Senator Klobuchar’s bill includes many useful proposals to bolster antitrust enforcement, but the antitrust laws have been so weakened by the courts and by regulators over the past four decades that a major overhaul is needed.

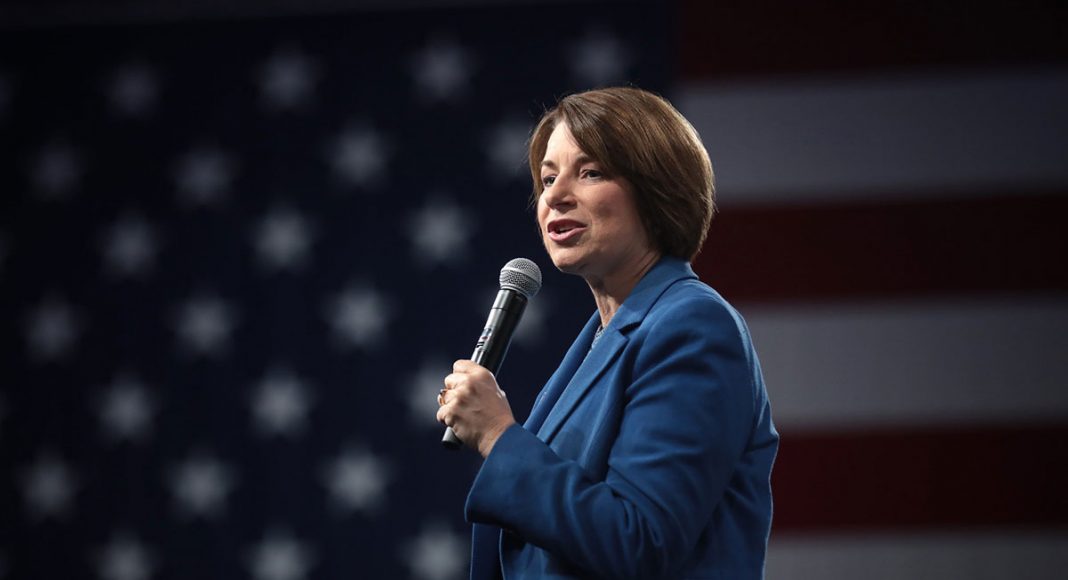

Last month, Senator Amy Klobuchar (D-MN) introduced a bill aimed at giving a boost to antitrust law. The bill surfs a wave of anti-Big Tech sentiment but it seeks to bolster antitrust law in general, rather than target the tech companies exclusively. There is much to admire in Klobuchar’s bill, but it does not go far enough. Courts and regulators have so weakened antitrust law over the last several decades that a major overhaul is in order.

The bill mixes together proposals that would give antitrust enforcement a much-needed shot in the arm, and others that tinker with existing standards in a way that will make little difference. Foremost among the first group of proposals is a significant increase in resources for the Antitrust Division of the Department of Justice and the Federal Trade Commission. Squeezed of resources over the last several decades, and opposed by the most powerful companies in the world, these agencies have not kept up as new technologies, globalization, and intellectual developments have thrown up new challenges to antitrust enforcement.

Other sensible innovations include the creation of a new office within the FTC with a mission to conduct market studies, evaluate past mergers, and sniff out new threats to competitive markets; the introduction of civil fines for antitrust violations; and enhanced whistleblower protections.

The bill also tries hard to strengthen antitrust law by creating stricter legal standards for mergers and other potentially anticompetitive behavior. This group of proposals includes some good ideas—like stronger presumptions against approval of mergers. But here there is less than meets the eye.

The bill adds the word “monopsony” wherever “monopoly” occurs in Section 7 of the Clayton Act, which prohibits anticompetitive mergers. The point of this amendment is presumably to make clearer that mergers that enhance buy-side market power are just as anticompetitive as mergers that enhance sell-side market power. But agencies and courts already recognize that the antitrust laws apply to monopsony as well as monopoly, and mergers are already reviewed for their buy-side effects. The real problem, to which the bill may be implicitly alluding, is the failure of the agencies to review mergers for their labor-market effects, and the traditional hostility of courts to antitrust cases brought by workers. The next version of the bill should go further by laying out clearer guidelines for evaluating labor-market effects of mergers and other business conduct. It should also direct the agencies to study the issue and supplement the legislative reform with regulatory guidance.

