The real danger is that the virus mutates and infects our economic system, even as we manage to root it out of our bodies. The objective of economic policy cannot be to eliminate the recession altogether. The priority is to short-circuit all the negative feedback loops and channels of contagion that otherwise amplify this negative shock.

We are facing a joint health and economic crisis of unprecedented proportions in recent history.

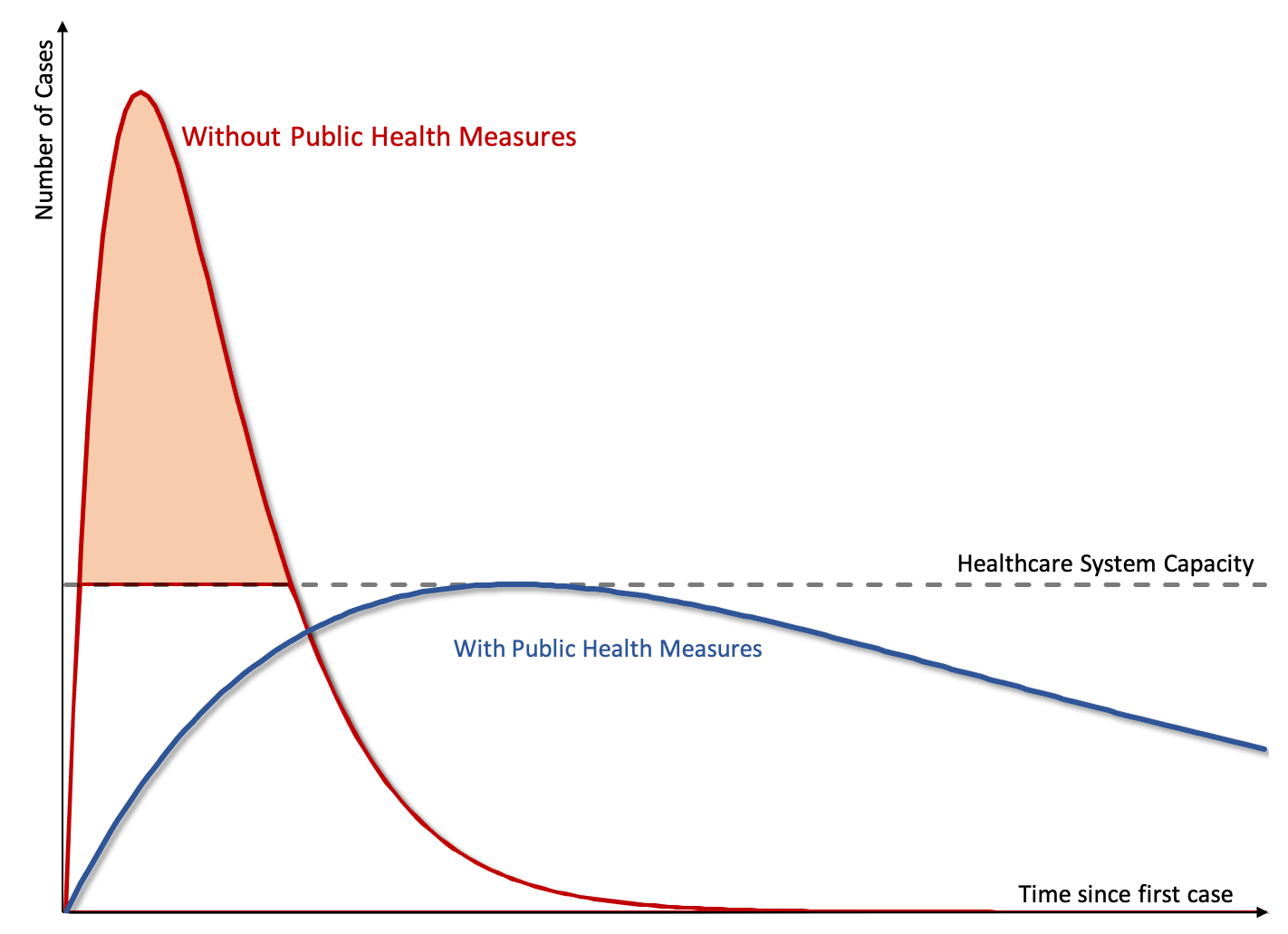

I want to start by acknowledging that containing the pandemic is the utmost priority. Figure 1 summarizes how public health experts approach the problem.

