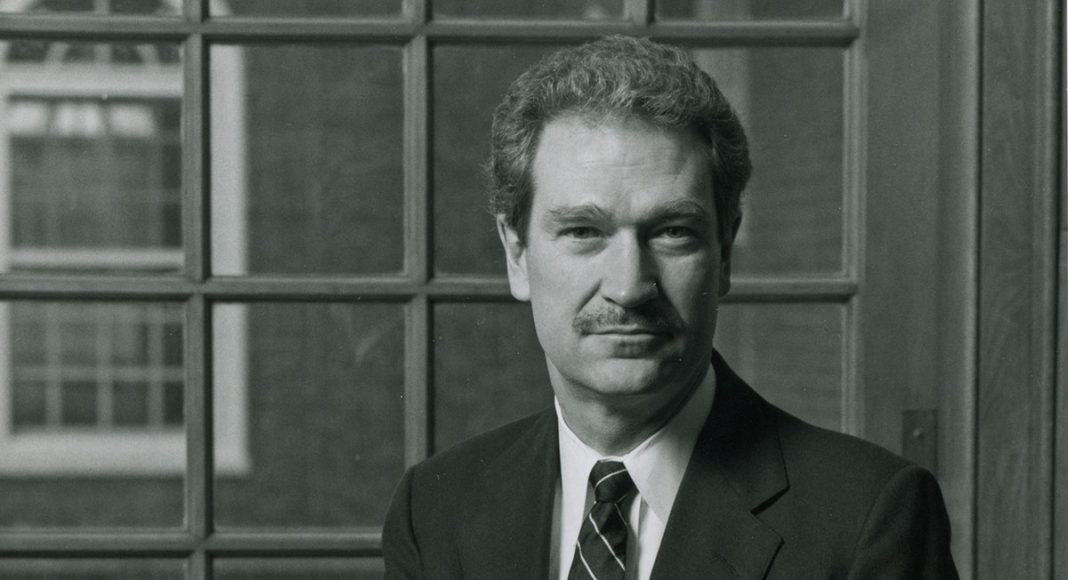

Michael Jensen, a leading late 20th century economist, pivoted from praising public companies in the 1970s to assailing public company governance in the 1980s and 1990s. Disappointment that corporate executives did much to thwart takeover activity prompted Jensen’s 180-degree turn.

Michael Jensen was a dominant force in the field of economics during the final quarter of the 20th century. He achieved notoriety, in part, because of intense criticism of public company governance and the cures he proposed. A forgotten feature of what Jensen had to say about the publicly traded corporation was a 180-degree turn in his thinking, from an admirer to a fierce critic. He thus was infused with the zeal of a new true believer, with trends affecting takeovers doing much to explain the conversion.

As the 20th century drew to a close, Jensen was “one of the most influential economists on planet Earth.” According to a 2006 study of citations in prominent economics journals focusing on articles published since 1970, Jensen had authored or co-authored five of the 102 most-cited articles. Only Joseph Stiglitz had more, with six.

The first of Jensen’s five “greatest hits” was from 1976, the famous “Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure” written with William Meckling. The final piece was a 1990 article on executive pay co-authored with Kevin Murphy.

Jensen’s views regarding the public company changed considerably in the intervening decade and a half. As my previous ProMarket post indicated, Jensen and Meckling were admirers of the public firm in 1976, maintaining that it was “an awesome social invention.” Jensen’s take was much different by 1990. Jensen and Murphy, having suggested “it was appropriate…to pay CEOs on the basis of shareholder wealth,” presented data showing chief executive officer wealth actually changed a mere $3.25 for every $1,000 change in shareholder wealth. In an accompanying Harvard Business Review piece they urged public company boards to incentivize managerial compensation, arguing in doing so that most senior executives behaved like bureaucrats because managerial pay barely varied in accordance with corporate performance.

Jensen already had a track record as a critic of the public company. In 1986, he maintained such firms were “fraught with conflicting interests.” In a 1989 article in the Harvard Business Review, provocatively titled “The Eclipse of the Public Corporation,” Jensen maintained the public company had “outlived its usefulness in many sectors of the economy,” citing chronic inefficiency and a lack of adaptability. Business enterprises taken off the stock market by way of leveraged buyouts, he suggested, were much better positioned. This was because the firms executing the buyouts (e.g., Kohlberg, Kravis and Roberts, otherwise known as KKR) could be counted on to eliminate “much of the loss created by conflicts between owners and managers, without eliminating the vital functions of risk diversification and liquidity once performed exclusively by public equity markets.”

“While Jensen’s public company U-turn was by no means unique, changes to the market for corporate control provided a special impetus.”

Jensen’s public company volte face was complete by 1993. In his presidential address to the American Financial Association that year, he chastised America’s public companies for “ineffective governance,” saying their boards and other internal control mechanisms had “failed” because the mechanisms “react too late, and they take too long to effect major change.” The legacy: “Many of our best known companies—GM, IBM, and Kodak come to mind most readily—have wasted vast amounts of resources over the last decade or so.” This was an emphatic 180-degree turn for an academic who was a fan of the American public company less than twenty years earlier.

