1916. The first stop was the University of Michigan, where he specialized in economics and received the AB in 1920. The brilliance and capacity for boredom that marked his entire life were already present: he was an excellent student (9 A’s, 5 B’s, in economics) and a poor accountant (1 A, 1 B, 2 C’s, 1 D).

He moved on to the University of Iowa in January of 1921, beginning as an assistant in principles and railroads ($700 per year), rising to assistant professor with a salary of $2,750 in 1926-27. At Iowa he met and eventually became the premier student of Frank Knight. He began the pursuit of a Ph.D., first sampling Columbia in the summer of 1922 and then shifting to Chicago (summers, 1923, 1924, and the academic year, 1925-26). A thesis on personal income taxation was launched, and when he followed Knight to Chicago in 1927 as a lecturer, he was given a leave to learn German in the first half of 1928. He spent the time in Germany, partly at the University of Berlin, and readers of his Personal Income Taxation (1938) will remember his perverse pleasure in quoting the German literature only in the original.

He returned to Chicago in 1928 as an assistant professor and Chicago was his home for the remainder of his life. By external signs he was a desultory, aimless student (that is, well ahead of his time!). No prelims were taken, and up to 1932 he had published only three book reviews. Paul Douglas led a strong opposition to the renewal of his appointment, beginning in 1932.

Simons’ main and perhaps only defender, unreasonable and intransigent and successful, was Frank Knight. But it was all Knight could do to preserve Simons’ position, and it was 1942 before he was promoted to associate professor—and then only with the backing of the Law School, where Simons had begun teaching economic theory in 1939. The further delay in reaching his professorship (1945) was due to the opposition of a dean who was incensed by Simons’ attack on labor unions in his famous essay, “Some Reflections on Syndicalism.”

The actual facts concerning his industry were different: by 1933 Simons had worked out the main elements of his position in virtually every respect. A famous unpublished memorandum, “Banking and Currency Reform” (of which he was the main author) has the fundamental elements of his monetary theory and hints of much of the remainder, and in the Positive Program for Laissez-Faire (1934) all the elements are present. The success of this pamphlet presumably insured his continuance at Chicago, although Douglas’ last effort to terminate the appointment came in 1935. There is no evidence that he ever received an offer from another university.

Simons seemed to everyone a confirmed bachelor, but sanity triumphed and he married Marjorie Powell (to whom I had introduced him) in 1941. For years his recordings—he was a classicist also in musical taste—accompanied by rye old-fashioneds had been a fixture of the Quadrangle Club. He was also excellent at billiards, formidable at bridge, and a lackadaisical tennis player. In my time as a student, Simons was too sophisticated and subtle to be a widely popular teacher: he could not bring himself to emphasize the important if it were moderately obvious; this changed later, as we shall see.

He was primarily an introspective philosopher of economics: he was uninterested in empirical economics (a trait shared with Knight), and found it more congenial to study economic life by reflection than by wide reading (the antithesis of Knight). There was, indeed, a basic conflict between his philosophy and that of his teacher: Simons was a strong believer in the possibility of purposive, disinterested reform, with the intellectual playing a great role in such reform, whereas Knight believed that social life was basically non-rational and hence not improvable (and hence ideal!).

“If we (responsible economists) could achieve agreement among ourselves—excluding those who would use all proximate means, fiscal and other, to prevent survival of this kind of a system—we might easily exercise decisive influence and rapidly induce a popular, political consensus.”

Henry C. Simons, Economic Policy for a Free Society

Simons was a soundly trained theorist, and his Materials for Economics 201 was a remarkably thorough training in the most important elements of price theory. In this material, which was never formally published, he developed also a lucid analysis of cartels, which was elaborated and published (with due acknowledgement) by Patinkin. He did not teach the graduate theory courses, however- always introductory courses (including that in the law school) and public finance.

His participation in the Law School deserves a remark. It began in 1939, and continued until his death, and it is the Law School which instituted the memorial lectures which have been given, chronologically, by me, Viner, Carter (of the Canadian Tax Commission), Friedman, Tobin, and H. G. Johnson (all appearing in the Journal of Law and Economics). Although Simons initiated the practice of having an economist in the law school at Chicago, the relationship was somewhat didactic in his time: there was no visible impact of his law school associations upon his own work, although he became an extremely popular teacher and had a substantial influence upon several of the law faculty. Simons’ primary interest was in macroeconomic policy, not allocative price theory, and the reciprocal relevances of monetary policy to the law and of the law to monetary policy are severely limited. Only when Simons’ friend, Aaron Director, succeeded him did the effect of the collaboration reach fruition. Director entered into the instruction of law (especially in the famous course on antitrust law, with Edward Levi) and in the process solved important problems in industrial organization such as the economics of tie-in sales, predatory competition, and patent licensing restrictions. The inauguration of the remarkable collaboration between law and economics which persists to this day at Chicago is one of Simons’ major contributions.

