Cheerleading is a huge part of American culture. It’s also an expensive sport, especially after a company called Varsity Brands bought the National Cheerleader Association in 2004 and built the perfect monopoly, thanks to acquisitions, vertical integration, and lobbying to prevent regulation.

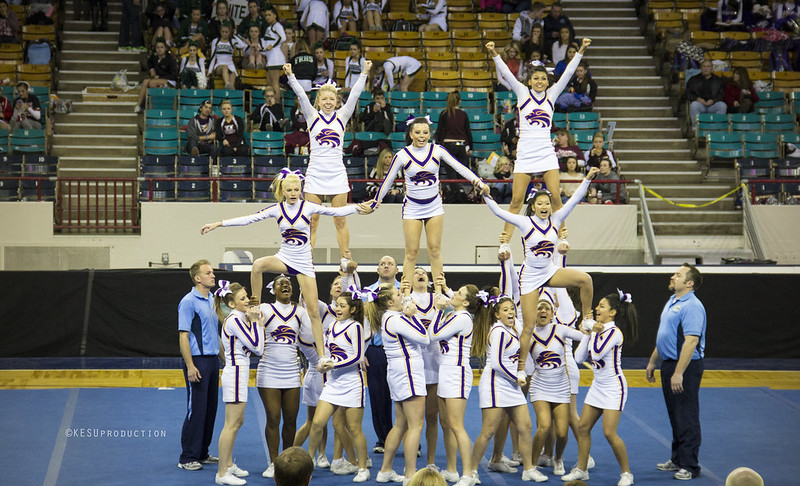

Cheerleading is a huge part of American culture, evolving from a male-oriented sideline spectacle in the 1940s to a serious female-dominated sport that sits between dance and gymnastics. There were many later famous men who were cheerleaders, everyone from FDR to Jimmy Stewart to George W. Bush.

Today, most cheerleaders are girls and young women, with one estimate of 400,000 in public high schools alone. But cheer goes way beyond high schools: there are now thousands of competitive dance teams, with members ages 7-17 who enter competitions, with something like 3.3 million who cheer in any given year, and 1.3 million cheerleaders across America who cheer for more than 60 days a year.

High school and college-age athletes participate in high profile competitions, get sponsorships, endure immense amounts of pain, and show off in contests and on social media. Cheerleaders are disciplined and often fanatical. The sport causes more than half the catastrophic injuries for female athletes in America, including skull fractures. And yet thousands of young girls wear cheer leggings and t-shirts, practice arm motions and cartwheels nonstop, and obsess over Instagram star “cheerlebrities.”

It’s an expensive sport, especially at the top, with top athletes spending $15,000 or more a year for competition uniforms, practice clothes, jackets, personalized bags, summer camps, tumbling classes, squad practices with professional cheerleading programs, and choreography fees. Families involved in cheerleading are above average in terms of affluence, and even non-top athletes spend between $2,500 to $10,000 a year.

And that’s where the monopoly comes in. The key player in the cheerleading world is Varsity Brands, which makes its money from cheerleading apparel, camps, and competitions. Its founder, Jeff Webb, started Varsity in the 1970s to offer high school training camps and clinics, eventually creating competitions for cheerleaders.

It’s with equipment and apparel that Varsity makes its money, “everything from the sequined uniforms on cheerleaders’ backs to the big bows in their poofed-up hair.” The key to Varsity’s monopoly is its chokepoint control of major cheerleading competitions. In the early 1980s, ESPN began showcasing the new sport, giving it wide distribution. In 2004, Varsity bought the National Cheerleaders Association, and has rolled up a dozen more, including its main competitor in 2015, Jam Brands. Today, competing means entering Varsity’s world.

While Webb is an aggressive businessman, Varsity had help from private equity; Charlesbank Capital Partners bought the company in 2014. Charlesbank organized a roll-up of the industry, in its public case study noting that it helped orchestrate the Jam Brands purchase, as well as a series of “highly strategic acquisitions.” These new private equity owners had Varsity buy up sports equipment distributors and enter the marching band space. Charlesbank sold it to fellow private equity firm Bain Capital in 2018.

Varsity’s market power over the business of cheerleading is entrenched. Participating in cheerleading competitions is expensive. If you want to see a bunch of cynical cheerleaders and cheerleading families angry about monopoly power, check out the discussion on Fierceboard about the acquisition and what it meant for what they would have to pay. It’s also costly to be a spectator.

Here’s a sycophantic interviewer interviewing Webb about how much it costs as a parent spectator to watch one of these events, congratulating the CEO on his pricing power. This market power extends to media. Not only does Varsity own magazines, but on Netflix’s Cheer, cheerleaders complain that they can’t watch cheerleading on TV anymore, because Varsity streams its competitions over its for-pay app Varsity TV, moving ESPN out of the picture.

In 2018, when speaking to Chief Executive magazine, Webb made it clear that monopolization was the strategy.

“We were really creating an industry as we went along and it became an ecosystem in that we were creating the concept, we were creating the industry, and then we were positioning ourselves to provide all the products and services that that affinity group utilized.”

Webb’s strategy worked. In 2016, competitors estimated that Varsity had 80 percent of the market for apparel and 90 percent of the market for competitions.

