A new report finds that being linked to human rights abuses—merely appearing in reporting around high-profile events—can significantly influence a company’s stock market value. The informational strategies of civil society, such as “naming-and-shaming”, can have material consequences for corporations caught in the spotlight.

Multinationals are political institutions. They operate where international laws are murky, states are weak, and in a world without a single political authority. By revenue alone, the largest global corporations rival the size of nations. The rise of the multinational poses a key question of governance for scholars of human rights and social scientists. Civil society is seen as indispensable in holding powerful actors accountable. But without formal power, how does civil society govern?

Influential human rights scholars argue that information and publicity are key weapons used by international activists to hold multinationals to account. Social scientists have previously focused on how the publication of human rights abuses—and naming their perpetrators—by NGOs and the media impacts nation-states and their governments. Much less clear is how human rights publicity and media campaigns impact multinational companies.

Our new paper examines how civil society and the media hold multinationals accountable. To do so, we turn to salient, high-profile events: the assassination of environmental activists in the natural resource sector. We examine what happens to the stock prices of publicly traded firms—and their operations—named in publicity around these events.

We find that publicizing abuses significantly impacts the stock value of multinationals at the heart of these controversies. Firms associated with an assassination experience large, negative abnormal returns following an event. Their median loss in market valuation amounts to over $100 million days following the event. We highlight the critical role of the media in making information available to a broader public in this context. Moreover, the negative impact of the publicity from assassinations is more pronounced on days not dominated by other news-worthy events.

“Firms associated with an assassination experience large, negative abnormal returns following an event. Their median loss in market valuation amounts to over $100 million days following the event.”

Deadly Environment

The assassinations we study are part of a larger story of conflict and natural resource extraction in the developing world. In fact, the assassinations of civil society activists embody a rising trend in violence across the global natural resource sector. Multinationals are key players in this story. In particular, those operating in the mining industry, which represents one of the most dangerous sectors for activists.

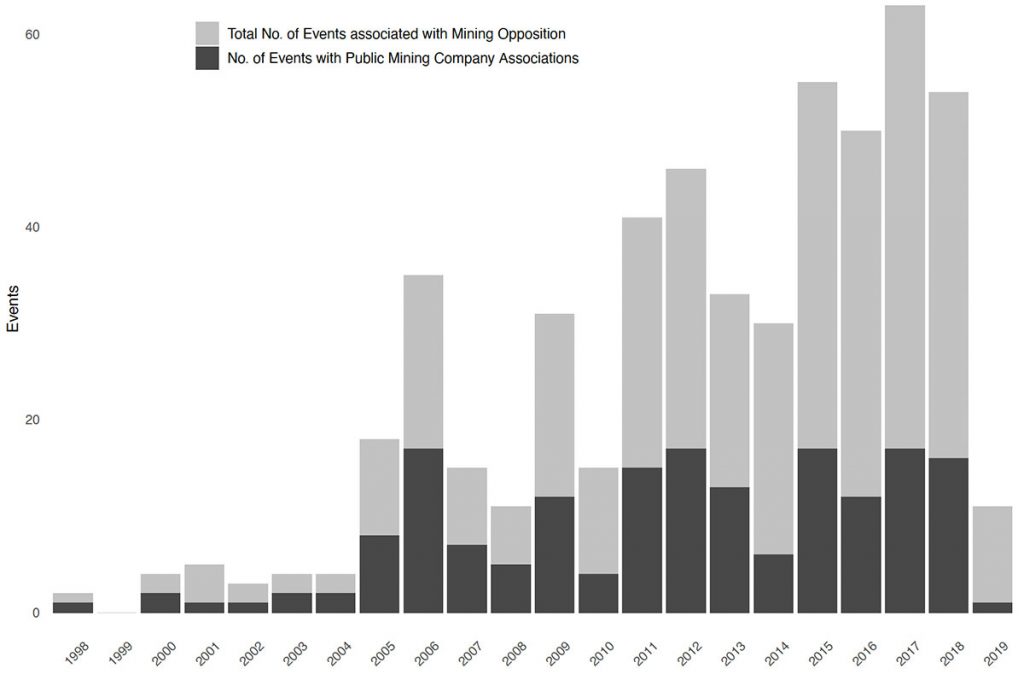

While these assassinations highlight the conflict between civil society and multinationals on the global periphery, they are also the target of international publicity campaigns meant to shine a spotlight on activist deaths. To study the impact of publicity we spent years hand-collecting news on the assassination of environmental activists. Our study examines 354 killings related to mining opposition in 31 countries over the period 1998-2019. Figure 1 shows the increasing acts of violence in the global mining sector over the past 20 years.

Figure 1 highlights another critical piece of data in our study: publicly traded mining companies. The dark grey bars show assassination events where publicly listed corporations—or their operations—are named in the press or public documents. In total, we are able to link 227 out of 354 assassinations to at least one mining company; among them 87 distinct public corporations.

