In the first chapter of his book Transaction Man, Nicholas Lemann explores how Adolf Berle, author of The Modern Corporation and Private Property and an adviser to President Franklin D. Roosevelt, came to worry about corporations becoming too powerful. Lemman was recently a guest on an episode of Capitalisn’t. You can listen to that interview here.

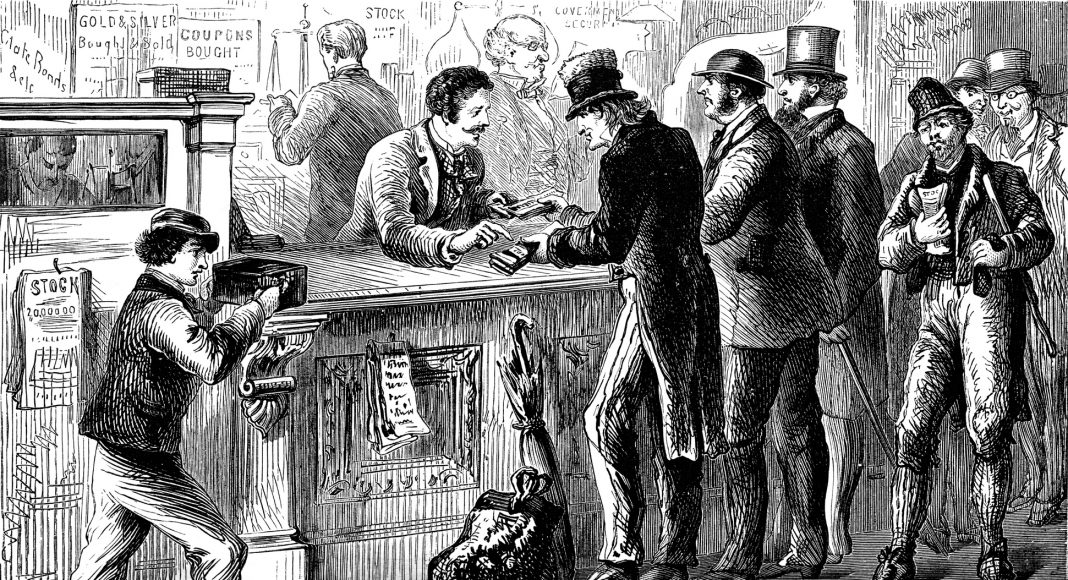

The liberal reaction against big business had been going strong for nearly half a century, having taken a number of different forms, but mainly it had identified its target as a coterie of men who made themselves very rich by building up the kind of business empires that people in the Progressive Era called “trusts”: Cornelius Vanderbilt in railroads, Andrew Carnegie in steel, Thomas Edison in electric power, John D. Rockefeller in oil, J. P. Morgan in finance. Now, in the 1920s, these people were dead or fading. Berle’s legal career on Wall Street, which put him in the middle of a lot of detailed work on stock and bond offerings, proxy votes, and so on, allowed him to come to what became the great insight of his career: the old trusts were being succeeded by corporations that did not have identifiable owners.

Business corporations had existed for a long time. What struck Berle as new and alarming was that a relatively small number of American corporations had rather suddenly become very large, very rich, and very dominant. They had outlived their founders. Although most of them had shareholders, they were really accountable to nobody. To Berle they looked like permanent, unstoppable institutions. As he wrote a few years later, “The huge corporation . . . has come to dominate most major industries if not all industry in the United States . . . There is apparently no immediate limit to its increase. It is coming more and more to be the industrial unit with which American economic, social, and political life must deal.” Therefore, it was time to do something to counteract the corporation:

“The economic power in the hands of the few persons who control a giant corporation is a tremendous force which can harm or benefit a multitude of individuals, affect whole districts, shift the currents of trade, bring ruin to one community and prosperity to another. The organizations which they control have passed far beyond the realm of private enterprise—they have become more nearly social institutions.”

Berle believed that they could no longer be permitted to have their way with every aspect of the country’s life.

He persuaded a research organization to give him a grant to make a detailed study of the corporation, hiring an economist named Gardiner Means—someone he’d known in the army, also a Harvard-educated son of a Congregationalist minister, married to a Vassar graduate who was a friend of Beatrice Berle’s—to work up statistical evidence about how big and powerful corporations had become. In 1932, when Berle was thirty-seven, the study was published: The Modern Corporation and Private Property, which became a classic almost instantly and still stands as the main intellectual achievement of Berle’s life.

Other intellectuals besides Berle had noticed how trusts and robber barons had been succeeded by corporations that operated on an even grander scale and that aspired to permanence. The final book by the radical economist Thorstein Veblen, Absentee Ownership: Business Enterprise in Recent Times (1923), was mainly about corporations. So was Main Street and Wall Street (1927), by William Z. Ripley, a professor at Harvard Business School who was a mentor of Berle’s. Both of these books were essentially hostile to corporations, focusing on the shenanigans—or, to use Ripley’s memorable language, “prestidigitation, double shuffling, honey-fugling, hornswaggling, and skullduggery”—that they used to disadvantage their investors. They diluted their shares, gave sweetheart contracts to their directors, took away shareholders’ voting rights, and were, as Ripley put it, “cloaked and hooded like the despicable Ku Klux Klan” when it came to issuing information about their economic performance.

