A new study looks at the discrimination of Jewish managers in Germany in the 1930s and shows how the rise of a discriminatory ideology can cause real economic harm.

Recent events have renewed interest in the effects of discrimination on the economy. For instance, the US travel ban on citizens of several Muslim-majority countries sparked an outcry from US corporations that worried about their ability to retain talent. In Turkey, several thousand executives who follow the cleric Fethullah Gülen have been arrested or have fled overseas since 2016, fueling concerns of an economic collapse.

Racism, xenophobia, and other forms of discrimination are, sadly, common phenomena. A culture of discrimination is, of course, extremely hurtful toward discriminated populations. What are its economic effects beyond the affected communities? And what happens to companies that discriminate—do they perform worse?

Increases in discrimination often lead to dismissals of talented business leaders and managers. Looking across modern history, discriminatory mass dismissals are common. For instance, the US forcibly interred Japanese Americans during the Second World War due to “race prejudice,” and ethnic Indians who owned 90 percent of Ugandan businesses were expelled by Idi Amin in 1972.

In a recent research paper, we show that such discriminatory dismissals can lead to first-order economic losses. Specifically, we analyze discrimination against senior managers with Jewish origins (either practicing Jews or Christians with a Jewish ancestor) in Nazi Germany. We show that the share prices and profitability of firms dropped sharply when Jewish managers were removed from the German economy due to rising anti-Semitism.

In total, discrimination against Jewish managers in Nazi Germany led to a fall in listed firms’ market value of roughly 1.8 percent of GNP. This number is likely to be a lower bound for the aggregate economic losses to the German economy, since Jews were also removed from firms not listed in Berlin and non-management positions.

Of course, this number does not do justice to the indescribable human suffering and loss of life that the Nazi ideology brought on the Jewish people and other targeted groups.

Discrimination Can Also Harm Access to Leadership Positions

Discrimination is not always targeted at individuals holding senior management positions. In general, discrimination often prevents minority groups from attaining leadership positions in the first place.

For instance, if a discriminatory system hinders access to education, minorities may not be able to fully develop their talents. If discriminated individuals have unique skills, they will never be able to use them fully to benefit firms and the economy. This means firms and the economy perform more poorly than they would have if all individuals were educated in line with their abilities and if all positions were filled on merit alone.

An important lesson from our estimates is that the harmful effects of discriminating against top managerial talent can be extremely large. In general, this means that policymakers should be careful not to exclude talented individuals from top positions. Just like in the setting of 1930s Germany, eventually firms and the economy suffer when top talent does not rise to top positions. Related theoretical research argues that the US economy in the 20th century has suffered because gender and racial discrimination interfered with the optimal allocation of talent.

The Exclusion of Jewish Managers from Firms in Nazi Germany

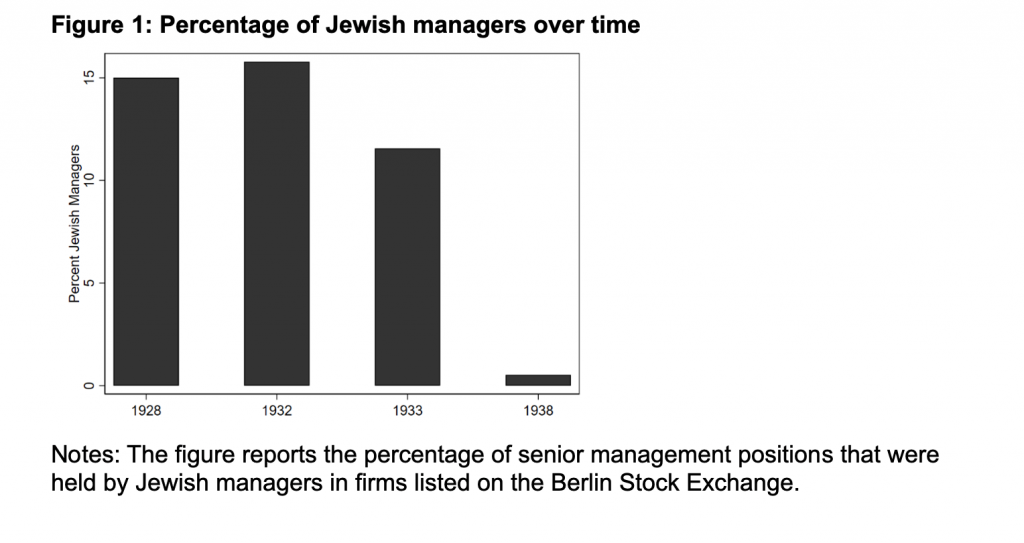

We collect new data on almost 30,000 manager positions in German firms listed on the Berlin Stock Exchange. Our data include all managers holding executive and supervisory board positions. Managers of Jewish origin held around 15 percent of senior management positions in Germany between 1928 and 1932 (see Figure 1).

After the Nazis gained power on January 30, 1933, discrimination against Jewish people became commonplace in Germany. Many firms voluntarily dismissed managers of Jewish origin or were coerced into removing them by Nazi officials. Deutsche Bank, for example, forced chief executive Oscar Wassermann and executive board member Theodor Frank to resign their positions by June 1st, 1933. By 1938, individuals with Jewish ancestry had effectively been excluded from the economy.

We analyze firms that had employed Jewish managers in 1932 and forced them out after the Nazis took power. Many firms that the public did not perceive as “Jewish” happened to employ managers of Jewish origin (such as Allianz, BMW, Daimler-Benz, and IG Farben). We compare these firms to other firms that had not employed any managers of Jewish origin and, therefore, remained unscathed by the removal of Jewish managers due to the Nazi ideology.

