Economists typically assume that capitalists and workers are different people. A new study, however, finds that the intersection between the top decile of capital-income recipients and labor-income earners is growing.

In classical political economy, it is assumed that the people who receive most of their income from ownership (capital) are different from those who receive most of their income from working (labor). Capitalists were not only assumed to be richer than workers, but to have their entire income come from property (stock market investment, interests from savings, rented out housing, and the like). Similarly, few workers were thought of as deriving part of their income from ownership of property.

To some economists, like Marx, this contradiction was antagonistic and inevitably led to conflict. For neoclassical economists, notably for John Bates Clark, the architect of the marginal productivity theory of income distribution, social classes collaborated in producing a greater output. But neither Marx nor Clark doubted that these two large groups of people existed and that they differed from each other.

Several studies in the United States, however, among them Atkinson and Lakner (2017), Milanovic (2019), and Zwick et al. (2019), show that the workers-capitalists dichotomy may no longer hold. In fact, a growing percentage of people who receive lots of income from property also have high wage earnings. Using data from US household surveys over the past thirty years, Milanovic showed in his book Capitalism, Alone that the percentage of people in the top decile of capital income who are also in the top decile of labor-income recipients has steadily increased in the United States from around 15 percent in 1980 to almost 30 percent in 2017. He called this phenomenon homoploutia, from the Greek word homo for equal and ploutia for wealth or “richness.” More recently, our paper documented the evolution of homoploutia in the United States over the past 70 years using three different sources of data and hypothesize what brought it along.

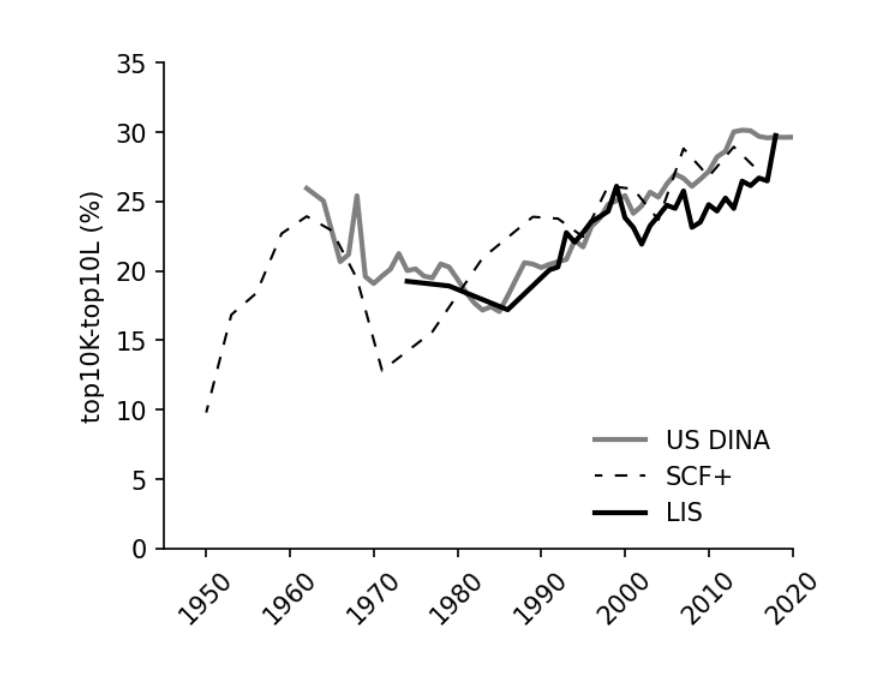

We define homoploutia as the intersection between the top decile of capital-income recipients and labor-income earners. The greater the intersection between the two, the more we move away from the capital-labor dichotomy, at least at the top of the income distribution. The three datasets that allow us to document homoploutia from 1950 until 2020 are the Luxembourg Income Study, the US Distributional National Accounts produced by Piketty, Saez, and Zucman (2020) and the Survey of Consumer Finances. Very importantly, the three data sets, collected independently and whose definitions of recipient units are not identical, agree about the rising importance of homoploutia and about the timing of the turning point.

As shown in the figure below, homoploutia was low after World War II, has increased by the early 1960s, and then slightly decreased until the mid-1980s. Since 1985, however, it has been sharply going up. In 1985, about 17 percent of adults in the top decile of capital-income earners were also in the top decile of labor-income earners. In 2018, this indicator was about 30 percent.

