In 2017, the Federal Communications Commission conducted a complex two-sided auction to reallocate spectrum from broadcasters to mobile communications companies. The way economists designed the auction included hundreds of millions of profits for private equity firms and a disappointing outcome for taxpayers. A former academic economist now working for Microsoft, Glen Weyl reflects on the role of the market design community in these unfortunate events.

A couple of months ago, I was provoked by a discussion on Twitter to reveal the perspective I have on the US Spectrum Incentive Auctions (USSIA). Twitter was not an ideal venue to do so and the tweets were composed late at night and in haste. This blog post tries to present what I know more systematically. The information around this is deeply shrouded in secrecy, which is part of the point I make below, so I apologize to the extent my facts end up being off in places; this post corrects some mistakes I made in my tweets.

The USSIA were a large-scale two-sided auction, through a public facility administered by the Federal Communications Commission (FCC), in which rights to use various spectrum bands across the country were purchased from current license holders, primarily engaged in over-the-air broadcasting, and resold to innovative users offering wireless telephony and broadband. It was empowered by a 2012 act of Congress and conducted during 2016 and early 2017. The auction cleared 84 megahertz of spectrum and roughly $20 billion in value.

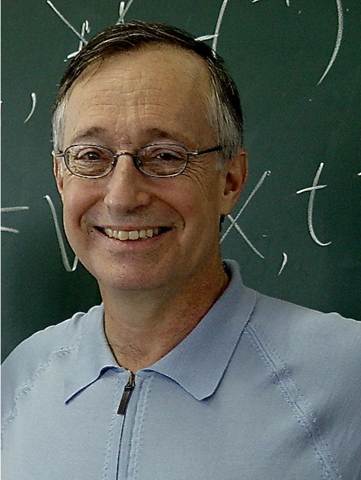

The auction is often held up as the leading and most ambitious example of auction design, especially by and within the “market design” community-led by Nobel Laureate Alvin Roth and Stanford professor Paul Milgrom. This community focuses its attention on what Roth described as “whispering in the ears of princes”: providing expert quiet advice to technocratic government officials on the design of market institutions, largely away from the public eye.

The principal designers in this case were Milgrom, his close collaborator Stanford professor Ilya Segal, long-time FCC auction specialist and civil servant Evan Kwerel, and computer science expert and University of British Columbia professor Kevin Leyton-Brown. The external advisors to the FCC (those other than Kwerel) worked, as Milgrom told ProMarket, as independent consultants for Auctionomics, founded by Milgrom, rather than in their capacity as academics.

Key Events

The USSIA was made possible by the 2012 Spectrum Act, part of the Middle Class Tax Relief and Job Creation Act of 2012. This was the result of roughly four years of political discussions around how to effectively reallocate spectrum from existing to new uses. One option would have been for the FCC to use its right, at their term expiration, to simply revoke existing licenses and then give them away or sell them off to new users, a process similar to what occurred in analogous cases in China.

This option was obviously opposed by incumbent broadcasters (e.g. television station WSAH New York and the National Association of Broadcasters), who lobbied to protect the de facto property rights they held in nominally public spectrum based on the FCC’s tradition of low-cost and low-scrutiny renewals of existing licenses.

The compromise, promoted by Milgrom and others and written into law in the Spectrum Act, was to recognize de jure these de facto property rights subject to provision that a one-time auction would occur in which the holders of these rights could either sell to the FCC or could be move by the FCC to “equally good” alternative bands for their current broadcasting purposes in order to avoid severe potential holdout problems.

This compromise was not widely debated or even discussed by politicians or the public and primarily grew out of a technocratic discussion between the FCC and the broadcasters lobby. It effectively amounted to a mass privatization of a public resource.

This compromise still posed a tricky problem. The FCC had to buy licenses while ensuring that it could, by relocating existing license holders, satisfy its duty to ensure all are reallocated to bands that can satisfy their existing audiences.

One way to address this problem, advocated at the time and before by some experts, is analogous to the way that urban areas address the “complex interference patterns” that motivate zoning rules, such as that one building may block another’s view. These involve a complex and messy web of democratic participation in zoning proceedings, legal disputes with associated liability findings adjudicated by courts and quasi-markets operating in the shadow of these legal constraints.

The designers of the USSIA, as well as University of Maryland professor Lawrence Ausubel and Stanford professor Jonathan Levin who were involved in early efforts in this direction, argued that a superior approach was to code all these constraints into a large computational optimization engine and design an auction which would take in bids and attempt to maximize (something like) the total economic value represented in these bids. They proposed to design, build, and with the FCC, implement such a system.

