Due to lack of transparency and mystery rebates, which are considered trade secrets, figuring out the price of a prescription drug is devilishly difficult. Our work shines a light. Going forward, one way to restore sanity to drug pricing is to make list price the touchstone reference for drug pricing throughout the supply chain.

Editor’s note: An earlier version of this article first appeared on www.statnews.com on November 23, 2020. This article has been published with permission from STAT.

A late-in-the game administration rule issued on October 29 by the Trump Administration will require insurance companies to tell their customers in advance what the out-of-pocket cost will be for a drug and what the drug company actually paid for it. Even though the rule only applies to private insurance, rather than Medicare and Medicaid, and it is likely to be bogged down quickly in litigation over issues such as proper rule-making procedure, freedom of speech, and trade secrets, it represents a major attempt at making the market more efficient by providing information to patients.

But behind the outrage over pharmaceutical profiteering and the technical rule-making lies a pressing question: What is the price of a drug?

At first glance, that may seem like an obvious question. In the world of prescription drugs, however, price is a murky term. Drug companies are often maligned for the headline-grabbing list prices they charge. But they argue—and rightfully so—that the list price does not necessarily reflect the price of an individual drug purchase. Although patients may pay for a drug based on the list price, drug companies argue that the true price is lower because drug companies shell out rebates long after a patient has completed her purchase.

So what is the amount of that rebate? Drug companies won’t say—not even to auditors and regulators. In fact, researchers and regulators have struggled mightily to determine post-rebate prices. Drug companies refuse to disclose that information, arguing that rebates and post-rebate price information are trade secrets.

“Trying to reform the system to improve market information and clarify the rebate mystery—or even talk about it—is like shadow boxing.”

Trying to reform the system to improve market information and clarify the rebate mystery—or even talk about it—is like shadow boxing.

The Origin and Mystery of a Drug’s Price

The market “price” of a drug begins in a perfectly ordinary fashion. A drug company sells its product to wholesalers, and the company must report the wholesale price to the federal government. This figure, which must be confirmed by actual sales, is statutorily defined and reported to the Centers for Medicare and Medicaid Services.

However, the wholesale price quickly sinks into an impressively obscure pool of industry terms: wholesale acquisitions cost, maximum allowable cost, average wholesale price, and more. Many of these terms lack consistent definitions, are not verified, or are not based on actual sales transactions.

In theory, a patient would pay the wholesale price with a small markup for the wholesaler’s profit. That would then be the list price. Yet in many circumstances, the list price is only the beginning. Drug companies offer substantial rebates—not to the patient, but to the patient’s health plan. These rebates are offered as a reward to the health plan if the plan’s patients buy a sufficient volume of the drug, and drug companies can demand to be favored in the health plan’s reimbursement system as a way of ensuring a high volume.

Of course, the patient never sees any of these rebates, at least not directly. Instead, payments are made to middle players—the pharmacy benefit managers that work for the patient’s health plan—and are based on large groups of purchases. Pharmacy benefit managers generally get to keep all or part of the rebate, and any portion passed on to the health plan may be used to lower the plan’s premiums (what a patient pays to enroll in the plan) or for other expenditures. In other words, the actual post-rebate price of a particular drug at a particular moment is impossible to determine.

Even With Rebates, Drug Prices are Rising

This pricing system raises two big questions about creating a more competitive marketplace and improving information about what patients pay: How can the government tackle rising prices if no one really knows the extent to which prices are rising or how dollars are flowing through the system? And how can lawmakers respond when drug companies can defend against criticisms of rising drug prices by noting that prices are lower than anyone realizes due to rebates—but then refuse to reveal any information about post-rebate prices?