In the short run, the capacity of any country’s health system is finite (capacity of Intensive Care Units, number of hospital beds, number of skilled health professionals, ventilators). This puts an upper bound on the number of patients that can be properly treated at any given point in time and is represented by the flat line in the Figure.

Unchecked, and given what we know of the transmission rate of the coronavirus, the pandemic would quickly overwhelm any health system, leaving many infected patients with deteriorating pulmonary conditions without any treatment. The fatality rate would surge.

The threat is almost beyond comprehension. With a 2 percent case-fatality rate baseline for overwhelmed health systems, and 50 percent of the world population infected, 1 percent of the world population—76 million people—would die.

This scenario corresponds to the red curve in Figure 1. The part of the curve above the capacity of the health care system faces a sharply higher mortality risk (shaded red area).

Instead, public health policy, at least in all semi-decently run countries, aims to “flatten the curve” by imposing drastic social distancing measures and promoting health practices to reduce the transmission rate.

This ‘flattening of the curve’ would spread the pandemic over time, enabling more people to receive proper health treatment—ultimately lowering the fatality rate. This is the blue curve in Figure 1.

These policies, where implemented, have delivered very strong results. The countries that adopted drastic containment measures such as Taiwan, Singapore, or the Chinese regions outside Hubei, have seen the number of cases grow at a markedly slower rate and are now experiencing a decline. Clearly and unambiguously, this is the right short-run public health policy.

Let’s assume that health authorities do the right thing, so we are on the flattened (blue) infection curve. What are the macroeconomic implications?

I will argue that, in the short run, flattening the infection curve inevitably steepens the macroeconomic recession curve.

Consider China, or Italy: increasing social distances has required closing schools, universities, most non-essential businesses, and asking most of the working-age population to stay at home. While some people may be able to work from home, this remains a small fraction of the overall labor force. Even if working from home is an option, the short-term disruption to work and family routines is major and likely to affect productivity.

In short, the appropriate public health policy plunges the economy into a sudden stop. To wit, all indicators coming out of China, for instance, indicate a dramatic plunge in production and trade.

In a perfect world, people would self-isolate until infection rates decline sufficiently and public health authorities give the all-clear. At that point, the economic engines would re-start: workers would go back to work, factories would turn back on, ships would load their cargo and planes would take off.

Why This Crisis Is Different

The first thing to note is that, even in that `perfect’ world, the economic damage would be considerable.

To see this, assume that, relative to a baseline, containment measures reduce economic activity by 50 percent for one month and 25 percent for another month, after which the economy returns to the baseline.

Such a sharp but short-lived decline in activity does not seem unreasonable if one thinks that a majority of the labor force is currently shuttered at home in places like Italy or China. In fact, we could anticipate a much more drawn-out process.

Yet, that scenario would still deliver a massive blow to headline GDP numbers, with a decline in annual output growth of the order of 6.5 percent relative to the previous year. Extend the 25 percent shutdown for just another month and the decline in annual output growth (relative to the previous year) reaches almost 10 percent!

As a number of economists have pointed out, most of this lost GDP will not be coming back, so it is reasonable to assume a return to the baseline, rather than a later surge in activity—although one could expect a post-recession surge in spending on postponed durable goods purchases.

As a point of comparison, the decline in output growth in the US during the 2008-09 Great Recession was around 4.5 percent. We are about to witness a downturn that could dwarf the Great Recession.

Why are the numbers so much larger now?

The short answer is that even at the peak of the financial crisis, when the US economy was shedding jobs at the rate of 800 thousand workers per month, the vast majority of people were still employed and working. The unemployment rate in the US peaked at “just” 10 percent. By contrast, the coronavirus is creating a situation where—for a brief amount of time—50 percent or more of people may not be able to work. The impact on economic activity is comparatively that much larger.

Yet, this is the ‘optimistic’ scenario.

The Worst-Case Scenario

We do not live in the ‘perfect world’ described above. Instead, a downturn of this magnitude will send shock waves through the economy that could do serious damage. Improperly managed, the economic cost could be much larger and longer-lasting.

A modern economy is a complex web of interconnected parties: employees, firms, suppliers, consumers, banks and financial intermediaries. Everyone is someone else’s employee, customer, lender, etc. A sudden stop like the one described above can easily trigger a cascading chain of events, fueled by individually rational but collectively catastrophic decisions.

Much like people may ignore self-isolation instructions—on the grounds that they have better things to do—so can economic actors make individual decisions that amplify and precipitate a much larger economic downturn.

