Direct loan cancellation is not the only policy option to lower student debt. If policymakers want more targeted loan forgiveness, aimed at lower income individuals, there already exists a system in place— income-driven repayment plans.

Student loan forgiveness has increasingly been in the public eye given recent proposals to cancel some student debts. There are many popular misconceptions about student loan forgiveness. First, cancelling student debt does not mean that a liability simply disappears—the cost is transferred from the borrowers to taxpayers. When we talk about student loan forgiveness, we are really talking about having taxpayers pay for the costs of college for current borrowers. This may or may not be desirable from a public policy standpoint, depending on a number of factors and the objective of policy makers.

One common misconception is that student loan forgiveness is only a proposed policy. In fact, there are currently several forgiveness programs. The largest forgiveness program is through income-driven repayment, or IDR plans. Borrowers in IDR plans pay a portion of their income, either 10 or 15 percent, above 150 percent of the poverty line. Then, after twenty or twenty-five years, depending on the plan, remaining balances are discharged. While modern IDR plans began to be offered in the US in 2009, IDR plans are common across the world and have been available in many places for decades. For example, in the UK and Australia all student loan borrowers are automatically enrolled in IDR plans. There are also other forgiveness options for some borrowers: for example, Public Sector Loan Forgiveness (PSLF) offers some loan cancellation to borrowers who work in public service for ten years. To date, relatively few applications under PSLF have been accepted largely due to bureaucratic hurdles.

“The largest forgiveness program is through income-driven repayment, or IDR plans.”

While IDR plans can lead to substantial forgiveness for low income borrowers, take-up remains incomplete. Only approximately one-third of student loan borrowers are enrolled in IDR. One problem is that many borrowers do not enroll in IDR plans due to cumbersome paperwork. A recent paper of mine with Holger Mueller at NYU Stern shows that eliminating paperwork drastically increases take-up of IDR plans. Another issue is that some borrowers can end up paying more under IDR plans. This can happen because, if borrowers make very low payments initially, interest can accrue through a process called negative amortization.

Thus, for borrowers who have IDR plans available, significant loan forgiveness is already available. When we are discussing further forgiveness options, what is really meant is forgiving loans for borrowers whose incomes are too high to qualify for forgiveness under IDR. Of course, enrolling borrowers in current IDR plans or cancelling debt are not the only possible policy options. One possibility is to make IDR plans more generous, for example by raising the threshold above which individuals pay to more than 150 percent of the poverty line.

For example, the federal poverty line in 2020 for a family of three is $21,720. Thus, individuals earning below $32,580 would pay nothing under an IDR plan. For each dollar someone earns above $32,580, they would pay ten cents under the Pay As You Earn plan, one of the more popular IDR plans. If a borrower earned $50,000, they would pay $1,742 annually, or about $145 dollars a month, regardless of their loan balance. For comparison, a borrower with a $50,000 balance and a four percent interest rate would pay $506 a month under the standard plan. Borrowers in a family of three would not end up paying a similar amount unless their income was close to $100,000. IDR can thus offer lower monthly payments and substantial savings for many lower and middle income borrowers.

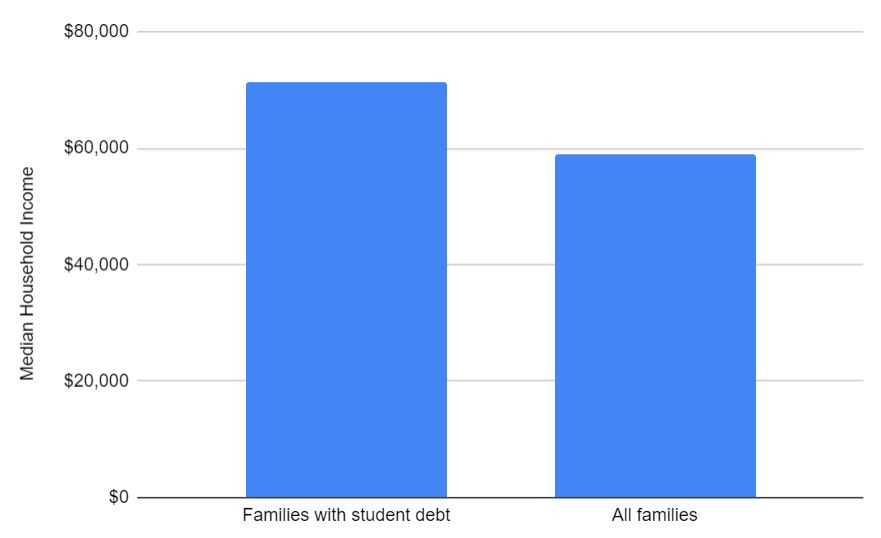

Another common misconception is that student loan forgiveness is a progressive policy. If progressivity is defined by the share of dollars given to each decile of the income distribution, this is not the case. This is because individuals with more student debt tend to earn more than individuals without student debt. According to the 2019 Survey of Consumer Finances, the median household income for families with student debt is $71,300. The median household income for all families is $59,100. While this may seem counterintuitive, the reasons for this pattern become clear once we think about who actually holds student debt, on average. Individuals who went to college earn more than individuals who did not go to college, and typically individuals who spent more time in college earn more than those who spent less time in college. In other words, a typical medical school graduate earns more than a typical community college graduate, who usually earns more than an individual who never went to college. Thus, universal debt forgiveness primarily benefits higher earners.

In a new joint paper with Sylvain Catherine at Wharton, we study the progressivity of student loan forgiveness options by computing the present values of outstanding balances. We find that direct loan cancellation policies are highly regressive, even if capped at $10,000 or $50,000. When the present values of loans are computed, loan forgiveness policies become even more regressive. The reason for this is that many lower-income borrowers are already not repaying their loans. Under a full cancellation of student debt currently in repayment, the top 20 percent of earners would obtain $192 billion, while the bottom 20 percent of earners would obtain $29 billion. The benefits of universal loan forgiveness would thus primarily accrue to high earners.

On the other hand, under expanded or more generous IDR plans most of the benefits accrue to the bottom and the middle of the income distribution. In fact, expanding IDR programs transfers more dollars to low income households, at a lower overall costs relative to universal loan forgiveness. This occurs because under IDR plans, high-income households do not see significant forgiveness. IDR effectively provides a targeted way of offering loan forgiveness.

Of course, there may be other benefits or drawbacks of student loan forgiveness. Arguments for forgiving student loans may be based on the possibility that these distort career choices, credit constraints may hinder entrepreneurship, debt overhang may distort labor supply decisions and debt relief may have macroeconomic consequences. IDR plans may also function in a fashion similar to a tax and reduce labor supply. On the other hand, colleges may use expected forgiveness to hike tuition. There is substantial evidence of the “Bennett hypothesis,” that increase in federal lending increases tuition.

Direct loan cancellation is not the only policy option. If policy makers want more targeted loan forgiveness, aimed at lower income individuals, there already exists a system in place—IDR. A more nuanced policy discussion would weight various options, and consider targeted forgiveness options.