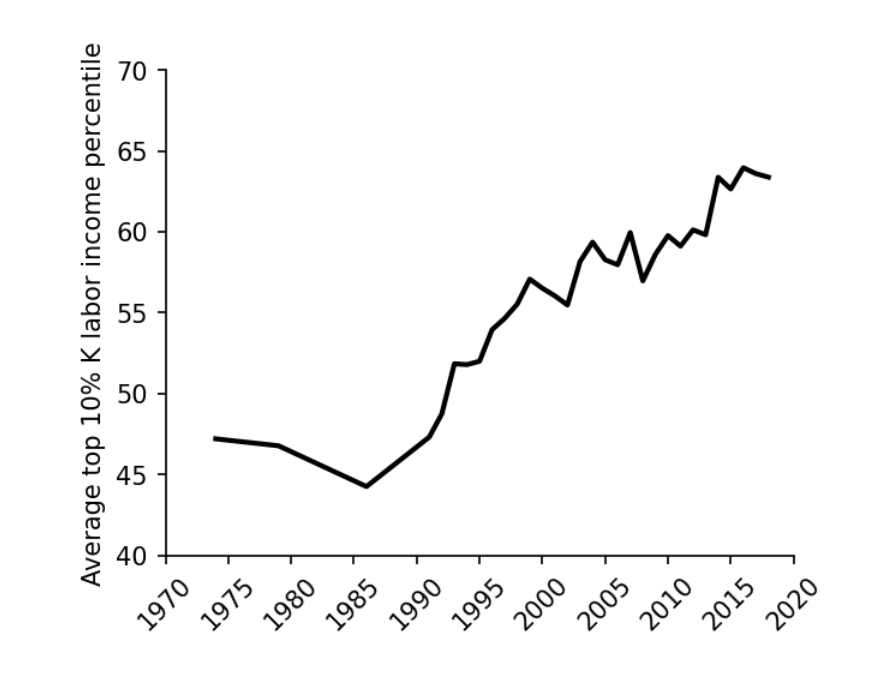

There are several other ways in which we can measure homoploutia. The chart below shows where (at what percentile) in the labor income distribution are, on average, people who are in the top decile by capital income. In classical capitalism, where top capitalists are unlikely to earn much from labor, we expect that their average position in the distribution of labor income should be low. This is confirmed by the results: up to the mid-1980s, top capitalists’ labor income was, on average, below that of the median wage earner (i.e., below the 50th percentile of labor earnings). Today, they are, on average, around the 65th percentile.

How important is homoploutia in explaining the increase in US income inequality? According to Piketty, Saez, and Zucman, the income share of the richest decile in the US went up between 1986 and 2020 by 10 percentage points, from 37 percent to 47 percent. We find that the increase in homoploutia has contributed 2 percentage points, or 20 percent, to this increase.

Where does homoploutia come from? The data do not allow us to determine that with certainty, but they allow to investigate what is consistent with individual hypotheses. There is strong evidence that increased wage-stretching that began around 1980 is associated with the rising homoploutia (the other alternatives that do not perform as well are rising inequality of capital incomes and rising capital share).

The link between higher inequality of labor incomes and homoploutia might have occurred in two ways. The first is that many high-earning individuals saved a large share of their wages, invested it, and after some years began receiving large capital incomes. The second is that many capital-rich people decided, perhaps because of changed social norms, or because top jobs became more lucrative as marginal tax rates were reduced, not to treat university education as “luxury consumption” but rather to use it to secure good jobs. It could be, of course, that both mechanisms were at work.

This leads us to the social implications of homoploutia: First, having a growing number of the rich who are rich in terms of both property and skills (human capital) may enable them to create an upper class that has little in common with the rest of the population. This upper class would be able, as the evidence shows, to invest heavily in children’s education, which in turn allows them to command high wages. This reduces social mobility. Second, from an ethical point of view, high taxation of a homoploutic upper class becomes more difficult: the rich are not mere passive coupon-clipping rentiers of the classical capitalism, but hard, and often excessively hard, working wage-earners. In a 2008 study, for example, Peter Kuhn and Fernando Lozano find that in 2002 the best-paid quintile (20 percent) of workers were twice as likely to work long hours (defined as more than 50 hours per week) as the bottom quintile of workers.

Homoploutia might thus, at the very top of income distribution, dispense with the old problem of class stratification, but at the “cost” of opening up a new problem of a self-reproducing elite.

References

- Atkinson, Anthony B., and Christoph Lakner. 2017. “Capital and Labor: The Factor Income Composition of Top Incomes in the United States, 1962–2006.” Tech. Rep., The World Bank. doi:10.1596/1813-9450-8268.

- Berman, Yonatan and Branko Milanovic. 2020. “Homoploutia: Top Labor and Capital Incomes in the United States, 1950–2020”, Stone Center on Socio-Economic Inequality Working Paper No. 28, December.

- Kuhn, Peter, and Fernando Lozano. 2008. “The Expanding Workweek? Understanding Trends in Long Work Hours among US Men, 1979–2006.” Journal of Labor Economics (The University of Chicago Press) 26: 311–343.

- Markovits, Daniel. 2019. The Meritocracy Trap. Penguin UK.

- Milanovic, Branko. 2019. Capitalism, Alone: The Future of the System That Rules the World. Harvard University Press.

- Piketty, Thomas, Emmanuel Saez, and Gabriel Zucman. 2020. “Distributional National Accounts Micro-Files.” Distributional National Accounts Micro-Files.