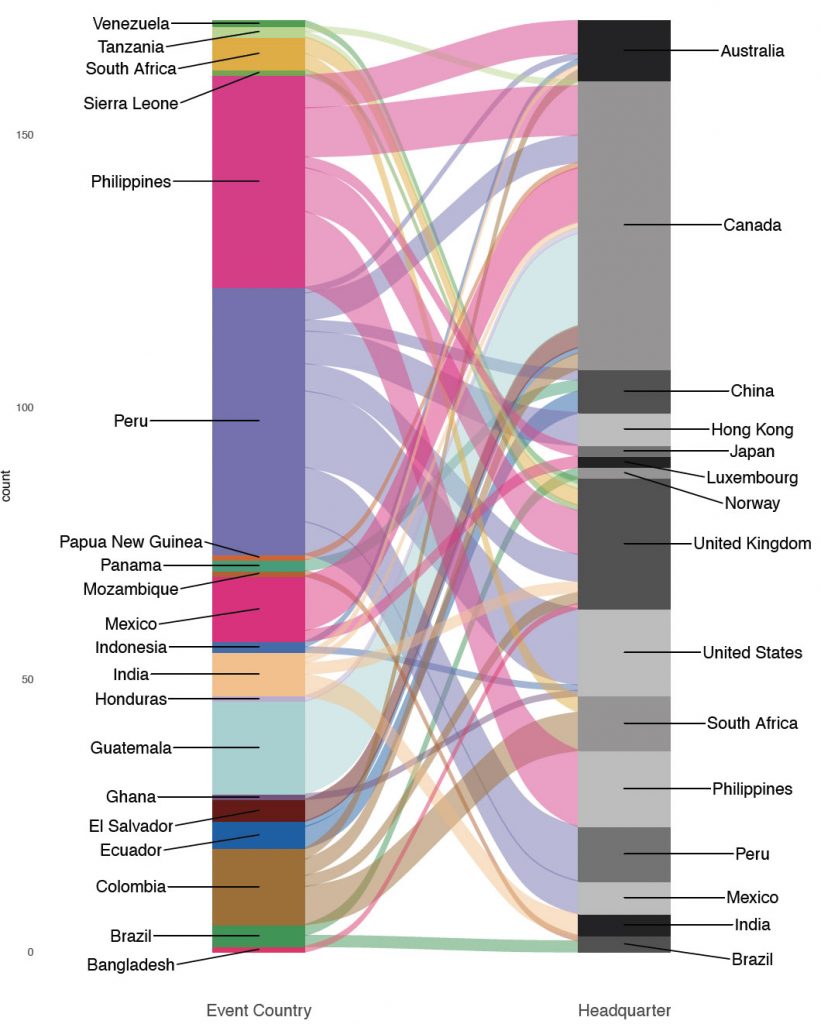

The alluvial plot in Figure 2 shows the global relationship between the publicly-traded companies in our study (right) and the assassinations surrounding their operations (left). In our data, Peru and the Philippines are the deadliest countries for mining activists, while Latin America is a regional hotspot for violence against civil society. On the other hand, companies headquartered in Canada, the United Kingdom, and the United States are frequently tied to media coverage of assassinations. Though these three countries are ones with strong legal institutions, suits against multinationals for human rights abuses abroad have yielded little to no success in court. The headquarter countries in Figure 2 beg the question: If multinationals are unlikely to face accountability for human rights abuse abroad, can the informational tools of civil society impact them?

