A new paper studies the link between ongoing political uncertainty and long-term property rights in Hong Kong. It finds that properties subject to political uncertainty are sold at a significant discount and that the discount is higher when people’s confidence declines and where residents feel more uncertain of the future.

Recent evidence (for example, Pastor and Veronesi, 2013; Baker et al., 2016; Hassan et al., 2019) shows that political uncertainty plays a significant role in asset valuation as well as economic activity in developed economies, typically associated with established and stable political environments. One would expect this universal economic force to prevail the most in emerging market economies, especially those struggling with protracted indeterminacy in political systems complicated by colonial history.

This can be particularly true for housing markets. In any housing market, the long-term asset value—the present value of expected net cash flows in the future—depends on the perpetuity and continuity of land ownership. Market participants, both households and financial institutions, are exposed to substantial political risk when land tenures expire at the end of their fixed terms.

In a recent paper, we study the link between ongoing political uncertainty and long-term property rights in Hong Kong, which the British handed back to China on July 1st, 1997. Although Hong Kong’s economy has straddled the boundary between what is considered developed and emerging, our setting offers several advantages for studying this topic.

First, Hong Kong, caught in the middle of the conflict between China and the western world, has become a political battleground over the fate of an unprecedented political experiment known as “One Country, Two Systems,” especially since the ongoing 2019–20 social unrest.

Second, all land in Hong Kong is held through leaseholds in which land tenure is granted to lessees by the government for a fixed term. This means that a homeowner who purchases a house does not own the land on which the house is built—the land is leased to the homeowner by the government. Leaseholds are subject to renewal/extension at the end of the term, possibly by a different government, hence exposing property rights to substantial political risk.

Third, for historical reasons, the political outlook of Hong Kong features an impending uncertainty that will be resolved on a predetermined future date (July 1st, 2047) when the current authority in power—the Hong Kong Special Administrative Region (HKSAR)—ceases to exist. This creates an interesting tension for land leases given by the colonial British Hong Kong government, many of which were given about 160 years ago and set to expire many years after 2047. In the most extreme cases, some land leases were even granted for 999 years.

Fourth, as the predominant long-term asset and liability on the balance sheets of households, housing valuations in a well-developed financial market like Hong Kong should reflect the political uncertainty, whether imminent or in the future. This last point is particularly relevant for Hong Kong, a city known for its notoriously expensive housing market; hence, any noticeable difference in the housing market can be sizable and meaningful for quantifying the real and financial effect of political uncertainty.

In a theoretical asset pricing framework where we incorporate different land lease extension policies facing political uncertainty after 2047, housing valuation is determined by a “natural” housing rent as well as a ground rent mandated by the government for leasing the land, typically calculated as a percentage of the property’s rateable (rental) value.

The ground rent is subject to change, instead of remaining constant at 3 percent, as it is today in Hong Kong, upon the next lease renewal in the future, affecting the house’s value in present transactions. This uncertainty regarding the future ground rent schedule is linked to the political fate of Hong Kong, which is determined by the complicated political struggle between all parties in Hong Kong, the HKSAR, and Beijing.

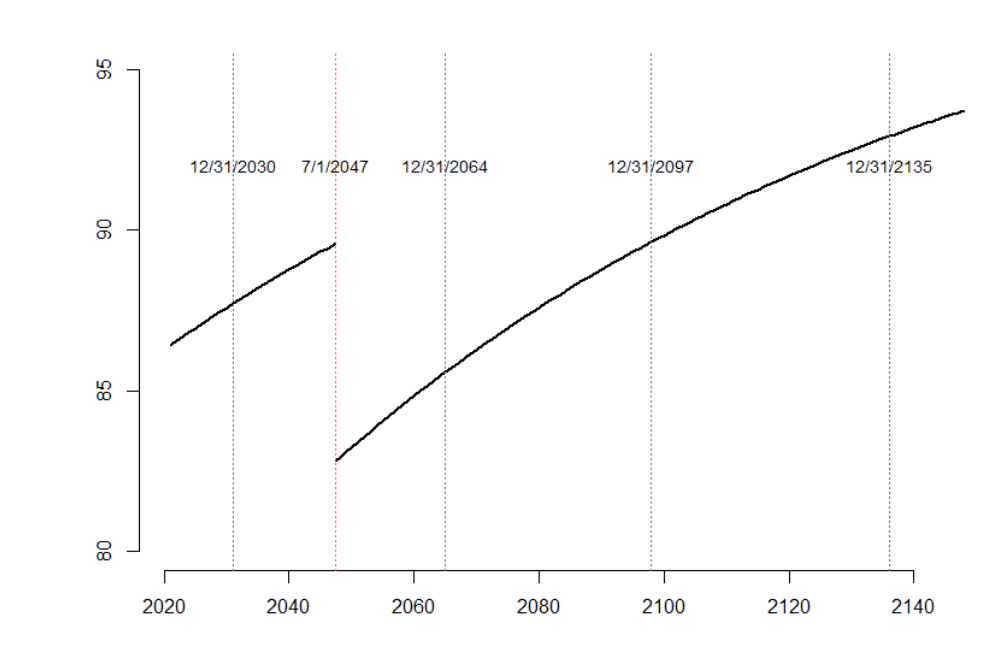

Our model captures the key idea that the greatest political uncertainty in Hong Kong’s housing market occurs at a predetermined future date (July 1st, 2047) when the Basic Law and the HKSAR are set to expire. As shown in Figure 1, this economic force implies a “periodic” housing price pattern with a discrete downward jump at the HKSAR expiry date, and further posits a price discount schedule that smoothly decays with the expiration year of the lease after 2047.

