A new paper examines whether shareholder activists tailor their campaigns to persuade large institutional investors and finds that in proxy communications, activists use phrases to align attack text with fund families that own a larger share in the targeted firm.

Hedge funds that engage in shareholder activism provide essential governance checks and balances for corporate America. Hedge fund activists engage with the management of firms they are invested in to push through changes, often in a confrontational way. The goals of the confrontational proxy attacks range from increasing shareholder value through changes in board structure, financing structure, corporate strategy, and cost cutting to pursuing social justice via climate friendly policies, women empowerment, and push for reduced carbon footprint.

One of the hurdles these activists face is that they do not have enough voting clout. Often, activists own just 5-8 percent of the targeted firm’s market cap, which is not enough to dictate outcome of the proxy attack. Therefore, activists usually hope to rally institutional shareholders to push through the majority support needed for their proposals. Increasingly, these institutional shareholders happen to be mutual fund institutions, or fund families. For example, just three fund families—BlackRock, Vanguard, and State Street—were the largest shareholder in 438 of the S&P 500 companies as of December 2018. The concentrated ownership structure gives hedge fund activists a chance to focus on just a few mutual fund institutions and still gather support from big chunks of voting blocks.

Engaging with stakeholders in the targeted firm is central to activism. Compared to traditional investment managers, who focus on entering and exiting investments positions based on a firm’s expected market value, the activists try to improve the firm’s market value by appealing to shareholders, winning shareholder elections, and altering the targeted firm’s strategies.

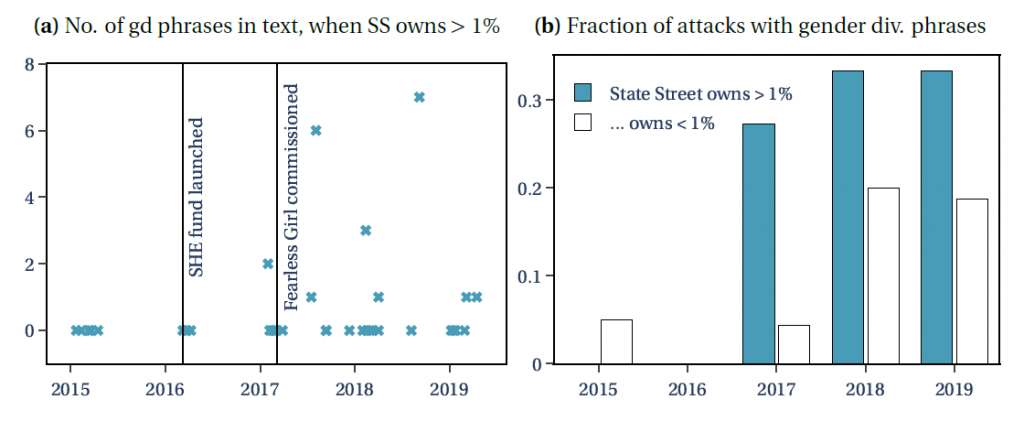

In their quest to win shareholder elections, activists have increasingly started focusing on issues that matter to larger shareholders. For example, a recent push from fund families to broaden gender diversity on corporate boards has coincided with a shift in hedge fund activists’ communications. State Street recently pledged to “vote against the entire slate of incumbent board members if a company does not have at least one woman on its board.” Earlier, the fund family started a gender diversity-focused fund, aptly named SHE, and installed the famous Fearless Girl statue on Wall Street. Simultaneously, whenever State Street was a major stakeholder in a firm that activists were actively targeting as part of their campaign, activists began using gender diversity phrases in their communications.

“In their quest to win shareholder elections, activists have increasingly started focusing on issues that matter to larger shareholders.”

Thus, activists provide a channel via which fund family preferences influence corporate governance, even when these families do not seem to actively seek such an influence. In a new paper, I examine whether activists tailor their campaigns to persuade these large shareholders and the impact of their strategies.

Hedge funds pushing fund families’ agendas has regulatory implications. Due to their enormous size and cross-holdings, fund families are restricted from engaging with managers in an openly confrontational way. As a prevention mechanism against anticompetitive influence, the SEC has different filing requirements based on the investors’ desire to influence. The SEC’s disclosure system is designed to deter the large institutes from exerting anticompetitive influence. Mutual funds influencing firms via activism echoes the concern that a few shareholders wield disproportionate power over the direction of corporate America.