The Value of Publicity

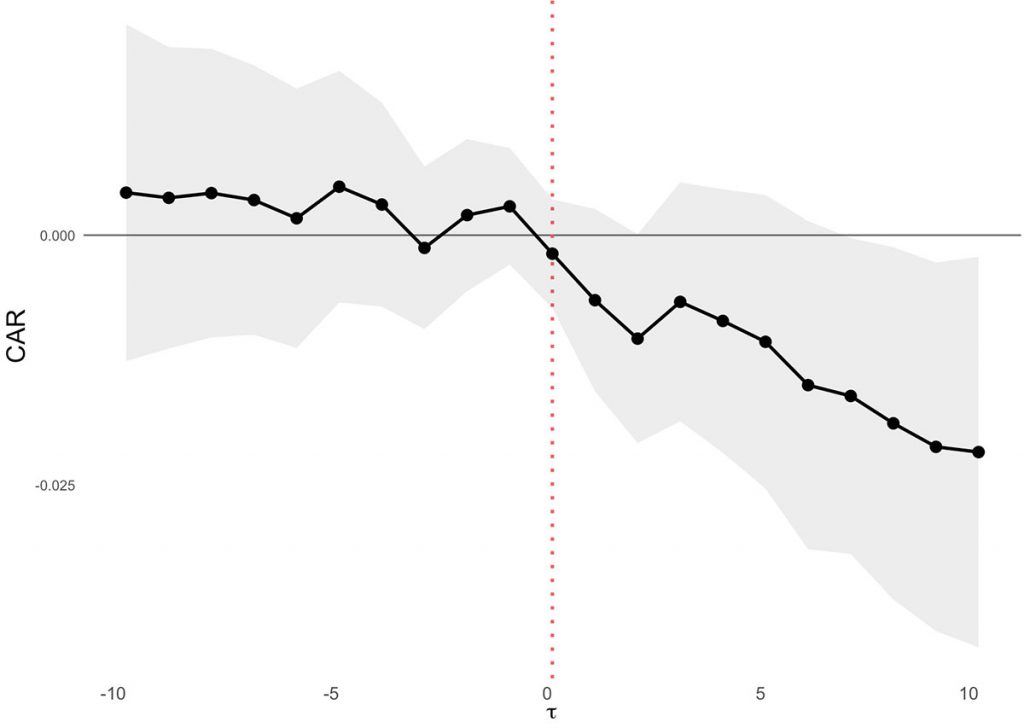

We study the power of publicity by examining how the stock prices for companies—those featured in human rights reporting—respond in the days after (and before) an assassination. More precisely, we examine the “cumulative abnormal returns” (CAR) of companies on the days surrounding an assassination, which capture the difference between the actual returns and the return we would have expected if the assassination had not occurred.

We find that the human rights spotlight has the power to impact companies. Figure 3 plots the effects for ten days before and after the assassination takes place. Specifically, we show the difference in cumulative abnormal returns for firms named in coverage of assassinations (“treatment group”) versus control firms “control” firms—those in the same country during the event year, but without such associations. Relative to control firms, companies named in reporting have negative abnormal returns directly following the assassination event at day 0 and these effects accumulate through time. Meanwhile, we do not observe a difference prior to the event.

These impacts matter. Figure 3 shows that by day ten after an assassination, the abnormal returns for exposed mining companies are between -2.2 to -3.3 percentage points. This market behavior is consistent with investors taking time to absorb the information and assess the risk for mining companies tied to assassination events. The effect is, moreover, economically significant. For companies named in publicity, we calculate that the median 10-day cumulative loss in market capitalization is over $100 million.

Importantly, our research design controls for an array of factors that could influence our results, or drive the negative effects in the data. For example, we account for contemporaneous political tumult in an event country that may drive results. Similarly, our design controls for general changes in market sentiment towards an event country’s mining industry following violence. Moreover, we compare treatment and control companies with a similar comparative advantage for operating in high political risk environments. Additionally, we control for firm characteristics that could influence the effects we observe. For instance, small or highly-leveraged firms may be more dependent on specific mining projects, and thus differentially impacted by violent events.

The pattern in Figure 3 presents a story we find consistently in the data. Across different analyses and different controls, the data delivers a core message: companies and projects named in assassination coverage face a significant hit in the days after an assassination.

The Role of the Media and the Incentives for Abuse

Our study highlights the importance of media attention. To show the importance of media, we consider how the negative effects of publicity change when they compete with other newsworthy events. Specifically, we compare how stock markets react to assassinations during periods of slow news cycles versus periods dominated by other newsworthy events. We show that the negative impact of assassinations disappears when they coincide with competing news stories, yet the penalty survives when assassinations occur over slower news cycles.

Similarly, we find that companies explicitly named in news coverage pay a particularly heavy price. We do so by comparing companies named in publicity to those close, or geographically proximate, to assassination events. We show that listed companies with operations close to the event do not experience significant penalties following the assassination, compared to firms near events but named in human rights reporting.

Likewise, we find the most nimble, news-sensitive players in the market react the most to media coverage of violence. We do so by examining how various institutional investors change their holdings after high-profile assassinations. We show, specifically, that investors that follow event-based trading strategies, such as hedge funds, divest more in mining companies relative to other types of institutional investors.

Being caught in the spotlight has material consequences for multinationals. Yet, if being associated with human rights abuse impacts a firm’s value, why do events continue? We provide a glimpse into the incentives for violence. Specifically, those who benefit from local mining operations.

Collecting data on taxes and royalties paid by mining firms to domestic governments, we show a link between violence and how important mining is for domestic elites. We find that the probability of assassinations is positively related to how important a firm is for local state revenue. We believe this relationship is revealing that local authorities may have an incentive to eliminate opposition to lucrative mining projects. An issue potentially exacerbated by limited control of multinationals over the behavior of local affiliates.

In short, being linked to human rights abuses—merely appearing in reporting around high-profile events—can significantly influence a company’s stock market value. We believe this research highlights the importance of considering the political role played by multinationals. With this in mind, we find that the informational strategies of civil society, such as “naming-and-shaming,” can have material consequences for corporations caught in the spotlight.