Self-isolated customers may have, perforce, fewer opportunities to spend. Yet, faced with uncertainties about future economic prospects, a common impulse may be to cut down spending even further. This, in turn, would make it harder for firms to earn income, even out of current inventories.

Faced with declining demand for their products—in some sectors such as leisure, travel or entertainment the collapse in demand is likely to be near-total—firms will want to cut costs, shedding workers to avoid a complete collapse.

Banks, with a worsening portfolio of non-performing loans, will naturally want to cut lending, further darkening the prospects of the non-financial sector. Suppliers will ask to be paid, etc.

Panic or loss of confidence adds another layer. The result would be cascading business failures, with an associated surge in layoffs and a build-up in financial fragilities.

In other words, a real danger is that the virus mutates and infects our economic system, even as we manage to root it out of our bodies. Its economic form is certainly not as deadly, but it can nonetheless do real damage.

Economists will recognize that the problem in both cases—infection and recession—are externalities: actions that are individually perfectly sensible, but collectively harmful.

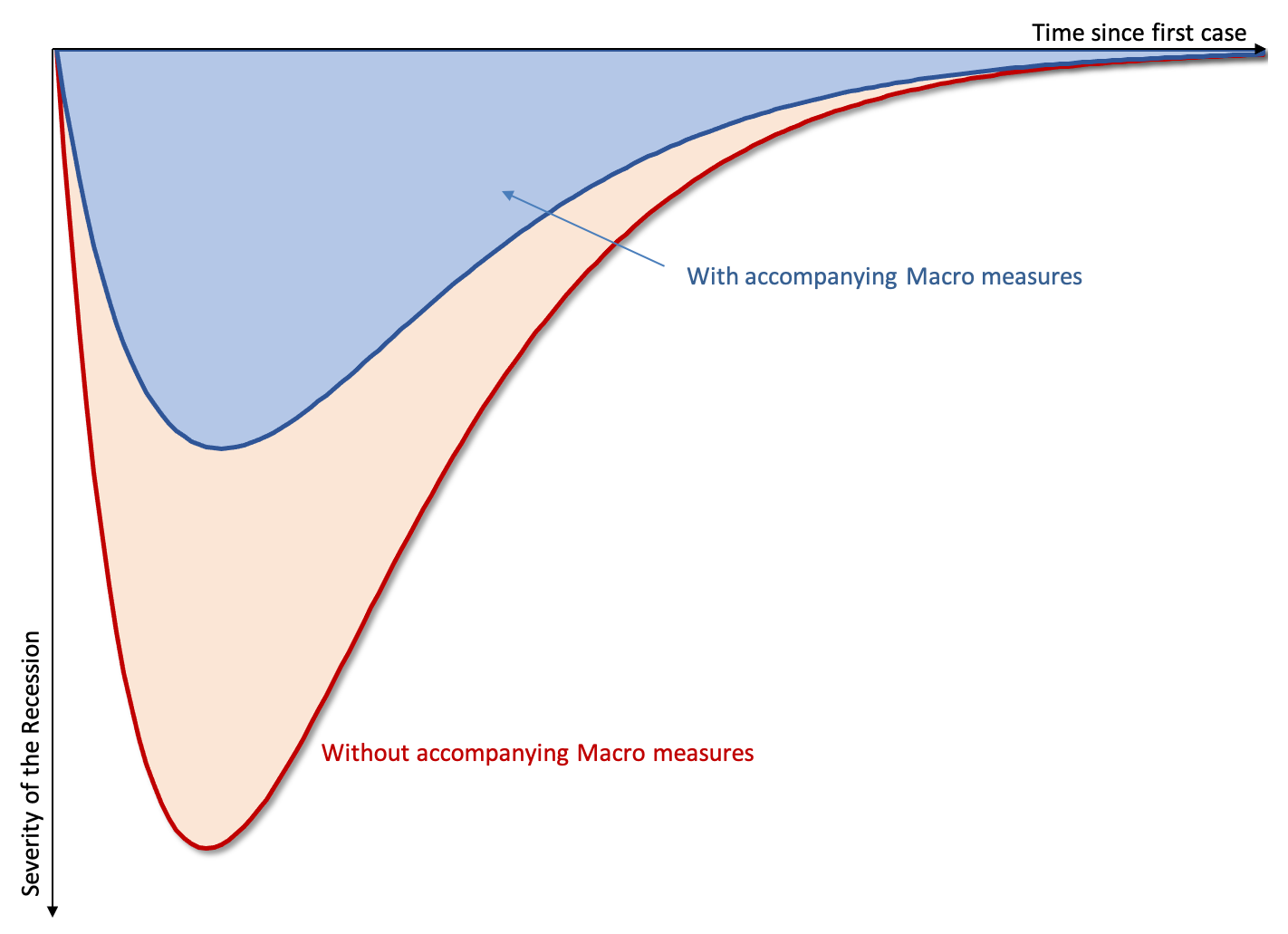

The upshot is that the economy also faces a “flatten the curve” problem. Without proper macroeconomic support, the impact of the downturn could be represented by the red curve in Figure 2.