The Positive Program for Laissez-Faire was Simons’ Manifesto, and it contained all of the major ideas which he was to elaborate in the next decade. Completed in the trough of the deepest depression of modern times, it had an urgency which never left his work: Western society was near the point of no return.

The central philosophy of the Positive Program was highly individual. Simons believed that it was essential to the preservation of personal freedom that a large sector of economic life be organized privately and competitively-this was a fundamental element of the liberal position that many, perhaps even an increasing share of us, still believe. With it, however, he joined an extensive and intricate set of tasks for the state:

1. The positive pursuit of competition by limitist laws as well as by antitrust policy.

2. Public ownership and operation of “natural” monopolies (preferably by local governments where possible).

3. Severe restriction of advertising and merchandising.

4. Elimination of tariff barriers.

5. The elimination of all forms of public debt except long-term bonds and of almost all forms of private debt except short-term credit, to strengthen the weapons of monetary policy and eliminate the forced liquidations consequent upon business downturns. (The 100 percent reserve plan was already fully developed in the 1933 memorandum.)

6. A monetary authority committed to maintain stability in the quantity or value of money.

All these policies, with the possible exception of the limitation of advertising, could be argued to be necessary to the preservation of a large and efficient private enterprise sector. To this theme, Simons adds a second major one which is surely independent: that there should be a large movement toward income equality, achieved primarily by reliance upon a personal income tax of elegant analytical simplicity. Income should include capital gains, inheritances, gifts—everything that increased a person’s relative command over resources. This strong egalitarian element separated Simons from most conservatives, and indeed one could make a strong case that Simons was a modern liberal who understood price theory. Certainly no other economist accepted so fully Mill’s proposition that the distribution of income was a matter of free social choice.

“Moreover, the control of the distribution of income through taxation represents a form of control which democratic governments can be expected to exercise somewhat correctly, i.e., without undermining the foundations of their own existence. No fundamental disturbance of the whole system is involved.”

HENRY C. SIMONS, PERSONAL INCOME TAXATION

Simons hardly ever departed from normative economics, and yet he had a vague and contradictory picture of the state as an instrument of economic policy. This state, which historically had been complaisant to strong minorities in granting tariffs and stupid in its grants of corporate license, was assigned arduous tasks such as the operation of railroads and insurance companies and the administration of a tax system of unprecedented intellectual elegance and fiscal severity. Simons had a theory of the demand for governmental services, but none of its capacity to perform these services. Only the former student of Leo Sharfman could have written of the Interstate Commerce Commission as “an unusually competent and scrupulous public body, and only a nonstudent could have had Simons’ 1934 faith in the Federal Trade Commission, which “must become perhaps the most powerful of our governmental agencies.”

The little volume on Personal Income Taxation (1938) was an elegant (his favorite word) and ingenious monograph. It contains, in addition to a consistent application of a comprehensive income measure, an early and influential case for income averaging. He once said that the Hicks, Hicks, and Rostas’ book, Taxation of War Wealth, belonged in the 5-inch shelf of good books in public finance; surely his own also belonged in this tight space.

The famous essay, “Rules versus Authorities in Monetary Policy” (1936), which Simons once said was the best piece of writing he had produced, is the fullest exposition of his monetary and cyclical views. Here I am content to refer to Milton Friedman’s perceptive study of Simons’ monetary theory, which gives the monetary theory high marks but criticizes the policy proposals, for whose faults Friedman assigns a large role to Simons’ (mis)understanding of the causes of the 1933 monetary collapse.

Henry Simons was closely tuned to the time and place in which he lived: America in the Great Depression. It was a time for great fears and bold reforms—indeed bold reforms require great crises, and Simons frequently invoked imminent and utter catastrophe as the justification for his proposals. Could it be that his tragic death in 1946 was an inevitable final bond with the disappearing era to which he had devoted his mind and heart?

The “Chicago School” has always been a phrase whose accuracy varied inversely to its content. The leading figures of the School in the 1930’s were highly diverse: Knight was the great philosopher and theoretician, almost in a Marxian sense; Viner was studiously non-dogmatic on policy views; Mints was a close historical student of money, and restricted himself to that field; Simons was the utopian one of the school had any interest in quantitative work, and indeed—like the rest of the economics profession—none (except Viner) had serious reservation that his understanding of economic life was incomplete or mistaken. At a doctrinal level, the one specific idea that carries over to the present day in Friedman’s writings is Simons’ demand for a fixed rule for the conduct of monetary policy. In forming most present day policy views of Chicago economists, Director and Friedman have been the main intellectual forces.

The evolution of institutions and theories has moved them beyond Simons’ positions—and beyond those of contemporaries such as Keynes, Hansen, and Tawney. Yet Simons’ central goal is as vital and as irresistible today as it was forty years ago: to devise a decentralized, unpoliticized world in which personal freedom and economic efficiency find wide scope and strong defense.