Effects on the Characteristics of Firms’ Senior Management

We find that losing the Jewish managers changed the observable characteristics of senior managers at firms that had employed Jewish managers in 1932. The number of managers with experience, university education, and connections to other firms fell significantly. Firms were unable to adequately replace the dismissed managers with other managers who had similar characteristics, at least for five years after the Nazis came to power.

Effects on Share Prices

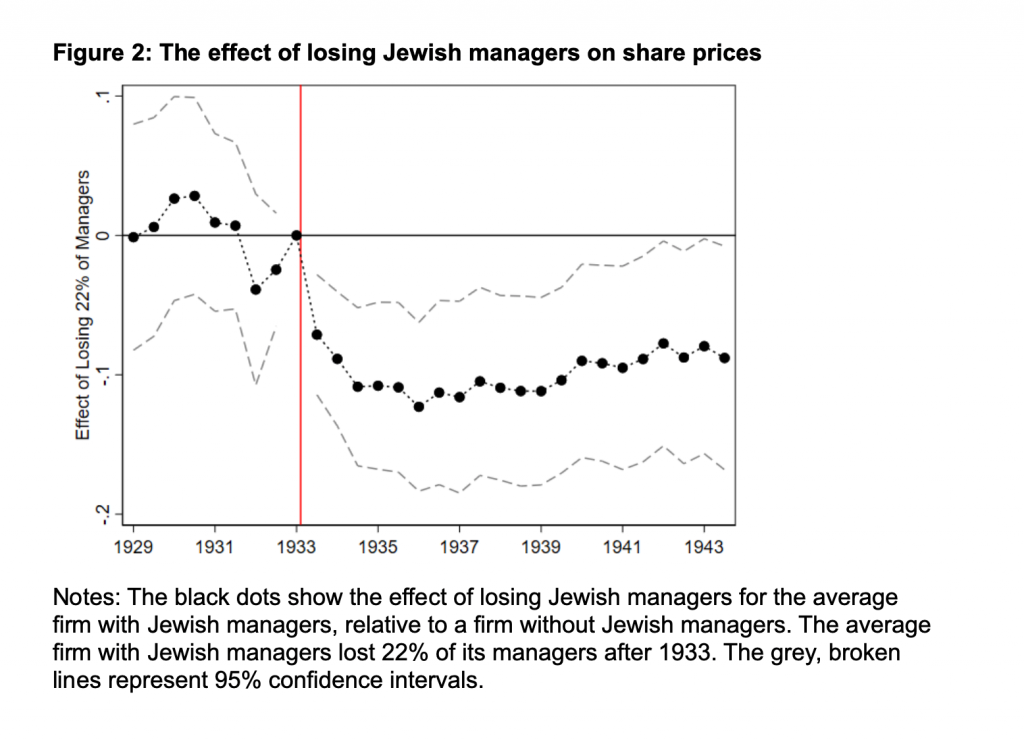

We show that the share prices of firms with Jewish managers fell sharply after the Nazis grabbed power in 1933, when Jewish managers were forced out (see Figure 2).

These losses persisted until the end of the share price sample period in 1943, ten years after the Nazis had gained power. The share price of the average firm that had employed Jewish managers in 1932 (where 22 percent of managers had been of Jewish origin) declined by about 12 percent after 1933, relative to a firm without Jewish managers in 1932.

It is striking that our estimated short-run effect of losing Jewish managers is close to the initial share price responses to the exits of prominent managers in recent times. For example, after Apple’s chief executive Steve Jobs took permanent medical leave in 2011, his company’s shares fell by 6 percent. When Fiat Chrysler’s chief executive Sergio Marchionne stepped down due to surgery in 2018, the company’s shares lost 5 percent.

Our data allow us to investigate the channels through which the loss of the Jewish managers affected share prices. Share prices declined only for firms where the removal of the Jewish managers led to large losses in the number of university-educated managers and managerial connections (measured by seats on other supervisory boards). Share prices did not significantly fall when the removal of the Jewish managers hardly affected these two measures. We find that losing managerial connections had larger effects in non-cartel firms, which implies that managers were particularly important in competitive industries.

Effects on Dividends and Returns on Assets

We analyze the effects of losing Jewish managers on two additional measures of firm performance: dividend payments and returns on assets. We find that after 1933, dividend payments fell by approximately 7.5 percent for the average firm with Jewish managers in 1932 (which lost 22 percent of its managers). We also find that after 1933, the average firm that had employed Jewish managers in 1932 experienced a large decline in its return on assets. These results indicate that the loss of Jewish managers also led to real losses in firm efficiency and profitability.

Aggregate Implications and Conclusion

The findings of our paper inform our understanding of how the rise of a discriminatory ideology can cause real economic harm. A back-of-the-envelope calculation suggests that the exclusion of Jewish managers reduced the aggregate market valuation of firms listed in Berlin by 1.8 percent of German gross national product, a first-order economic loss.

We study arguably the most severe form of discrimination against a particular group of individuals, but even less severe forms of discrimination can lead to a loss of talent. As highlighted above, the travel ban on citizens of seven Muslim-majority countries in the United States or the persecution of Turkish businessmen who follow the cleric Fethullah Gülen are current examples of rising discrimination that are likely to affect firms.

Even the perception of not being welcome in a country may lead to an outflow of high-skilled individuals. A recent survey in the wake of the Brexit referendum suggests, for example, that 12 percent of Europeans who make between £100,001 ($130,000) and £200,000 a year were planning to leave the United Kingdom in the coming years. The results in our paper indicate that such an exodus could significantly hurt firms and the economy.