A new study examines the efficacy of climate-focused investor engagements initiated by the New York City Pension System. Its findings support the view that long-term shareholders—through environmental activist campaigns—improve firms’ environmental impact and indicates that such campaigns could be an effective tool for shareholders to address climate change risks.

Editor’s note: To mark the 50-year anniversary of Milton Friedman’s influential NYT piece on the social responsibility of business, we are launching a series of articles on the shareholder-stakeholder debate. Read previous installments here.

Scientists warn us that climate change is the greatest challenge facing humanity in the foreseeable future. Mounting evidence suggests that climate change poses a significant risk for firm profits, capital markets, and households. Given this, investors are increasingly concerned about the long-term viability of their investments. In responding to such concerns, large institutional investors, including pension funds, have resorted to putting pressure on companies to consider and address climate change risks adequately.

Against this backdrop, understanding the willingness and ability of long-term investors to influence a corporations’ environmental impact is important. It informs policymakers who are increasingly trying to understand the impact of funds pursuing a non-financial objective. For example, the Department of Labor recently proposed new rules that restrict retirement accounts’ such that it would be, “…unlawful to sacrifice returns, or accept additional risk, through investments intended to promote a social or political end.”

Ultimately, research on the efficacy of climate-focused engagements brings us one step closer to understanding the costs and benefits associated with corporations having a social purpose.

In our paper The Real Effects of Environmental Activist Investing, we study one such climate-focused engagement initiated by a large pension fund system. We ask whether these campaigns can affect the environmental impact of firms. If so, what are these effects, who benefits, and what are the costs of such engagements to firms? To answer these questions, we focus on the Boardroom Accountability Project (BAP), an initiative of the New York City Pension System (NYCPS) aimed at addressing climate change risks through engagements.

The BAP is a socially motivated activist campaign initiated by the NYCPS and focused on improving portfolio companies’ sustainability characteristics. The campaign brought together two other influential investors: the California Public Employees’ Retirement System (CalPERS) and the California Teachers’ Retirement System (CalSTRS). While the BAP targeted firms for distinct mandates, we focus on firms targeted for failing to adequately address climate change concerns, which was one of their most significant mandates.

Our results support the view that long-term shareholders, through environmental activist campaigns, improve targeted firms’ environmental impact. Using plant-level data, we find that plants of targeted firms reduce their toxic chemical releases, that are harmful and cancer-causing. Moreover, following the targeting campaign by the BAP, we see a significant reduction in emissions of lethal greenhouse gases that contribute to global warming. These improvements benefit the surrounding areas of the targeted firms, with air quality improving within a one-mile radius of targeted plants. These improvements suggest potential important externalities to local economies, perhaps due to these investors engaging in environmental activism.

Evaluating the measures undertaken to achieve these improvements, we find that firms incur costs along two dimensions: They adopt operation-related initiatives and invest in abatement technologies. This increase in expenditures is not perfectly offset by financial benefits, at least in the short run. It is possible that these benefits, such as customer acquisition and retention, or a lower cost of capital, may take time to materialize and offset the costly investments in abatement technologies. These results shed light on the fundamental cost-benefit tradeoff that firms face when incorporating stakeholders in their decision-making.

“Our results support the view that long-term shareholders, through environmental activist campaigns, improve targeted firms’ environmental impact.”

At its core, our research brings nuance to the basic tenet of the economic theory that a firm should maximize shareholder value. It shows that shareholder engagements can benefit the firm, its stakeholders, and society.

Relatedly, our findings have implications for current debates on stakeholder welfare, which questions the recent shift towards “Stakeholderism.” Moreover, our study suggests that shareholders can impose their pro-social preferences on firms and provides investors and asset managers a useful framework for engaging in responsible investment. Further, our results provide direct evidence that institutional investors’ engagements provide a countervailing force to parts of the market that are difficult to monitor and regulate.

To elaborate on our paper, we use the BAP as a setting to understand whether long-term shareholders can affect their targeted firms’ environmental impact. Our study compares plants of targeted firms to the plants of similar firms. We ensure that the comparison firms are in the same industry and have similar financial characteristics and sustainability performance. These comparisons of similar firms rule out factors such as industry-wide shocks as explanations for the changes in environmental performance that we capture. This allows us to attribute the changes to environmental activism.

To accurately measure and identify the effects of climate-focused engagements, we rely on administrative data from the Environmental Protection Agency (EPA, the Energy Information Administration (EIA), and commercial datasets. This helps provide a complete picture of the changes in corporate environmental behaviors of firms.