“The real problem that Congress must confront and overcome is not the language of the existing antitrust laws, which is broad and flexible. Congress must confront a culture of hostility to antitrust law that pervades the federal judiciary.”

The bill also puts too much trust in subtle variation in legal formulations. It changes the Section 7 standard for evaluating mergers from “substantially” lessening competition to creating “an appreciable risk of materially lessening competition.” The bill defines “exclusionary conduct” as conduct that “materially disadvantages” or “tends to foreclose or limit the ability [of] competitors to compete.” While these and similar changes will do no harm, they will only marginally affect how courts decide cases. Hairsplitting verbiage gets lost in the mountain of idiosyncratic facts that characterize a typical antitrust case.

This is a problem as well in other parts of the bill, which are sensible, but unlikely to have much effect. Sometimes led by the Supreme Court, and sometimes on their own, the lower courts have cut back on traditional antitrust law by adding burdensome requirements. Some courts have hinted that a refusal to deal claim (where a monopolist eliminates competitors by refusing to transact with them) may require proof of an earlier course of conduct; the Supreme Court has imposed a demanding recoupment requirement for predatory pricing claims; the Court has also imposed heightened requirements on parties who challenge one side of two-sided platforms. The list goes on. One section of the bill pushes back on these requirements by providing that they are not requirements but only relevant evidence. One wonders whether such a gentle nudge will influence the courts.

The bill also misses an opportunity for broadening the reach of antitrust law. Recent scholarship has pointed to the risks to competition posed by the massive consolidation of power over capital markets in the hands of the largest institutional investors. The bill takes a baby step by directing the FTC to study the issue. It could have done more—for example, by amending the passive investment exception in the Clayton Act to make clear that institutional investors who exercise voting power are not protected by it.

The real problem that Congress must confront and overcome is not the language of the existing antitrust laws, which is broad and flexible. Congress must confront a culture of hostility to antitrust law that pervades the federal judiciary. Unless it does so, legislative reform will be whittled down by the courts, as has happened many times before, going back to the original Sherman Act of 1890.

One part of the problem is the influence of the Chicago School. The Chicago School correctly pointed out that many types of business behavior that the Supreme Court had condemned as anticompetitive in the past may often be efficient or pro-competitive or harmless. However, the School’s larger influence has been corrosive skepticism about antitrust law. The correct point that certain behaviors, including mergers and exclusive dealing relationships, can be good or harmless has morphed into a strong presumption that virtually any business behavior—other than horizontal collusion—should be permitted unless plaintiffs can marshal overwhelming evidence to the contrary, and often as a practical matter, at the pleading stage, before plaintiffs have had a chance to find evidence through discovery.

The other part is the tendency of many courts to try to get rid of antitrust cases, which pose logistical and intellectual challenges that most district judges would prefer to avoid. The Supreme Court has offered them an array of tools for accomplishing this task: restrictions on standing, heightened pleading standards, deference to arbitration contracts, limitations on class actions, and much else. These tools are often manipulated by defendants—who can adjust their business arrangements so as to limit their exposure to liability from those most likely to sue. But the real damage is that these tools supply courts with pretexts for disposing of cases they dislike.

The bill could do more by overturning Supreme Court and lower court cases that established these limitations on antitrust liability and enforcement. But it takes a long time to change a judicial culture. If Congress seeks to reinvigorate antitrust enforcement, the most direct way to do is to enhance the authority of the agencies by requiring courts to give them more deference.

Even during business-friendly administrations, the Department of Justice and the FTC have taken a more aggressive line on antitrust than the courts have. They also have considerably more expertise. Taking a page from the European competition scheme, and drawing on a homegrown American legal tradition of vesting authority in regulatory agencies, the next version of Klobuchar’s bill should give the FTC and the Department of Justice the authority to conduct formal adjudications of anticompetitive mergers and related behavior, and to require courts to give a reasonable level of deference to their factual determinations and their interpretations of the law.