Jensen had something of a penchant for intellectual pivots. Whereas Jensen and Meckling maintained in the mid-1970s that it was “reasonable to argue that all markets are always in equilibrium,” Jensen argued in his 1993 presidential address that “the product and factor markets are slow to act as a control force” and kicked into operation “too late” to preclude a substantial “waste of resources.” Likewise, with respect to the efficacy of share prices, he went from saying in 1984 that “a security’s market price represents the best available estimate of its true value” to a 2002 condemnation of a “dysfunctional conversation between Wall Street” and public company executives focusing on corporate earnings which resulted in “overvalued stock.”

While Jensen’s public company U-turn was by no means unique, changes to the market for corporate control provided a special impetus. The 1980s were The Deal Decade, where takeover related activities preoccupied executives, commentators, and the public to an unprecedented extent. Jensen offered a cautious endorsement of the market for corporate control in 1983, referring to “the takeover market” as “an external court of last resort protection” for shareholders. By 1984, however, Jensen was forcefully debunking pessimistic takeover “folklore” in the Harvard Business Review, arguing in so doing that “(t)he takeover market…provides a unique, powerful, and impersonal mechanism to accomplish the major restructuring and redeployment of assets continually required by changes in technology and consumer preferences.”

Jensen’s cheerleading for takeover activity continued throughout the rest of the 1980s. He wrote in the New York Times in 1986 “that shareholders and the economy would gain enormously if companies in industries with high agency costs, such as energy, airlines, broadcasting and cable TV, felt the pressure of potential hostile takeovers.” In a 1988 article analyzing empirical evidence on takeovers, Jensen heaped praise on the market for corporate control, saying it was “creating large benefits for shareholders and for the economy as a whole by loosening control over vast amounts of resources and enabling them to move more quickly to their highest-valued use.”

In 1987, Jensen implored in relation to takeover activity in a Wall Street Journal op-ed: “We must not strangle these productive forces.” He was aware that takeovers had strong opponents, led by “top-level managers of many of the largest and most inefficient corporations…threatened with the loss of their jobs by takeovers.” A front-line tactic public company executives could use to thwart an unwelcome takeover bid was to invoke takeover defenses. As the 1980s got underway, Jensen was prepared to give managers the benefit of the doubt with regard to resisting unwelcome bids for control, saying “anti-takeover provisions often enhance the price target shareholders ultimately are paid in a subsequent takeover.” By 1988, though, Jensen was a robust takeover defense skeptic, arguing in his article on empirical evidence on takeovers “(a)ctions by managers that eliminate or prevent offers or mergers are most suspect as harmful to shareholders.”

Legal trends helped induce Jensen’s change of heart on managerial resistance to takeovers. When the Delaware Supreme Court ruled in the 1985 case Unocal Corporation v. Mesa Petroleum Co.that the board of a takeover target could make a discriminatory offer to buy back shares so as to thwart a takeover raider’s plans, Jensen described the ruling as “ludicrous,” “an incredible victory” for the target’s chair of the board, and “a loss for all the rest of us.”

Jensen reacted similarly to a wave of anti-takeover statute enactments by US states in the late 1980s. In his 1988 article on empirical data relating to takeovers, he attributed the introduction of such laws to lobbying by “top level corporate managers and other groups who stand to lose from competition in the market for corporate control” and bemoaned the trend as “another example of special interests using the democratic political system to change the rules of the game to benefit themselves at the expense of society as a whole.” And Jensen in turn drew general negative inferences about managerial priorities, arguing that “Evidence on management actions taken to forestall takeovers is inconsistent with the view that management always acts in shareholders’ interest.”

The Deal Decade came to a shuddering halt as the 1990s began. Jensen, in his 1993 American Financial Association presidential address, bemoaned the “shutdown of the capital markets as an effective mechanism for motivating change, renewal, and exit.” Despite his pessimism, the public company thrived during the 1990s. More than 3,800 companies carried out initial public offerings, share prices surged, and for the first time ever the aggregate market capitalization of publicly traded stocks exceeded US gross domestic product. Nevertheless, there would be no reversal of Jensen’s 180 degree turn regarding the public company. He wrote in 1995:

“The objectives of corporate managers often conflict with those of the shareholders who own their companies. Laws and regulations enacted since the 1930s have effectively put most of the power in the hands of management, frequently at the expense of the interests of the owners of the corporation. At the same time, boards of directors have tended to go along with management and to ignore the interests of the very party they were created to protect.”

A damning verdict indeed for what had been “an awesome social invention” less than two decades earlier.

This post is based on “What Jensen and Meckling Really Said About the Public Company,” to be published as a chapter by Edward Elgar in Elizabeth Pollman and Robert Thompson (eds.), Research Handbook on Corporate Purpose and Personhood.