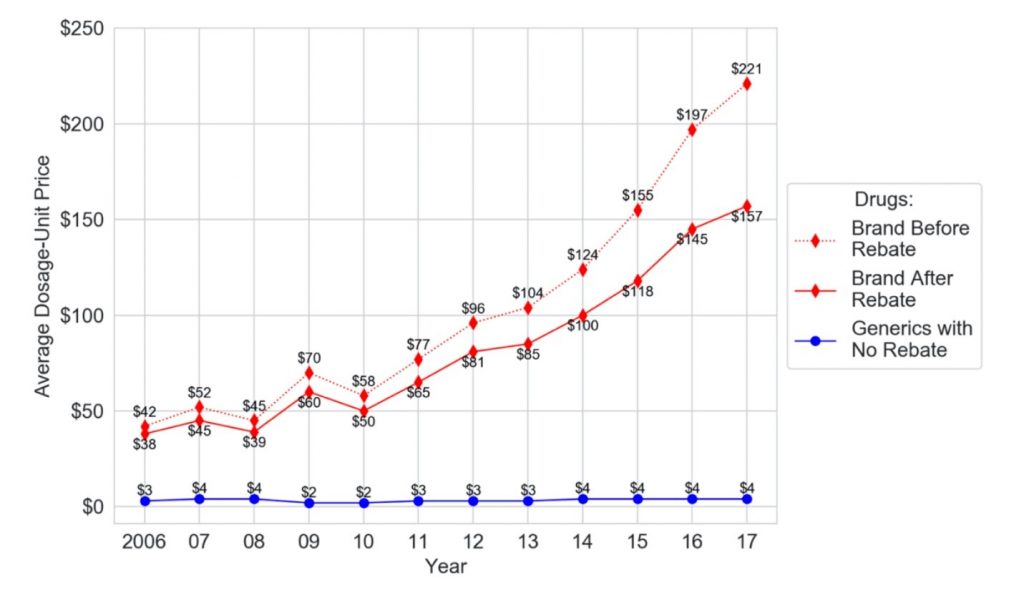

My research has found a way through the impasse. As part of a broader review of the drug pricing system, I analyzed data from the Centers for Medicare and Medicaid Services, following 1 million Medicare Part D patients between 2006 and 2017. This work was just published in the peer-reviewed Journal of Law and the Biosciences.

Since drugs are often dispensed in different dosages or quantities, my research team and I created an average dosage-unit cost for particular drugs in particular years, using data from tens of millions of claims. To understand the average dosage-unit costs, consider an analogy from the beer industry: Imagine a 12-pack of Bud Light cans standing next to a single bottle of Heineken. To compare pricing between the two, you need to know the price of one ounce of Bud Light beer compared to one ounce of Heineken beer. We then used other information derived from Medicare data to determine post-rebate pricing.

The conclusion is stark. Although rebates rose, prices rose faster, far outstripping the effects of the rebates. In fact, the average dosage-unit price of branded drugs after rebates rose a shocking 313 percent across the 12-year study period, from $38 to $157. During that period, the corresponding price for generic drugs barely budged—from $3 to $4 —creating an ever-widening gap. In fact, the difference between generic and after-rebate brand prices rose from $35 in 2006 to $153 in 2017.

Although generics are far less expensive than brand-name drugs, the study found that they are increasingly disadvantaged in health plan formularies. Formularies determine which drugs a patient’s insurance plan covers and at what co-pay or co-insurance cost. In theory, cheaper drugs should be placed on lower tiers, where patient costs are lower.

Between 2010 and 2015, however, my study found that the percentage of generics on the lowest tier of formularies fell substantially. The shift to higher tiers creates a considerable burden for patients, given that the average co-pay triples when a drug moves even from the first tier to the second. It also underscores how generics are not improving the competitive landscape of drug pricing as they are intended to do.

“[G]enerics are not improving the competitive landscape of drug pricing as they are intended to do.”

Although understanding the true price of a drug is essential for any reform discussion, understanding the price before rebates is also important. Many people do pay the full, pre-rebate list price, at least at certain times, and some have payments that are tied to the list price. Specifically, some patients pay full price until reaching a deductible; others pay coinsurance as a percentage of the list price rather than a flat co-pay.

My study also examined pre-rebate prices to understand the trajectory from the perspective of these patients. The trajectory for pre-rebate prices was even worse than for after-rebate prices. Between 2006 and 2017, the average dosage-unit price increased 426 percent, rising from $42 to $221, as the price of generics remained essentially the same.

It’s important to note that the study did not examine how rebate dollars that are returned to the health plan—as opposed to those retained by pharmacy benefit managers—might flow back into overall costs in the system. There is some evidence that rebates help defray patients’ premium costs (their cost of enrolling in a health plan). Fully understanding the flow to health plans would require determining how much money goes toward premium reduction as opposed to executive pay or other expenditures, and how these flows affect premium payments among different types of patients.

For example, to the extent rebates reduce premiums, scholars have pointed out that rebates may actually shift cost burdens away from healthy patients and onto sick patients. Insurance is supposed to operate in the opposite manner, spreading the impact of a burden away from the party experiencing the burden and across a larger group, to soften the blow.

Improving Market Information by Embracing List Price

An unruly problem demands a disruptive solution, and therein lies the startling recommendation arising from this research. Knowing the true net price isn’t necessary for restoring sanity to drug pricing and improving competition. The solution is to make list price the touchstone reference for drug pricing throughout the supply chain.

Focusing on the list price eliminates the need to ferret out and decipher complex deals. It also avoids the practical problem of navigating around parties’ claims that trade secret law protects net price information. Using the list price also has the beneficial side effect of removing incentives for the rebate and quasi-kickback games that drug companies use and pharmacy benefit managers demand.

Despite widespread recognition of the problems related to drug pricing, access, and market competition in the pharmaceutical industry, complex legislative and regulatory reform attempts have failed. In contrast, a simple congressional, regulatory, or even presidential mandate that government programs use list prices for formularies would sweep aside the incentive for playing the rebate game. By doing that, the price—and its implications—are already set, and the information is fully available to the market. The price is the price.