A new paper finds that judges who attended law schools with a strong law-and-economics intellectual environment use more economic reasoning, which is positively correlated with a higher frequency of pro-business decisions.

A duel of experts played out in the AT&T-Time Warner merger lawsuit, referred to by some as “antitrust trial of the century.” Each side had lined up a defense from prominent economists. These expert testimonies were extensively cited in the US District Court Judge Richard Leon’s written opinion. While discussion of highly technical economic analysis might strike most as surprising, reliance on economic expertise in court is currently quite common.

Courts frequently turn to economic experts to calculate damages associated with harmful conduct. In employment discrimination cases, statistical evidence of discrimination is brought to bear on the claim as proof for class certification and to identify persons entitled to awards. And cost and benefit analysis is now the single most important analytic device in environmental regulation cases. But it’s not just the experts whose knowledge of economics might sway the outcome. It’s also judges and their understanding of economics.

In a new paper, I explore the role of economic reasoning in court and extend the focus of analysis beyond the legal area of antitrust law, where the influence of economics and economists has been growing for decades. I find that judges who attended law schools with a strong law-and-economics intellectual environment use more economic reasoning, even after controlling for their political ideology (proxied by the party of the appointing president). I also find that a judge’s economic sophistication is positively correlated with a higher frequency of pro-business decisions even after controlling for political ideology and a rich set of other judge covariates.

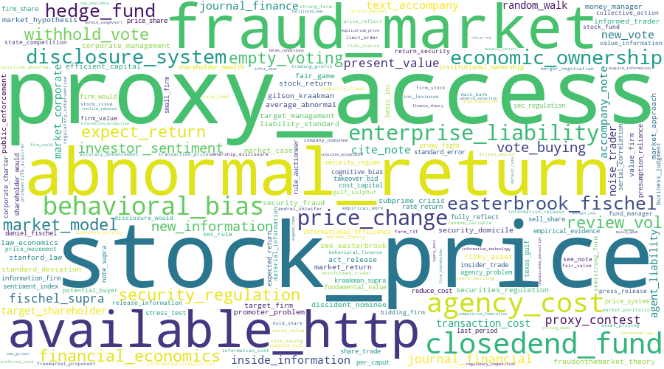

In their written opinions, judges explain how they arrived at their decisions. These texts are unique windows into what they know and how they rule. Assembling the universe of judicial opinions in the federal district courts concerning antitrust and securities regulation, I employ computational linguistics tools to measure the use of economic reasoning in court during the 1932-2016 time period. Specifically, for each individual legal area of interest, I pick a training library containing textbooks that is representative of economic analysis and another one of legal reasoning to identify bigrams, two-word combinations including “marginal cost,” “demand curve,” “abnormal return,” “fraud market” and so on, that are distinctively used in economics arguments.

Figures 1 and 2 visualize the economic bigrams that most frequently appear in the corresponding textbooks and research articles. I show that many of these terms are employed by judges in case rulings. Economic terms such as marginal cost and the elasticity of demand have become part of the language of antitrust law. Ranking opinions by the measure of economic reasoning, my measurement strategy successfully identifies high-profile cases, such as Ohio v. American Express, which made it all the way to the Supreme Court in 2018. The central debate in this antitrust case revolved around the economic concept of a “two-sided market.” Opinions in cases such as this contain substantial references to economic concepts, economic authority, and economic expertise.

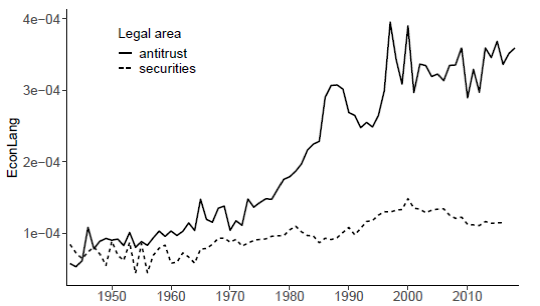

Figure 3 plots the evolution of economic reasoning in federal district courts and across different areas of law since the 1940s. Consistent with prior qualitative accounts, the share of economic reasoning in judicial opinions has been growing since 1943 in both antitrust and securities areas, although growth has been more rapid in the former. The divergent absorption of economic ideas in different legal fields is affected by the legislative constraints and the enforcement agency’s capability to perform economic analyses.