Rebates, Gyms and Vertical Integration

Varsity uses tactics reminiscent of a glittery John D. Rockefeller. According to Leigh Buchanan in Inc., “Teams appearing in Varsity competitions can wear whatever uniforms they want. But rival apparel makers can’t show their wares at those events, which are important showrooms for cheer merchandise.” That is, in antitrust parlance, a form of ‘vertical foreclosure,’ or using your control of one part in the supply chain, in this case competitions, to block rivals who compete with you in another area, apparel. This became quite obvious when Jam Brands, which ran most non-Varsity competitions, merged with Varsity, immediately ending marketing agreements with Varsity apparel competitors.

There’s more than blocking advertising and distribution at these competitions. Webb admitted that in at least one contest, cheerleaders got more points if they used more Varsity equipment as props. In other words, it’s not just a rigged game as some sort of metaphor, Varsity actually rigged the rules of its cheerleading competition to coerce purchases of Varsity products. Indeed, Webb has testified in court that the competitions exist solely for the “promotion of his cheerleading supply business.”

This level of control hasn’t gone unnoticed. As one person in the cheerleading world sarcastically put it in 2014:

“Shocking that they don’t have officially sanctioned Varsity make-up, underwear, and no-show socks yet (or maybe they do, who knows?) I can foresee the Varsity Secret Police (the same ones that patrol the lobbies of non-STP hotels looking for girls in bows & bling) checking each athlete in warm-ups to make sure they are wearing Varsity brand hair clips and rubber bands.”

And then there are the gyms, where cheerleaders train and form teams. Most cheerleaders buy their uniforms and apparel from their gym. Varsity owns some gyms and has strong control over others. Varsity signs multi-year supply contracts with gyms, giving them a cash rebate if gyms send their cheerleaders to Varsity competitions and buy Varsity equipment. It’s not a surprise to see rebates used in this space. Rebates are a standard tool of monopolists; they are how Standard Oil controlled railroads, and how Microsoft orchestrated its power over computer makers.

Like a good organizer of market power, Varsity also extends and expands its legal powers. The corporation sued a competitor for copyright violations, going all the way to the Supreme Court to establish the ability to copyright cheerleading outfits (Sotomayor, Kagan, and RBG took Varsity’s side).

Suffice to say, it is difficult to compete in the market.

“Some small competitors just throw up their hands. Tish Reynolds launched Just Briefs, a maker of cheerleading practice wear, in 2005, and grew the business to $3 million. But “Varsity kept telling [customers] you’ve got to buy your uniforms from us,” says Reynolds. Varsity acquired Just Briefs in 2010 and closed it, even though it hired Reynolds as part of the deal.”

Varsity has such an entrenched competitive position that CNBC noted, “stands out as one of the few retail businesses of scale that may also have an Amazon defense.” That’s how powerful Varsity is, it’s a retail brand that is not even afraid of Amazon.

Fear, Safety, Political Control and Monopoly

As with nearly all monopoly power, Varsity also has imposed fear of retaliation across the industry.

“’Varsity has free rein,’ Kimberly Archie, founder of the National Cheer Safety Foundation, said. Archie said she has tried to loosen Varsity’s grip on cheerleading by assisting plaintiff teams during personal injury claims and even attempting to bring antitrust lawsuits against Varsity. But she said she has been unable to get any current gym owners or cheerleaders to testify against Varsity because they fear possible retaliation.

‘Varsity has control over cheerleading at every level in the U.S. and abroad,” she said. “There is no resistance.’”

In a glittery version of Google’s financing of civil society groups focusing on privacy, Varsity finances nonprofit associations associated with cheerleading, including the governing body that handles safety, the nonprofit American Association of Cheerleading Coaches & Administrators. And it aggressively lobbied to prevent cheerleading from being considered a sport so that it could remain unregulated. (It’s “more than a sport,” says Varsity.)

In one of Varsity’s 2003 filings with the Securities and Exchange Commission (Varsity was briefly a public company), the company stated that recognition of cheerleading as an official sport and the ensuing increased regulation “would likely have a material adverse affect on Varsity’s business, financial condition and results of operations.”

Should cheerleading be more closely regulated, it could mean implementing participation restrictions on teams and athletes, threatening Varsity’s competitions and its off-season camps, one of the company’s most profitable components.

There is one looming problem for Varsity. Last year, the NCAA, which controls college athletics, established a cheerleading-like sport called “Acrobatics and Tumbling,” and placed control of the sport not under Varsity but under scandal-ridden USA Gymnastics. In other words, the only thing that has stopped Varsity was another more powerful monopoly.

So there we have it all. Catastrophic injuries, rigged competitions, vertical foreclosure, private equity. Fixing this situation isn’t that hard, and basically requires a restoration of basic antimonopoly principles, with glitter. That means stopping coercive rebates, ending long-term gym contracts, having competitions not controlled by Varsity, and regulating cheerleading like a sport.

Oh, and there’s one more thing. Cheerleading monopolist Jeff Webb, after selling his business to private equity, has entered politics. He now runs a pro-Trump anti-immigrant political advocacy group called the New American Populist, one of whose goals is to “advance our use of existing anti-trust laws.”

You can’t make this up. And what I love about studying monopoly is that you really don’t have to.

Editor’s note: A previous version of this article appeared in BIG, Matt Stoller’s newsletter on the politics of monopoly. You can subscribe here. Matt Stoller is the author of Goliath: The Hundred Year War Between Monopoly Power and Democracy and a fellow at the Open Markets Institute.

The ProMarket blog is dedicated to discussing how competition tends to be subverted by special interests. The posts represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty. For more information, please visit ProMarket Blog Policy.