What Berle brought to the subject was the combination of a much broader historical and social perspective, and detailed evidence in the form of the charts and tables that Means had worked up. And Berle’s timing was better: Veblen’s and Ripley’s books came out when the rise of the corporation was generally seen as a great achievement and as a delirious moneymaking opportunity for the growing American middle class. The Modern Corporation and Private Property was published in the wake of the 1929 stock market crash, with the Great Depression under way and the country coming to the view that the economic arrangements of the 1920s had utterly failed and needed to be replaced.

The Modern Corporation and Private Property had two central arguments: first, that a relatively small number of corporations had rapidly come to dominate the American economy, and second, that because these corporations had so many shareholders (the biggest one, American Telephone and Telegraph, had more than half a million), they represented a historically new kind of economic institution that was not under the control of its owners. Means’s research showed that of three hundred thousand American corporations, two hundred of them controlled half of the national wealth—and their proportionate power, being relatively new, was sure to increase in the future. They were ubiquitous and inescapable, Berle wrote:

“Perhaps . . . the individual stays in his own home in comparative isolation and privacy. What do the two hundred largest companies mean to him there? His electricity and gas are almost sure to be furnished by one of the public utility companies; the aluminum of his kitchen utensils by the Aluminum Co. of America. His electric refrigerator may be the product of General Motors Co., or of one of the two great electric equipment companies, General Electric and Westinghouse Electric.”

And so on.

What Berle called the corporate revolution was every bit as significant as the Industrial Revolution, or maybe even more so: “It involves a concentration of power in the economic field comparable to the concentration of religious power in the medieval church or of political power in the national state.” And unlike the church, the state, or earlier-stage industry, the corporation had severed the tie between control and ownership. As Berle put it, “The dissolution of the atom of property destroys the very foundation on which the economic order of the past three centuries has rested.” Adam Smith’s conception of the market no longer applied, because the owners of businesses, the shareholders, were no longer vigorous entrepreneurs. They were passive and distant from the enterprise. Control lay in the hands of managers and directors who were not significant owners. There was not yet a theory or practice of economics or government big enough to encompass these developments. Therefore, the task ahead was clear:

“The recognition that industry has come to be dominated by these economic autocrats must bring with it a realization of the hollowness of the familiar statement that economic enterprise in America is a matter of individual initiative. To the dozen or so men in control, there is room for such initiative. For the tens and even hundreds of thousands of workers and of owners in a single enterprise, individual initiative no longer exists. Their activity is group activity on a scale so large that the individual, except he be in a position of control, has dropped into relative insignificance. At the same time the problems of control have become problems in economic government.”

It would have been possible to take the same set of economic facts and arrange them differently from the way Berle did. Twenty years before The Modern Corporation and Private Property, Louis Brandeis wrote a searing series of articles for Harper’s Magazine, later published as a small book called Other People’s Money and How the Bankers Use It, that noted the widespread dispersion of ownership of stocks and bonds but treated it as a minor point. That was because, to Brandeis, it didn’t matter who nominally owned shares in big companies—the real control was in the hands of the “money trust,” meaning bankers, especially J. P. Morgan. They assembled the great corporations and then sat on their boards of directors and pulled the strings from there. Berle, in The Modern Corporation and Private Property—or for his entire life, really—barely mentioned banking and finance. His focus was on the industrial corporation.

Berle believed that the public’s widespread buying of government war bonds during the First World War had greatly accelerated the habit of small-scale ownership of financial instruments. That continued during the stock market boom of the 1920s. And bankers, he thought, had become less important because, by the early 1930s, the major corporations were fully formed independent entities, so financially powerful on their own that they didn’t much need bankers’ help. Still, there was something almost fetishistic about his preoccupation with the corporation as the dominant element in society. In this way Berle was influential: the corporation still looms large in the liberal mind.

It wasn’t entirely clear in The Modern Corporation and Private Property what Berle wanted to do with the corporation. At the end of the book he called, rather vaguely, on “the community” to “demand that the modern corporation” serve “all of society.” But what did that mean? Many years later, Berle wrote a book that he wanted to be considered as major an achievement as The Modern Corporation and Private Property. It was called, simply, Power. The book didn’t take hold, but the title indicates what Berle was always most interested in. What drew him to the corporation as a primary concern was that it was so powerful and was evidently free of any external control. What he wanted was for its power to be reined in.

