The time has come for companies, economists, and society to abandon the argument that the only responsibility of business is to maximize profits.

Editor’s note: This article was first published on HBR.org and in ProMarket in October 2017. We are re-publishing it as part of our series on the shareholder-stakeholder debate, marking the 50-year anniversary of Milton Friedman’s influential NYT piece on the social responsibility of business. Read previous installments here.

Is the only responsibility of business to maximize profits, as Milton Friedman famously argued in 1970? Many scholars and business people have criticized this idea on the grounds that companies should cater to employees and the community, not just to shareholders. But the law seems to support shareholder primacy: Under Delaware law, which controls the vast majority of corporate America, directors are elected by shareholders, and, according to Leo Strine Jr., a Delaware judge, directors owe their loyalty to those who elect them.

In a recent paper we offer a different perspective, one that we believe is perfectly consistent with the fiduciary duties of corporate directors: Companies should maximize shareholder welfare, not value.

Our starting point is that shareholders care about more than just money. Many shareholders pay more for fair-trade coffee, or buy electric cars rather than cheaper gas guzzlers, because, using the current economic lingo, they are prosocial. They care, at least to some degree, about the health of society at large. Why would they not want the companies they invest in to behave similarly?

This intuition is borne out by recent shareholder behavior. Until a few years ago corporate managers heard only two complaints from institutional investors: that executive pay was excessive and that the company had an insufficient number of independent directors. Not anymore. The new mantra, especially in Europe, is ESG: Companies should care about the environmental and social impact of their investments. In fact, research has shown that the majority of shareholder proposals in the U.S. now concern ESG.

Friedman acknowledged that shareholders might have ethical concerns, but he implicitly assumed that a company’s profit and social objectives are separable. This is true for the example he used in his article: corporate charity. One dollar donated by the corporation is not worth more than one dollar donated by shareholders. Why should corporate boards decide about charitable giving when they can distribute the profits to be donated as dividends and let the shareholders decide directly?

We agree with Friedman on this point. But we are interested in situations where profit and social consequences are inextricably connected. Think about the shareholders of a company such as Walmart, who are concerned about mass killings in the United States. Walmart’s ability to restrict the sale of high-capacity magazines or assault rifles in its stores would be more effective than if it took the extra profits from those sales, returned them to shareholders, and let shareholders donate to gun control advocacy.

Therefore, if investors have some objectives other than money, there is no reason why a company’s board should ignore them and pursue only profit maximization. The fiduciary duty a board has to a company’s shareholders is to maximize their welfare, not just the value of their pocketbook. This raises an important question: How can a board do that?

Can Boards Incorporate Shareholder Welfare?

It may seem an impossible task: Should a board stop before every decision and poll its shareholders? The answer is no. In all representative democracies most decisions are delegated to representatives, who are elected on the basis of their stated preferences about important social issues. Shareholders elect directors to pursue their interests, which can include nonmonetary considerations.

Occasionally, on very important matters the citizens are polled directly, through a referendum. We propose the same for companies. On decisions with major social consequences, referenda should be used to elicit shareholders’ preferences.

If shareholders care only about money, the system will produce the same result that we observe today. But if many shareholders do have social objectives, as both data and intuition suggest, the system will allow them to achieve these objectives and increase their utility.

One concern is that adding social dimensions will overwhelm investors. How many elections and referenda should an investor follow every year? Can they keep up with a company’s social impact as well as its financial performance? But this problem could be solved through the formation of mutual fund companies specializing in voting on certain issues.

Following up on our earlier example, imagine a “curb assault weapon” index fund. It would be identical in every respect to other mutual funds, buying and selling the same basket of stocks, with the exception that it would vote against any sale of assault weapons and ammunition to ordinary citizens. (Such a fund might also stipulate that the fund would sell the stock if other shareholders voted to allow gun sales, but this is not strictly necessary for the index fund idea to put positive social pressure on companies.) Issue-oriented index funds would eliminate cognitive overload for investors and would not be more expensive than a standard index fund, which has to pay a proxy adviser to direct it in how to vote. Prosocial investors would rush to buy such a product, ensuring its success in the marketplace.

In fact, the idea is so simple that one might wonder why we do not already see such products. We think that the answer can be found in existing proxy access rules, which make it difficult for moral issues to be put up for a shareholder vote. If these rules were eased, we would expect this kind of ethical fund to arise.

Does It Matter?

To a casual observer, the difference between shareholder welfare and shareholder value might seem small. Yet it is on the basis of the shareholder value principle that corporate boards and courts of law reject the ability of shareholders to influence corporate policy on social issues that shareholders care about.

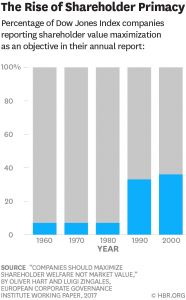

Friedman’s rule has had a big impact on the way companies are managed. The figure below shows the percentage of Dow Jones Index companies that mention value maximization as an objective in different decades. It has dramatically increased in the last three decades.

The impact extends to asset management companies. Pension funds, foundation endowments, and university endowments have been run on the basis of Friedman’s separation principle: Maximize the wealth of investors, and let shareholders use the proceeds to achieve their goals. Thus it is not unusual to have peace-promoting foundations investing in arms-producing companies, environmental foundations investing in repeated polluters, or law school endowments investing in companies that regularly pay bribes. At most, there is some mild attempt to divest from these “tainted” companies, but changing their behavior has taken a back seat to financial gain.

There is no doubt that foundations and university endowments have social objectives other than maximizing return. Why should they leave those objectives out of the boardrooms? Moving from shareholder value maximization to shareholder welfare maximization may be a small step for theory, but it could trigger a leap forward in the way our corporations are run.

There is no doubt that foundations and university endowments have social objectives other than maximizing return. Why should they leave those objectives out of the boardrooms? Moving from shareholder value maximization to shareholder welfare maximization may be a small step for theory, but it could trigger a leap forward in the way our corporations are run.

Some may object that our proposal is antidemocratic. Social goals, the argument goes, should be left to the political system, where every vote is treated equally. If we allow shareholders to vote on social issues involving their companies, the vote of wealthy people will count more.

We are sympathetic to this concern, but in our view it is misplaced. The same could be said of sustainable consumerism, where the purchases of richer people “count” more in dollar terms. Moreover, our proposal would make corporations more democratic, not less, by elevating the social concerns of the millions of present and future pensioners. Finally, by restricting shareholder concerns to pure profit, we’re not simply leaving values to the realm of politics; in practice, we’re often declining to consider those values at all.

In recent decades, companies have grown to rival governments in size: 69 of the largest 100 entities in the world by revenues are corporations. Entire industries are dominated by a handful of players, sometimes by a single one. In this world, many of the corporate choices, like the one to sell high-capacity guns, have social consequences that are not limited to economics. Yet the legitimate owners of companies are prevented from intervening to choose the social consequences they prefer. Until now these restrictions had found a justification in Friedman’s argument. Our work highlights how this justification is based on an implicit assumption, but is unlikely to hold in practice. The time has come for companies, economists, and society to abandon it.

Disclaimer: The ProMarket blog is dedicated to discussing how competition tends to be subverted by special interests. The posts represent the opinions of their writers, not those of the University of Chicago, the Booth School of Business, or its faculty. For more information, please visit ProMarket Blog Policy.