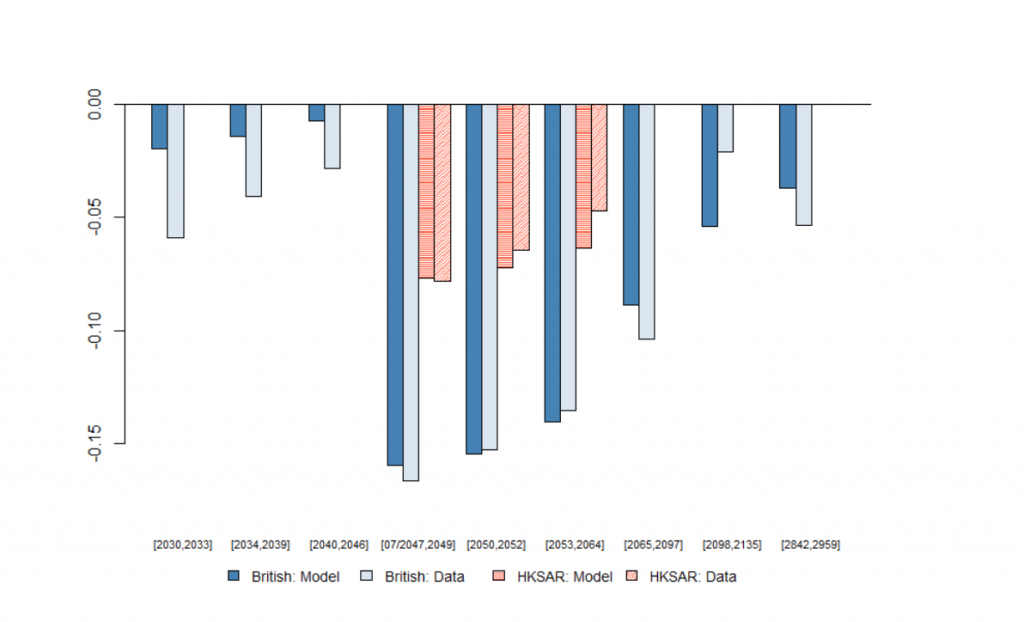

Empirically, we find that relative to the control group whose leases are set to expire on June 30th, 2047, and who expect to receive an extension until 2097, properties with leases expiring immediately after that date are sold at a 14.1 percent discount. The estimated price discount relative to the control group decreases as the expiration year moves further away from 2047, and the prices of those set to expire after 2097 are similar to the control group, with an estimated discount statistically insignificant from zero.

We also find that properties with leases granted by the colonial British Hong Kong government are different from those granted by the HKSAR. The former are sold at a significantly greater discount—about 8 percent—than leases with a similar expiration date granted by the HKSAR, suggesting that homeowners assess a reneging risk in these legacy leases due to the expectation that the future government will be still under the rule of People’s Republic of China (PRC) and thus will be more aligned with the HKSAR than the British colonial government.

Our final model incorporates the reneging risk and is estimated to match the price discounts in the data, as shown in Figure 2. These empirically estimated price discounts imply that after the HKSAR ceases to exist in 2047, homeowners expect a 25 percent penalty as a fraction of the house value to renew their expired land leases. British Hong Kong leases are expected to be reneged every 73 years, with an additional penalty of 13 percent.

We further establish the link between the relative price discount embedded in land leases and the political uncertainty faced by Hong Kong. Interestingly, the estimated lease discount has increased over time since 2004, as people’s confidence in Hong Kong’s future has declined, reaching about 20 percent in recent years.

The land lease discount is also related to geographic variations in local political sentiment inside Hong Kong. We show that a greater land lease discount is related to:

- a higher percentage of pro-democracy seats in district council elections, which is motivated by local residents’ discontent due to fear and panic of losing a “high degree of autonomy” promised under the “One Country, Two Systems” design); and

- a higher percentage of migrants from mainland China recorded in Hong Kong’s censuses each five-year period, capturing Hong Kongers’ rising antagonistic sentiments toward cultural influences from the mainland and their increasing fear of losing their own identity.

Taken together, our analysis shows that properties subject to political uncertainty are sold at a significant discount than those that have been promised an extension protection, and the discount is higher when people’s confidence declines and where residents feel more uncertain of the city’s future.

Putting our findings into an international context, we see that history has always left its mark on Hong Kong’s economic and political landscape. First, the discount of these lease contracts without the HKSAR’s promised protection suggests that the market attaches a significant premium to the extension protection offered by HKSAR, just like the promise made by the PRC when it signed the Sino-British Joint Declaration in 1985.

It is also worthwhile to point out the interesting difference between Singapore and Hong Kong, two similar economies whose housing markets contain similar land leases largely influenced by the same British system. Unlike Singapore, where 999-year leases are traded at some significant premium thanks to the legality of leases promised by its British colonial government, in Hong Kong 999-year leases were transacted at a discount because China never fully acknowledged the legality of leases made by the British colonial government.