“At heart he was what political scientists would call a corporatist, a believer in a highly structured society in which big business would dance to a tune called by government—forced to provide economic benefits to the rest of society as the price of its extraordinary prosperity and stability. “

It soon became clear to Berle that the institution by far best suited to control the corporation was the federal government. That he was wary of corporate power did not mean he was wary of power per se, in the manner of the Founders or Brandeis. He liked centralized government power just fine. At heart he was what political scientists would call a corporatist, a believer in a highly structured society in which big business would dance to a tune called by government—forced to provide economic benefits to the rest of society as the price of its extraordinary prosperity and stability. In a sense he wanted to use the power of the corporation as a pretext for a great expansion of the power of the government. Back in 1912, when Theodore Roosevelt and Woodrow Wilson were arguing between the New Nationalism and the New Freedom, Berle was too young to take sides officially. By the 1930s he had taken a side. He was a New Nationalist—a Clash of the Titans liberal.

Because Berle’s intellectual milieu was a highly enclosed world in which law professors debated technical questions of corporate governance and ownership, he was not immediately understood as what he understood himself to be—a big thinker about power. The one immediate challenge to Berle’s writing about corporations came from a Harvard law professor named E. Merrick Dodd. From the law review articles Berle had published before The Modern Corporation and Private Property was finished, Dodd got the impression that Berle’s main complaint about the corporation was that its managers weren’t running it solely for the economic benefit of their shareholders. He thought Berle was looking for a way to restore the shareholders’ power over management—to reclaim their rights as owners. Understanding this to be Berle’s position, Dodd then argued against it, saying that corporations had a broad “social responsibility” to their employees, their communities, their customers, and the public, not merely an economic responsibility to shareholders. The executives of the great new corporations should see that “they are guardians of all the interests which the corporation affects and not merely servants of its absentee owners,” and the law should see to it that they be permitted to follow this impulse even if their shareholders objected.

But if Berle ever had any genuine concern for shareholders, he had moved away from it by the time he was writing The Modern Corporation and Private Property. Their disempowerment was merely a piece of evidence used by Berle to sound the alarm about the excessive power of the men who were running corporations—and therefore, really, the country. (It also differentiated his theories from those of the thinkers he thought of as his competition, Adam Smith and Karl Marx, since they both had posited that capital controlled capitalism; Berle was saying that was no longer the case.) He believed that the big corporation itself was the problem, and that government had to be empowered to counteract it. As early as 1929, just as he was homing in on the full extent of corporate wealth, Berle wrote to a friend, “This is a problem of government rather than finance.”

Berle did disagree with Dodd, but that was because he did not believe the corporation’s immense power could be exercised independently, voluntarily, and benignly for the benefit of the whole society—not because he thought shareholders were being denied their economic rights. He felt that Dodd was naïve if he believed the corporation would ever behave responsibly unless it was forced to. In a published response to Dodd’s criticisms, he wrote, “The industrial ‘control’ does not now think of himself as a prince; he does not now assume responsibilities to the community; his bankers do not now undertake to recognize social claims; his lawyers do not advise him in terms of social responsibility. Nor is there any mechanism now in sight enforcing accomplishment of his theoretical function.”

In The Modern Corporation and Private Property, there was no discernible remnant of the argument Dodd thought Berle was making. It was an attack on the corporation not for the way it treated its shareholders, but for the fact of its power. Shortly after it was published, the book’s original publisher, a financially oriented firm called Commerce Clearing House, “discovered that they had harbored a viper in their bosom,” as Berle later put it, because it did not want to be associated with dangerous sentiments like Berle’s. Berle always believed that the most powerful corporation, General Motors, had somehow exercised its influence over Commerce Clearing House to put an end to the book’s publication. But the publisher’s unionized printers in Chicago filched the book’s plates and sent them to New York, where it was republished by a trade publishing house.

After the book was finished but before it was published, Berle wrote a letter to Louis Brandeis, perhaps by way of preparing him for the news that he was just about to depart publicly from the justice’s preferred solution to the power of corporations, which was to break them up into smaller parts. “Rereading your collected essays not so long ago, I was struck with your opposition to the tremendous corporate concentration,” Berle wrote.

“You were writing in 1915. Now the concentration has progressed so far that it seems unlikely to break up even in a period of stress. I can see nothing at the moment but to take this trend as it stands endeavoring to mold it so as to be useful. If the next phase is to be virtually a non-political economic government by mass industrial forces, possibly something can be done to make such government responsible, sensitive and actuated primarily by the necessity of serving the millions of little people whose lives it employs, whose savings it takes in guard, and whose materials of life it apparently has to provide.”

It may have been that, as he wrote to Brandeis, he had taken a position at odds with the justice’s simply in response to changing conditions, but his position on corporations also suited his large ambitions. A society that had been broken down into smaller units that engaged in constant mundane quarrels was much less appealing to Berle than a society devoted to grand struggles between great forces—especially if he could be a significant participant on the side of the national government, which was the only entity potentially more powerful than the biggest corporations. Now he had to find a way to do that.

Excerpt from “Institution Man” from TRANSACTION MAN by Nicholas Lemann. Copyright © 2019 by Nicholas Lemann. Used by permission of Farrar, Straus and Giroux. https://us.macmillan.com/fsg