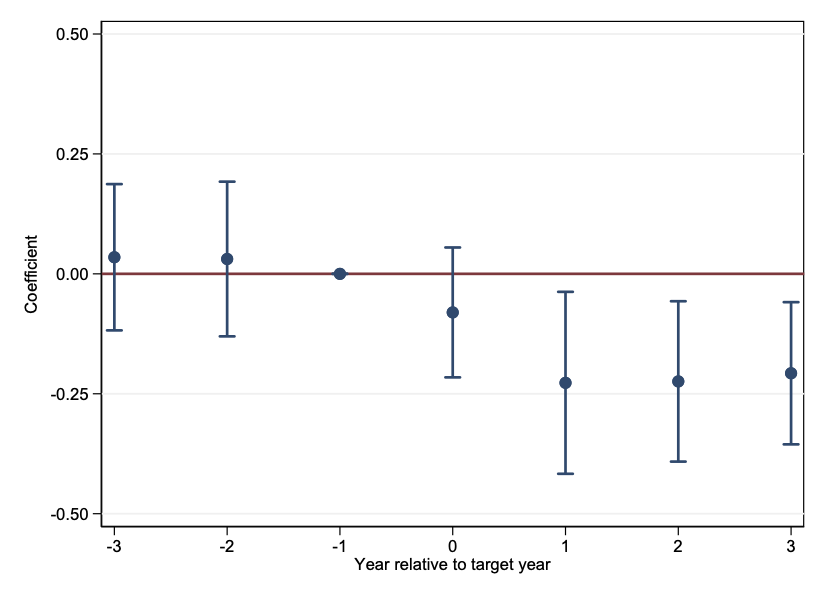

Our analysis of the impact of the environmental activist campaigns finds that plants of targeted firms, relative to plants of similar firms, reduce their total toxic chemical releases (see Figure 1). This improvement is not preceded by a decline in toxic releases before the campaign, suggesting that the BAP did not target firms that were already improving their environmental performance. Furthermore, these improvements are persistent. The empirical estimates imply that plants of targeted firms, when compared to plants of another similar firm, reduce their toxic chemical releases, on average, by 13 percent.

Breaking down these results, we find that active on-site reductions in releases drive overall improvements. Thus, firms are less likely to move their pollution off-site for release or disposal.

Studying the medium of releases, we find that the improvements primarily arise from reductions in stack-air emissions. Stack emissions relate to gases and solids that come out of the smoke-stack after the incineration process. When we focus on the type of air emissions, our estimates suggest that plants of targeted firms reduce their greenhouse gas emissions. They reduce releases of some of the most lethal greenhouse gases like methane, carbon dioxide, and nitrous oxide, contributing to global warming.

These improvements beg the question of whether their benefits extend to stakeholders beyond the firm. Our results suggest that climate-focused engagements have several positive effects on stakeholders.