It plots output lost during a sharp an intense downturn, amplified by the economic decisions of millions of economic agents trying to protect themselves by cutting spending, shelving investment, cutting down credit and generally hunkering down.

Notice the irony: for the economy, it is isolation that has negative externalities.

In this figure, the blue shaded area represents the economic downturn, if we could prevent any additional ‘economic infection’, i.e. limit the loss of economic activity to the lost production during the public health containment period.

As already discussed, this is likely to be a large negative number. The red line and additional red shaded area- represent the additional loss of economic activity once the economy itself gets “infected” and the various negative feedback loops and amplification mechanisms described above kick-in.

Not by coincidence, the measures that help solve the health crisis can make the economic crisis worse—at least in the short run—and vice versa: stricter health policy forces a larger economic shutdown, a larger blue-shaded area. Yet, while this may look like a trade-off, it’s not really: unemployment versus lost lives, there is not much to debate, at least at the infection and fatality rates that we are witnessing.

Moreover, even if no containment measures were implemented, a recession would occur anyway, fueled by the precautionary and/or panic behavior of households and firms faced with the uncertainty of dealing with a pandemic with an inadequate public health response.

Fortunately, economic policy can act decisively to prevent these “economic infections.” The basic objective here is to also “flatten the curve” and limit the economic damage to what is inevitable given that output is not produced when the labor force is largely quarantined.

Modern economic system—again, when properly managed—contain a number of fail-safes that are designed to prevent or limit catastrophic collapses of this type. Think of these as the “intensive care units, beds, and ventilators” of the economic system.

Specifically, central banks can provide emergency liquidity to the financial sector. Fiscal stabilizers (the decline in government fiscal revenues and the increase in transfers) also help lessen the blow of economic downturns on household and firms’ bottom lines.

In addition, governments can deploy discretionary targeted fiscal measures or broader programs to support economic activity. These measures help `flatten the economic curve’, i.e. limit the economic loss, as illustrated in Figure 2.

It is important to keep in mind what economic policy can and cannot do. The objective is not and cannot be to eliminate the recession altogether. The recession will be there, it will be massive, but hopefully short-lived. Instead, the priority is to short-circuit all the negative feedback loops and channels of contagion that otherwise amplify this negative shock. Unchecked, the recession threatens to destroy the complex network of economic linkages that allows the economy to operate and would take time to repair.

From this perspective, the priority should be:

(a) to ensure that workers can remain employed—and collect their paycheck—even if quarantined or forced to stay home to look after dependents. Temporary layoff assistance is a key component. Without it, it is even unclear whether public health advisories can be followed. Households need to be able to make basic payments (rent, utilities, mortgages, insurance).

(b) to ensure that firms can weather the storm without going into bankruptcy, with easier borrowing terms, possibly temporarily waving tax or payroll payments, suspending loan payments, or providing direct financial assistance where needed;

(c) to support the financial system as non-performing loans will mount, so as to ensure the crisis does not morph into a financial crisis. These measures will dampen -possibly eliminate- the amplification loops and greatly reduce the economic downturn.

The timing is important. Economic measures are most acutely needed while the economy is in shutdown mode. Stimulus packages after the health crisis is over are only needed if we do not manage to act decisively right now to avoid a catastrophic collapse, and could potentially be much more costly.

Timing matters in another dimension too. Strict health policies can dramatically dampen the spread of the disease. They have one downside: they leave a larger fraction of the population for a longer time, otherwise the pandemic might flare up again. Indeed, there is some indication that the number of cases in China and Taiwan may be on the rise again.

The Fiscal Costs

How long could production remain shut down before the size of the recession becomes catastrophically large? The simple calculations above indicated that one month at 50 percent and 2 months at 25 percent would already cost 10 percent of the annual output. Another two months at 75 percent production would cost another 5 percent of annual output.