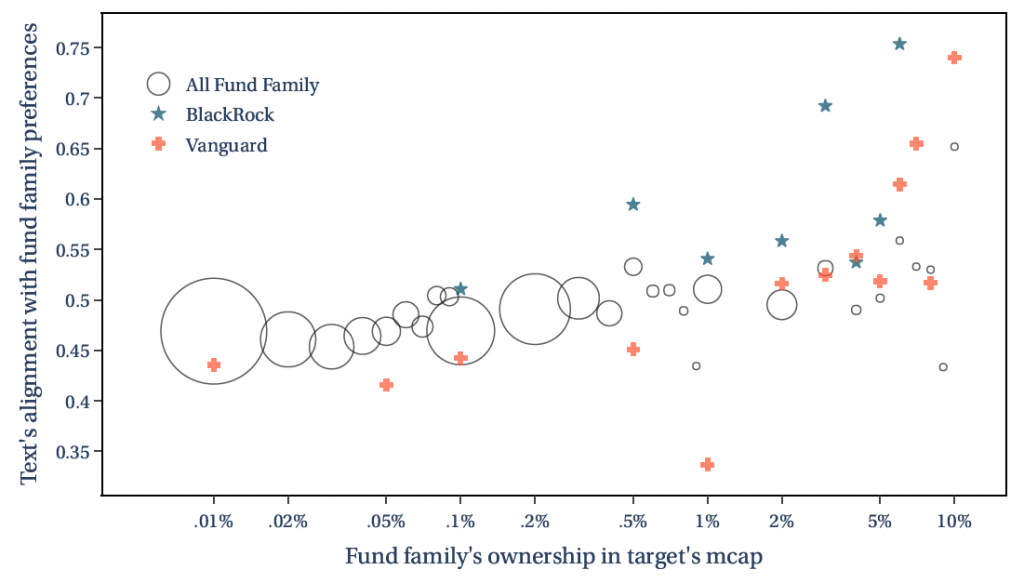

An empirical challenge to proceed with this study is knowing what these fund families want and how aligned a particular attack is with the fund family. There are hundreds of dimensions on which preferences vary among fund families, including shareholder’s proxy access, executive pay structure, takeover defense, etc. For example, compared to Vanguard, Fidelity has supported a much higher fraction of proposals across the years to implement simple majority voting standards. Moreover, the preferences also vary with respect to time. Issues such as climate change, diversity and inclusion, which have been at the forefront of discussions in last few years, were not a major issue for these institutes a decade ago. As such, it is somewhat difficult to objectively measure an attack’s alignment with a particular fund family.

To manage these variations, I use a supervised machine-learning model, named Support Vector Regression (SVR) that relates the fund family’s voting choices with shareholder proposals’ textual features (phrases). For instance, during 2017–2018, DWS voted against management recommendation in 97 percent of climate-related proposals; in contrast, Vanguard voted against management recommendation in only six percent of such proposals. Thus, the machine learning model trained on these proposals will figure out that phrases such as “climate change,” “environmental concerns,” etc., are important for DWS and assign a higher coefficient to these phrases. To measure the attack text’s alignment, I use frequencies and weights for phrases in the activist’s communication. An attack that focuses on environmental issues, and thereby uses climate-related phrases, is considered better aligned with DWS preferences.

I find that in proxy communications, activists use phrases to align attack text with fund families that own a larger share in the targeted firm. The figure 2 below relates the attack text’s alignment with the fraction of target’s market cap the fund family holds. As the fund family ownership in targeted firm increases, the activist tends to align communications more to-wards the fund family, illustrated by an upward trending plot. The results hold true, if we fix for fund family and attack level variations. Thus, the activists discuss issues such as gender diversity more, when an interested fund family like State Street owns more shares in the targeted firm.

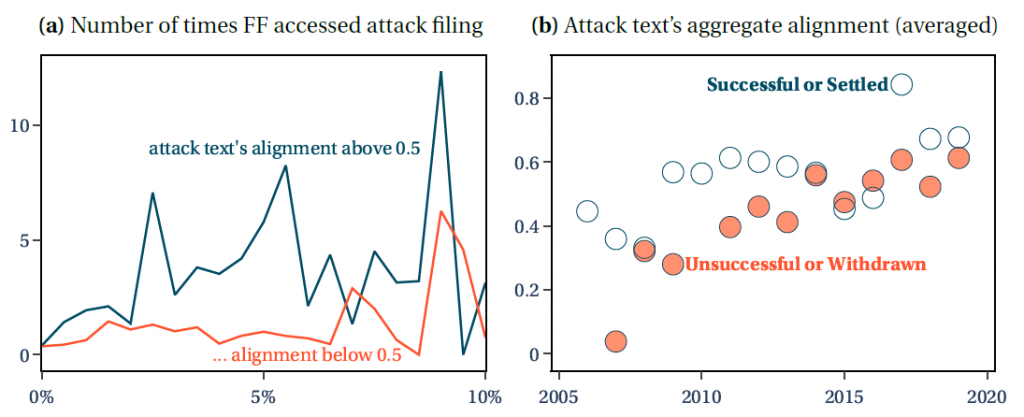

The campaign tailoring affects how fund families react to activists proposals. The fund family to whom the attack is well aligned tends to pay more attention to the attack. The figure 3a below shows that the fund families are more likely to view filings of attacks on SEC.gov where the activists talk about issues relevant to the fund. These fund families are also more likely to vote in favor of the activists when they talk about issues that matter to the families. I find that the attacks that are well aligned with larger shareholders are also more likely to be successful. In the figure 3b below, the aggregate alignment of successful attacks on average is higher than the unsuccessful ones.

The success of the strategy is shaping the interactions between parties. I define hedge fund-fund family significant interaction as an attack by the activist where the fund family owns more than one percent of the target’s market cap. The activists learn from their activism experience with fund families and align their communications better with every significant interaction. The hedge funds learning curve could explain the increased success of activists and the increased openness of some institutions to activists’ demands. For example, in his 2015 letter to CEOs, BlackRock CEO Larry Fink stressed that short-term thinking is getting in the way of long-term business growth. In contrast, Fink admitted in 2018 that the interactions between targets and activists are often productive for long-term investors like his funds.

Thus, the shareholder base’s implicit preferences influence the issues raised, as well as interactions between parties during proxy solicitations. Activists act as a vessel for larger shareholders’ agendas, increasingly using language to placate their preferences, and their tailored campaigns enjoy improved shareholder attention, more votes, and a greater likelihood of success.