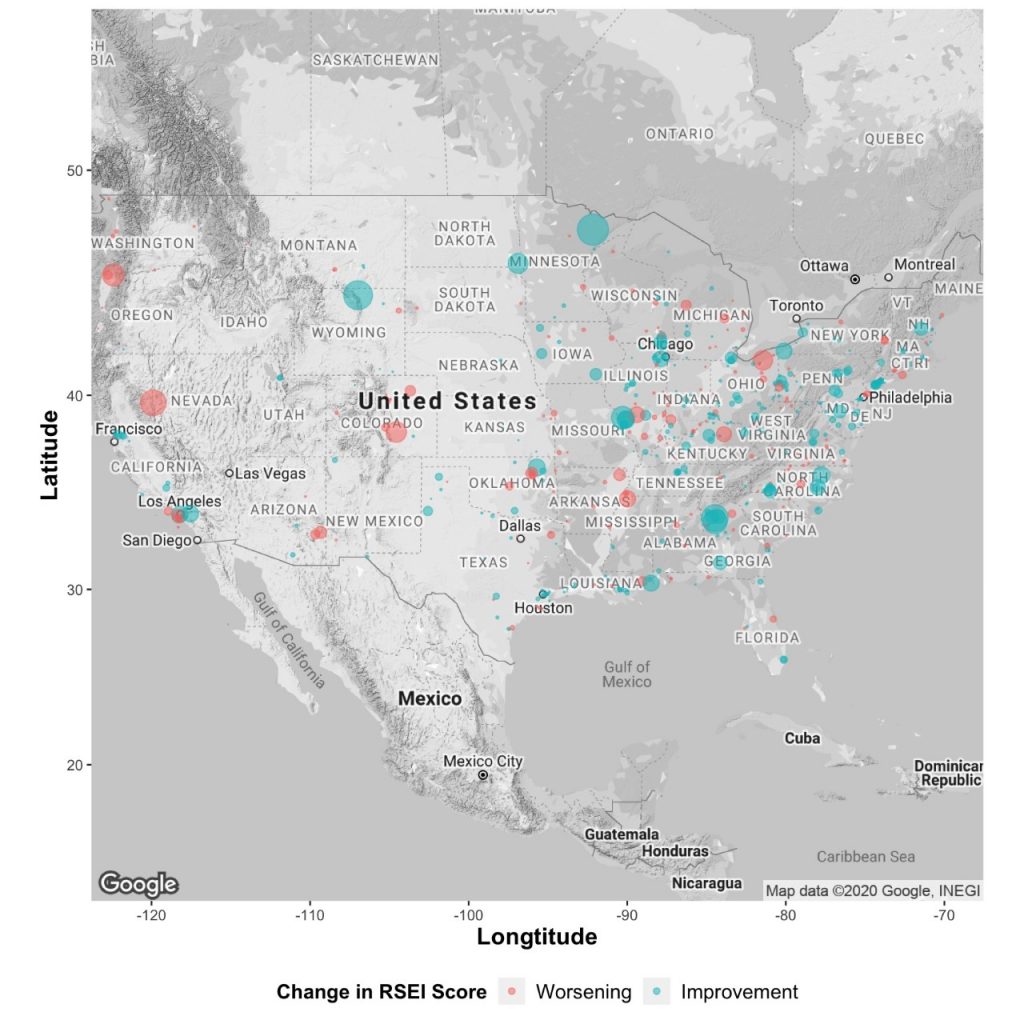

First, we find that targeted firms effectively reduce their release of cancer-causing chemicals, benefiting public health. Second, we find that the improvements in pollutive activities benefit the surrounding areas of the targeted firms. Specifically, using air quality monitor data and focusing on a one-mile radius around targeted plants, we find a significant drop in key emissions. The targeted firms choose to decrease their pollution intensity distant to New York City, the location of the lead activist investor (see Figure 2). Lastly, we also find that targeted firms’ plants reduce the intensity and toxicity of their pollutive activities around environmental activism campaigns. Overall, our results suggest that targeting seems to positively impact stakeholders close to plants of targeted firms.

Furthermore, we ask how the firms are achieving these improvements and what the associated costs are. We consider measures that firms undertake to reduce chemical releases and emissions. We find that firms adopt costly operational practices that reduce, eliminate, or prevent pollution while also increasing abatement expenditures focusing on emission control. Disclosures in the sustainability reports of targeted firms corroborate that firms are making these investments.

As the firms increase their abatement investments significantly, these costs are not perfectly offset by financial benefits in the short run. When we focus on the changes in targeted firms’ financial performance, we see a commensurate decline in the return on assets. Nonetheless, long-term benefits such as new customers or a lower cost of capital may take time to materialize and offset the costly investments in abatement technologies.

One alternative interpretation for the observed decline in emissions is that firms are now producing less, which mechanically leads to lower emissions. To put it differently, if firms make less, it is apparent that they also emit less. We do not find that this is the case. We examine and see no changes in both the level and growth in production. Further, we conduct a set of robustness tests to mitigate concerns related to reporting biases, offshoring, plant closures, and indirect governance effects, among others.

Finally, we consider the broader implications of our study for other environmental campaigns. To this end, we conduct external validity tests using other climate-focused campaigns initiated by other shareholders and find that our results extend outside of the BAP. Targeted firms respond only in cases where the activist investor has a firm-specific environmental mandate. These results, coupled with our baseline estimates, establish that shareholders can impose their pro-social preferences on firms to improve corporate environmental impact.

Recent research points to investors’ strong preference for sustainability, resulting in investors moving away from low sustainability investments. At the same time, this preference for sustainability may come at the cost of lower future expected returns. Our results provide a counterpoint, suggesting that investors may maximize their total value through monitoring and engagement to affect change. These findings also indicate that focused engagements could be an effective tool for shareholders to address climate change risks.

In conclusion, our study takes an essential step towards understanding the costs and benefits associated with engagements driven by investors who want corporations to have a social purpose.