This indicates that the right strategy is dynamic. In terms of Figure 1, the primary goal of fiscal policy should be to expand the capacity of the health system. Raising the horizontal line in that figure allows both to treat more patients, but also to relax the containment measures. This directly benefits the economy, without degrading the public health response.

Inevitably, these measures will have a heavy fiscal cost. To a first-order approximation, I would consider that governments may need to provide income support on a scale roughly comparable to the output lost. If total output loss is in the order of 10 percent of annual GDP, I would not be surprised if we need to deploy a comparable level of fiscal resources, even before we account for health expenditures.

By comparison, while the markets cheered the UK announcement of a $39bn stimulus package, this represented “only” 1.5 percent of the UK’s output.

Should we worry about this? Put differently, are we constrained in what we can do on the macroeconomic side, much like hospital beds, ventilators, and the number of health professionals constrain the capacity of the health system? I will argue that—with some exceptions—we are not.

To start with, borrowing rates for sovereigns are at historical lows—even more so since the beginning of the crisis. The yield on 10-year US Treasuries is at 0.88 percent. Rates in the Euro area are similarly low. Even a 10 percent increase in debt-GDP only increases annual interest costs by 0.1 percent of GDP.

If now is not the time to borrow to support an economy on the verge of collapse, when is a good time?

“We Are All Italians”

Most advanced economies should be able to face such a one-off increase in public debt. There are important exceptions: Eurozone countries like Italy, with elevated public debt levels and subject to stringent fiscal rules.

Here, the answer is clear: strong signals should be sent that the Eurozone will support these efforts. This could take many forms.

First, there is little doubt that the European Commission will temporarily waive the budgetary rules, allowing countries like Italy to run larger deficits. But this may not be enough.

Given Italy’s elevated debt levels, and the fragility of the current financial environment, one needs to make sure there is a backstop.

Substantial support could come from the ECB via its Outright Monetary Program (OMT). But an OMT comes with a program, which is entirely superfluous in this case. Europeans should recognize that there is nothing “Italian” about the current crisis, or equivalently that “We are all Italians!”

It is only a matter of days before France, Germany, and other European countries face the same situation. To a common shock, basic economic theory suggests that there should be a common answer.

The proper response, then, would be to issue a Euro bond—possibly via the ESM—with two specific purposes: to finance necessary health expenditures and to prevent economic dislocation in the affected countries.

Many Eurozone members are opposed to the creation of a Eurobond. One of the main objections is moral hazard, i.e. the potential risk that countries would apply insufficient fiscal discipline in the future, in the hope that other countries foot the bill.

This objection fades when we think of the challenges created by the coronavirus. After all, the RNA strand that constitutes the virus cares little about incentives, or borders for that matter.

One certainly cannot fault the policy response of the Italians, which ultimately benefits all other countries in the region (and more generally). They deserve all the European support they can get. A Eurozone coronavirus bond would send a strong signal that European countries stand behind the weakest of their members when confronted by a common shock.

It will be more powerful than monetary policy contortions in restoring economic confidence and enabling the health authorities in all the affected European countries to fight the real battle.

Should a targeted Eurobond issuance prove a bridge too far for European policymakers, there is an alternative. A coordinated jumbo sovereign debt issuance between 10 percent to 20 percent of GDP, coordinated with an expansion of Quantitative Easing by the ECB would provide much needed fiscal space.

Large scale debt issuance may also be a problem for many developing and emerging countries. Here, again, some backstop is needed. Financial assistance from international organizations (IMF, World Bank, regional development banks) is the way to go. Upstream, advanced countries should be willing to provide the necessary financial firepower to these institutions so that they can help out as quickly and efficiently as possible. This is a good, self-oriented health policy.

If infection rates in the emerging part of the world are out of control, it makes it that much harder to regain control in the rest of the world. It is also a good self-oriented economic policy: financial assistance now means less, possibly much less, fiscal solvency problems in the future for these countries.

The bottom line is that we need bold policy initiatives to contain the looming recession. The right combination starts with public health policy in the driver seat to limit “human contagion.” Fiscal and financial policies should then be designed to accompany the resulting shock to our economic system and prevent “economic contagion.”

This is not the time to be cautious.

Pierre-Olivier Gourinchas is a Professor of Economics at UC Berkeley, currently visiting at Princeton University.

The ProMarket blog is dedicated to discussing how competition tends to be subverted by special interests. The posts represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty. For more information, please visit ProMarket Blog Policy.