Action by Private Equity Firms

Even before the passage of the Spectrum Act, private equity firms, especially LocusPoint (a shell for Blackstone Group), NRJ (a shell for Fortress Investment Group) and OTA (a shell for MSD Captial, Michael Dell’s family office), purchased many of the licenses in patterns that were likely to create maximum leverage to block efficient reallocations of spectrum while preserving the rights of current broadcasters.

Note: Under Section 7 of the Clayton Antitrust Act it is a civil violation subject to treble damages to purchase assets in such a way as has the effect of substantially reducing competition, including in a public procurement auction like this.

Section 1 of the Sherman Antitrust Act makes coordination across participants in an auction or communication that could facilitate such coordination if it tends to reduce competition a criminal offense.

University of Maryland economist Peter Cramton provided much of the intellectual work that guided these purchases as a consultant for OTA. He also acted as an important collaborator for a consortium of broadcasters (the Expanding Opportunities for Broadcasters Coalition or EOBC) including these three private equity companies and others in the design of the auction rules. In the paper he wrote on this topic, his disclosure of these connections was a single sentence, “We are grateful to a member of the EOBC for funding this research,” with no disclosure of his relationship to OTA specifically.

Cramton is a long time collaborator of Milgrom’s and especially Ausubel’s; for example, as late as 2010 these three filed a joint patent on an auction design. According to Cramton’s website, Milgrom and Roth were, until 2016, co-principals of Market Design Inc., a consultancy.

A primary focus of Cramton’s argument, as extensively cited by the EOBC in their comment to the FCC (which Cramton lists on his website as a paper by him), was to prevent the auction rules that would have limited the power of license holders with many licenses to profit by withholding or overpricing some licenses and thereby raising the prices of other licenses they sold.

Early drafts of the auction rules included such provisions, including dynamic reserve prices. The final version of the rules did not, instead focusing only on ensuring “strategy-proofness” (an incentive to truthfully bid one’s valuation) for license holders with only a single license, and included other concessions to the EOBC’s requests.

Section 1 of the Sherman Antitrust Act makes coordination across participants in an auction or communication that could facilitate such coordination if it tends to reduce competition a criminal offense

Furthermore, the FCC has the right to block purchases of licenses (e.g. by private equity firms) both under its direct regulatory power and could have filed lawsuits under Section 7 of the Clayton Act if it believed such acquisitions would tend to reduce competition in the USSIA. It filed no such suits nor, to the public record, blocked any of the purchases made by the above-listed private equity firms.

Thus, the final auction and FCC actions made little or no provision to reduce the profitability or impact on allocations of the actions of the above-listed private equity firms. At the same time, purportedly to reduce collusion (contra the design of other rules as noted) and in line with the Spectrum Act, rules were designed to make all the bidding data necessary for analysis of what had occurred in the auction secret and unavailable to the public after the auction for a period of two years. Even after this period, only limited data were made available. This made a post-mortem of what may have gone wrong in the auction difficult or impossible to conduct for a significant period after.

In or about March 2016, during a seminar at Microsoft Research’s New England Laboratory, I became aware of these features of the design and the plan by the private equity firms, and in particular of Cramton’s leadership therein. Shortly thereafter, I became aware of an academic paper by several economists at the University of Pennsylvania Wharton School of Business that documented the above-mentioned asset purchases and projected that they could greatly reduce the efficiency of the auction, as well as redistributing large amounts of wealth to the private equity firms involved.

I was alarmed by the cost this could have to the public and the potential antitrust violations involved. I immediately contacted Paul Milgrom; I also had a call with Evan Kwerel around the same time. I will not comment on their responses out of respect for the confidence of those conversations.

The auction began in late March 2016. In July 2016, I attended a conference at the Stony Brook University led by Leyton-Brown and Milgrom, at which the Wharton paper was presented and Kwerel was in attendance.

Being concerned by this response, I took several actions over the coming months with the intention of preventing the attack on the auction from succeeding and/or ensuring legal justice for the public and other victims of the attack, including a) trying to find antitrust litigators interested in working with participants in the sales phase of the auction who might be interested in bringing suit under the Clayton Act’s right of private action, b) discussing the case with several investigative journalists to interest one in reporting on it, and c) taking up the issue with Roth, who was at that time President-Elect of the American Economic Association.

None of these led anywhere.

