Corruption, lobbying, corporate malfeasance, and frauds: a weekly unconventional selection of must-read articles by investigative journalist Bethany McLean.

I had an utterly irrational sliver of hope that I would be able to write a non-coronavirus focused reading list today. Funny, isn’t it, how even pessimists can find their inner optimists in times like these?

I’m going to make this week’s list longer than usual, because one very small blessing is more reading time.

After this passes, and it will, because everything does, somehow or another, there will be plenty of blame to go around.

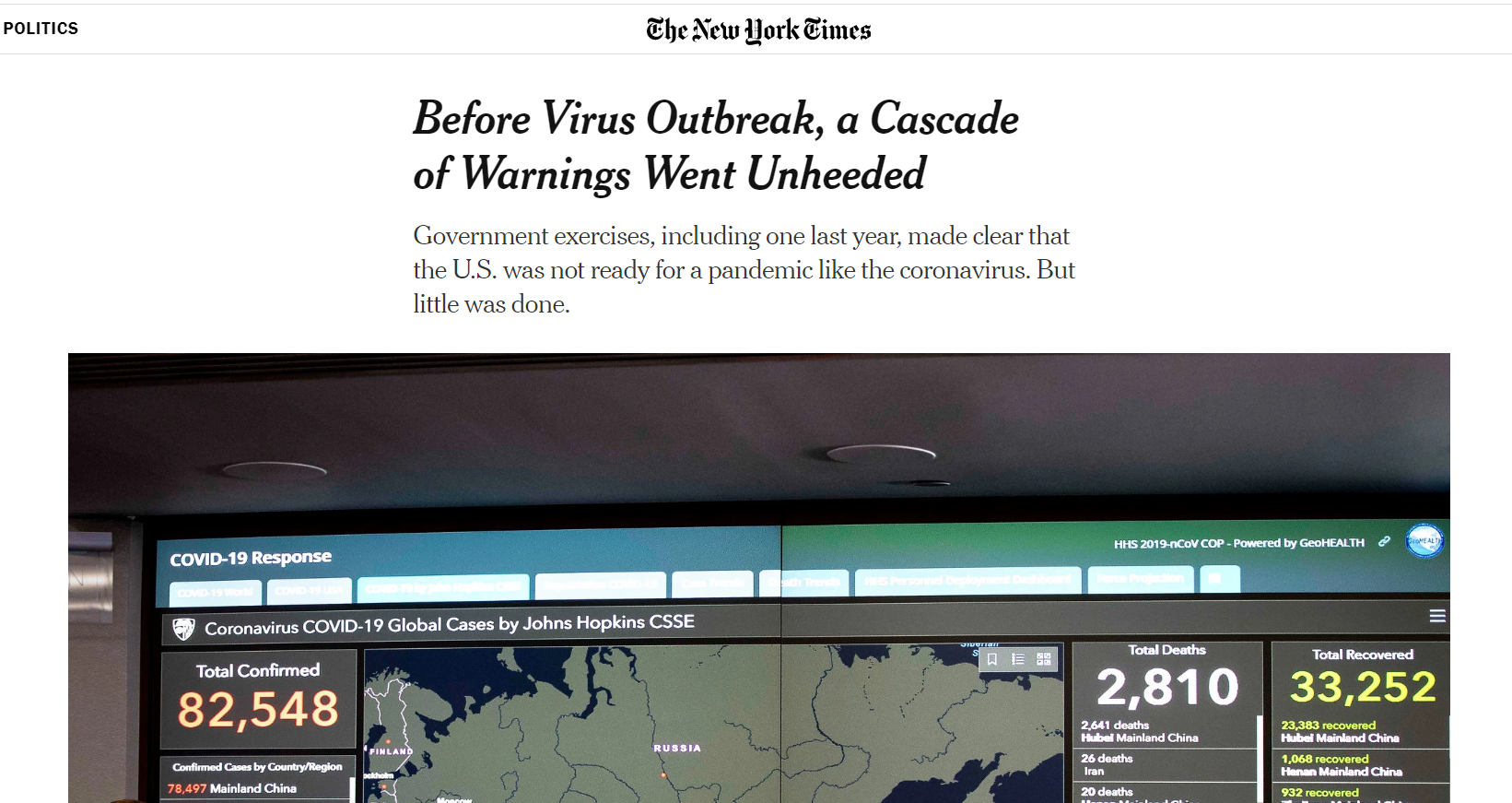

While partisans of all stripes will want to make it a simple story, it will not be a simple story. Read these three pieces in conjunction:

Oh, and this:

On some levels, I find this last one the most appalling. It’s no different than Ken Lay selling stock as Enron collapsed—except Ken Lay wasn’t supposed to be a public servant.

As I wrote last week, we’re just beginning to sense the inklings of how profoundly this could reshape the world. H/T @ritholtz for this:

And for a broader take:

From an economic perspective, if the 2008 crisis was the transmission of financial risk into the real economy, this is looking like the opposite: The crisis will begin with the real economy and be transmitted back into the financial sector. And it comes at a particularly dangerous time because the tinder was piled ever higher and just waiting for a match, as these two pieces show:

and:

ProMarket is dedicated to discussing how competition tends to be subverted by special interests. The posts represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty. For more information, please visit ProMarket Blog Policy.