What explains the differences in the use of economic reasoning in court case opinions? To answer this question, I break down the case-level variations in economic reasoning and find judge-specific differences among judges serving on the district courts. District courts are the largest component of the federal judiciary, handling 330,000 cases per year. District court judges manage an incredible caseload, and a substantial fraction of cases led in district courts are decided without written opinion. Notwithstanding that cases with written opinions is a selective sample with merit and substantive issues, this is exactly where the judges explicitly reveal their legal reasoning.

Unlike courts of appeals where judges sit on a panel of three for each case hearing, or the Supreme Court hearing all cases en banc, district courts assign one single judge to a case on a random basis. Hence it is a simpler judging environment where no collective deliberation or peer effect is involved. The presiding district court judge has sole responsibility for a case and issues orders and opinions independently. Thanks to random case assignments, any overall difference in economic reasoning within a given court-year pair is a result of which judge gets to hear the case. Linking to judges’ training, I find that judges who obtained a JD degree from schools that have strong law and economics traditions write opinions that are characterized by greater use of economic reasoning. This camp includes the University of Chicago, University of Virginia, University of Southern California, University of Miami, Emory, and George Mason.

Ranking judges by their measured use of economic reasoning, I find that Judge James Noland of the District Court for the Southern District of Indiana comes top in the seventh circuit. According to his biography, judge Noland earned an MBA degree while attending Harvard Business School in 1942, and afterward remained a firm believer in free enterprise until his death in 1992. Both findings justify the interpretation of the language of economic reasoning as a proxy for judges’ economic sophistication.

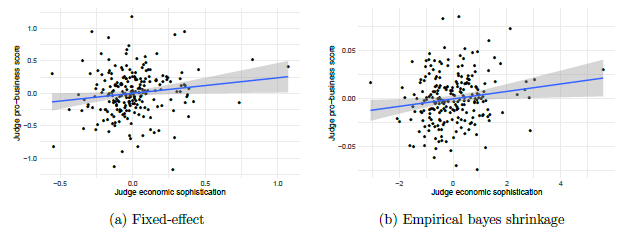

If judges differ in how much economics they know, does it influence how they rule? My paper says “yes.” Having collected a novel sample of district court cases from 1970 to 2016 that involve major federal regulatory agencies, I read three thousand case summaries and dispositions to hand-code the direction of the ruling—whether it is pro-business or pro-government. Figure 4 correlates a judge’s pro-business voting tendency with his economics sophistication. I find that a one standard deviation increase in economics sophistication is correlated with a 12.9 percentage point increase in the probability that a judge will rule in favor of business.

This correlation cannot be interpreted as causal. It is possible that judges who study economics are systematically more pro-business than other judges, even after controlling for their political ideology. Nevertheless, it is very important. It shows that judges’ ideology matters in judicial decisions. While at the moment my evidence is limited to regulatory decisions, I think it is reasonable to interpret that this influence is more likely to be important where the statutory component of the law is more limited (i.e., antitrust).

One implication of my result is that a proposed merger challenged by the Federal Trade Commission is more likely to receive a favorable court decision if it is assigned to a judge who is more adept at economic reasoning. This correlation is robust to inclusion of additional predictors of conservative ruling, notably ex-ante ideology. Contrary to a closely related study, I do not find that attending the Manne economics training program predicts or has a causal impact on how judges rule, although data limitation prohibits me to make further diagnoses. It is not impossible that the economics training program does not affect district court judges in the way that it does for appellate court judges. If district judges participate in the program for reasons not related to learning economics—for example, to build connections to higher court judges or enjoy an all-expense-covered break from the regular heavy courthouse workload—this channel will not work.

Modern states rely on expert knowledge to make policies. Among all areas of expertise, economics is perhaps the most sought after, and it is distinctly visible in the public policy sphere. This is mirrored in the judiciary, where, more than in other social sciences, judges are reliant on economic evidence and influenced by economic authorities. While economics knowledge is certainly useful, even indispensable, in the determination of many legal issues such as damage calculations, we should be aware of its potential role in formulating a policy view that overemphasizes economic efficiency.

My paper suggests that judicial knowledge is an important indicator of the way they will rule, even after controlling for their ideology. It suggests that the Supreme Court might lack diversity in another dimension: training. Before the appointment of Amy Coney Barrett, the Supreme Court was composed only of graduates of Yale and Harvard, as Luigi Zingales discussed in a recent episode of Capitalisn’t.