The USSIA closed in March 2017, after the failure of three rounds of attempted clearing, having cleared only 84 of 126 potential MhZ of the initially-projected quantity of spectrum and generated shy of $20 billion of revenue, compared to early projections of as much as $60 billion, half of which was revenue to the broadcasters. Because this was a two-sided auction, this could have resulted either from weaker-than-expected demand or suppliers (broadcasters) withholding their licenses.

Despite this apparently somewhat disappointing performance, Milgrom celebrated the auctions as the “obscure science…that connected the world” and “benefited society” in an opinion piece promoting his winning of the Golden Goose Award for successful, federally-funded long-term scientific research, as well as in several academic presentations.

As far as I know, no presentation Milgrom has given on the subject has mentioned the actions of the private equity firms, how they interacted with the auction design and the potential impacts on the auction outcome. Their recent review article on the auction mentions these actions only in a footnote and does not discuss the Wharton paper, and celebrates their design as one of “the most successful new market mechanisms.”

The auctions are so widely perceived as a success within the market design community that they are held out as an example to be emulated in a wide range of applications.

In October 2017, I attended a National Bureau of Economic Research (NBER) Market Design Meeting organized by Stanford professor Michael Ostrovsky and MIT professor and John Bates Clark Medalist Parag Pathak. At this meeting, three papers on the USSIA were presented, including one by Milgrom and Segal describing and celebrating their design and the one mentioned above by the Wharton professors. Because of the lack of data on bidding in the auction, this paper remained (and remains today) based on data sources other than the actual bidding in the audience, though why the authors have not updated their paper to incorporate the bid data released two years after the auction by the FCC remains unclear.

The Problem With “Technocracy”

While the USSIA did conclude, its failure to reallocate as much spectrum as it aimed to is an important contributor to the United States’ laggard status in developing cutting edge broadband internet, which itself is a major national security concern.

What I find instructive about this example and what impelled me to share it is precisely not its exceptional nature. Instead, it fits perfect the pattern of what, in a related essay I recently posted, I call “technocracy”.

I was once very much a member of the market design community. I still believe that ideas building off those of Nobel Laureate and founder of the field of mechanism design William Vickrey have some of the greatest potential to transform our society for the better of any ideas in the world. I wrote a book based on this idea and founded and chair a non-profit dedicated to this mission.

I once believed that these ideas being good ones, and that the community practicing them being a “meritocracy” full of “smart people” and remedying some specific flaw of previous technocracies, would be enough to move beyond the general problems of technocracy. I now believe these views were wrong-headed and my experiences, described above, were critical to changing my mind. Because the ideas developed in the market design community are so important, it is critical that this community moves beyond their current practices to ones that are more likely to contribute to the renewal of liberal democracy.

We are in the midst of a crisis of confidence in existing institutions such as liberal democracy, capitalism, and especially the technocratic elites that are widely seen to have hoarded the status and privileges in our present order without repaying the trust the public placed in them

Like all technology, these tools can be used as weapons of oppression and exploitation by the powerful, as much as they can as tools of liberation and democracy by the many. To achieve the latter requires that those who are expert in the tools use them in a “democratic spirit,” in the sense that they clearly communicate key insights to broad publics that are then able to use these technologies on their own terms, for their own purposes, subject to their own critiques and reimaginations.

This will almost always require distillation, simplification and imperfect optimization, as well as deep collaboration with those holding skills that market designers lack, such as artistic design, entrepreneurship, activism, etc. If instead they are used for whispering in the ears of princes, they will be captured for the particularistic benefit and narrow vision of the few who can hear and understand the whispers.

We are in the midst of a crisis of confidence in existing institutions such as liberal democracy, capitalism, and especially the technocratic elites that are widely seen to have hoarded the status and privileges in our present order without repaying the trust the public placed in them.

Circumstances like the above fuel and affirm this public distrust. The alternatives widely on offer, in the form of nationalist and statist populism, are unattractive to many (especially in the political center), and I personally believe they are likely to only worsen the currently-perceived problems.

This leads to a natural temptation among technocrats to further conceal these incident from the public, defending the present order at the cost of eroding transparency and building further fragility into the system.

I believe that this approach is not only unsustainable. More importantly, it makes the type of transformational change these technologies could potentially offer impossible, as such systemic change requires the active engagement, broad understanding and widely shared legitimacy that only democratic conversation can create. I believe such fundamental change is necessary to recreate a foundation of trust in the social order.

Justice for and public judgement of those who broke the public trust is a necessary part of moving beyond mistakes of the past, in this case and in many related cases. Yet the direction of this motion should be towards a new practice of design in a democratic spirit.